This article is co-authored by Maple Finance with data/charts provided by Parsec

Introduction

Since the start of the year, while the wider DeFi lending market experienced tepid growth and yield compression, Maple TVL and revenues have risen six-fold, and the protocol has positioned itself as a proven and trusted name in institutional DeFi.

The growth story of Maple points to two overarching trends - institutional demand for onchain credit and rising demand for institutional yield. Additionally, Maple’s growth has been accelerated through the launch of Syrup.

Syrup leverages Maple Finance’s digital asset lending infrastructure to make institutional yield accessible throughout DeFi. Syrup yield is generated from fixed-rate, overcollateralised loans to institutional borrowers, and these short duration loans enable Syrup to provide consistent high yield as well as short term liquidity for users. The strategy has a track record of yield outperformance relative to leading DeFi lending protocols, including Aave and Sky, and other reputable yield sources, such as Ethena.

To complement this recent growth, on the 13th of November, Maple will launch SYRUP, enabling token holders to participate in the long term growth of the protocol through staking rewards and governance participation.

In this report, we track the growth of Maple compared to leading DeFi protocols, why users are flocking to Syrup, and Maple’s role in the wider DeFi Renaissance.

DeFi Lending: Maple vs. The Market

While still a leader in DeFi lending in terms of loans outstanding and TVL, Aave’s USDC borrowing has risen steadily since the start of the year, and total active loans on the platform grew 2.5x. Similarly, borrowing on Sky (formerly Maker) rose noticeably throughout the past year.

Deposits and loans outstanding on Maple have further outpaced the wider DeFi lending market - growing 3x since January - pointing to accelerated demand for institutional yield and high utilisation of the loan book (i.e. strong institutional demand for onchain credit).

Maple Blue Chip Secured pool provides the security of only accepting BTC and ETH collateral, held in institutional custody, while Maple High Yield Secured generates a higher yield by underwriting loans backed by select digital assets and reinvesting the collateral in staking and/or secured lending opportunities. Syrup yield is derived from a blend of both.

While Aave, Maker, and Maple all offer overcollateralised loans backed by liquid digital assets, what makes Maple’s lending strategy distinct is that Maple’s borrowers are permissioned, and the permissioned nature of the yield source ensures both security and quality.

Meanwhile, Aave and Sky primarily offer variable-rate loans with permissionless borrowers. Compared to institutional borrowers, these borrowers’ higher demand sensitivity contributes to greater volatility in yield for lenders, and these loans are non-recourse (i.e. a shortfall in collateral is not made-whole by the borrowers).

In short, Maple’s growth is not just noteworthy because of its size relative to the wider market, but also because of what it signals: definitive rising supply of crypto-native institutional borrowers looking for credit and rising demand from DeFi-native lenders looking to earn yield onchain.

