BTC ATH, what next?

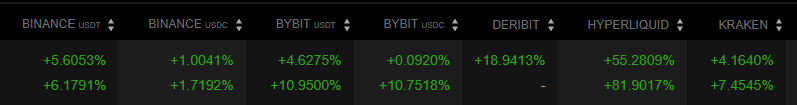

During what has perhaps been one of the most subdued breakouts I have personally witnessed, BTC has run to new all time highs in USD terms this week. Funding rates during the breakout reflected this lack of euphoria with rates across most crypto exchanges at baseline or below it:

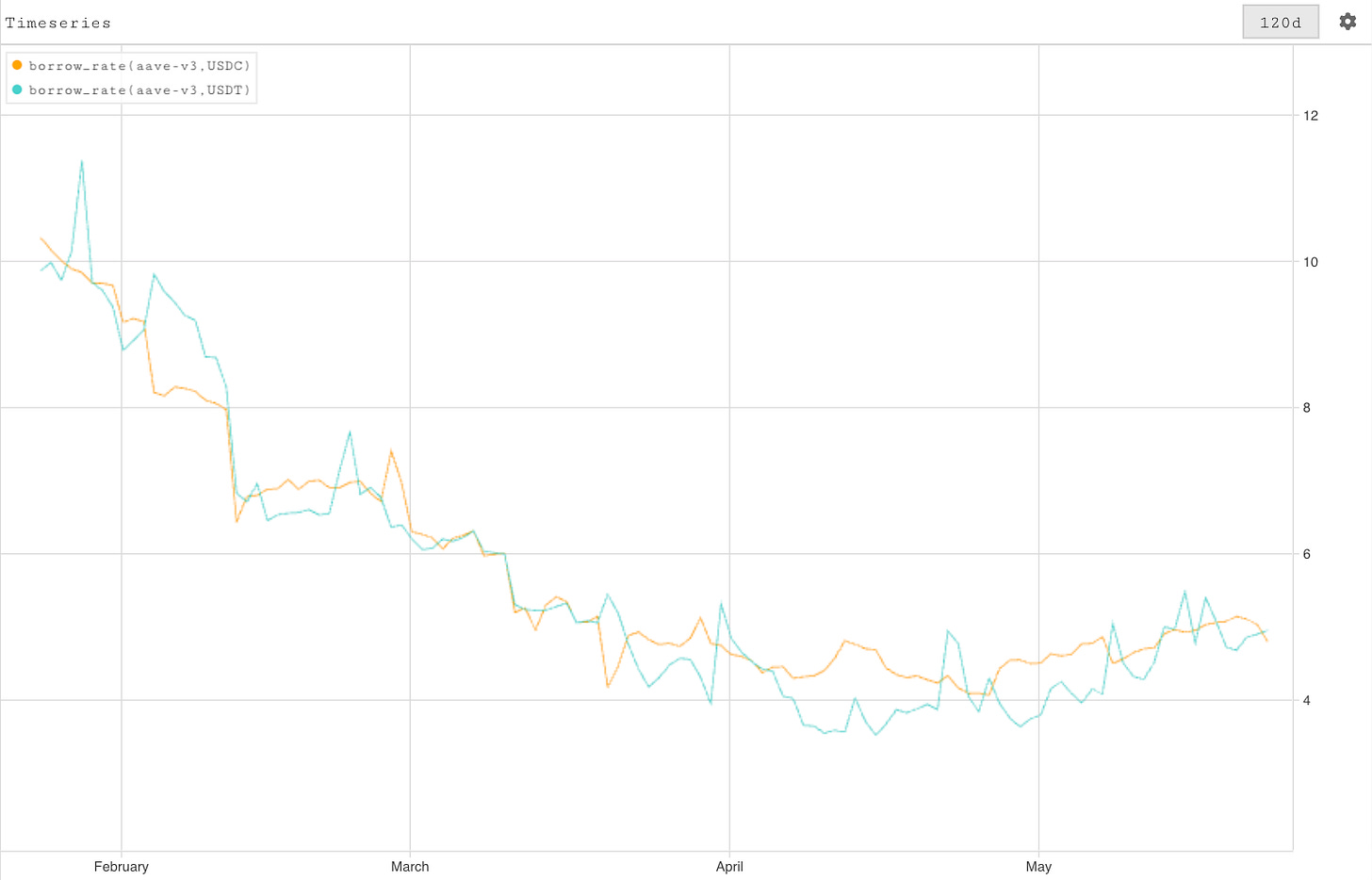

On chain borrow rates have remained subdued too reflecting a general lack of leverage in the system:

