Stablecoin Farming In A Bull Market!?

In the depths of a bear market, stablecoin yield farming is a survival mechanism. In a bull market? Many would say it’s not worth your time when you can make 20% in a day on the shitcoin du jour.

I would argue it still makes a lot of sense for undeployed stables or profits you don’t want to put back into the market. It can be a cheat code — if you know where to look.

This past week saw a mini explosion in looping activity and basis spreads, let’s dive in...

Ethena x Pendle Looping Gets Juicy

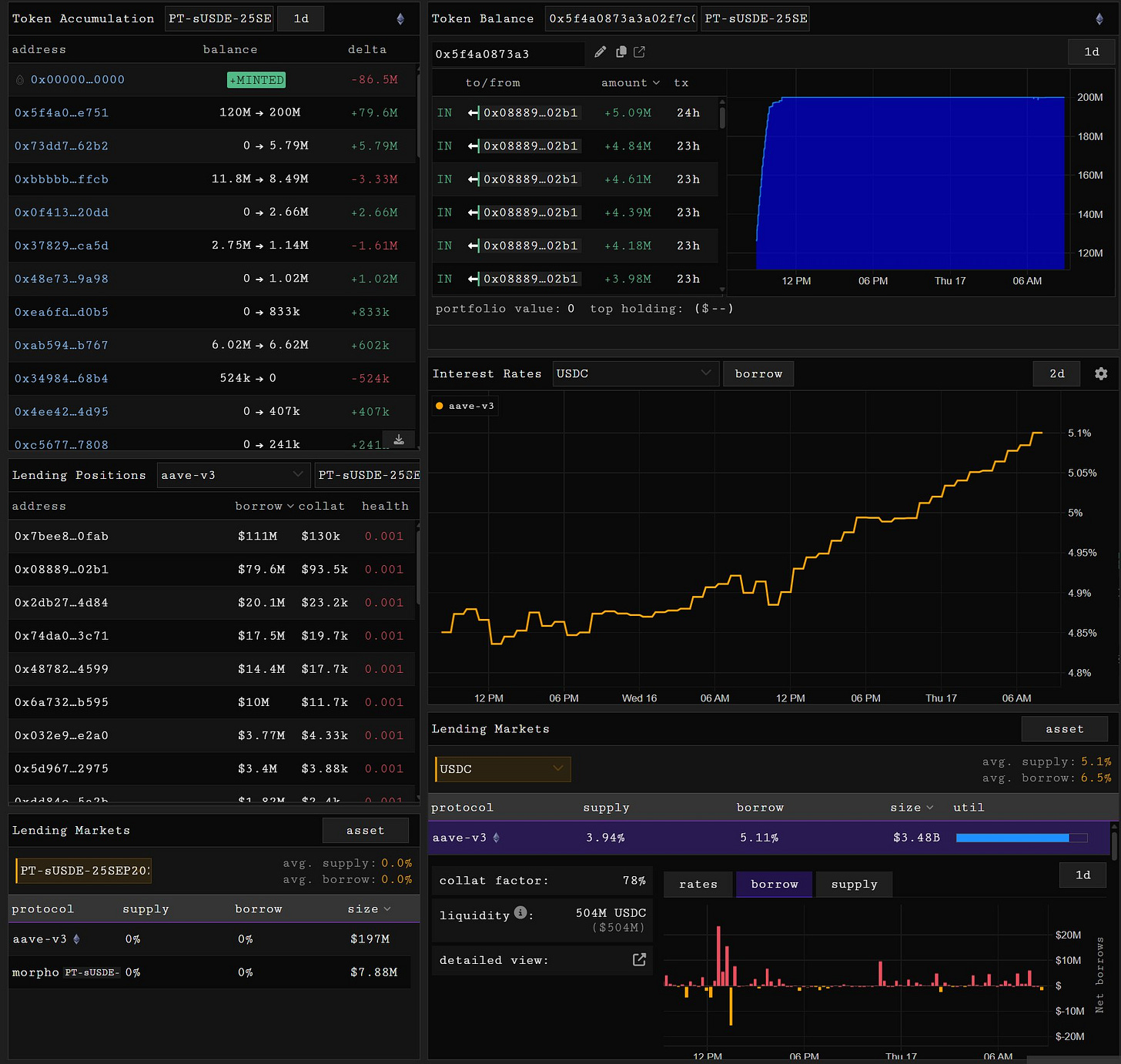

With funding rates perking up, sUSDe yields are back in double digits. Pendle PTs on the July expiry topped 12% APY last week and with the September PT listing on Aave, the looping flywheel is back in motion.

