Tokenised Stocks Are Back (For Real This Time?)

If you’ve been around long enough to remember Mirror Protocol, you probably rolled your eyes when the recent stock tokenisation newsflow started doing the rounds on CT. But this time, something feels different — and not just because Robinhood is in the mix.

The original idea behind tokenised stocks was simple: put equity exposure on-chain. Mirror and Synthetix tried it with a synthetic model, FTX and Binance tried it via wrapped shares. None of them worked. Mirror imploded with UST, Synthetix deprecated the product (likely due to a lack of interest), Binance got clamped down on by regulators, and FTX... well, we all know how that ended.

The truth is that there were multiple issues with all of these offerings:

Mirror and Synthetix products were not backed by real assets

Binance/FTX offerings lived or died on regulatory goodwill

Liquidity / Trading volumes suggested low taker interest and a lack of maker willingness to make markets

There was no real compelling reason to hold these products over the real thing (for almost all users)

This begs the question of whether the recent offerings are any different...

xStocks

Launched by Backed Finance, xStocks are tokenised equities issued under Swiss law and settled on Solana. They’re backed 1:1 by actual shares held via a regulated custodian, issued through a Liechtenstein SPV. You can’t redeem them unless you’re KYC’d and not in the U.S., but that’s the trade-off for legal survival.

So far, there has been pretty solid support:

Kraken and Bybit list the tokens, and allow withdrawals to on-chain wallets

DeFi liquidity on Jupiter and Raydium

Chainlink oracles

Lending markets (Kamino) spinning up DeFi use cases

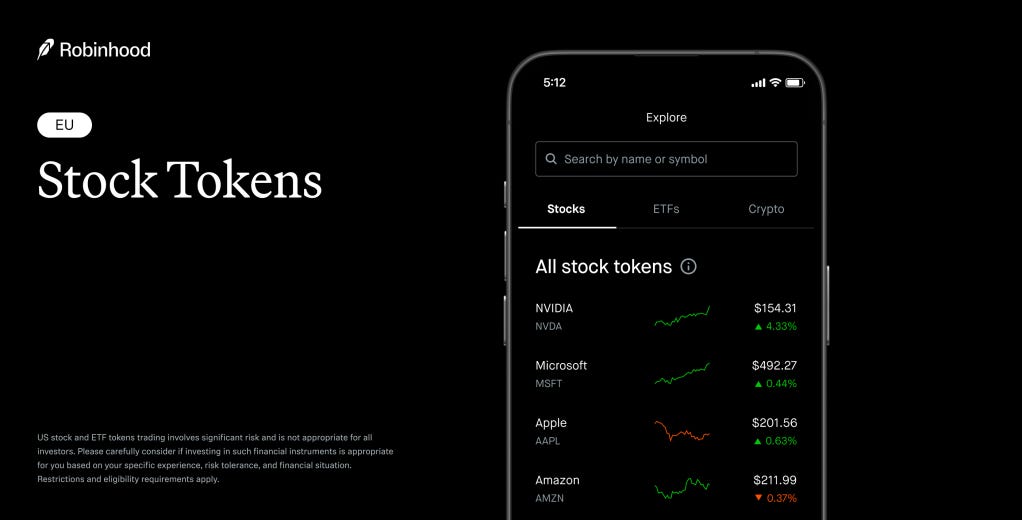

Robinhood

Robinhood recently dropped a bomb of their own.

They’re rolling out tokenised U.S. stocks to European users, settled on Arbitrum, with plans to migrate to a custom-built L2 (“Robinhood Chain”). The pitch is 24/5 trading, real economic exposure, instant settlement. They also previewed future access to private equity names like OpenAI and SpaceX, pushing the idea of retail-friendly, tokenised exposure to assets which have been walled off previously.

The biggest difference vs. xStocks is that Robinhood is taking the full-stack approach — they’re the issuer, custodian, and UI. This probably yields superior UX but in more of a walled garden than the DeFi friendly xStocks approach.

Still, Robinhood leaning into tokenisation is no small signal. This is a public company with existing regulator relationships, if they’re betting on this, it's worth paying attention.

So why could this make sense now?

Well, there’s a lot that has changed since the prior attempts:

Infrastructure has significantly improved (Solana’s performance + L2 time to finality/fees)

Stablecoin layer is much more mature

Legal frameworks in Europe and Switzerland are more developed than they were in 2021

Signs of real RWA demand starting to show

But there are still significant frictions with these new products:

U.S. exclusion

Liquidity cold start problem (liquidity begets volume but relies on market makers taking the risk and betting on real usage), spreads will be wide and probably insane on weekends

Cross-chain fragmentation and multiple standards (xAAPL on Solana won’t be the same as rAAPL on Robinhood Chain)

It’s not guaranteed the average user has demand for tokenised stocks

A lot of similar frictions to the prior iterations of these products. I am tempted by the notion that “this time is different” especially with entities like Robinhood getting involved. If this can pull through the early stage friction, we might actually see a 24/7, global equity market take shape through a set of regulated wrappers sitting quietly on Solana and Arbitrum, letting you swap Apple stock like you would USDC.

I for one would value a liquid spot market for an S&P500 token to use as collateral on spot lending markets and dex derivatives markets alike. Perps on single name equities would be very cool too. Looking forward to seeing how this sector evolves and covering it more into the future!