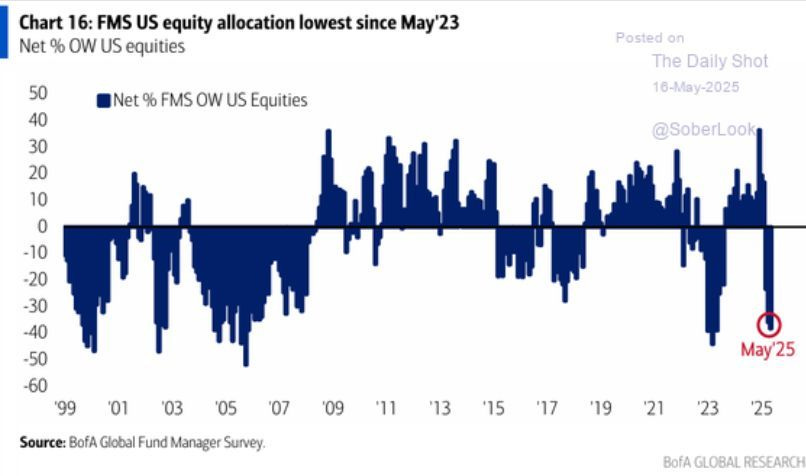

Given the extremely quick recovery from absolutely bombed out sentiment and prices just 1-2 months ago, it’s likely that many traders were not positioned for this move - hence the lack of palpable euphoria this week. This is certainly true from a traditional markets pov with fund managers being sharply underweight equities:

So... what can we expect from here?

Both times it took exactly 152 weeks from the prior bear market lows to the all time highs of the 2017 cycle and from the prior bear market lows to the highs of the 2021 cycle. If we are still respecting some form of a 4 year cycle in BTC, we would be expecting the highs of this cycle in early October.

