Parsec Weekly #113

the controlled sUSD depeg

the controlled sUSD depeg

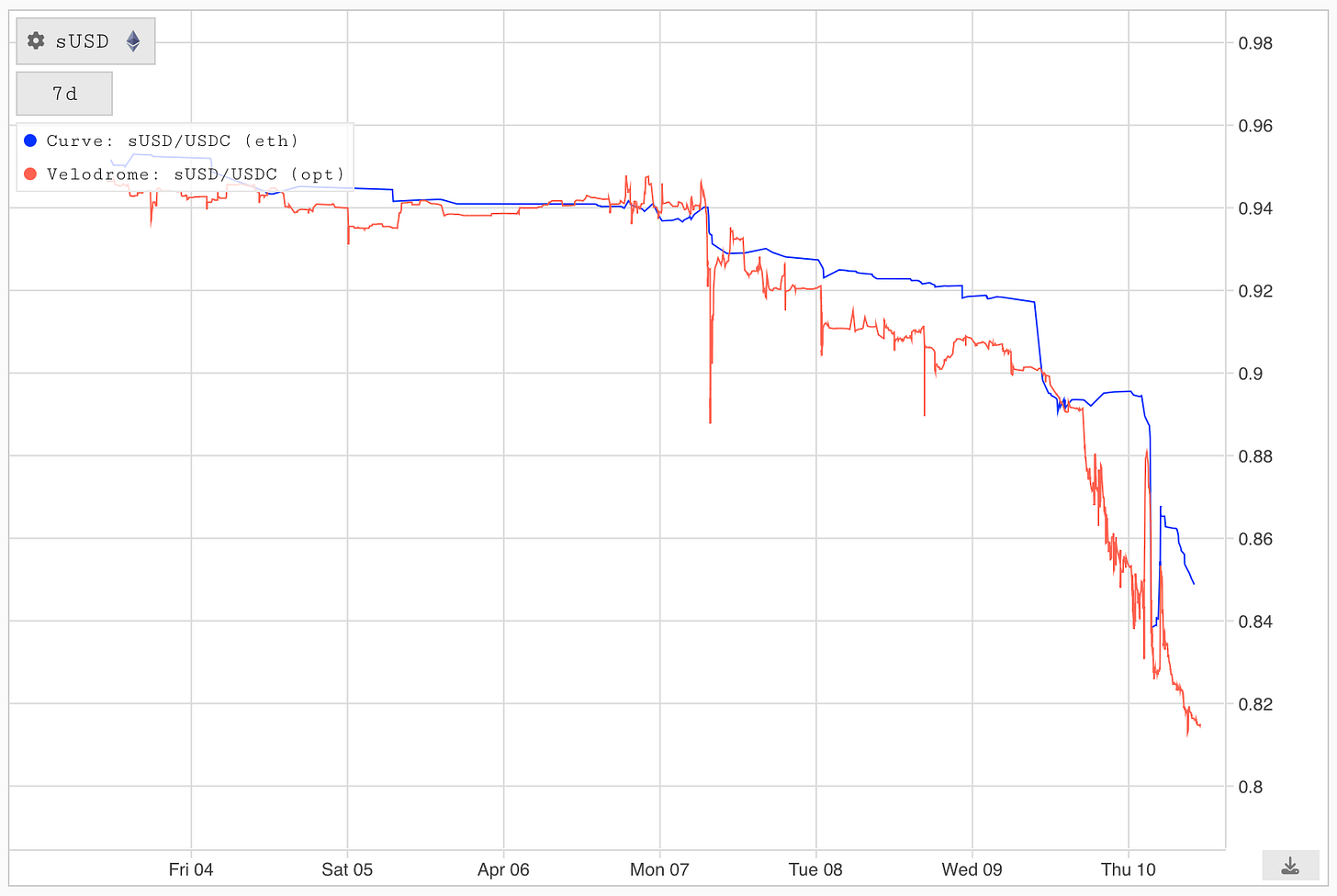

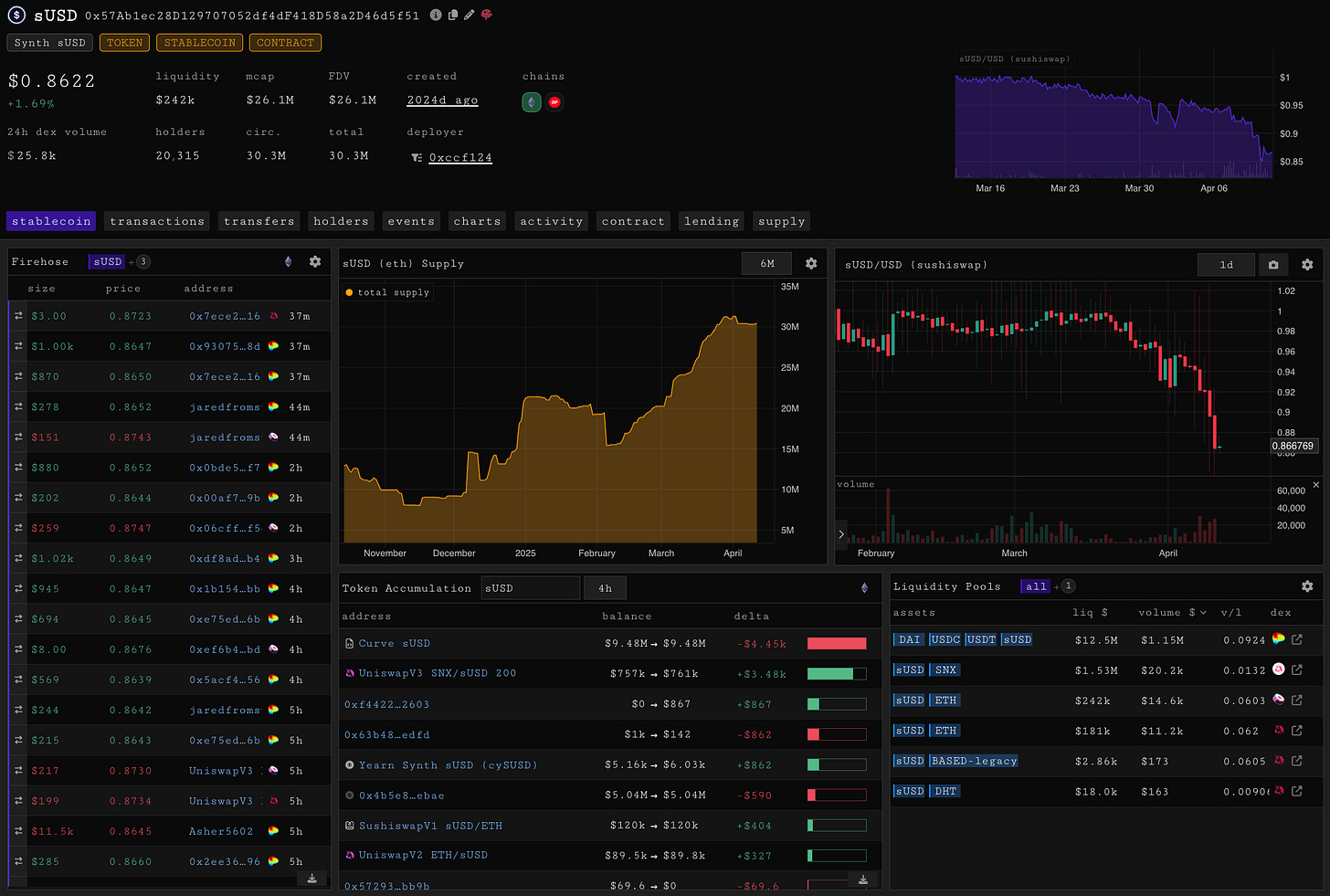

sUSD is supposed to be a stablecoin which trades at $1 but a recent governance proposal has had some unintended consequences. This depeg did not arise due to bad debt or a broken mechanism but instead represents a side effect of SIP-420.

SIP-420 introduced a protocol-owned staking pool to Synthetix. That means instead of individual SNX stakers minting sUSD and managing their own debt, they now delegate into a shared pool.

The intended impact:

No liquidations

No individual debt

Lower c-ratio (200%)

