Parsec Weekly #140

$AZTEC Public Sale

$AZTEC Public Sale

Ignited by the PUMP ICO in July, we are well and truly amid an ICO season as high profile teams seem to be favouring this form of “community alignment” (fundraising from the public at what the team believe to be reasonable terms) as opposed to the airdrops of old.

Since Pump.fun we’ve seen the Plasma, MegaETH and Monad ICOs, there are rumours that Fogo are eyeing a December ICO pre TGE in January too...

Today I want to talk about a team who have been grinding on privacy for 7 years - through the Tornado Cash arrests, through the “privacy is dead” narratives, through multiple product iterations. Aztec’s full vision is just around the corner and unsurprisingly, they are taking a rather unique approach to their public sale.

Today’s piece will follow this structure:

Aztec

Ignition

Use Cases

$AZTEC

Public Sale

Takeaways

Aztec

With a tenure in the crypto<>privacy space since 2018, Aztec just recently announced the Aztec Ignition chain. Now before you retort that building a chain doesn’t take 7 years, let me explain to you why Aztec’s case is a little different.

Aztec didn’t start with a chain but with a problem. In 2017, the team tried to tokenise corporate debt on Ethereum and immediately hit a wall: no institution would put their portfolios and trade data on a transparent ledger. That limitation sparked a 7 year obsession with privacy.

This isn’t their first rodeo. They shipped zk.money in 2021 (Zcash-style privacy for payments) and Aztec Connect in 2022 (private DeFi on L1) - both successful products that reached tens of thousands of monthly active users. But they sunsetted both to build something more ambitious: a fully programmable private L2 where privacy isn’t bolted on but baked into the base layer.

The Aztec team concluded that an entirely new virtual machine and programming language was required in order to realise their vision; becoming the “private world computer”.

So that’s what they did; build a more complex, programmably private Layer 2 network powered by Aztec’s Noir language.

Noir is a Rust-based programming language specifically for ZK circuits. It’s now being used beyond Aztec with teams like Payy (another super interesting project, I strongly recommend @jon_charb’s piece on it) using Noir (Just write “if”: Why Payy left Halo2 for Noir).

Think of Aztec as SSL for blockchains. The internet faced the same bottleneck in the 1990s - it couldn’t go mainstream without privacy and security guarantees. SSL/HTTPS unlocked trillions in value. Blockchains are at that exact inflection point now, and programmable privacy is the unlock.

Unlike privacy coins like Zcash (single asset, one use case) or privacy tools like Railgun (application-layer bolt-ons), Aztec is the birth of fully decentralised, programmable, composable state.

The key innovation here is private composability. On a transparent chain, if you want to add privacy, every app needs its own custom ZK toolchain. These don’t play nicely together and complexity explodes. Aztec solved this by building privacy into the base layer, so any smart contract deployed there gets privacy guarantees out of the box. Think: private ERC-20s, private DEXs, private identity primitives - all composing atomically within single blocks.

Aztec uses client-side proving for private transactions - computation happens on your device, you generate a ZK proof locally, then send just the proof to sequencers. This is fascinating from a scaling perspective because sequencers only need to verify proofs for private transactions, not execute them.

Ignition

Ignition is a bit like Aztec’s version of the Beacon chain in that it doesn’t allow for transactions. Once the final checks and audits are in place, Ignition will be upgraded to enable Aztec’s private execution environment which is expected in Q1 2026.

Ignition launched as a Stage 2 Layer 2 with 668 sequencers (stake.aztec.network) distributed globally from day one. This is almost unheard of with most L2s running centralised sequencers printing $40-150M annually with a promise to “decentralise later”.

Aztec had no choice. When your value prop is privacy, a centralised sequencer could face massive government pressure for backdoors. As the founders put it: “There will be a backdoor in Aztec over our dead bodies.”

To cement credible decentralisation, the Aztec Foundation, Labs employees, and investors are banned from participating in staking and governance for one year post-launch. Control rests entirely with the community, not any single entity.