Modest leverage on PT looping (borrow sUSDe → buy PT → LP → repeat) is now yielding 30–40%+.

As Matt Casto pointed out, Ethena continues to act like a black hole for borrow demand — the September PT cap filled quickly, and USDC borrow rates on Aave have risen in its wake. Borrow size now sits near $200M with rates pushing above 5%.

Long Spot, Short Perps on Hyperliquid

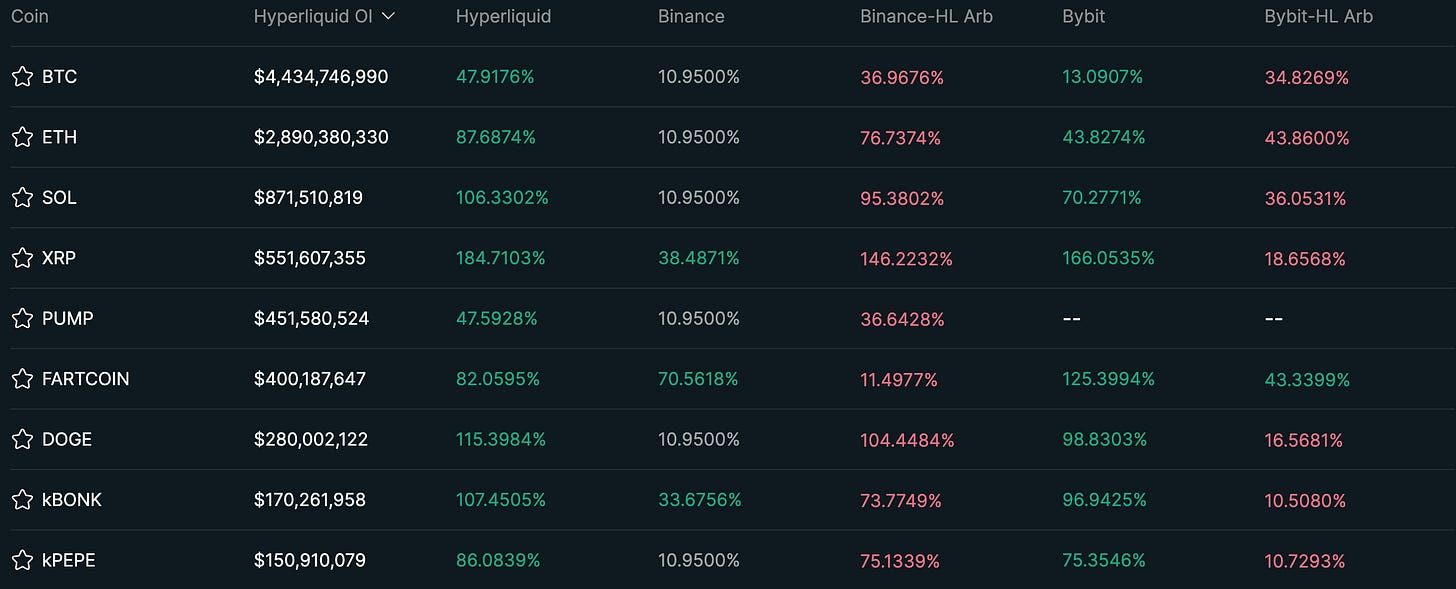

As mentioned above, if you’ve been watching funding rates recently, you’ll know they’ve started to pick up post breakout. The set up here is pretty simple; buy spot, short the perp, farm the funding.

