A tale of two cities

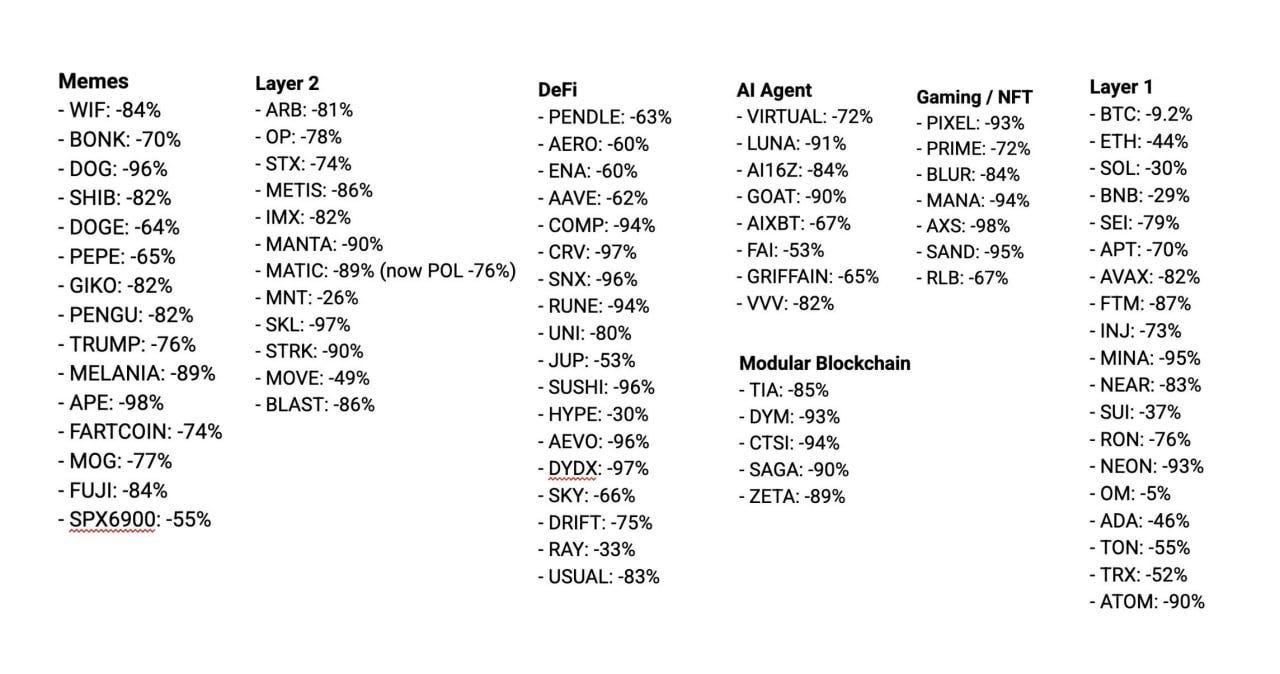

A common theme this cycle (Nov 22 bottom until now) has been significantly heightened dispersion amongst the performance of different crypto assets.

In practice this dispersion has been characterised by systematic BTC outperformance and cyclical pockets of altcoin strength with an extremely small handful of alts which have displayed consistent positive returns.

Pattern matching and anchoring to prior market behaviour, such as the notion of an “alt season”, has generally not been fruitful. Given an entirely different set of conditions, open mindedness has been heavily rewarded.

This has led to K-shaped outcomes for crypto investors and traders. If you have not been positioned in BTC and/or played altcoin rotations correctly, there is a high chance you have not experienced a bull market with many coins not surpassing previous all-time-highs.

This contrasts heavily to prior cycles where a bull market in BTC would eventually trickle down to almost every altcoin, resulting in positive returns for all crypto investors.

There are probably a few principal reasons for this:

A “Traditional financialisation” of BTC meaning it trades much more in line with traditional markets

Rapid expansion of token creation as the cost of token creation has approached zero, inflows are spread amongst an almost infinite universe of coins which is constantly expanding

Increased nihilism amongst participants, many crypto participants have been burned in prior cycles so they now opt for a trading vs investing approach, this inherently creates cyclicality

From my perspective, the nature of this cycle represents increasing efficiency as the market becomes more mature over time and the rules of the game become more widely understood. The majority of market participants will come to realise that what they thought was a trading or investing strategy resembles something which looks a lot more like gambling given that it only worked in extremely forgiving environments which are not guaranteed to return.

So... what happens from here on out? Unfortunately for many, it is likely that we simply see more of the same. Traders who do not possess material edge will bleed to those who do. “Investors” who do not intimately know what they own and how incentives are aligned will be farmed by those who do.

One would not naively expect to outperform the S&P500 by watching a YouTube video or copy trading an influencer on Twitter, why should the expectation be any different in an increasingly efficient Crypto market?

Great 👍