Use Cases

A very clear near term use case is private DeFi for crypto natives. Particularly the bridging angle as users can send transactions through Aztec to public chains thereby hiding the origin address and maintaining wallet hygiene and segregation. For many on chain users this would completely remove the need to use centralised exchanges as bridges.

In this respect one can view Aztec as “positive sum” to other L1s/L2s because they’re not necessarily competing for the same transactions; transactions can be routed through Aztec to add a degree of privacy to public chains. This creates a scenario where Aztec can generate fees without needing to siphon liquidity from other chains. A simple view on Aztec’s utility; what percentage of existing DeFi users would like to route their transaction through Aztec to add privacy.

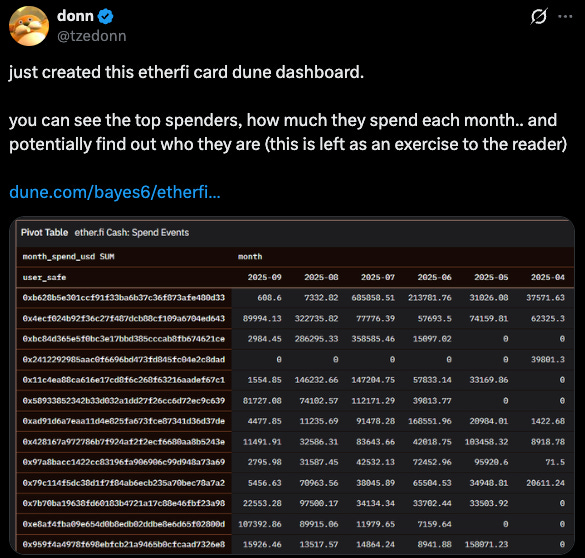

Another interesting userbase in the private DeFi category would be the emerging crypto neobanks (think EtherFi, Gnosis Pay, UR etc.). It seems quite clear that transparency is a bug not a feature here given that current crypto cards allow anyone to reconstruct your credit card statement (h/t @tzedonn). Interestingly, this is the major pain point Payy (which uses Noir as mentioned prior) was created to tackle.

In the medium-term, one could see identity primitives using ZK Passport take the fore (for applications which currently have to take the unfortunate sacrifice of storing user data in order to remain compliant).

There are funky example use cases in sectors like gaming too. For example, breeding mechanics don’t work on transparent chains as they get reverse-engineered instantly, you need ZK for information asymmetry in games like Cryptokitties.

Under-collateralised lending becomes more likely too. Your bank statement is cryptographically signed and fed into a ZK proof to prove “my salary is above X, outgoings below Y” without revealing the actual data. Suddenly, real consumer finance can begin to exist on-chain.

In the long- term, the Aztec core vision is to serve as “the global exchange and settlements platform for the world’s assets. Not digital assets, but all assets”.

There are 16 teams currently building on testnet (and launching on mainnet when transactions go live). I would expect that number to grow materially as transactions go live early 2026 and developers realise what’s suddenly possible)

So how does the token actually work?

$AZTEC

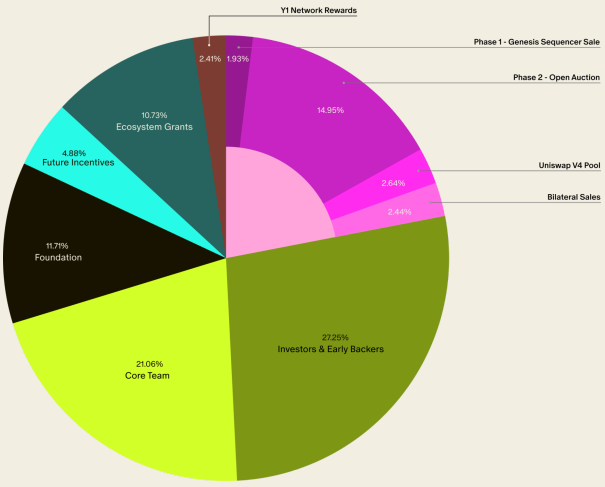

The $AZTEC token has the following token distribution (according to their economic whitepaper):

