Stablecoins. Stablecoins. Stablecoins.

Stablecoins continue to chug along both in terms of supply growth and “real world” organic usage. Today I’ll discuss a number of extremely exciting developments which are likely to supercharge an already strong trend. Don’t worry, we’ll take a look at some liquid proxies to bet on the stablecoin trend too for the gamblers (ahem, traders) amongst you.

But before we dive in, let’s take a moment to appreciate the resilience of the stablecoin supply trend (it really does not seem to care about price volatility in broader crypto markets):

But what is it that has me so excited at this particular juncture? Well, there’s a few to unpack...

The “GENIUS Act”

The “GENIUS Act” is the most serious attempt yet from US regulators to give stablecoins a proper regulatory framework. It sets clear rules around licensing, reserves, and consumer protection. It made it out of its committee with strong bipartisan support but has hit a bit of a wall in the Senate. A small group of Democrats want tighter language on AML, national security, and foreign issuers. There are rumours that the initial bill was slightly too favourable for Tether and Circle representatives have been kicking up a fuss - unconfirmed rumours but interesting nonetheless.

The fact that something this comprehensive made it this far is a big deal. Whether it passes this year or next, it’s exciting to see stablecoins finally being treated like a core part of the US financial system.

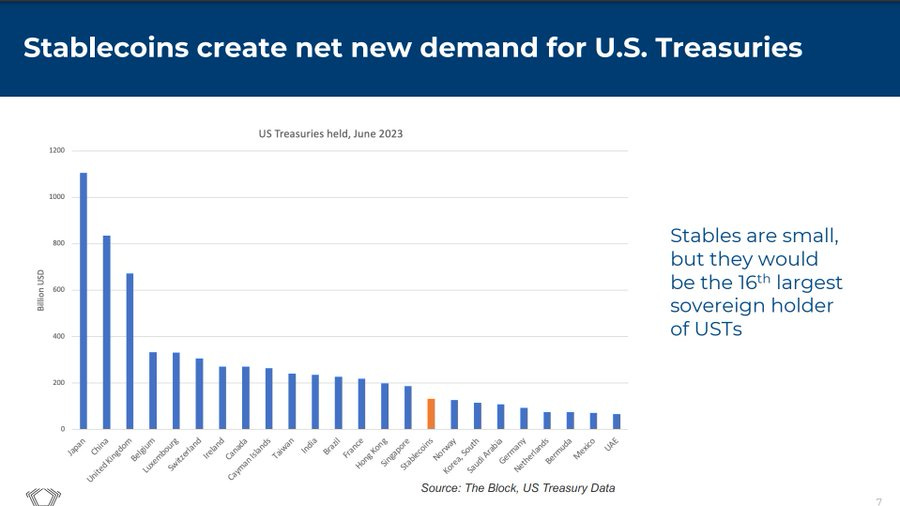

Stablecoins as a trojan horse for treasuries demand

Equally, we are starting to see signs of real recognition surrounding the potential demand which stablecoins could offer for US treasuries. US Treasury Secretary Bessent was recently quoted stating; “I see up to $2T Treasuries demand from digital assets”.

The Treasury Borrowing Advisory Committee recognised stablecoins as a potentially huge source of demand for US T-Bills:

As foreign demand for US treasuries looks to be in structural decline (looking at you China), a new and sizeable marginal buyer of US debt securities has always seemed notable to me. This level of recognition was on my bingo card back in late 2023, for a while I thought I was wrong but I guess just very early (or are they the same thing?). Lawmakers have probably been aware of this for a while but are only recently making public statements.

Fintech integration + adoption

While this has been a consistent trend, there are a couple of developments here which seem particularly notable. The first of which is a seemingly 360 degree turn from Apple with nfts and crypto payments now allowed in IOS apps:

The other notable development I wanted to mention comes out of the Stripe camp. Staunch readers will recall the Stripe<>Bridge acquisition in February which was big news at the time. It seems as though that acquisition is now breaking water with Stripe announcing Stablecoin Financial Accounts powered by Bridge. These stablecoin financial accounts enable users to hold a stablecoin balance and send and receive funds with fiat and crypto rails.

With users being able to hold a stablecoin balance, it seems as though Stripe might be able to venture into a form of stablecoin first business banking here which could be valuable for SMEs/online businesses who are already Stripe customers. Exciting stuff.

How to bet on it?

So I know what you’re thinking; “thanks for stating the obvious, of course Stablecoin growth is the most obvious bullish trend in the entirety of Crypto but how can I make money from it?”.

Let’s take a look...

Unfortunately, the BEST stablecoin plays live in private markets for now (Circle, Tether, Plasma), there’s nothing we can do about it but worth noting for context.

One potential way of playing this would be to express a bullish view on the smart contract platforms which are best positioned to benefit from this growth but with ETH/BTC looking like this, it’s a tough call to make:

While contrarian plays tend to pay the best, many traders have been victim to hero longing what they thought was the bottom of ETH/BTC before it traded to new lows once again. SOL/BTC certainly has less baggage but the issue I find with both of these ratios is that they do not represent an isolated bet on stablecoins - a large part of the performance depends on BTC strength which I do not want to bet against.

The alt basket which makes most sense here is probably one of or some combination of Ethena, MakerDAO, Aave, Curve. Each has a different exposure vector to the Stablecoin trend and very different tokenomic/economic situations, pick your fighter:

Equally, TRX has historically been a very strong bet on stablecoin growth, outperforming the great majority of coins on a multi cycle basis. My only fear there would be the launch of Plasma which could stand to disrupt a lot of the USDT activity which has been native to Tron for so long. I will be looking to find creative ways to farm a Plasma airdrop and will certainly be watching closely at the pre-market and TGE valuation whenever that happens. As is often the case with high quality projects, I expect it to launch far higher than what would offer attractive r/r but you never know.

That’s all for now, see you next week!

Exciting news