Simpler UX

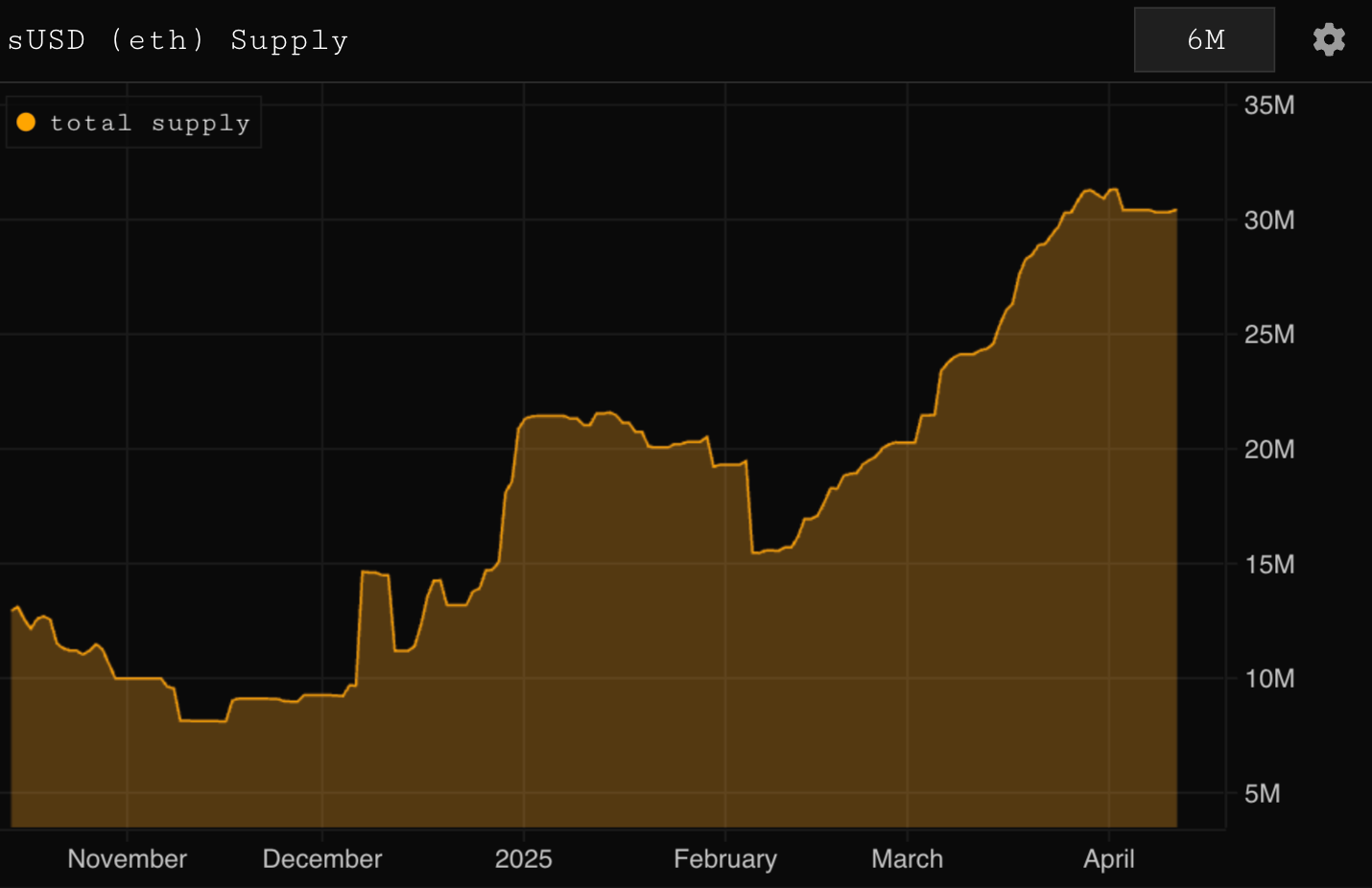

In return, each SNX stake now mints significantly more sUSD — roughly 2.5x.

But here’s the kicker: with debt now sitting in a communal pool, stakers don’t have skin in the game when sUSD trades off peg. There’s no incentive to buy it cheap and retire debt — because it’s not your debt anymore. A reflexive defence mechanism which was once in place is now gone.

Combine that with $80M+ SNX flowing into the 420 Pool and an Infinex campaign driving holdings, there has been an expansion in sUSD supply with some Curve pools sitting 90%+ sUSD. With no demand to counteract this increase in supply, there has been no market pressure to restore peg.

The SNX team have been consistent with their messaging that this is part of a transition and that they’re standing up new demand sinks (integrations with Aave and Ethena etc.) and reinforcing Curve incentives. The peg still matters — even if it’s not quite being defended in the same way.

Zooming out, the model is still sound, sUSD is overcollateralized but that doesn’t guarantee a stable price. Collateral != confidence.

This was always going to be the tradeoff with SIP-420. It solves for simplicity, capital efficiency, and scalability — but at the cost of removing one of the strongest organic peg stabilizers.

It’s yet to be seen how this will be resolved be it through active peg stabilizing mechanisms (e.g., arbitrage incentives) or real demand sinks.

Until then, we’ll be watching closely → sUSD layout on parsec.fi

It's a great project 👍