Can a non-USD RWA universe take shape?

It’s undeniable that real world asset market capitalisation is absolutely dominated by USD denominated assets today with USDC and USDT representing ~$40b and ~$75b of market cap on Ethereum mainnet alone:

This doesn’t include the long tail of USD denominated stablecoins (DAI/SKY, USDe etc.) or tokenised USD debt (treasuries and private credit) which amounts to a further ~$16b according to rwa.xyz.

While Crypto native assets amount to a significant portion of TVL across DeFi markets (wrapped versions of BTC, ETH, staked/restaked derivatives of ETH, governance/other tokens), one area which has always seemed extremely under developed and under represented is the universe of non-USD RWAs. In other words, “real world” or off chain assets which are not USD denominated.

One pocket we have seen expanding as of late is in the realm of tokenised Gold with PAXG seemingly finding a bottom in supply and experiencing a broad based increase in supply for the first time since 2022. With market cap being subject to changes in gold price, token supply indicates the underlying supply growth of PAXG:

In the grand scheme of things, PAXG is still very small at just $773m of market capitalisation. It’s surprising to me that the largest tokenised gold asset barely reaches into the top 100 tokens by market cap. Tether Gold (XAUT) is marginally smaller sitting at $657m in market cap but has experienced almost no growth in underlying supply recently.

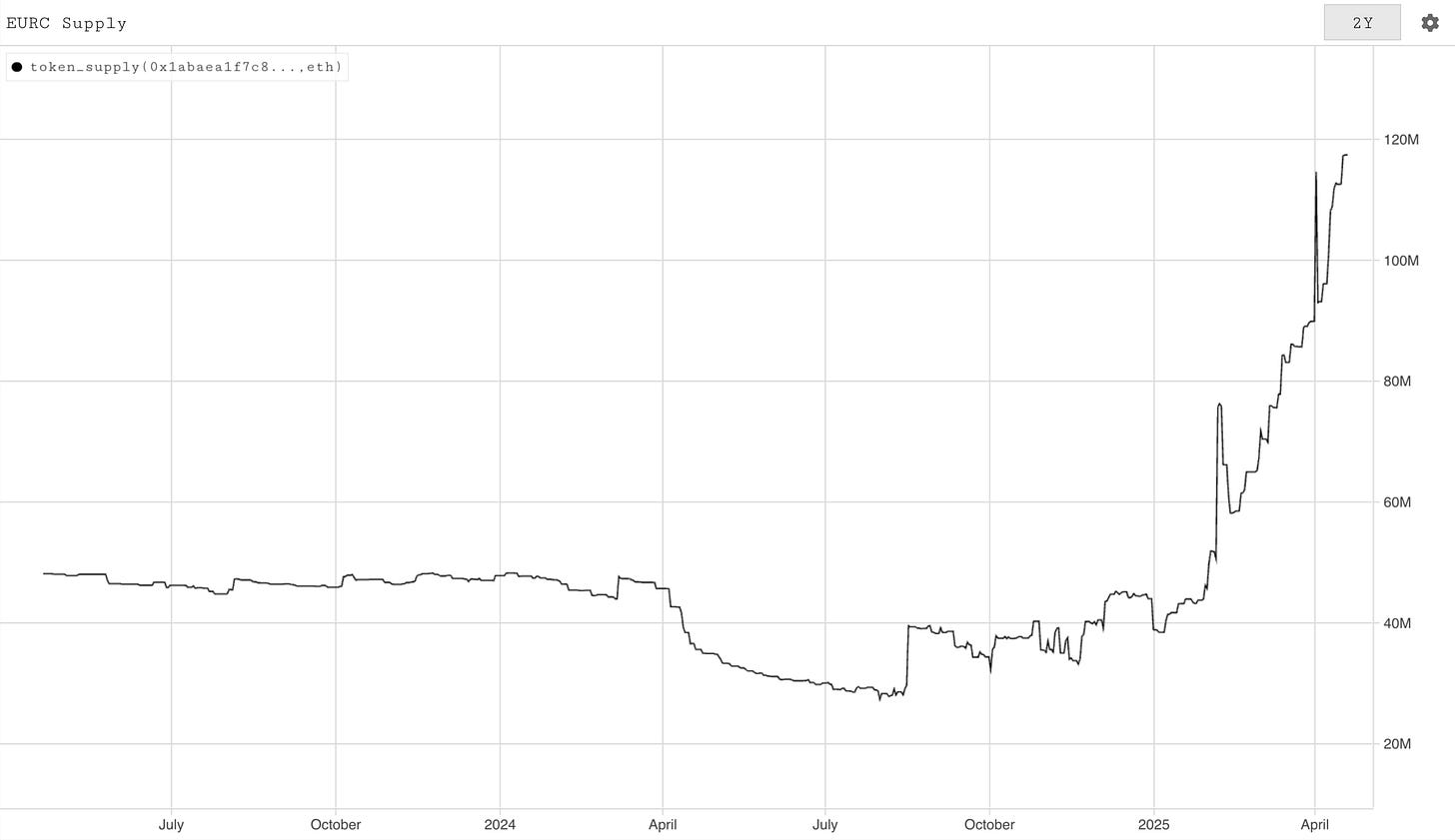

The world of non USD stablecoins is even smaller still with EURC (Circle’s euro-backed stablecoin) sitting at $213m of market capitalisation but has experienced notably strong growth in supply as of 2025:

One notable commonality amongst these assets is a low level of DeFi integrations, one would imagine that integrations would contribute to supply growth especially in assets like PAXG and XAUT as traders/investors look to lever up. It will be interesting to see whether these DeFi integrations come over time as supply expands further.

There are many voices (particularly in the world of traditional finance) who are describing the current regime as a shift. A regime shift from US exceptionalism and USD dominance to one in which the rest of the world plays a more important role (at least on a relative basis).

I am not an economist, nor am I a macro predictooor but if these voices are right, one would imagine that these non USD assets could begin to gain more traction as the winds shift. One would imagine this regime shift falls in BTC’s favour too, we’ll see whether price confirms that in the medium term. Bitcoin and Crypto more broadly as a non-sovereign economic system seems well positioned to house some of these shifting trade volumes - at least from where I’m sitting as an armchair economist! While small in absolute terms, it is certainly interesting to note the strong growth in supply in both PAXG and EURC.

As always, we’ll be monitoring the onchain footprint of the non-USD RWA universe as it evolves on parsec.fi