Parsec Weekly #128

The Battle of Stablecoin

The Battle of Stablecoin

It’s not controversial to suggest that to date, stablecoins have been Crypto’s killer use case with the most profitable company in the industry being a stablecoin issuer (Tether). We’re entering a new phase of the stablecoin wars: not about who issues them, but who controls the rails they move on.

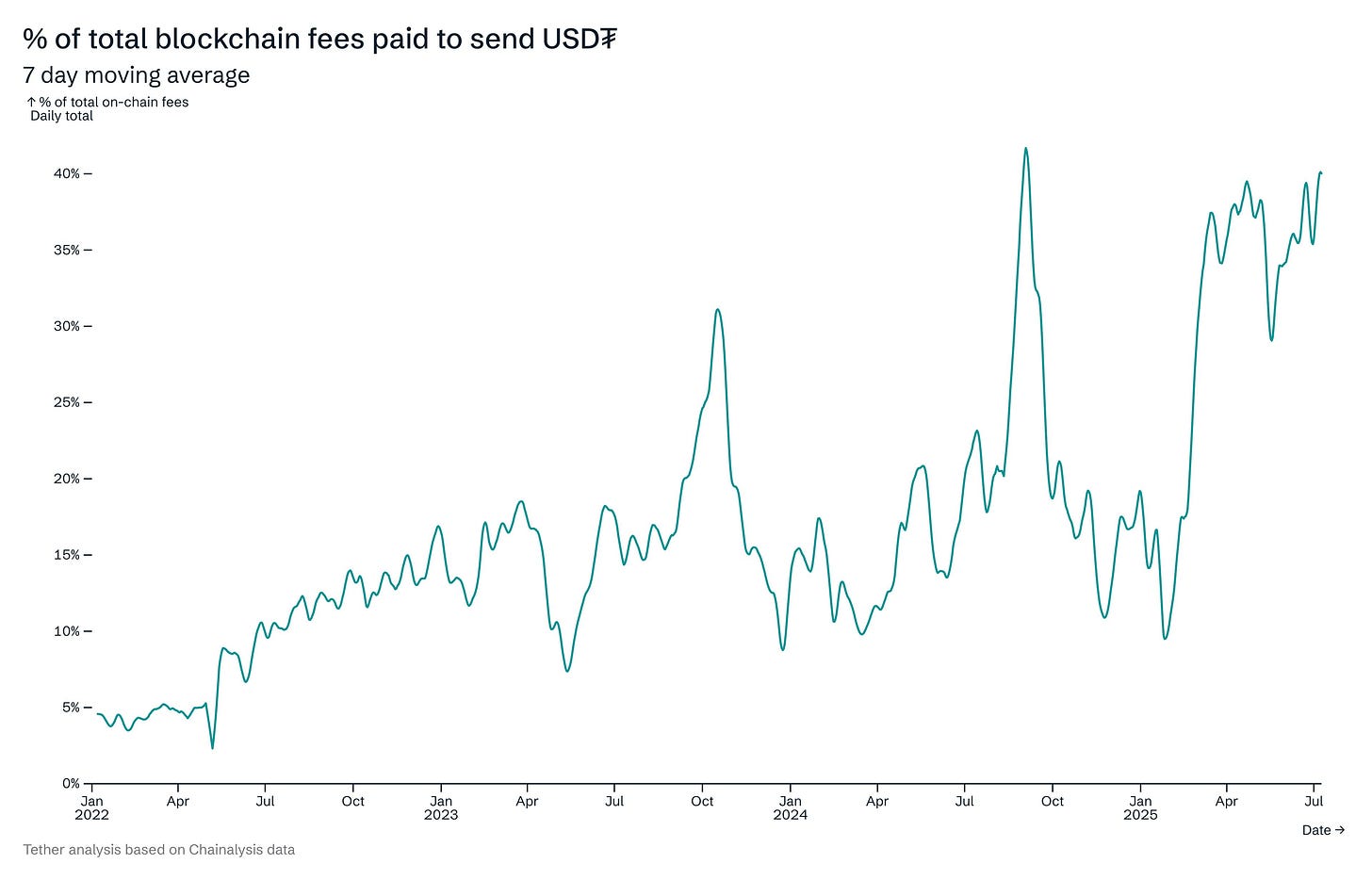

I recently saw a data point that 35%+ of total blockchain fees are USDT transfers (which is insane):

