Parsec Weekly #138

Stream Finance

Stream Finance

This week, the DeFi ecosystem suffered one of the most significant blow ups we’ve seen in quite some time. Stream Finance — a yield-focused protocol — disclosed a $93 million loss attributed to an external fund manager, triggering a cascade of liquidations, depegs, and frozen withdrawals across the entire ecosystem.

What makes this particularly interesting (and concerning) is not so much the size of the initial loss, but rather the intricate web of interconnected positions that amplified a $93m problem into what analysts now estimate to be at least $285 million in total exposure across lending markets.

The incident has reignited debate about the “risk curator” model that’s become increasingly prevalent in DeFi — a model where third-party vault managers promise double-digit yields on stablecoins through complex leverage loops, while taking management fees and claiming to “curate risk.”

As the dust begins to settle, let’s dissect what happened, who got caught in the blast radius, and what this tells us about the current state of DeFi infrastructure.

What Happened?

On November 3rd, users began noticing that Stream Finance’s stablecoin xUSD was depegging. Despite no official communication from the team, the token started sliding.

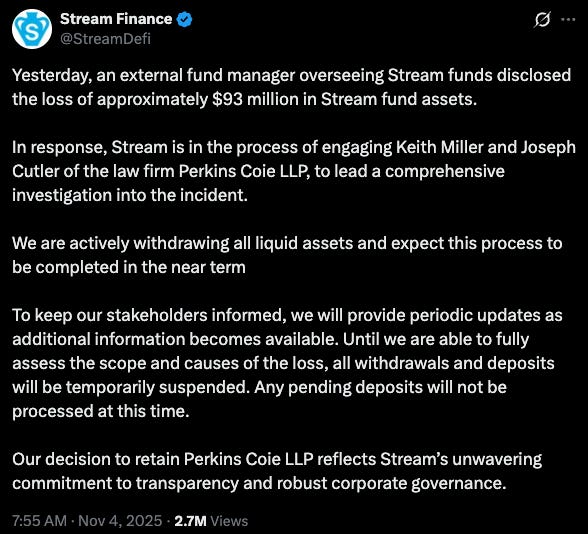

Hours later, the team finally acknowledged the situation in an X post:

The announcement confirmed what many had already suspected: Stream had frozen all deposits and withdrawals, trapping an estimated $160 million in user funds. The protocol engaged law firm Perkins Coie LLP to lead a comprehensive investigation into the incident.

Stream Finance operated what’s known as a “recursive looping” yield strategy.

Deposit collateral (USDC, ETH, BTC)

Mint Stream’s synthetic assets (xUSD, xBTC, xETH)

Use those synthetic assets as collateral in lending markets

Borrow more assets, then repeat

This allowed Stream to offer a headline yield of 18% on stablecoins — far above what traditional DeFi protocols like Spark could provide.

The problem? Stream’s xUSD was used as collateral across multiple lending platforms (Euler, Morpho, Silo, Gearbox), creating a house of cards.

When confidence evaporated and xUSD began depegging, it triggered liquidations across these platforms. But because many of these markets were “custom” or “isolated” pools with low liquidity and fixed-price oracles, the normal liquidation mechanisms failed to function properly.

As Omer Goldberg from Chaos Labs pointed out, Stream’s reliance on “fundamental value” oracles instead of real-time market pricing meant that liquidation triggers were delayed. While such systems can prevent unfair liquidations during normal volatility, they convert “price discovery into trust discovery” when confidence falters.

The result? Markets went to 100% utilization, meaning lenders couldn’t withdraw their funds even if they wanted to.

The Contagion

DeFi research group Yields and More (YAM) mapped out the exposure, revealing a staggering $284.9 million in interconnected debt positions:

Largest victims:

TelosC: $123.6 million

MEV Capital: ~$34 million across four lending markets

Re7 Labs: $27.4 million ($14.65m in isolated xUSD/USDT0 pool + $12.75m in bad sdeUSD/deUSD collateral)

Elixir’s deUSD: Backed 65% by Stream positions ($68m loan to Stream)

Treeve’s scUSD: Exposure through lending market positions

Perhaps the most dramatic secondary effect was on Elixir Protocol’s deUSD synthetic dollar.