The token has three functions:

Staking: 200K $AZTEC minimum to run a sequencer (currently 668 sequencers live as per stake.aztec.network)

Fees: Transaction fees paid in $AZTEC (users can pay in ETH/USDC via Fee-Paying Contracts that hold $AZTEC reserves)

Governance: Control over network parameters, upgrades, and token issuance

The fee mechanism mirrors Ethereum’s EIP-1559. Aztec uses “Mana” (their version of gas) with a target per block. When usage exceeds the target, fees burn automatically - creating deflationary pressure as the network scales.

At modest scale (10 TPS, ~$0.15/transaction), the protocol generates ~$22M annual revenue. Transaction costs run 2-5 cents for basic payments mostly consisting of data costs to Ethereum. Year 1 inflation is 2.41% but there is scope for that to go deflationary as usage grows over time.

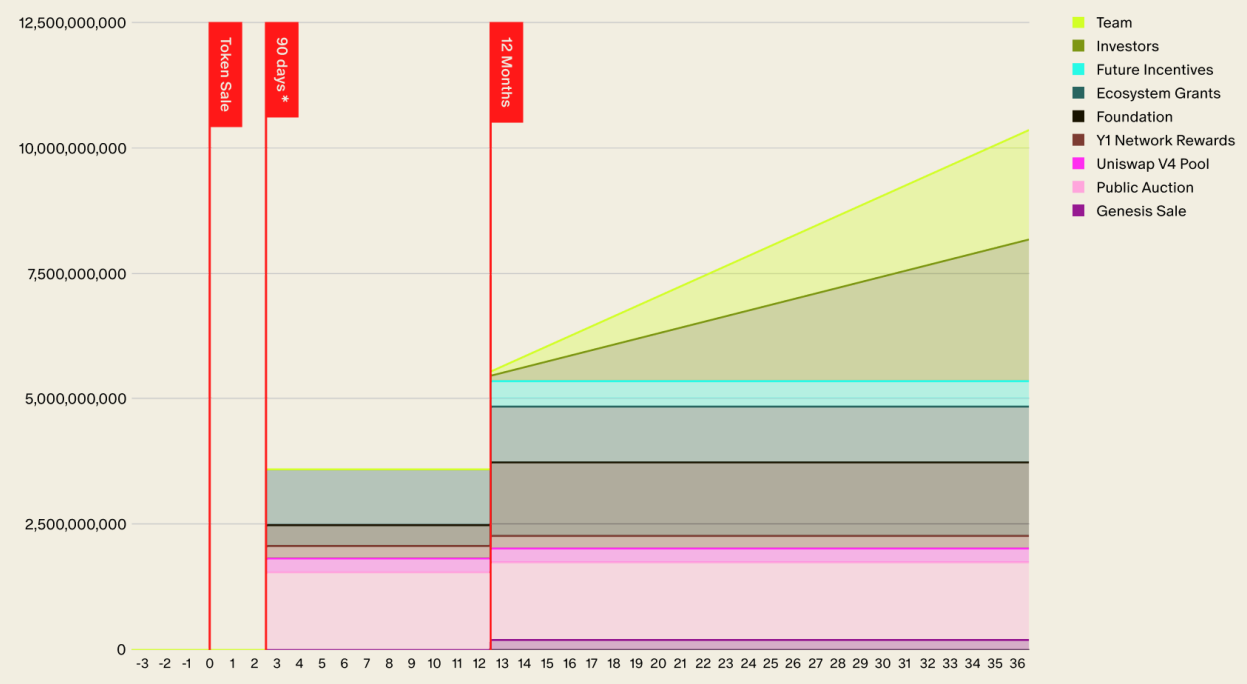

Note that the staked $AZTEC shown on stake.aztec.network represents tokens sold during the Genesis Sequencer Sale. These tokens were sold at a discount to the floor FDV for the Public Sale with a clearing FDV around $250m, these tokens are locked for 12 months.