The Larger Trend: Liquidity and Yield Outperformance

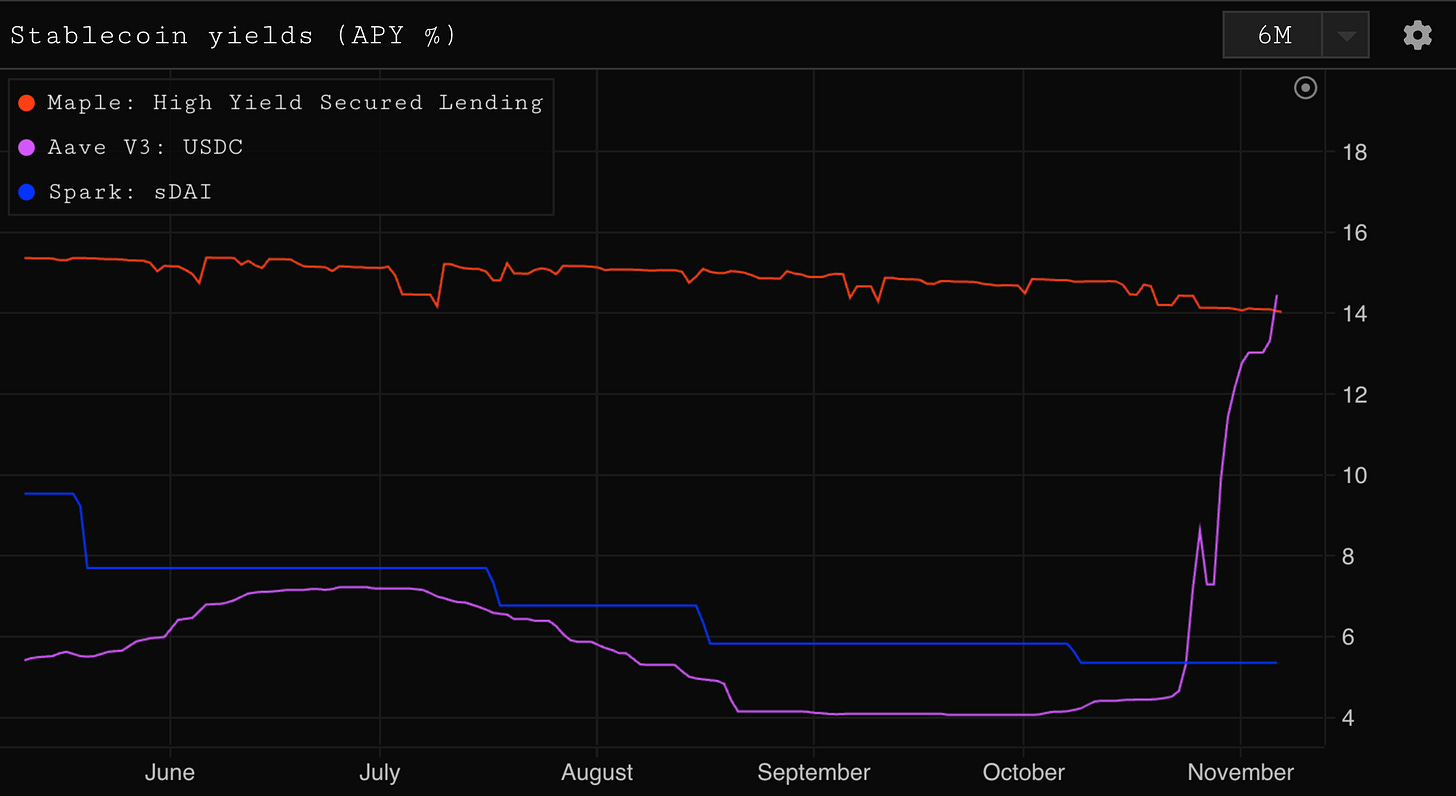

For lenders, Maple’s yield outperformance and consistency are differentiating factors. Maple’s performance is based on the high utilisation of its loan book, clever duration management, and active collateral management (e.g. liquid and native staking in DeFi).

As these loans are fixed-rate and overcollateralised, they provide stable yields as well as superior risk management for lenders. And their short duration provides rapid liquidity for users. This is reflected in their stability and outperformance relative to Aave and Sky yields over the past year.

From the credit demand side, institutional borrowers are coming onchain for operational efficiencies (i.e. receiving a loan in days rather than months), access to liquidity, and the ability to borrow against collateral other lenders won’t accept.

From the supply side, demand for institutional yield comes from multiple ‘lender types’ including DeFi natives, stablecoin yield funds, credit funds, treasuries, and new DeFi lending primitives.

Often, DeFi natives and stablecoin yield funds want to capitalise on deleveraging in the market by borrowing cheaply and depositing in high-yield opportunities. Thus, they borrow on lending protocols with variable-rate loans during times of yield compression and deposit into fixed-rate high yield alternatives, such as Maple and Syrup.

Together, these tailwinds have contributed to significant growth in Maple TVL, and protocol revenues have climbed as a result.

The Appeal of Syrup

Tracking Maple’s monthly deposit volumes since Q2’24 shows that the majority of deposit growth in recent months has been directed to Syrup since its launch in July. The permissionless nature of Syrup yield, its attractive yield, and integrations into the wider DeFi ecosystem have all contributed to inflows.

Syrup announced a strategic partnership and allocation with the largest liquid restaking protocol on ETH (ether.fi) - to provide a consistent and differentiated yield source for ether.fi users. Similarly, Syrup launched an integration on Pendle, whereby users can trade the yield of syrupUSDC. The pool rapidly climbed to $13M in liquidity in one week.

SYRUP Token

Based on recent growth, Maple has begun to play a central role in a wider ‘DeFi Renaissance’ - characterised by improved user experience and risk management. Maple provides the infrastructure for mass institutional adoption of onchain credit opportunities, and the launch of Syrup has given the Maple community permissionless access to its core institutional lending product through DeFi.

To empower the community to share in its growth, Maple is introducing SYRUP token. Through SYRUP staking, fee revenues generated from Maple’s and Syrup’s lending operations will be used to buy back the SYRUP token and form part of the token emissions that go to stakers. Staking rewards and governance capabilities form the basis for long-term partnership between the Maple protocol and active participants.

In the first 90 days after token launch, a fixed amount of SYRUP emissions will go to SYRUP stakers, ensuring that all early stakers are incentivised with a staking yield for participating actively in the growth of the protocol. Existing MPL holders will simply be able to convert 1 MPL to 100 SYRUP.

SYRUP token will launch on the 13th of November, commencing the conversion from MPL to SYRUP.

For more information, visit: https://maple.finance/news/syrup-token-launch-13-november