Unusual Money

before I begin, this is just based on my understanding of the events which transpired, I am not throwing shade here as I do not have perfect information

In the past 24 hours we saw USD0++ (the USD0 Liquid Bond) trade from 1:1 with USD0 all the way down to 0.89 (the largest sell being $5m at 0.895), trading at around 0.91 at the time of writing following a protocol announcement. It seems to me as though the market was simply assuming that the two assets should be pegged with no real economic rationale for the assumption... let’s dive in.

For those who are not versed in Usual Money, it is a relatively new stablecoin/RWA project which has quite an interesting mechanism design and tokenomic model:

Usual’s stablecoin is USD0, which is backed by US Treasury Bills (predominantly Hashnote’s USYC to my knowledge).

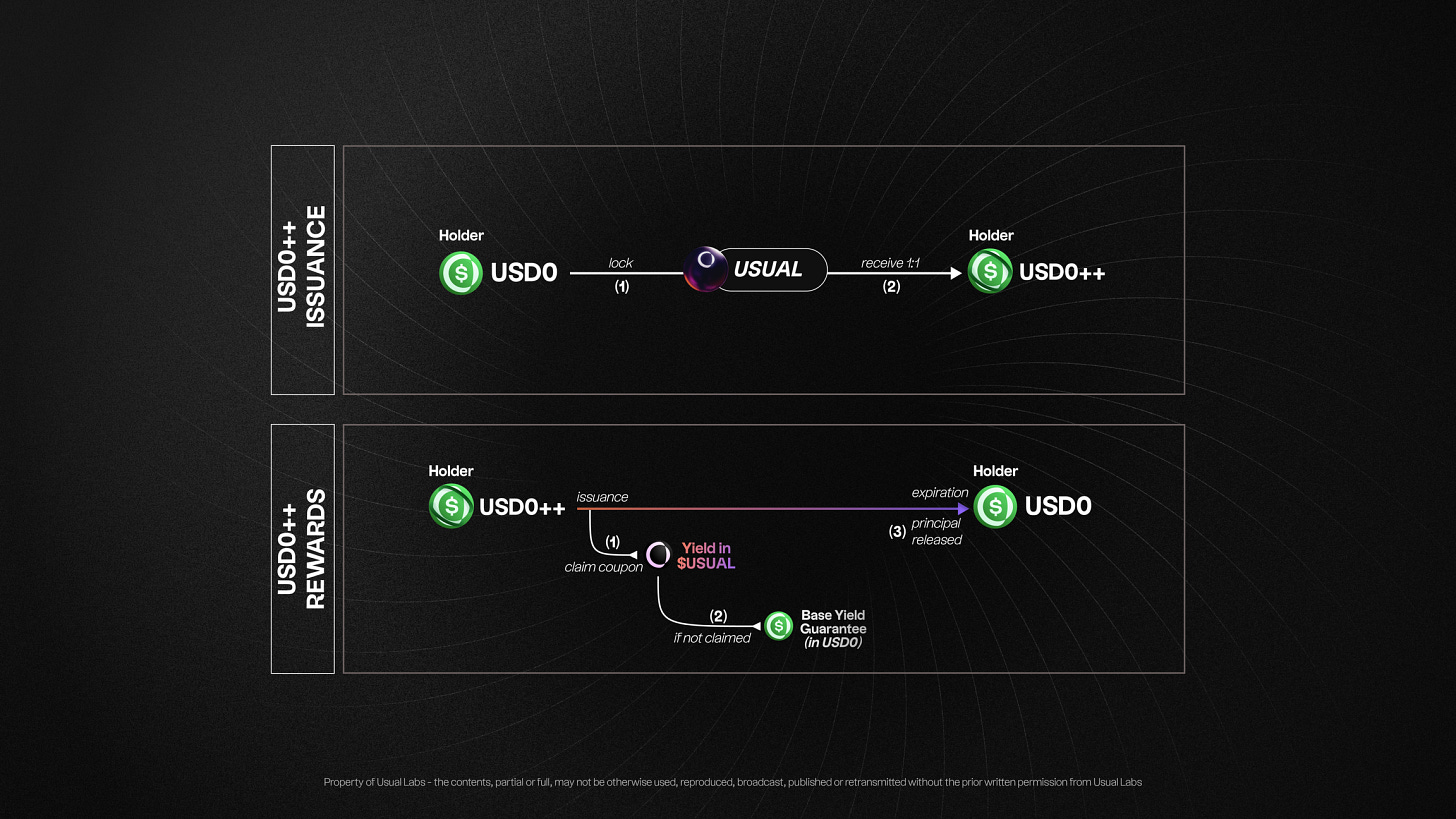

USD0++ is the “enhanced T-Bill”, “Liquid Staking Token” or “USD0 Liquid Bond”, a staked/locked version of USD0 which earns $USUAL rewards. Until recently the headline reward paid in $USUAL on USD0++ was up to 60% APR. USD0++ effectively acts like a zero coupon bond in that it pays no coupon (other than $USUAL emissions) and can be redeemed at par after 4 years of issuance.

