A big start to Boyco

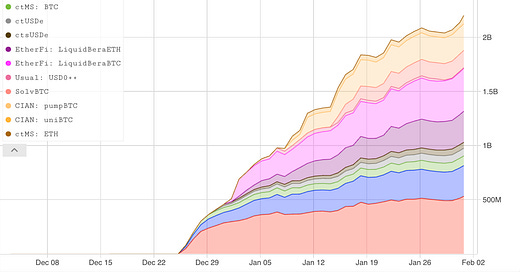

If you haven’t been living under a rock, you’ve probably seen some noise about Boyco (boyco.berachain.com) - Berachain’s pre-mainnet liquidity and incentives hub which is attracting a ton of TVL and interest. It seems as though the Berachain in Q5 prophecy may be coming true!

This pre-mainnet liquidity initiative began with the community, Core Berachain ecosystem projects establishing “external vaults” and raising capital to seed their expansion to Berachain and to seed initial DeFi liqudity on Berachain. These projects include StakeStone, Pendle, Concrete, Ethena, Cian, Lombard, ether.fi and more.

This community-driven campaign has been running since late December and to date represents the lions share of Boyco TVL ($2.3B/$2.5B).

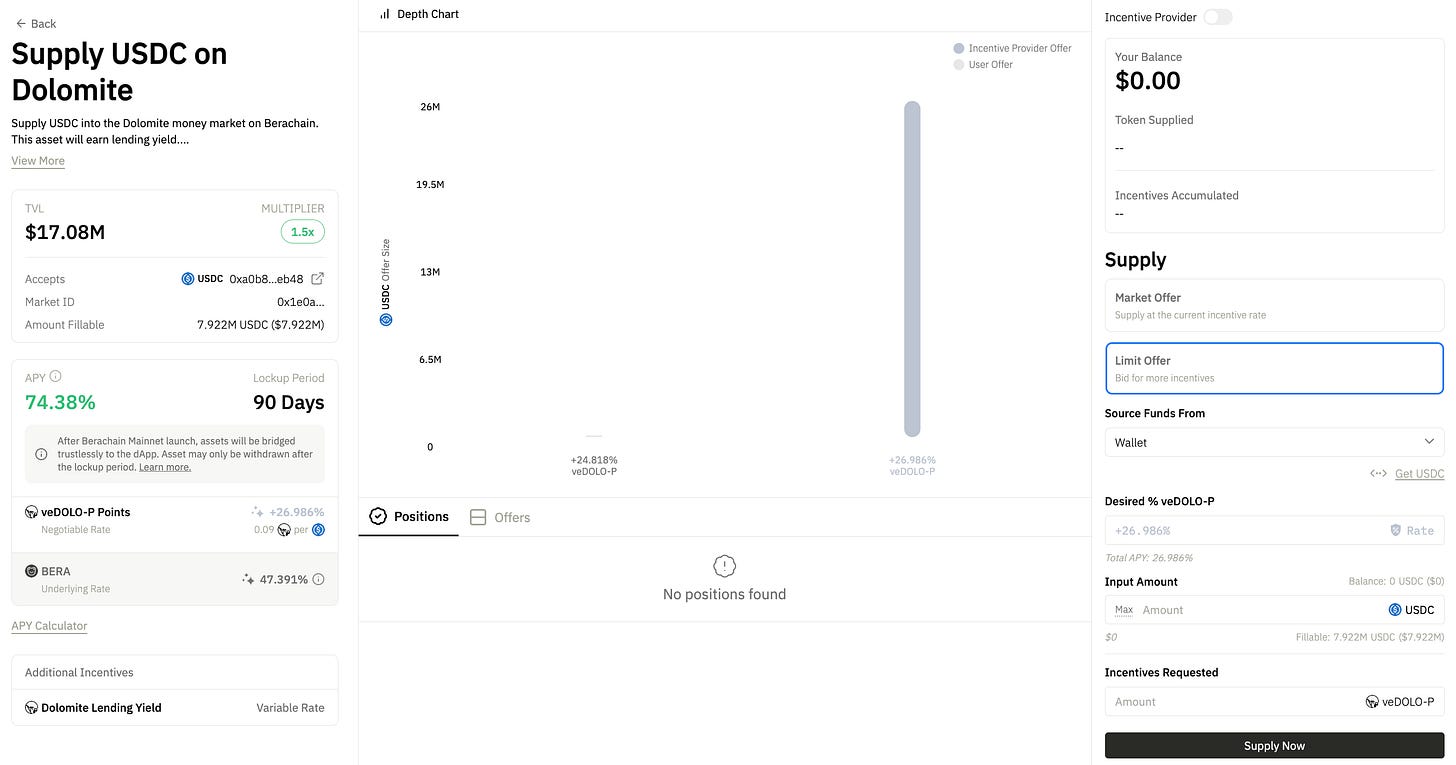

Then you have the more recently launched Boyco Marketplace which represents a much smaller pool of capital and critically, allows depositors to deposit into one specific strategy or position vs the External Vaults which tend to be more broad.

Another key difference is that the Boyco Marketplace is a whitelabeled version of Royco; a form of liquidity<>incentives market place where liquidity and incentives can come together and set terms for the respective role each will play. This allows some interaction between incentives providers and liquidity providers vs the External Vaults which is a more traditional liquidity incentives campaign; “here is the rewards pool, pour in as much TVL as you like and accept the dilution”. Example Boyco market:

Importantly, all of the capital across external vaults and the boyco marketplace will be bridged to Berachain and deployed into native DeFi applications; seeding liquidity on Berachain-native DEXs like Kodiak, making deposits into Berachain money markets etc. For the most part, these deposits are subject to long lock up periods (typically 3 months post-Berachain mainnet). This is most likely to better align incentives and discourage mercenary farming and dumping as much as possible.

The rewards and incentives pool is split into three main groups:

2% of BERA supply; 0.9% to boyco marketplace pools and 1.1% to external vaults, all weighted by TVL and time.

Native protocol incentives; the protocols which will be recipients of the bridged liquidity are each offering their own version of points or ve tokens to entice depositors.

External vault provider incentives; some of the protocols offering external vaults are adding their own layer of incentives to dpeosits too, an example would be StakeStone’s ETH vault which carries StakeStone incentives above and beyond BERA and Native protocol incentives:

These incentives “will be awarded on a cliff at the end of the market expiration”, indicating that incentives will be distributed 3 months post mainnet once Boyco deposits unlock.

It will be interesting to monitor how Boyco wraps up as we approach the end of the program on February 3rd. It will also be interesting to see what the incentives end up looking like from a realised APR perspective.

You can track real-time Boyco flows using our very own Parsec Boyco dashboard here: https://parsec.fi/layout/geeogi/nsmSPfV3

solid insight in this article🫡