Annualised funding on majors like BTC, ETH and SOL has been clocking in high rates in short bursts — with minimal basis risk. In some cases, the yields are getting absurd — Pump funding has been 100%+ for the majority of this week with plenty of liquidity to leg in/out of both legs.

Yield on HyperEVM

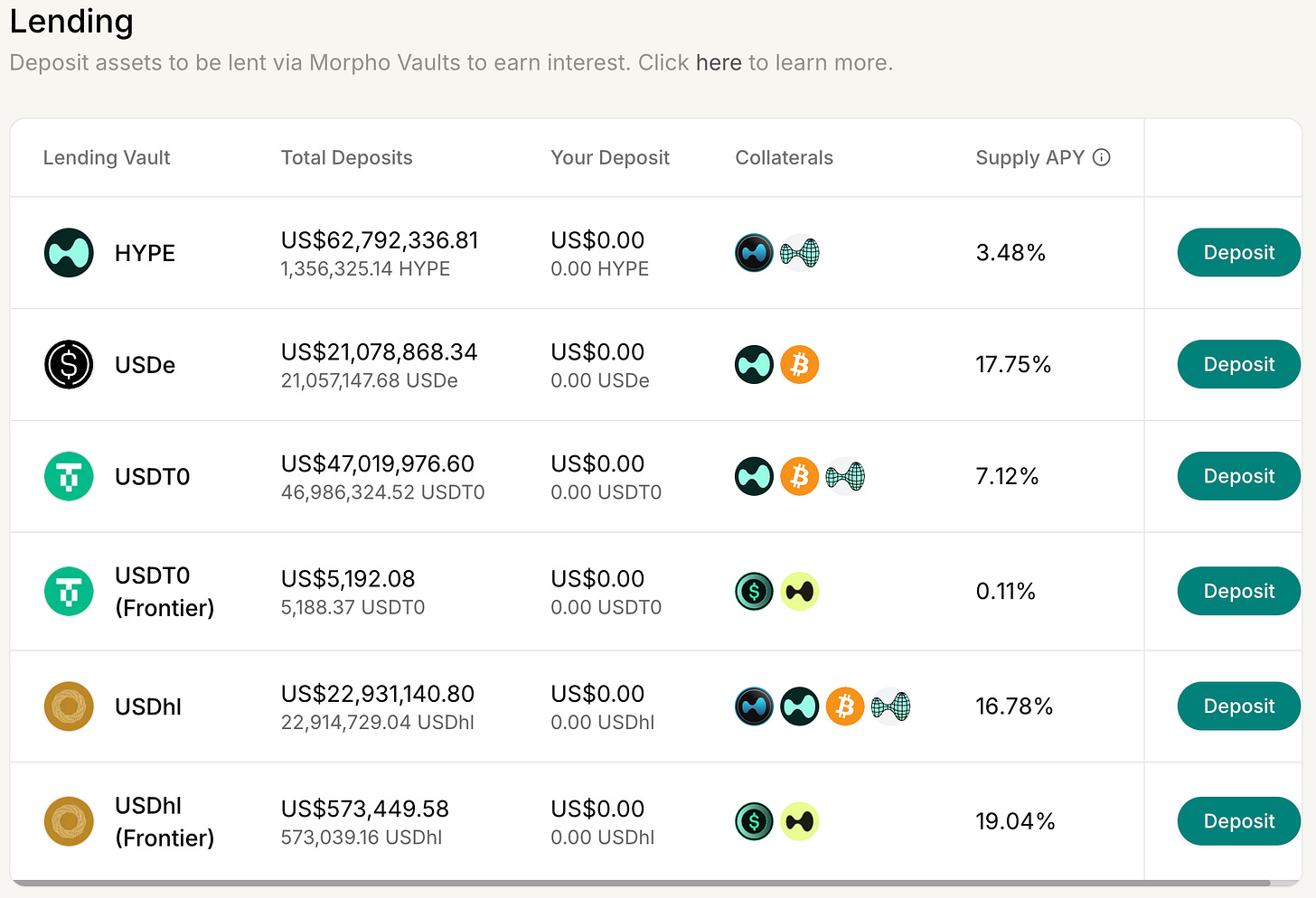

And finally, HyperEVM is also quietly becoming one of the most attractive places to farm onchain yield.