For a more detailed explanation of tokenomics including the USUAL, USUALx and USUAL* see @mytwogweis thread (which was very useful in understanding all of this today!).

If we assume market participants are rational, they would likely only be willing to buy USD0++ at a minimum of $0.84 (napkin math pulling the U.S. 5 Year Treasury Yield), likely higher given some assumed discounted $USUAL yield during the period.

But until yesterday... DeFi traders and yield farmers were paying $1 (1 USD0). It’s not clear whether all of these participants understood they were buying a 4 year zero coupon bond and it was being priced accordingly at 1:1 factoring in the assumed discounted $USUAL yield. Or, the perhaps more likely scenario where naive users assumed they were just buying a yield-bearing stablecoin given the price appeared to be pegged 1:1.

In Usual’s defence there is a clear disclaimer one can review before minting USD0++ with USD0:

If a user had simply bought USD0++ at market, they might not be aware of the underlying mechanism, but buying an asset on the secondary market is 100% buyer beware and we can’t attribute any responsibility to Usual here.

So with some background established, what led to the depegging

Yesterday Usual announced “the dual exit option” (announcement), allowing users to redeem USD0++ early for 0.87 USD0.

This $0.87 “reflects the expected revenue the DAO would earn until USD0++ matures”. Naturally, following the announcement of the new price floor, a realisation began to spread among market participants that perhaps a 1:1 pricing with USD0 was in fact not correct the aggressive ~10% selloff ensued.

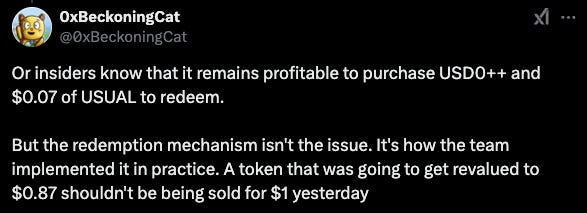

Different commentators have different takes, some see the marketing as predatory:

Others indicate that buyers should have been aware of the risks they were taking by buying at $1:

Meanwhile the only borrow/lend market was deployed on Morpho by @MEVCapital which pegged USD0++ 1:1 with USDC but interestingly exhibited a 86% max LTV, conveniently sitting below the later announced $0.87 floor price. The borrow/lend shenanigans are still playing out, so keep your eyes peeled for a follow up article👀

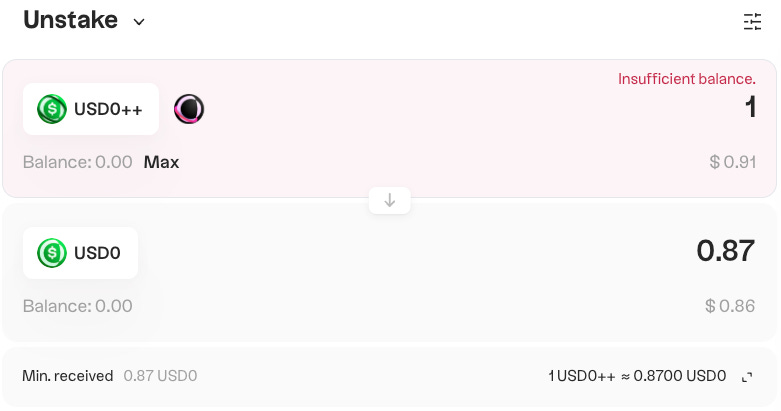

As of writing, it seems as though Usual still allows users to stake USD0++ 1:1 with USD0 via their front-end while pricing the unstake at the aforementioned 0.87:

Either way, the protocol has effectively “locked up” quite a significant amount of USD0 (and the associated yield on the underlying USYC) by selling a bunch of 4 year zero coupon bonds at $1 which can now be redeemed for $0.87... maybe we’ll see this “TVL/yield locking” reflected in the $USUAL price or perhaps this publicity black eye will just be too hard to wear off.

What ever the case may be, we’ll be tracking it all on parsec.fi

Quite unusual