nothing mentioned should be taken as financial or investment advice

Points return to Hyperliquid?

$HYPE has recovered extremely quickly from the lows, trading back up to around $27 at the time of writing. Naturally this strong price momentum has been coupled with equally strong metrics as the exchange approaches a $1B run-rate, with 97% of that being directed towards buying back the token on the open market.

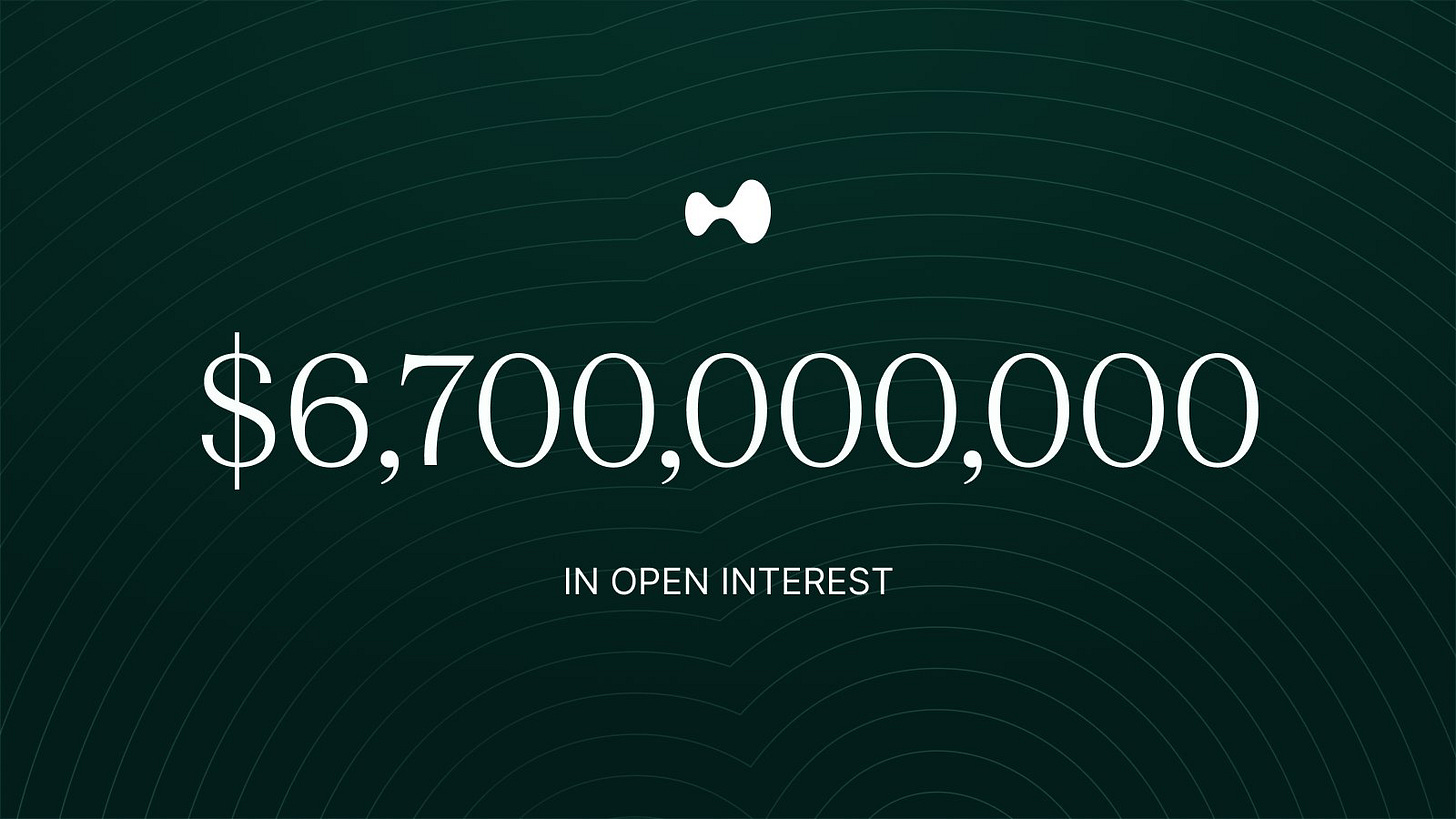

We’ve seen OI ramp to new highs along with TVL:

Interestingly, we’ve also seen the points tab added back to the Hyperliquid app (https://app.hyperliquid.xyz/points) indicating that a points season could be on its way soon or perhaps is already underway.

This got me thinking... what could be some lower risk, passive ways to farm such a points season. HLP is one option but HLP deposits didn’t do too well in terms of points on a relative basis last time around. Rather, I am leaning towards HyperEVM opportunities given the novelty of the chain and the fact that it was non existent during prior points seasons which makes it more likely to be incentivised heavily this time around.

While HyperEVM activity remains below the highs, it seems to have bottomed and be picking up again:

One interesting opportunity which has arisen on the HyperEVM very recently is Hyperstable. Hyperstable allows users to mint USH using WHYPE as collateral, think Liquity but for HYPE.

USH can be deposited into a variety of incentivised Curve pools to farm PEG (unlike many protocols on HyperEVM, Hyperstable’s governance token is already trading) for healthy APRs:

Having launched just a few days ago, USH is small but growing:

I would imagine this growth will continue as long as the yields remain attractive.

Hyperstable stands out as a promising option to generate a good liquid yield while also *potentially* earning hl points at the same time.

If HyperEVM continues to heat up, it’s likely we’ll see more of these opportunities emerge - promising liquid yields combined with the potential for points.

It's very informative

Waaw