USDH is just a ticker

USDH is just a ticker, it really doesn’t matter as much as people think. Allow me to red pill you on what *actually* matters as we emerge from this little USDH saga.

In customary crypto twitter fashion, much of the discourse surrounding USDH this week has been salty to say the least. Abundant lamenting that there is cabal activity taking place; missing the woods for the trees in what has been a magnificent display of high calibre teams showing interest in building on Hyperliquid.

Yes it seems as though Native Markets might have had the jump on putting a proposal together, but is that really as catastrophic and distressing as some commentators would have you believe? I don’t think so. The price performance of HYPE during this period has been a testament to this.

A wide array of service providers, large and small, have come to the fore with extremely strong proposals and I do believe validators have considered all options in good faith.

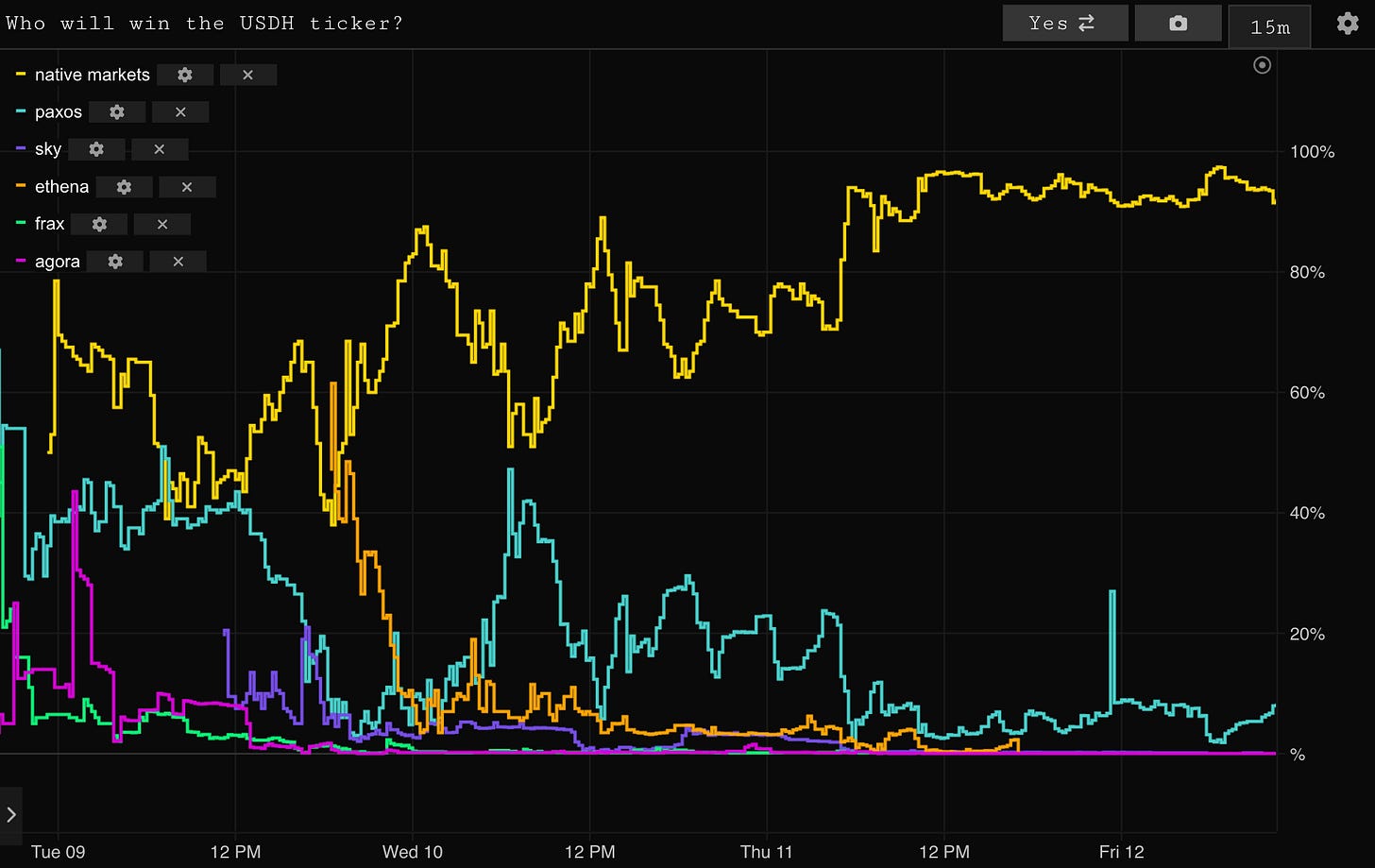

While not the most liquid market, the Polymarket on this event hints that the outcome was not entirely “predetermined” as we saw odds vary significantly during the first half of the week:

The single most important thing to remember in all of this is that USDH is just a ticker... the best and most aligned teams will likely do everything they laid out in their proposals anyway and we will simply see a broader selection of high quality quote assets (Stablecoins) being deployed.

For example, we’ve already seen Ethena come out and say that no matter the outcome, they will continue with the plans laid out in their proposal, notably:

hUSDe native synthetic dollars in partnership with Liminal + other USDe enabled savings and card spending products

Bringing USDe hedging flows to Hyperliquid

Ethena-enabled HIP-3 initiatives including:

reward-bearing trading collateral

modular prime broking

perpetual swaps on equities

Equally, I find it highly likely that Paxos (and by extension PayPal) will stay true to much of what they laid out in their proposal too:

HYPE listing on PayPal/Venmo

Free on/offramps for their quote stable

Integrations for PayPal Checkout, Braintree, Venmo, Hyperwallet, Xoom, and Pay With Crypto

Quote stable migration from USDC, PYUSD, USDG, and supports enterprise credit/debit cards.

This is all especially prevalent given the quote asset network upgrade which looks be coming soon, as announced by the Hyperliquid team yesterday:

The most notable pieces for me are the 200k HYPE stake requirement and liquidity requirements for spot quote assets.

While this specific network upgrade will only support alternative quote assets for spot markets, it is only a matter of time before we see alternative quote assets for perp markets. This will likely act as a big unlock for Unit by enabling non stable quote assets for perps.

I’m consistently impressed by Hyperliquid’s rapid, high-quality development and the exceptional calibre of teams building within its ecosystem. We’re proud to support the ecosystem with Purrsec and look forward to the very bright future ahead.