Parsec Weekly #119

Circle IPO and XPL Sale

Circle IPO and XPL Sale

Next Wednesday will see Circle IPO on the NYSE with the ticker symbol CRCL in the highest profile IPO we’ve seen since Coinbase back in 2021. Circle aims to raise $624 million in a 24 million share offering at a target valuation of $6.7 billion.

Cathie Wood will reportedly take $150m and Larry Fink (Blackrock) a further $60m, both of whom will likely push it to their investor circles. With 35% of the raise already accounted for from just these two parties it feels likely that the raise will be oversubscribed which would certainly be a net positive, signalling demand and confidence for the stablecoin narrative amongst big traditional finance money.

Coincidentally (or not), we’ve seen Plasma (read: Tether chain) come out this week with a near term fundraise announcement too:

$50m at a $500m FDV for the XPL token. Note the verbiage here that this round is at the same valuation as their last equity round - somewhat misleading given that this fundraise is for token and we do not have information about what the implied valuation of the token warrants was in the aforementioned equity raise.

Either way, a $500m FDV does feel reasonable on a relative basis, especially given the deal terms stipulate a 1 year cliff + no vest, meaning participants will be liquid in 12 months post raise.

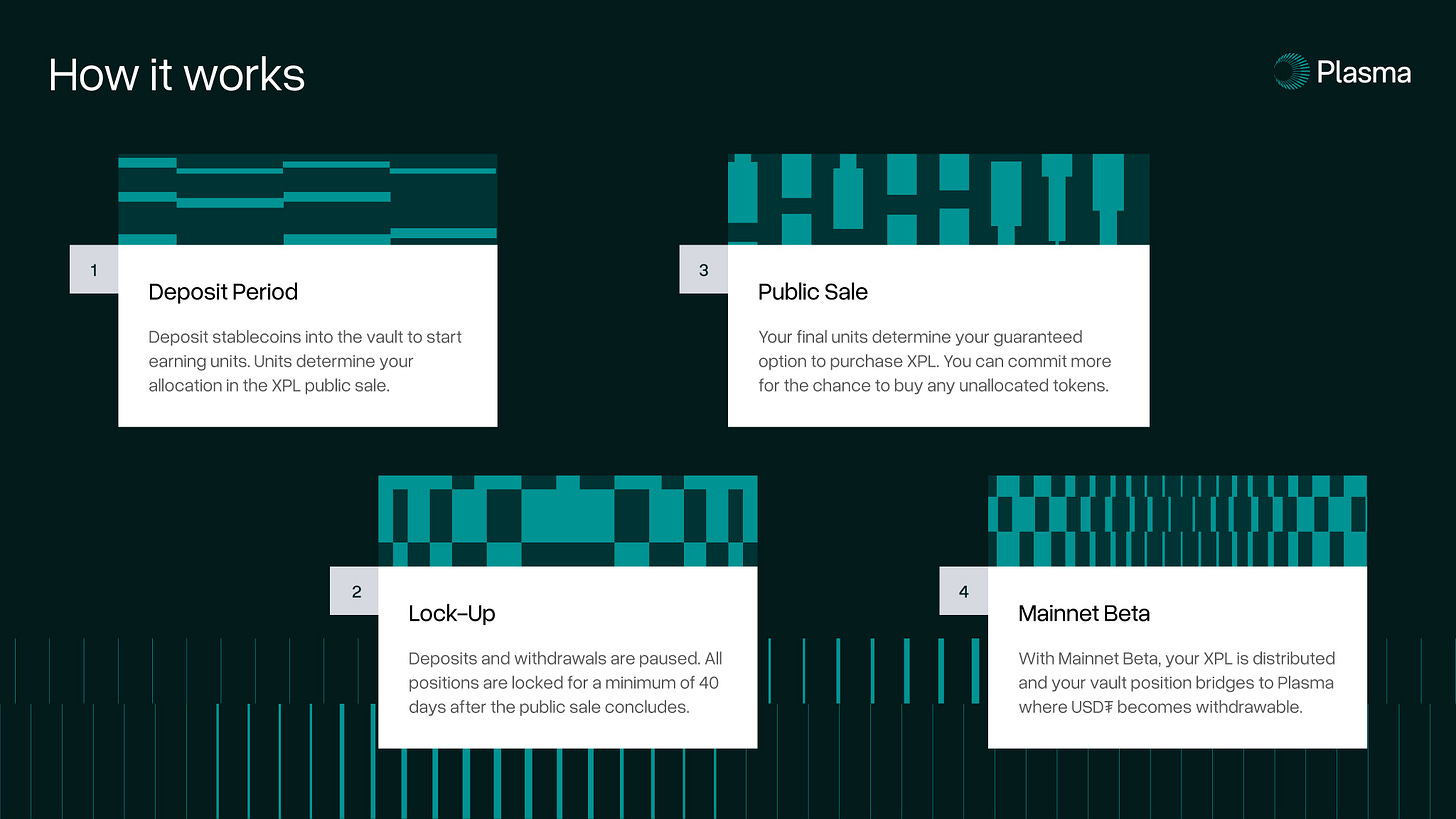

To be eligible for the XPL token sale, participants will have to deposit USDT, USDC, USDS, or DAI into the Plasma Vault on Ethereum mainnet on June 9th. The vault will deploy stables into deployed into Aave and Maker and will take a maximum of $100m in deposits, each depositor’s proportional ownership of the vault defining the proportion of the $50m raise they will be able to fill on Sonar (Echo’s new public sale infrastructure product). The vault deposits will unlock as of Plasma mainnet which could be a matter of months away, or up to a year, no one really knows...

What this effectively means that for every $1 invested in XPL, a further $2 need to be locked into the Plasma Vault for an unspecified amount of time (up to 12 months assuming mainnet launches no later than XPL TGE) earning the risk free rate.

This certainly changes the dynamic from an opportunity cost perspective so it will be interesting to see how quickly the vault fills in what could be the first gas war we’ve seen on mainnet in quite a while.

The competitive landscape is certainly intensifying with both Circle and Tether making big moves in their respective lanes. We look forward to watching how the Circle IPO goes next week and whether the Plasma Vault gets insta-filled or not shortly after - the latter of which we’ll be watching on parsec.fi