The interesting bit is that client-side proving means users generate proofs locally and sequencers just verify them. Sequencers don’t execute private transactions, only verify proofs. This is why the cost structure scales differently than transparent chains.

For context, during Ignition (no user transactions yet, just empty blocks), the network costs are ~$2.4M annually to run. The pre-minted rewards cover this and incentivise sequencers before transactions go live and fees begin to flow.

All public sale tokens have a 12-month lockup that can be shortened to 90 days via governance vote. Given that initial holders either bought or earned tokens via staking, governance will likely vote for the minimum 90-day period so we can assume the $AZTEC TGE will take place February 17, 2026. Team and investor tokens have 12-month cliff + 24-month linear unlock, and they can’t stake or vote for the first year:

At TGE, circulating supply will consist of:

a) Public Sale tokens (14.95%)

b) A portion of pre-minted Y1 Network Rewards (0.6%) (representing sequencer rewards in the Nov 17th → Feb 17th period)

For a cumulative ~15% at TGE.

Public Sale

The cynic points to the Aztec Public Sale and ignorantly ascribes the recent “privacy meta” as the reason to raise now.

The Aztec enjoyooor (me), thanks to conversing with the team, knows that the Aztec Public Sale has been in the works for just over a year. You have to remember, Aztec has been in development for 7 years, they are hardly jumping on the privacy bandwagon here. It’s equally foolish to assume Uniswap would rush the first public sale utilising their Continuous Clearing Auction (CCA) mechanism just to capture a potentially ephemeral narrative/meta in the secondary markets.

The Aztec team believe that airdrops are great for creating initial hype but not so optimal for the formation of long-term aligned community holders, they cite that communities tend to churn within 3-6 months post-airdrop. They argue that for PoS networks, participants need skin in the game which is not compatible with airdropping a large % of supply.