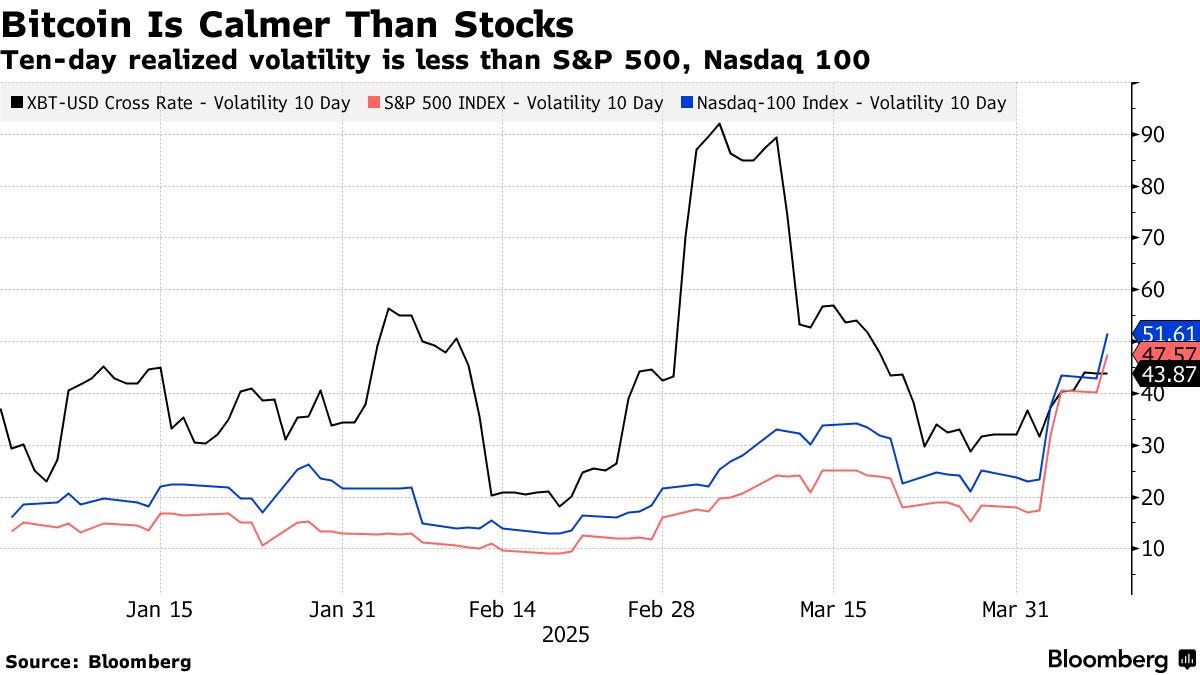

Whether we are still bound to a 4 year cycle or not is yet to be seen, there’s a strong chance that the introduction of ETFs and tradfi’ification of BTC has changed the dynamics but ultimately only time will tell. BTC’s behaviour during the recent tariffs driven selloff told a strong story as the asset continues to show increasing signs of maturity. Realised volatility for BTC actually came in below US equity indices during the meltdown (which is pretty remarkable):

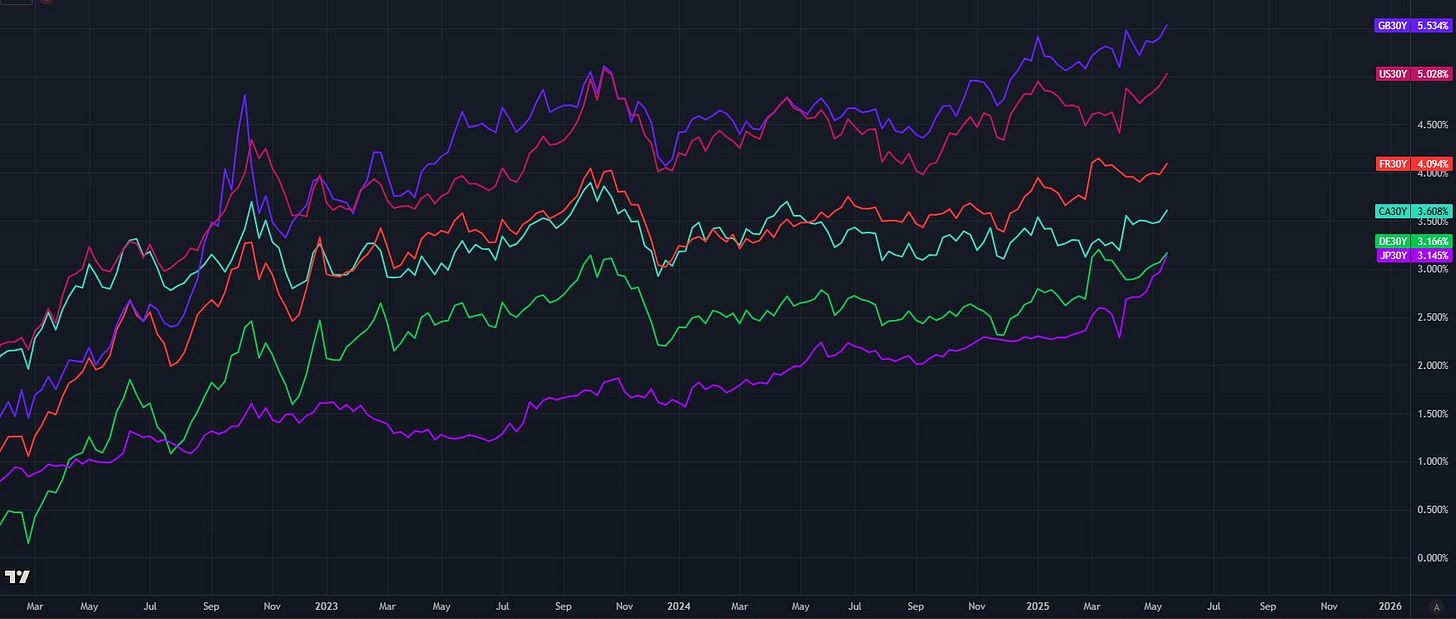

The dynamic of an all time high breakout in BTC accompanied by long end yields ripping across major developed economies feels notable too in terms of where the market is placing bets on the long term fiscal situation:

We’re looking forward to seeing how a buoyant BTC will play out into the rest of the market, particularly on-chain. You know where we’ll be watching it, that’s right - on parsec.fi!

Insightful. All eyes on BTC