Outperformance in big DeFi

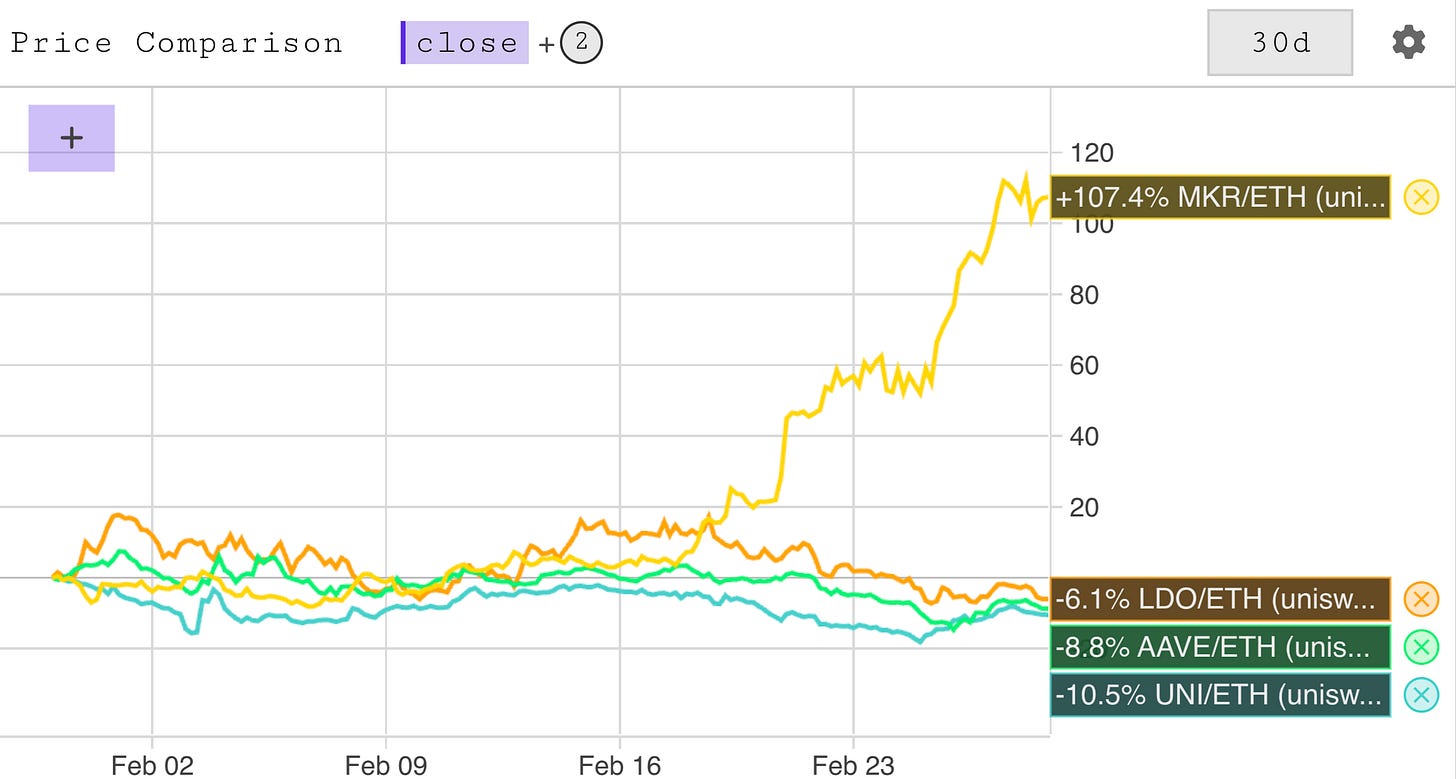

The following chart tells a rather particular story:

It’s a story of significant MKR outperformance vs other big DeFi peers. While there are some commentators and traders who have caught onto this, it seems as though much of this outperformance has gone unnoticed amid the carnage in the broader market.