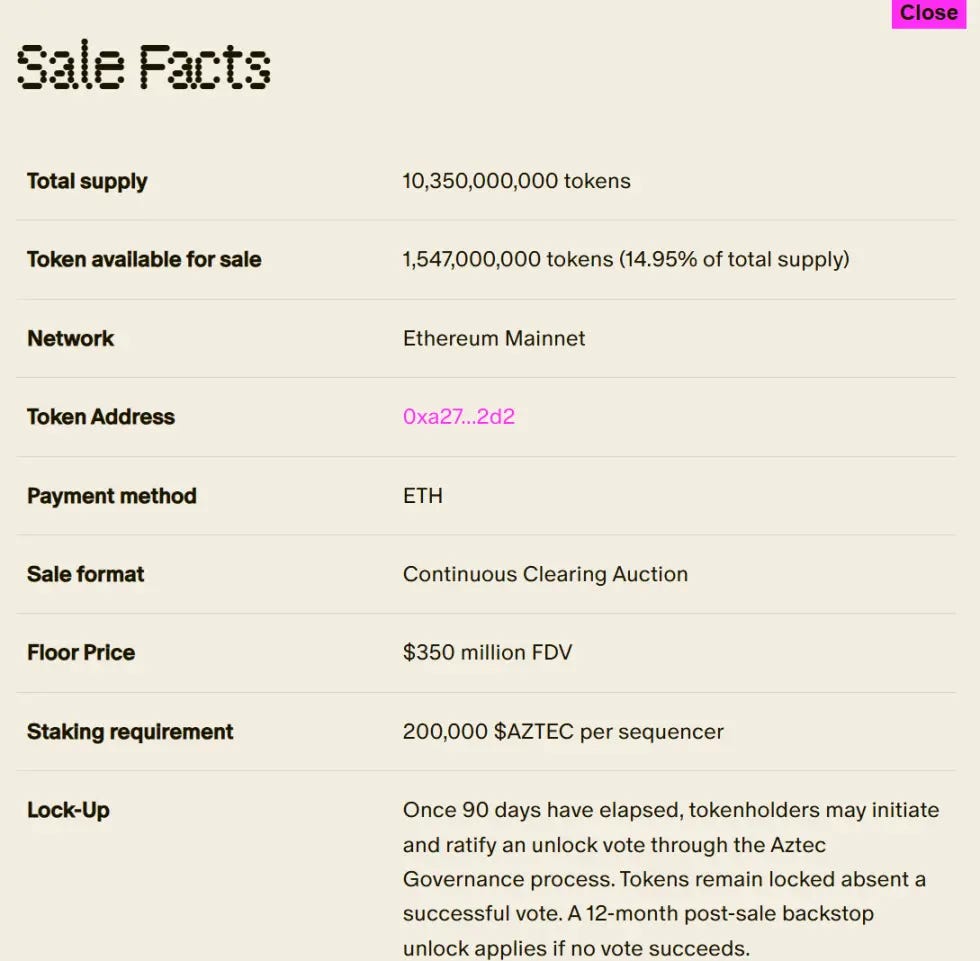

The sale is open to US retail, uses ZK Passport for compliance and has had a long pre-registration period to avoid information asymmetries (public bidding starts Dec 2nd).

As per the tokenomics above, 14.95% of $AZTEC supply will be sold at a minimum valuation of ETH 98,493 ETH (sale is denominated in ETH).

Given an ETH price of ~$3k at the time of writing, we get to minimum FDV of just below ~$300m. Naturally, the exact FDV will depend on the price of ETH at the time orders are filled. Note that Aztec’s most recent equity round put the token valuation at a ~$1.4b valuation.

As I briefly mentioned, the Public Sale utilises Uniswap’s new Continuous Clearing Auction (CCA) mechanism which Aztec worked closely with Uniswap Labs on as core contributors.

Part of the CCA mechanism involves seeding a Uniswap V4 pool at the final auction price but the more interesting part is how the auction itself functions:

The seller chooses 3 variables:

auction length

supply size and schedule (number of tokens sold at each interval)

minimum sale price

And the buyer simply has to (h/t @jaosef):

a) set a budget and maximum price (or market price)

b) sit back and relax; no gas wars, no timing games

c) each period the contract auto-allocates your tokens if your bid ≥ the clearing price

d) at auction completion, you claim your tokens and wait for TGE

The CCA clears every block so supply and demand create a price in real time on a continuous basis rather than discretely at the end of the sale. The aforementioned floor FDV/price remains the clearing price until cumulative demand exceeds the tokens available.

