Parsec Weekly #136

A market hungry for yield

A market hungry for yield

the following does not constitute investment or financial advice

One of the most salient characteristics of the on chain environment at present is an insatiable demand for yield, particularly on stables. As the market has matured, the market for on chain yields has become increasingly efficient too.

We are seeing projects become smarter about how they incentivise liquidity/TVL, often opting to bootstrap with capped deposit programs in the early days which often pay a higher retroactive APR. Naturally the market is reacting to this with extremely competitive windows on chain surrounding these deposit program openings.

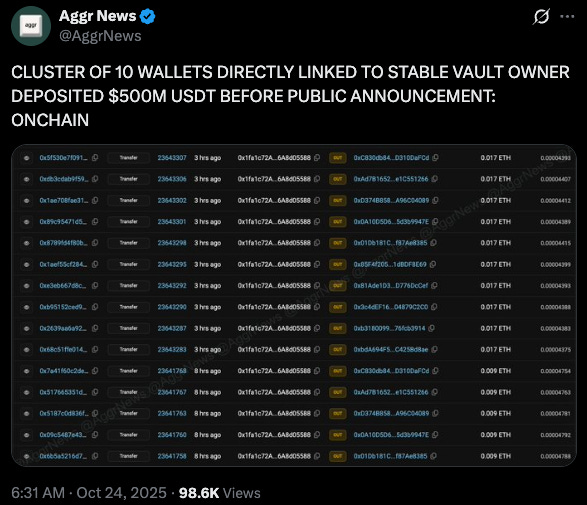

For example, yesterday saw a project called Stable (Stablecoin chain, Plasma competitor, backed by Bitfinex and USDT0) open up an $825m pre-deposit campaign:

As it happens close to $600m of this cap was already filled prior to the public announcement. Anecdotally, users who saw the announcement and wanted to allocate had about 45 seconds until the entire cap filled.

I am not speculating on whether there is insider activity at play here (I’ll let you be the judge) but rather highlighting the idea that demand for “safe” stablecoin yield is extremely high and the level of competition to get that yield is increasing exponentially.

We have seen similar instances with USDai caps filling almost instantaneously when raised:

It does beg the question as to why? What is driving this increase in demand and therefore efficiency? I think there are probably a few reasons:

a) increased perceived difficulty presented by other sources of returns in the market

b) decreased friction for sharp trading firms/family offices to onboard capital

c) decline in historically dependable and high sources of yield (likely driven by both a and b) as we see funding rates/on chain interest rates exhibit a lower baseline and liquid incentive/reward opportunities quickly normalising to a risk-adjusted baseline as capital rapidly moves to capture outsized yield

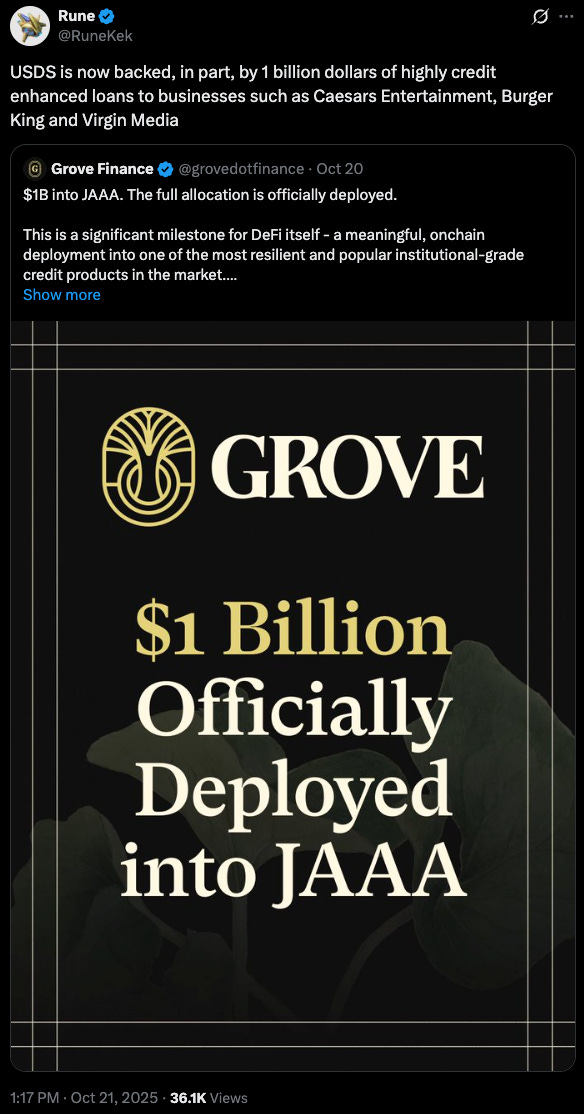

This is likely why we see projects like Sky begin to shift backing to include higher yielding corporate credit instruments:

It’s also why I personally find projects like USDai and Daylight interesting, as their promise is to bring exogenous yield on chain in a scalable manner.