Elixir had lent $68 million to Stream Finance — representing roughly 65% of deUSD’s backing collateral. When Stream halted withdrawals, deUSD holders panicked, despite Elixir claiming to have “full redemption rights at $1” as Stream’s only creditor with such privileges.

The reality proved more complex. As Elixir later admitted:

“Stream holds roughly 90% of the deUSD supply (~$75m), while Elixir holds a similar proportion of its remaining backing as a Morpho loan to Stream.”

Translation: Stream Finance controlled most of the deUSD supply and owed Elixir the backing collateral. A perfect circular dependency.

By November 6th, Elixir announced it would sunset deUSD entirely. The team processed redemptions for 80% of holders and took a snapshot of remaining balances for 1:1 USDC redemption through a forthcoming claims portal.

Winners, Losers, and the Risk Curator Debate

The “risk curators” who had embraced Stream’s high yields found themselves on the wrong side of history:

MEV Capital: $34 million exposure across four permissionless lending markets

Re7 Labs: $27.4 million total exposure

TelosC: The biggest loser with $123.6 million

Perhaps most damningly, Re7 Labs faced accusations of holding funds hostage in illiquid markets, unable to process withdrawals even after the depeg.

The incident also exposed questionable risk practices. Re7 Labs later admitted they had identified “centralized counterparty risk” in xUSD through due diligence but chose to list it anyway due to “significant user and network demand.”

In other words: they saw the red flags, but the yield was too attractive to pass up.

Not everyone was caught in the blast radius. Conservative risk managers who had avoided xUSD entirely emerged vindicated:

Steakhouse Finance: Zero xUSD exposure

K3 Capital: Not only avoided xUSD, but actually made $250,000 during the crisis managing Neutrl Labs’ $75 million deposit

Gauntlet: No xUSD exposure, though they still had to pause certain markets due to Elixir contagion

As one DeFi participant put it:

“There are actually some curators that never touched xUSD. Shout-out to them as they actually seem to CURATE RISKS. A very unknown concept for many curators.”

The Stream collapse has forced the DeFi community to confront some uncomfortable truths about the “risk curator” model:

Incentive misalignment: Curators earn management fees on deposits regardless of risk. Higher yields attract more deposits, so there’s natural pressure to take on more risk.

Opacity masquerading as transparency: While positions are technically “on-chain,” the complex web of recursive loops, cross-chain exposure, and synthetic collateral makes true risk assessment nearly impossible for retail users.

Fixed-price oracle risk: Using “fundamental value” oracles instead of market pricing creates a false sense of security. As one analyst noted: “Hardcoded oracles mean in an impairment, you’re potentially riding it to zero.”

The race to the bottom: When users can get 18% on stablecoins from one curator and 12% from another, capital flows to the highest yield. This creates competitive pressure to take on more leverage, tighter collateral, and riskier positions.

Lessons and Implications

Having observed this unfold in real-time, a few things are clear:

1. Yield isn’t free

The 18% yields weren’t magic — they were compensation for taking on catastrophic tail risk. When protocols like Spark offer 5% and Stream offers 18%, the 13% difference is the premium for insolvency risk, leverage risk, and contagion risk.

2. Oracle design matters enormously

The use of “fundamental value” oracles rather than real-time market pricing meant that positions didn’t liquidate when they should have, allowing bad debt to accumulate. This is a critical design choice that needs more attention.

3. The circular dependency problem

Stream borrowing against its own xUSD to create leverage, which was then used as collateral elsewhere, created a perfect storm. When confidence broke, there was no way to unwind positions in an orderly fashion.

Closing Thoughts

For those of us who participate in DeFi, this is a sobering reminder that higher yields GENERALLY always come with higher risks. The protocols that survived this crisis unscathed weren’t the ones with the cleverest leverage loops or the highest APYs — they were the ones with boring, conservative risk management.