Parsec Weekly #126

This Week Onchain: Stables Yield, ETH Unstaking + Base Gems

This Week Onchain: Stables Yield, ETH Unstaking + Base Gems

Onchain activity has been heating up quite a bit during what has been a pretty buoyant market over the past month. Let’s dig in...

Stablecoin yields driving supply growth

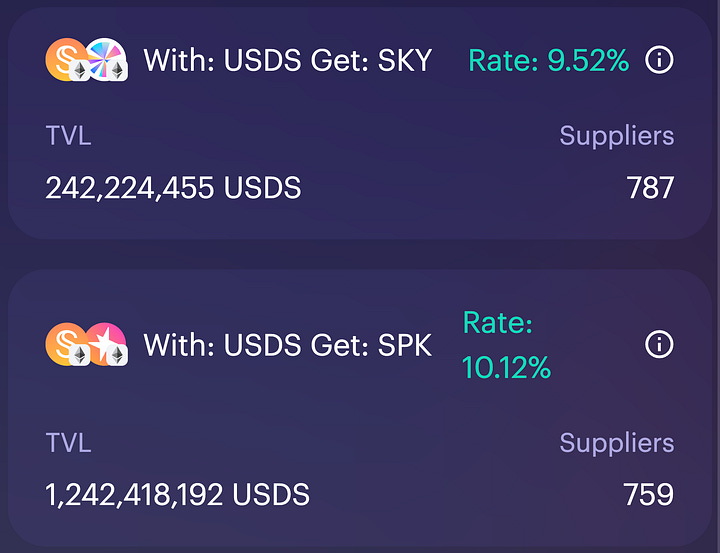

This week we’ve seen a surge in both USDS and USDe supply, both of which seem to be thanks to an increase in yield offered to stakers.

Funding rates and futures basis have begun to reflect the bullish sentiment in the market which has driven sUSDe yield back towards 10% resulting in an all time high break in USDe supply towards 7 billion! Note that this has been helped along by the Aave x Ethena Pendle PT looping shenanigans which I discussed last week.

Equally, SPK (the first SubDAO token launch) has been on a monster run which has significantly juiced the USDS<>SPK rewards vault, reviving USDS supply back above 4 billion and resuming its uptrend back towards 5 billion in supply:

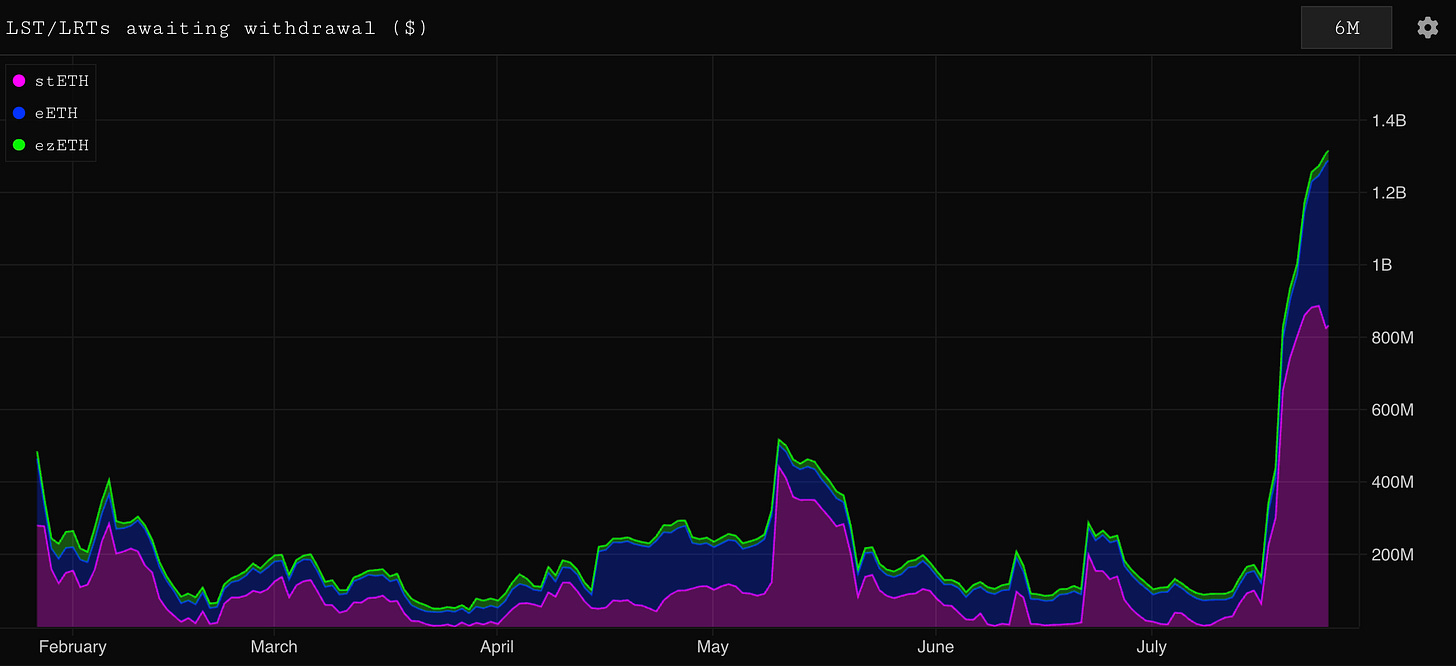

Significant ETH withdrawals from staking tokens

This week has also seen quite significant ETH entering the withdrawal queue, reflected here by ETH withdrawing from various staking tokens:

My first reaction would be; is there a big ETH Digital Asset Treasury vehicle pending announcement and some coins moving out of staking to fund that. It seems like this might be the case, but not the direct cause of this spike necessarily...

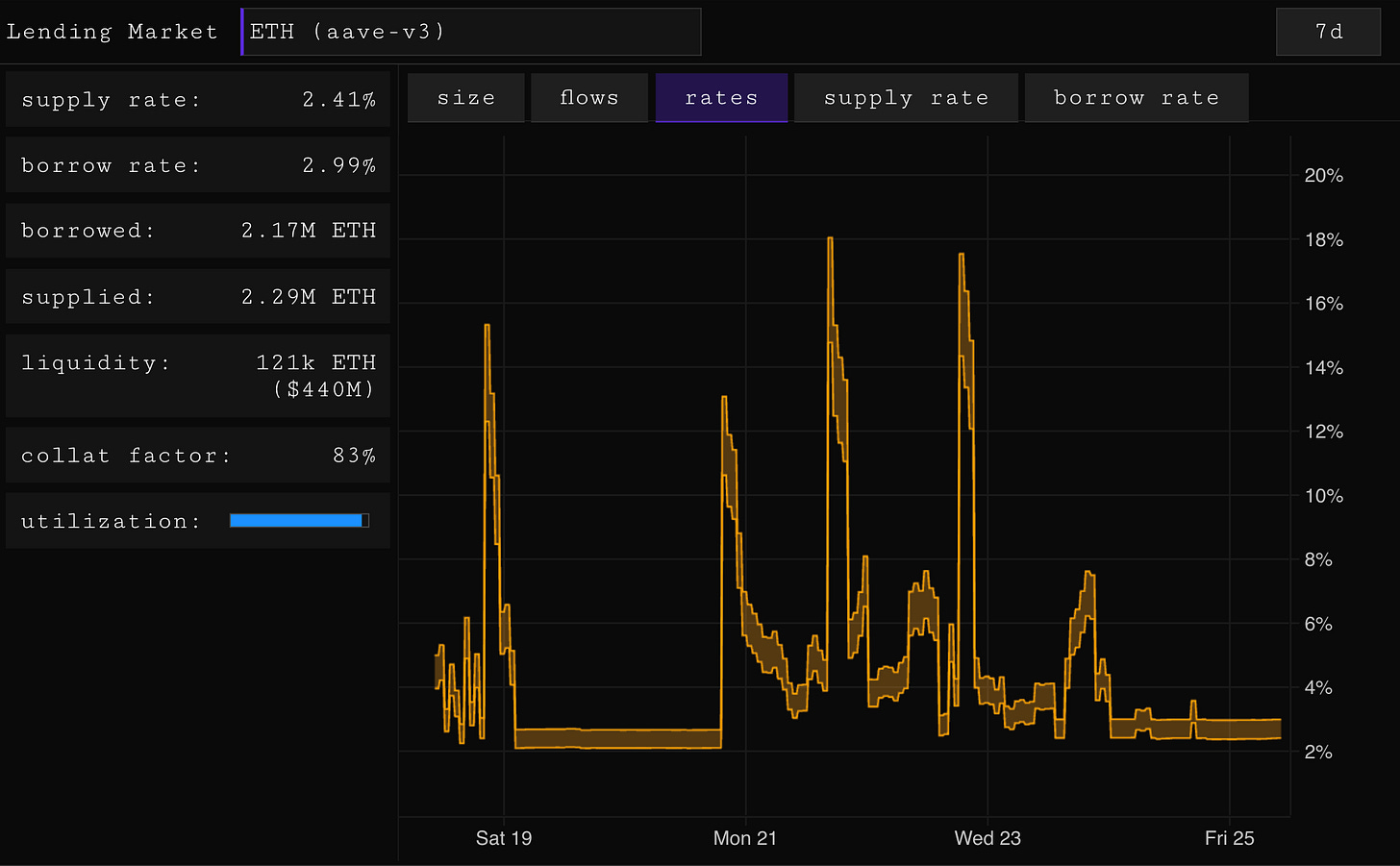

A whale address (apparently Justin Sun), withdraws quite a significant amount of ETH from Aave (to launch his own DAT?):

This drives a spike in utilisation and therefore rates on ETH:

This renders overleveraged loopers unprofitable and they unwind positions, causing ETH to enter the unstaking queue. Perhaps this is also why we’ve seen stETH depeg a little in the past few days as some participants sell to jump the queue:

An interesting DeFi tale! ETH rates have since normalised very quickly; there can also be the dynamic of ETH leaving staking to capture the high borrow rate caused by high utilisation which is also a likely scenario which has driven unstaking.

