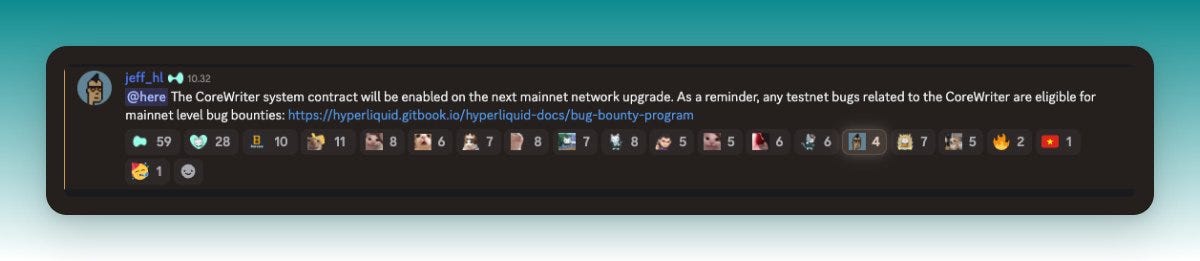

CoreWriter - Hyperliquid's next big unlock?

What would DeFi look like if protocols could write directly to one of the centralised exchange-grade order books? Well, it seems that we’re about to find out.

Hyperliquid just rolled out CoreWriter which could be the most important release they’ve shipped to date.

Let’s refresh.

Hyperliquid’s architecture runs on two execution layers: HyperCore (CEX-like trading engine) and HyperEVM (smart contract layer). Both share the same state. Until now, smart contracts on HyperEVM could read from HyperCore — monitor balances, view positions, track prices — but couldn’t actually do anything.

This changes with CoreWriter.

HyperEVM contracts can now place orders, manage vaults, interact with liquidity, and more — all directly on HyperCore.

Despite being connected to their respective centralised exchange counterpart, chains like BSC, Base, and Mantle have always existed as siloed environments with the only interaction being token transfers from chain to exchange, and vice versa.

Hyperliquid breaks that trend with CoreWriter, opening up an entirely new design space. Here’s a quick look at how three protocols are already planning on using it:

Kinetiq – LSTs That Don’t Rely on Multisigs

Kinetiq plans to upgrade $HYPE liquid staking. Instead of relying on manual validator delegation or multisig flows, they plan to use CoreWriter to ingest HYPE on Hyper EVM, score validators and delegate via StakeHub — all through smart contracts.

That means no manual routing, no custodied assets — just a fully trustless delegation layer. A big step forward for liquid staking on Hyperliquid.

Felix – Liquidations Meet the Order Book

Lending protocols usually handle liquidations via AMMs. It works, but it’s not exactly efficient. Felix, one of HyperEVM’s largest borrow/lend protocols, is now exploring orderbook-based liquidations using CoreWriter — a first in DeFi.

Instead of dumping into AMMs, liquidators can interact directly with the order book. That unlocks tighter pricing, lower slippage, and more precise risk management — especially when it comes to volatile collateral.

They’re also eyeing new mechanics like per-position borrowing and collateralising perps directly. Still early, but the primitives are forming.

Rysk – Delta Hedging Without Offchain Crutches

Options protocols tend to rely on some element of centralisation for delta hedging. Rysk might be breaking that trend.

With CoreWriter, Rysk can execute delta hedges directly through smart contracts, writing into HyperCore’s order book without touching offchain infra. That means LPs get automated hedging with full onchain transparency — a huge leap for trust and composability.

It’s the first real example of fully onchain, orderbook-native options infrastructure — a strong sign of what’s possible when execution and logic live on the same state layer.

So… What’s Actually Changed?

CoreWriter quietly removes one of the biggest bottlenecks in DeFi: the disconnect between smart contracts and high-performance execution.

With smart contracts now able to read and write to the same engine that powers onchain perps, books, and vaults, the design space just expanded dramatically.

Alongside the first large centralised exchange spot listing for HYPE on the way to Bybit today and the recent Phantom perps announcement, it’s going to be an exciting few months for the Hyperliquid ecosystem.

And yes, you guessed correctly, I’ll be monitoring the latest HyperEVM developments on purrsec.com