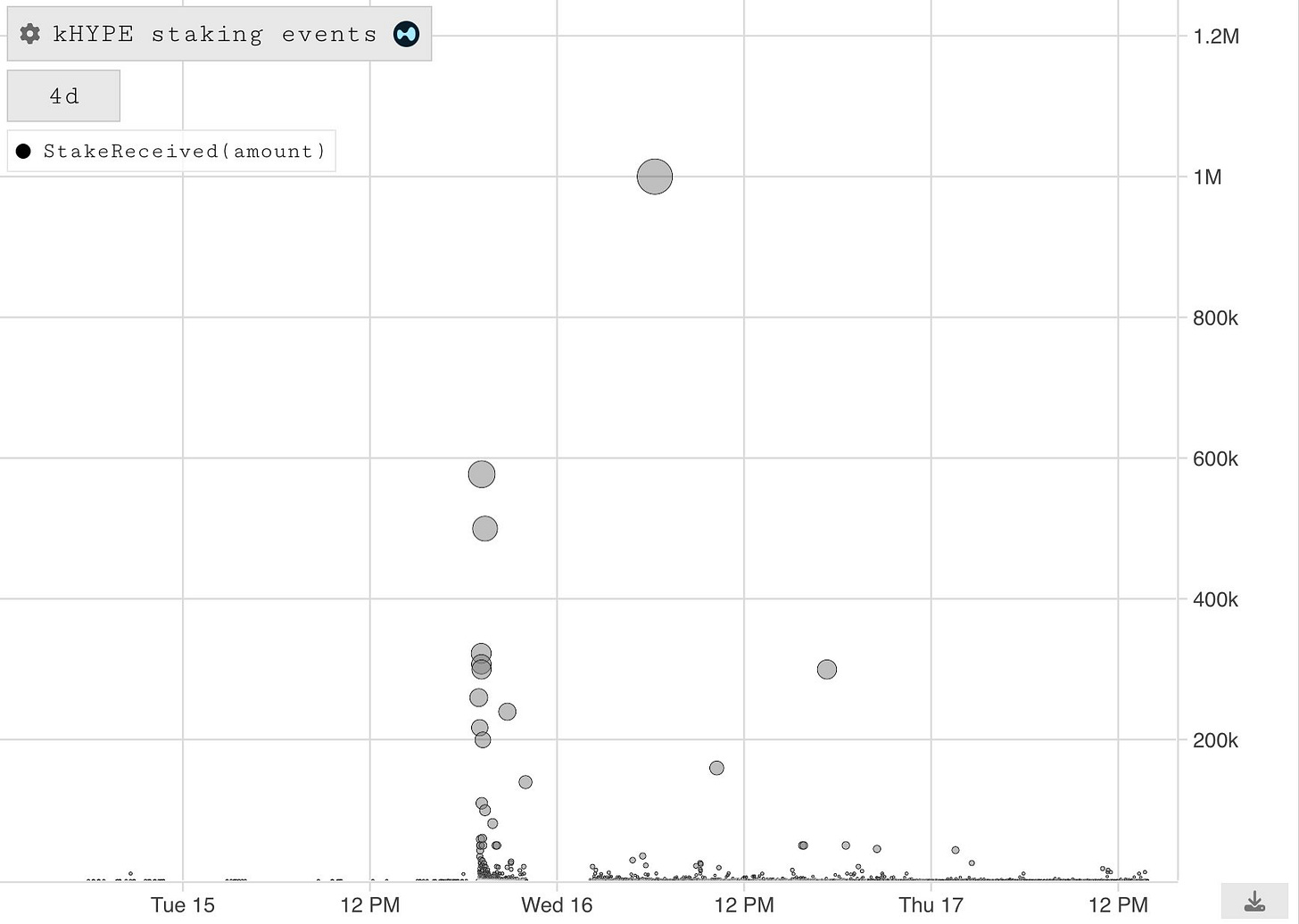

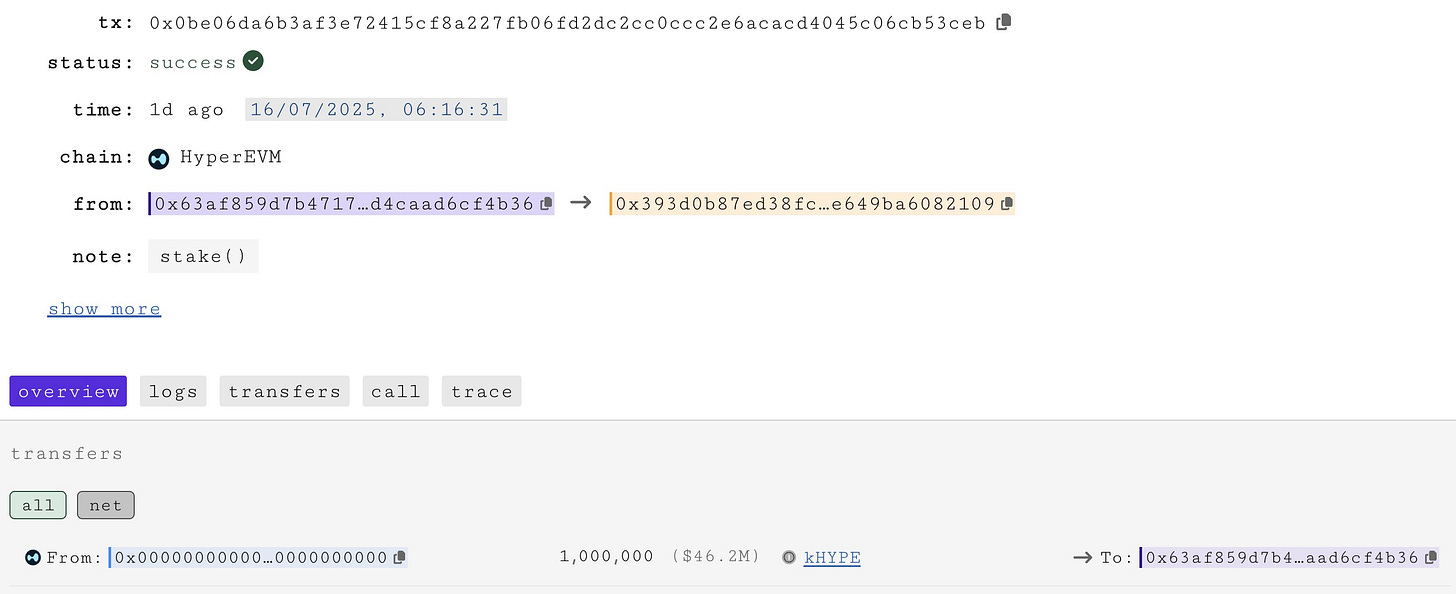

Felix’s Vanilla markets are starting to offer attractive APYs for one sided stablecoin lenders (17.75% on USDe as shown above). With the introduction and rapid uptake of kHYPE (breaching 10m HYPE within 1 week of launch with the largest deposit being 1m HYPE as shown below!), we are likely to see borrow demand continue to be strong on HyperEVM, driving strong lending rates for stablecoins.

Whether you’re sidelined, rotating profits, or just trying to stay sane while markets go parabolic — boring yield is back and it’s paying handsomely!