During the past month we’ve seen a barrage of MakerDAO (or should I say Sky) governance activity, notably:

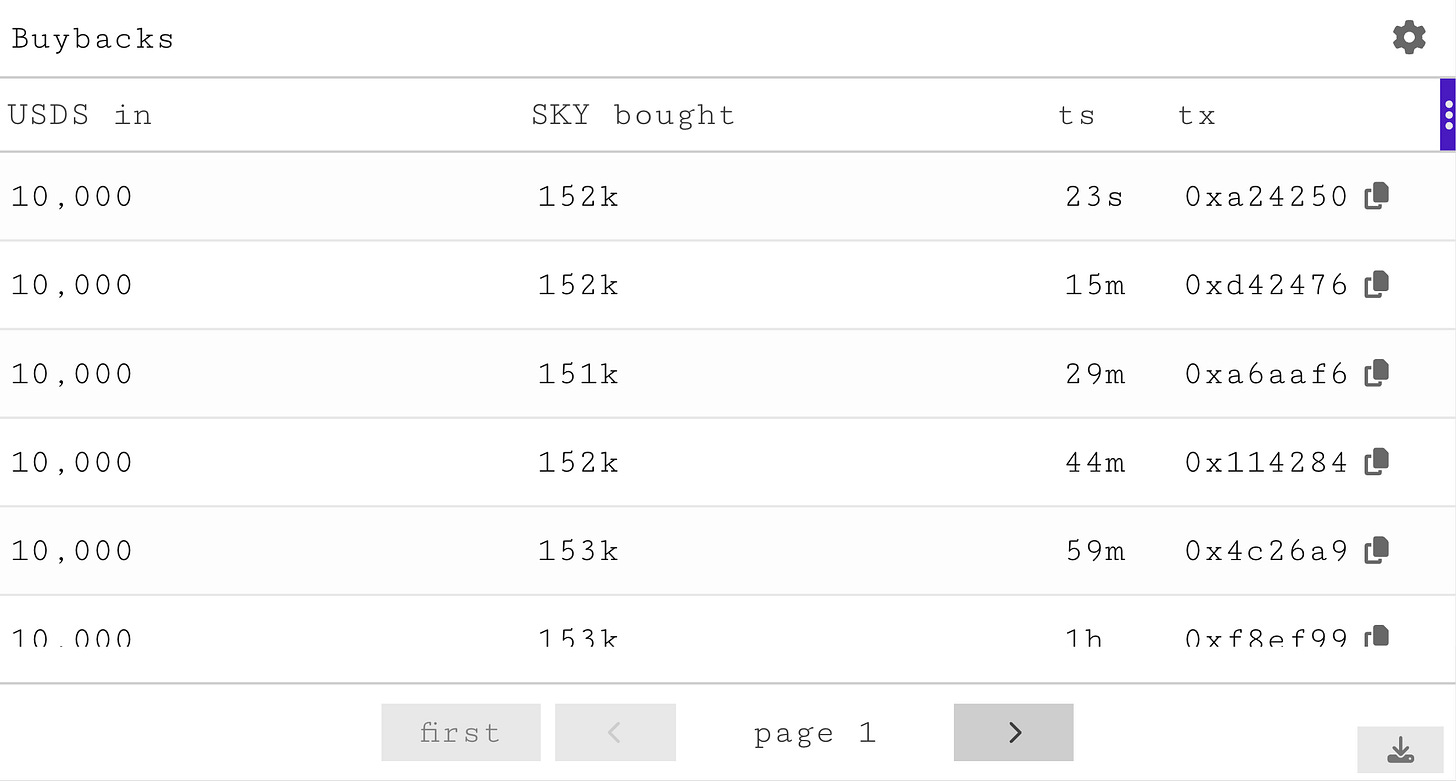

adjusting the System Surplus threshold for buybacks from 120m to 70m

reducing SKY/USDS protocol owned liquidity to 15m, thereby releasing 60m of USDS directly into the System Surplus

allowing the protocol to buyback 30m USDS of SKY per month (note that this has since been revised down to 12m)

TLDR: MKR buybacks are back, in a big way.

A few charts tell the story nicely:

We have also seen rumours of a Spark token coming soon and announcements about other MakerDAO spin offs like Polaris who are building towards USDS cross-chain expansion by extending Sky’s scale to Berachain.

Buybacks, protocol spinoffs (which could create SKY and USDS farming opportunities) and a stablecoin bill on the horizon could be key ingredients for a broad based MKR recovery which has been largely subdued following a 10 month downtrend.

We’ll be tracking the latest developments here: SKY buybacks layout

Great info 👍