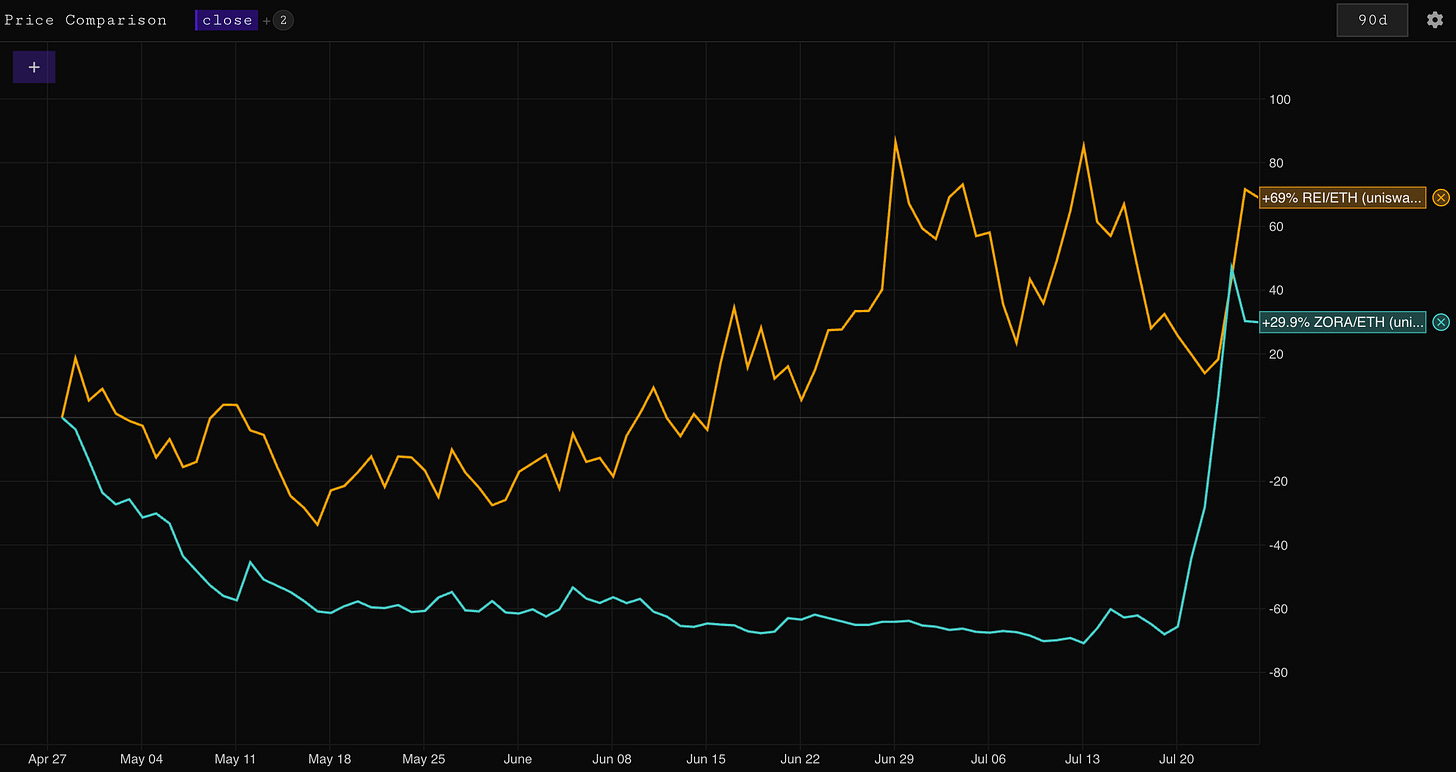

Silent Base Season?

While it seems as though the whole market has been sitting watching the ETH price go up in awe or tending to their wounds after the PUMP shenanigans, we’ve seen a couple of very strong performers on Base which seem to be sailing somewhat under the radar:

Despite a shaky initial launch with a lot of hate towards Base and Jesse Pollak for trying to push the “coin everything” narrative, it seems as though the people are coining! Under the hood the tokenomics are quite interesting with 1% of trading fees going to the creator and every token that launches on Zora being paired with ZORA. Similar to Virtuals but for “creator coins”.

Rei is an AI lab with a token which is attempting to build a model which overcomes some of the shortfalls which traditional models from the big labs tend to portray. Notably Stateless Memory, Frozen Weights and Hallucinations. Following the collapse of the AI coins in Q1, REI has been one of the only to put in a full recovery - probably worth monitoring!

And that’s all for today! Head over to parsec.fi to take a look at some of these data points for yourself.