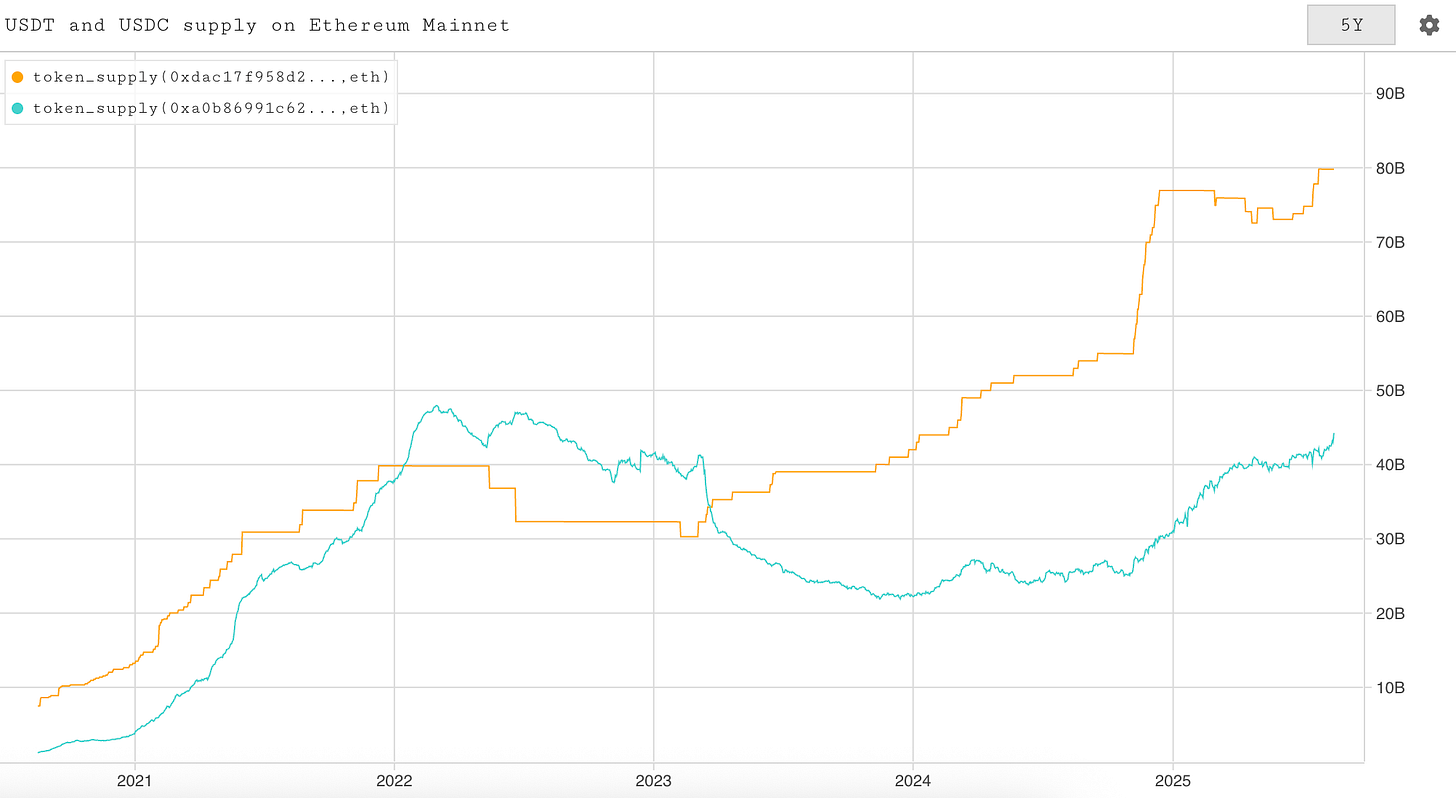

Meanwhile, stablecoin supply looks like this (on Ethereum mainnet alone):

With that said, it’s no surprise that we’re seeing an influx of projects looking to capitalise on this trend, including a plethora of new L1s, each bidding to be “the stablecoin chain”. Competition is intensifying with both stablecoin issuers and fintechs in the race, today I wanted to break down the most prominent front runners, especially given some recent announcements from both Circle and Stripe.