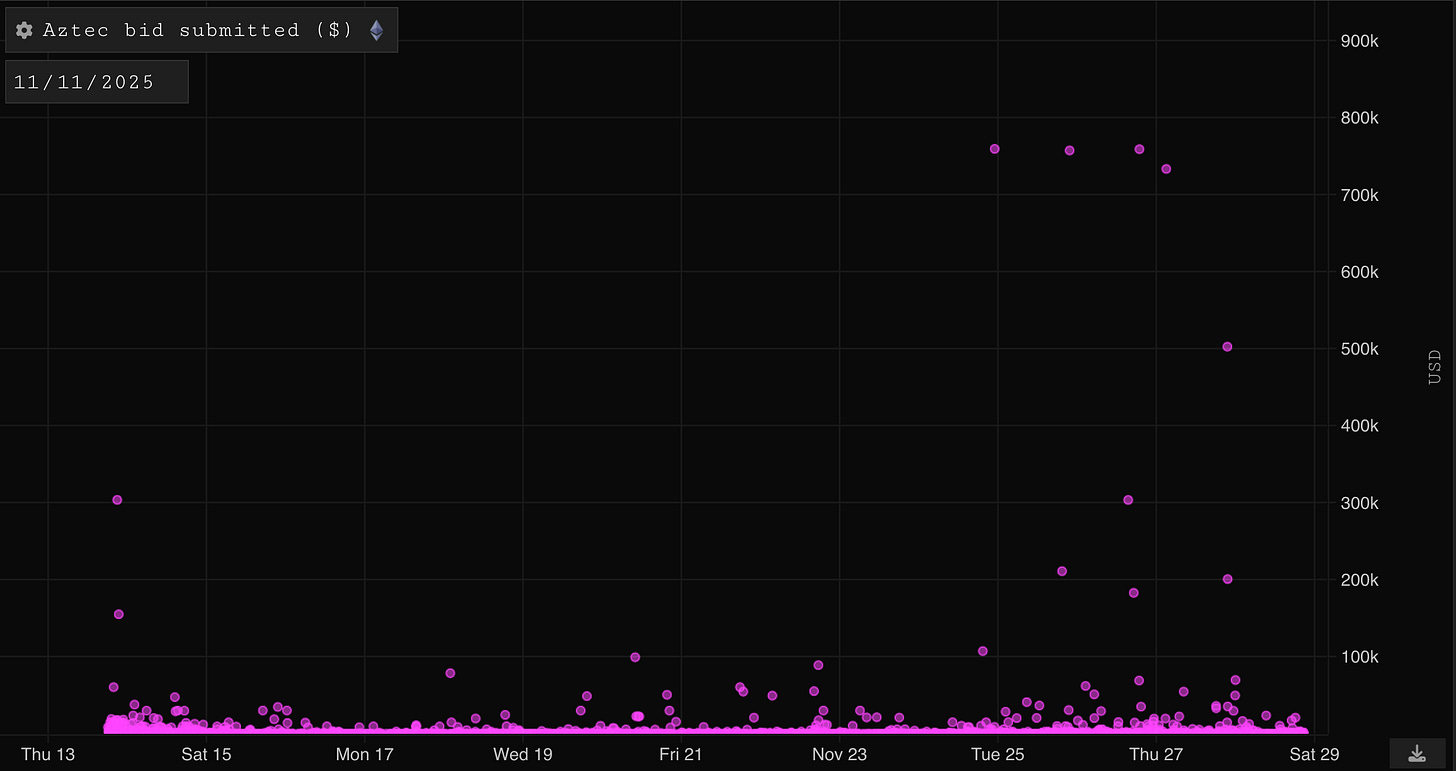

While supply remains constant, if demand increases over time so does the clearing price such that participants who bid earlier are more likely to receive allocations at lower prices.

Their use of CCA certainly seems to be in keeping with what seem to be Aztec core values in that it is entirely onchain, promotes transparency and fair price discovery.

If it’s still not clear, @FreddieFarmer wrote a really good primer on how the CCA works in practice which I can highly recommend: https://x.com/FreddieFarmer/status/1994469052840886613

