Parsec Weekly #137

MegaETH

MegaETH

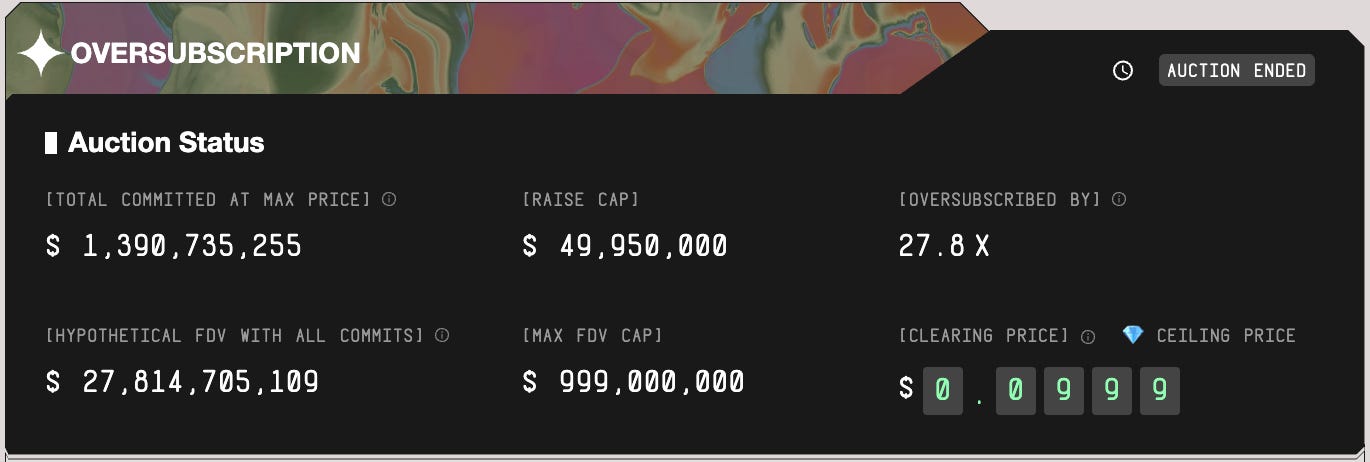

This week the MegaETH ICO saw:

$1.39bn committed

$49.95m raised

$999m valuation

27.8x oversubscribed

50k+ total bidders

This has certainly been the highest profile ICO I have personally witnessed (I wasn’t around for the 2017 ICO era). It certainly eclipses the PUMP ICO earlier this year from my perspective.

Empirically there seems to be a clear divergence in the profile of participants in this sale:

Profile A simply views $1bn as underpriced and a free money opportunity, they opt for no lock up and likely are a seller in the pre market (violating Sonar T&Cs) or at TGE.

We’ve even seen what looks like sybil activity (likely from the Profile A types) to get a greater than max allocation using multiple identities:

Profile B is in it for the tech, likely opts for the lock up and may be adding to pre-existing Fluffle and/or Echo exposure to MegaETH.

Both are logical for different reasons, Profile A is looking at the pre market and thinking this could be a profitable and low risk quick flip while Profile B is looking into the tokenomics and thinking this might be the first L2 token which actually has a valid raison d’être, taking a longer term view.

And it’s one of those spots where both profiles do have a strong and valid point of view (of course other than hedging against T&Cs which I cannot advocate for).

Naturally from the team’s perspective, Profile B is significantly more “aligned” and represents the kind of holder base you want to foster and encourage. Equally, if you offer 100% of the allocation to Profile B you suffer from no float at TGE and this huge looming cliff unlock event 1 year post TGE.

We likely see allocations go to both lockers and non-lockers in order to balance this dynamic but given the severe over subscription, it’s hard to believe anyone, even the most aligned, get anything close to the max allocation.

MegaETH certainly seem to be one of those teams who are doing all the right things: community first ethos, vibrant native ecosystem and a refreshing approach to KPI-based token vesting (something I have wanted to see forever).

For those who participated in the ICO, let’s see what November 5th has in store, I wish each and every reader luck in their allocation.

For those who didn’t participate, in my opinion this is a fantastic example of what projects should strive for in terms of fundraise design, community involvement and marketing.

Here at parsec.fi, we are looking forward to exploring ways we can strengthen our ties with and contribute to MegaETH and the ecosystem.