Plasma

Initially touted as “the USDT chain”, Plasma is a stablecoin L1 designed to make USDT transfers free and instant. Technically, Plasma is an EVM-compatible Bitcoin sidechain running “PlasmaBFT” consensus for rapid finality. It features a native BTC bridge, whitelisted gas tokens, and zero-fee USDT transfers.

The team recently ran a blockbuster token sale with $373 million in commitments (7x larger than the initial $50m target raise). As part of the sale, investors were mandated to commit stablecoin deposits to bootstrap initial TVL, thanks to this mechanism Plasma mainnet will launch with $1b in stablecoin TVL - a healthy head start!

Stable

Prior to the announcement of Stable, it seemed as though Plasma was Tether’s bet for “the USDT chain”. However, with Tether on the cap table for Stable too, it seems clear they are hedging their bets.

While technically different, the idea here seems to be almost identical to Plasma. Stable will be a high-performance, EVM-compatible L1 built for USDT and running StableBFT (CometBFT-based PoS). It uses USDT as native gas and offers gas-free USDT transfers and unwraps for frictionless stablecoin transactions.

While it makes sense for Tether to hedge their bets with respect to execution, the risk here would be liquidity and user fragmentation across both chains. Interoperability will be a key question here and one to monitor from an investment perspective.

Arc (Circle)

Arc was just recently announced on Aug 12th with this blog post, it looks to be Circle’s answer to the L1 bets Tether are making.

In summary, Arc is an EVM-compatible L1 purpose-built for stablecoin finance, using USDC as native gas and sub-second finality via “the Malachite consensus engine”. It features a built-in FX engine, opt-in privacy, and deep integration with Circle’s payment, minting, and cross-chain tools. The target use cases are enterprise-grade payments, FX, capital markets, and tokenisation.

Tempo (Stripe)

And like clockwork, an announcement from Stripe shortly followed! For now we don’t have much context here, just that Stripe is developing a blockchain called "Tempo" in partnership with Paradigm. It is being described as a “high-performance, payments-focused blockchain” - basically the exact same use case/description as every single one of these chains.

Interestingly, Paradigm’s Matt Huang will act as inaugural CEO - Paradigm are putting both significant capital and human capital behind this one. Unlike the aforementioned chains, Tempo will directly benefit from Stripe’s pre-built distribution prowess. Stripe can route merchant payouts and cross‑border flows over Tempo on day one, abstracting the chain behind its API surface. If Stripe end up issuing their own stable (which could be logical given the Bridge/Privy acquisitions), they’d be capturing the entire stack.

Winners and Losers?

With Plasma and Stable being focused on USDT, the logical loser here would be Tron given that Tron wears the “USDT chain” crown at present. Applying the same logic, as a current leader in stablecoin TVL and transfer volume Ethereum mainnet would be another likely loser.

However, this assumes that the introduction of these L1s doesn’t bring net new users and therefore issuance. Tron already has very strong distribution in certain regions and Ethereum mainnet has a very strong head start from a DeFi/Liquidity perspective. It’s not as though the introduction of Solana or any other new cheap and fast L1 has meaningfully cannibalised Tron or Ethereum stablecoin usage so it will be interesting to see whether any of these new L1s changes the calculus.

If Treasury Secretary Scott Bessent’s estimations for stablecoin growth are even directionally correct, there will be plenty of value to be had for all of these players.

My base case is that their distribution or go-to-market strategy makes a much bigger difference than the tech stack (surprise, surprise) and that rather than purely eating market share from incumbents, these new L1s will grow the pie and bring net new users and entities on chain.

Based on the information we have at present, there will likely be more opportunities for us Crypto Natives to be involved with both Plasma and Stable. Plasma token is confirmed (XPL) and I believe it is likely that Stable will go down the token route too.

As a humble retail minnow myself, I will continue to monitor ways that I can interact with these projects both from a usage and investment perspective. Similar to what we saw with the XPL token sale, there’s a high chance that there will be further opportunities for public/retail investors to benefit from this trend. I look forward to discussing such opportunities when they arise, so stay tuned for that!