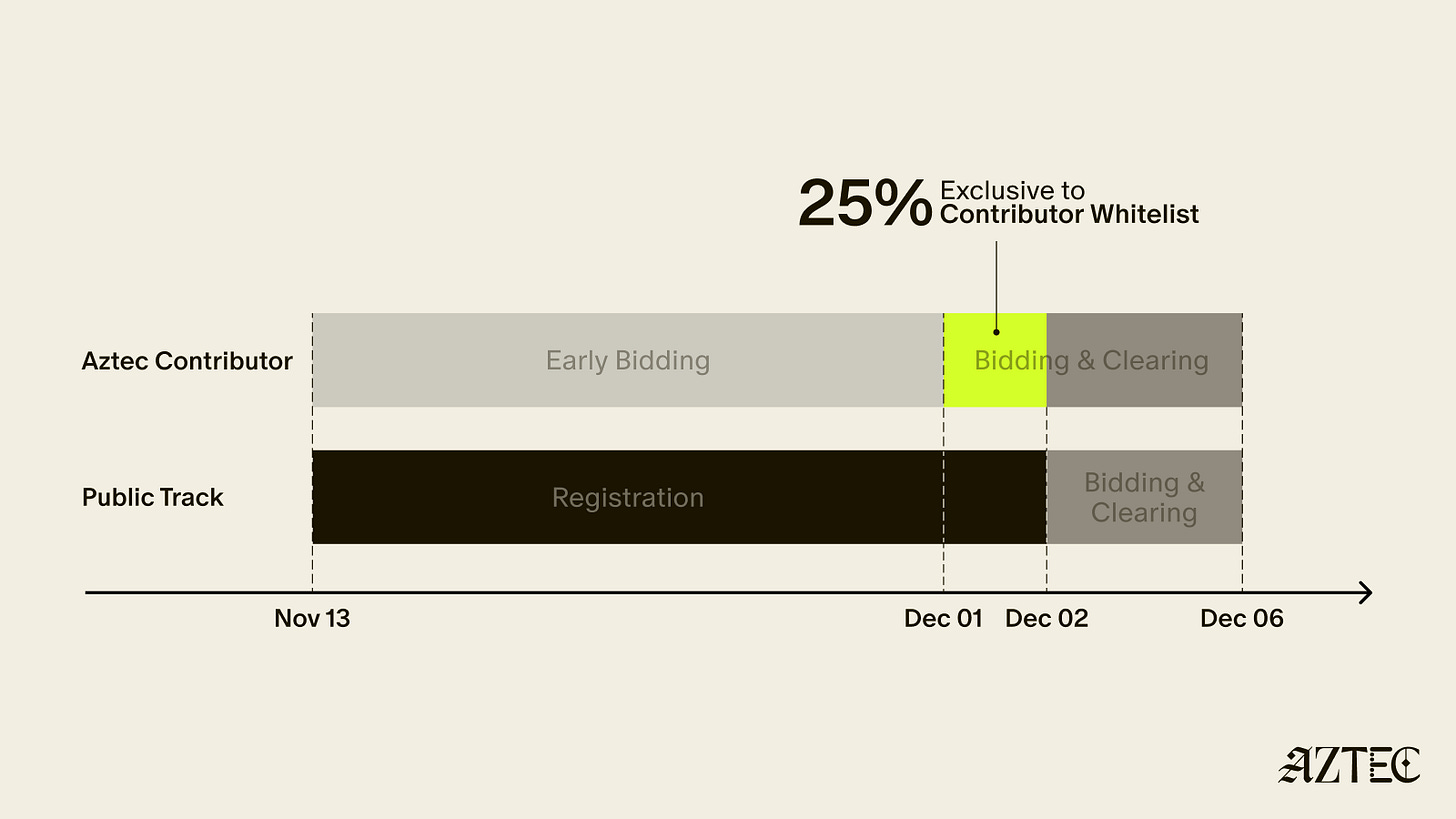

The sale timeline is as follows:

Wallets in the Contributor Whitelist (consisting of early contributors and long-standing community members, including genesis sequencers, OG Aztec Connect users, network operators, and community members) can start bidding today, ahead of the public auction. They will enjoy one day of clearing before the public track bids begin to clear on Dec 2. This is a form of airdrop if we assume high demand from the public track given that contributors benefit from this early advantage in the form of representing only a subset of total demand.

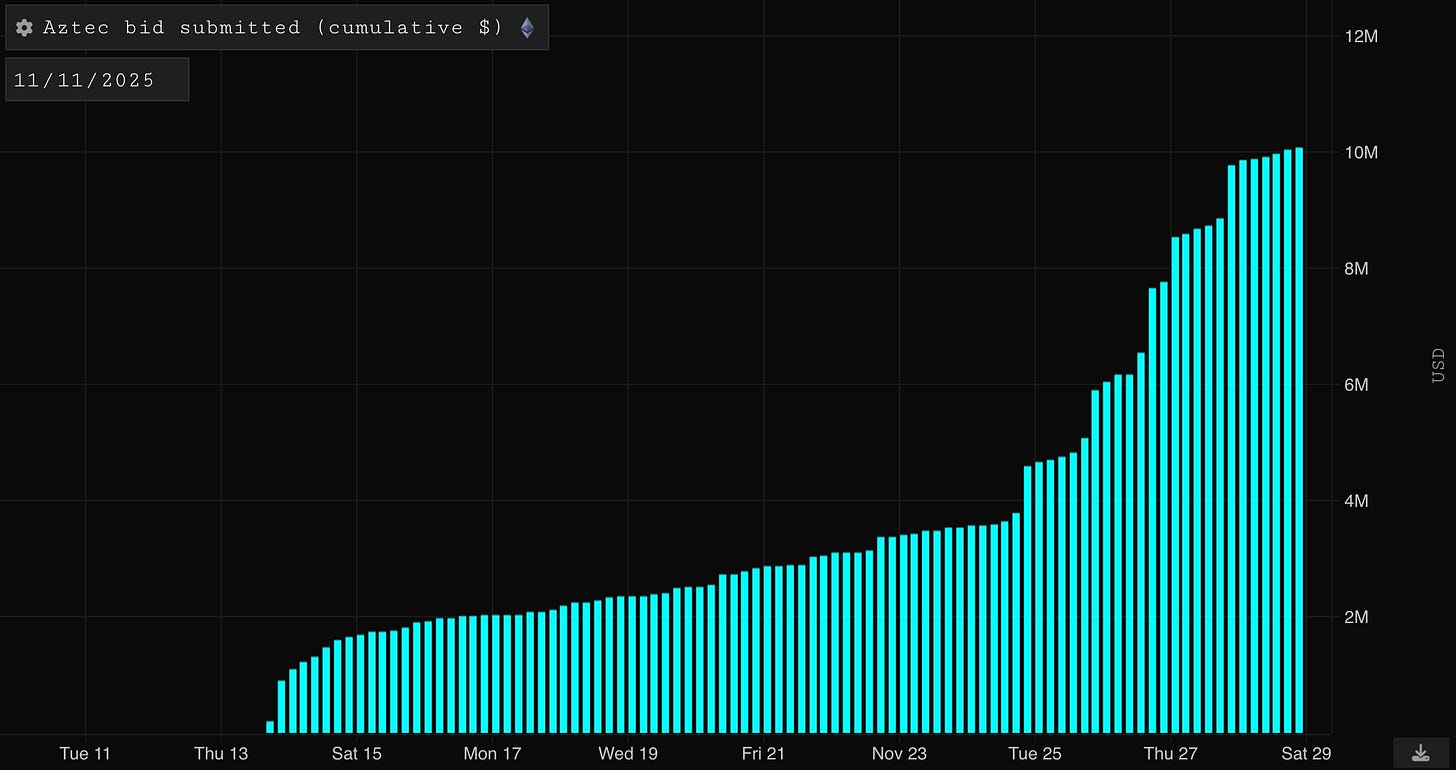

So far, we are seeing bidding activity really picking up from this lucky and aligned early cohort:

link to parsec dashboard (h/t @geeogi)

Takeaways

Aztec is the most egalitarian thing I’ve ever seen. It’s insanely ambitious, and if it works, it can reshape the fabric of society

All jokes aside, while I was not around in the truly early days of Crypto, from my perspective Aztec are very much channeling the Cypherpunk energy which I have only been fortunate enough to read about.

There are so many use cases which fall flat on their face without some degree of privacy which is exactly why Aztec came to be in the first place.

This is why viewing Aztec through the lens of “just another L2” is missing the forest for the trees in my opinion given the promise for an entirely different class of applications that cannot exist on transparent chains.

Whether their differentiated blockspace has product market fit is yet to be seen and it certainly won’t be an easy road but from where I’m sitting, Aztec seem to be taking all the right steps towards their vision of becoming the “private world computer”.

I’d recommend watching this one very closely. What is my strategy you ask? Market order & chill (h/t @FreddieFarmer).