Parsec Weekly #143

Will Rate Swaps Enable Fixed-Rate Lending in DeFi?

Will Rate Swaps Enable Fixed-Rate Lending in DeFi?

With MegaETH mainnet rapidly approaching (Feb 9th), I’ve been digging through Mega Mafia teams to ascertain whether there are any ecosystem projects of interest to me.

As a self-proclaimed DeFi nerd, I've been positively surprised by Supernova.

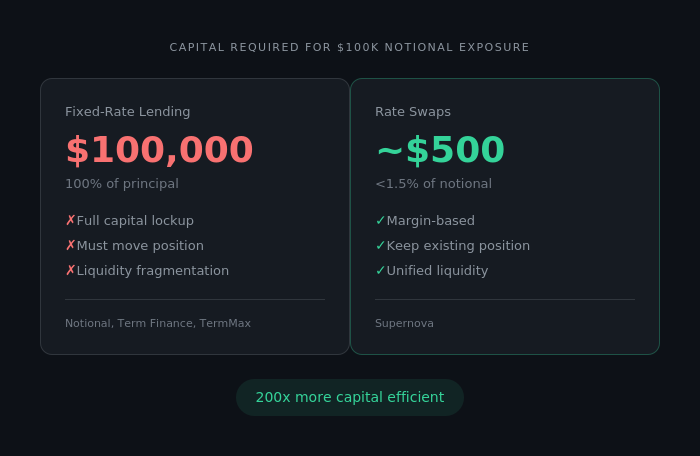

The thesis here is compelling: new fixed-rate money markets can’t scale because they require moving 100% of principal. Interest rate swaps, on the other hand, require a small % of notional and so can potentially enable a fixed-rate market to emerge and scale.

The Graveyard of Fixed-Rate Protocols

If you’ve been around long enough, you’ve seen multiple attempts at fixed-rate lending (Notional, Term Finance, TermMax) with no single project being able to sustainably scale over time.

The answer as to why is elegantly simple; fixed-rate lending protocols force both sides into what is often an impossible negotiation. Lenders won’t give up flexibility cheaply while borrowers won’t pay 10% fixed when Aave is floating at 5%.

Despite Pendle offering yield tokenisation, not fixed-rate lending, their PTs prove this dynamic on the supply side. Fixed rates with a lockup only work when yields are dramatically higher — think Ethena PTs at high double digits. But real borrowing demand simply can’t sustain such high rates consistently.

Supernova

This is where Supernova’s thesis gets interesting. From founder Nico Pei:

“for fixed-rate loans, borrowers don’t need to get a full loan term locked up for the fixed duration. Borrowers only need to get capital willing to absorb the spread between the agreed upon fixed rate and Aave’s floating rate, and get the rest from Aave, Morpho, Euler, or wherever they prefer”

Instead of building another fixed-rate lending protocol (which requires moving 100% of principal), Supernova is an interest rate derivatives market that enables fixed rates on existing money market positions without requiring users to move anything.

A $100,000 notional position on “Aave-USDC-30 days” would require ~$500 USDC in margin. This is the same capital efficiency that makes rate swaps an $18 trillion daily market in traditional finance.

How It Actually Works

The architecture consists of a vAMM and order book sitting side by side. It uses a constant-product AMM for ParRates (Supernova’s interest rate swap) combined with a CLOB for limit orders with orders automatically routing to whichever venue (order book or vAMM) offers the best price.

Behind this sits a System Vault that acts as a liquidity backstop, taking both long and short sides and absorbing net open interest imbalances across multiple durations.

Position mechanics are straightforward:

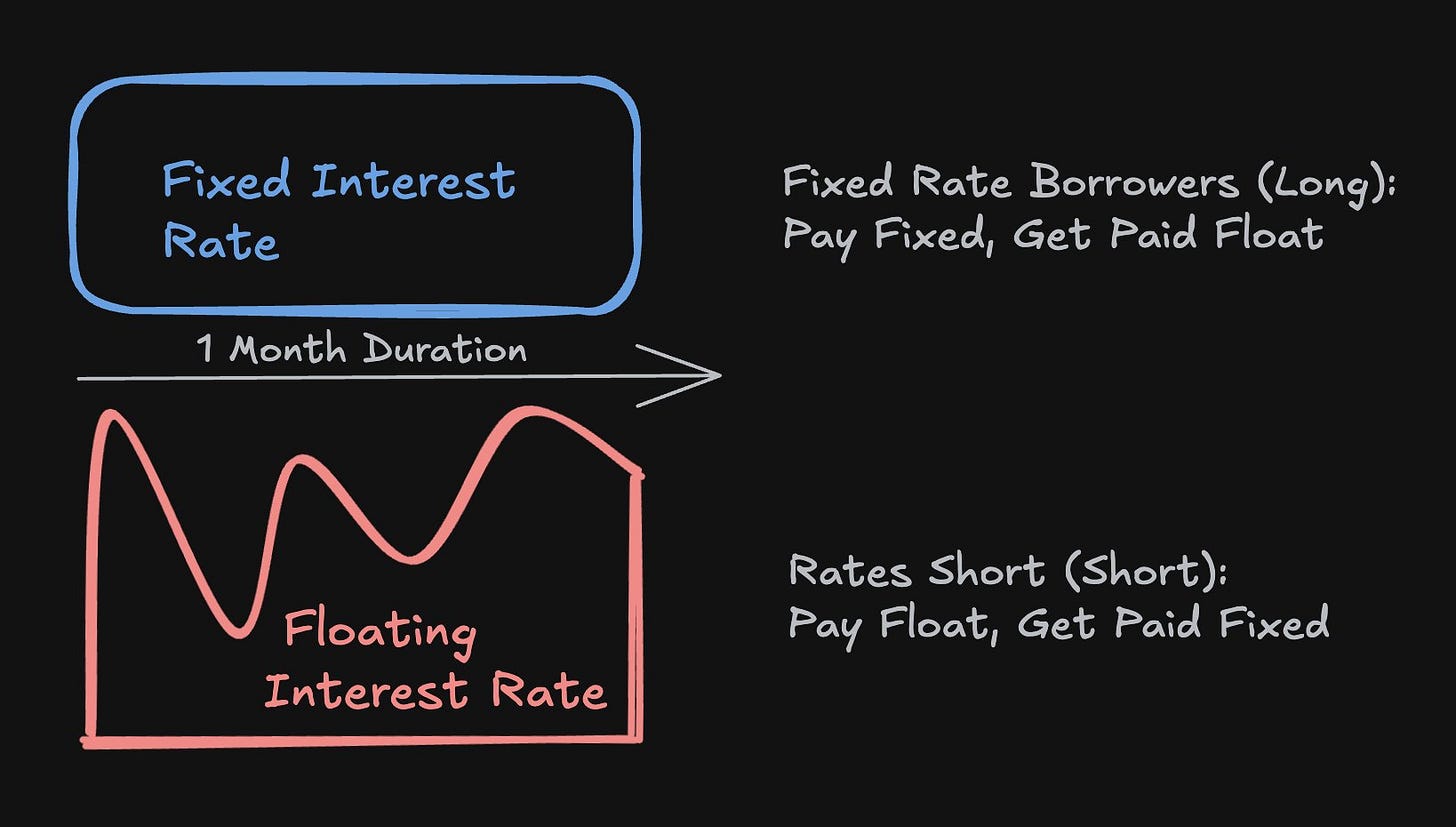

Long Rate (Pay Fixed, Earn Float) — This is what borrowers hedging floating liabilities want. Critically, these positions have no liquidation risk.

Short Rate (Earn Fixed, Pay Float) — Directional or speculative positions. These can be liquidated.

The fee structure is equally simple: 5 bps on notional for trading, 15 bps on the fixed-rate side for settlement.

To bootstrap liquidity, all fees flow to Vault LPs in the early phase with a “seeding premium” of 50 bps above floating (which should equate to an initial ~20% APR on the System Vault LP). The vault will support $100m of fixed-rate borrowing capacity on Day 1.

The Competitive Picture

It’s worth mapping where Supernova sits relative to other players in this space:

Boros focuses more on CEX perp funding rates but is showing impressive traction with $268m peak OI.

IPOR is a more direct competitor given that they focus on DeFi lending rates. They use an RFQ AMM with up to 500x leverage on 28/60/90 day tenors with their LP pool acting as a counterparty to all swaps. IPOR has an unfortunate quirk in that traders on IPOR must hold positions for a minimum of 1 week.

Supernova differentiates on execution mechanism (vAMM + CLOB), scope (includes rates, FX and cross-rates) and go-to-market (B2B/API-first along with retail frontend).

Supernova is betting on a superior execution model and, importantly, a more B2B-focussed GTM strategy (bringing fixed rates to where users and TVL already are). Their target audience spans six verticals:

Looping Strategies

Loopers can lock in guaranteed positive carry on PT loops when yields exceed implied borrow rates with a one-click API call rather than manually managing rate exposure. Crucially, they retain full flexibility to unwind principal from the underlying money market while maintaining fixed-rate exposure.

Institutional Borrowers

Supernova offers an SDK for fixed-rate borrowing on Aave and Morpho targeting institutions seeking a predictable cost of capital. Borrowers can lock in fixed rates while preserving the ability to return capital early, thereby avoiding rigid term lockups and maintaining balance-sheet flexibility. Supernova is targeting the likes of Galaxy Digital and Hyperithm here.

Risk Curators & Fixed-Rate Protocols

Supernova enables risk curators in Morpho v2 and Kamino fixed-rate markets to hedge interest-rate exposure while providing fixed-rate loans, removing the risk of being locked into a low fixed rate when underlying variable rates rise. This completes the fixed-rate borrowing stack: borrowers can either borrow directly from fixed-rate markets or borrow variable and hedge via Supernova. Their pipeline includes Gauntlet, Euler and Kamino.

On-chain Credit Markets

Fixed-rate credit on top of existing variable-rate on-chain credit markets is a core requirement for institutional borrowers. Supernova is in active integration planning with Cap Protocol, which lends to Amber, SIG, Flow Traders, and IMC Trading. On the consumer credit side, Supernova allows crypto neobanks like Ether.fi to offer users fixed-rate borrowing while sourcing liquidity from Aave and Morpho.

Rates Trading

Traders can express directional views on rates and convert small basis spreads into potentially attractive returns. Supernova promises simplified UX with leverage and TP/SL functions specifically designed for rates trading. Re7, Caladan, Flow Traders and Portofino are all key targets here.

Crypto Neobanks

Supernova enables savings apps and neobanks to offer users higher, predictable fixed-rate yields while deploying capital into Aave and Morpho. The SDK also supports synthetic FX exposure, letting users hold USDC/T while gaining exposure to alternative currencies. Their pipeline here includes Altitude (Squads), MoonPay, Aave App and Nook.

My Take

Conceptually, Supernova’s approach to enabling fixed-rate lending to take place on top of existing DeFi markets makes sense to me. Whether they are able to execute and scale a historically niche market is yet to be seen.

What I’m watching:

Launch announcement (will we see something soon with MegaETH mainnet coming Feb 9th?)

Partnership announcements (across the target audiences)

Whether fixed rates offered are competitive with Maple’s 5-8%

Vault liquidity bootstrapping and early yields

Brilliant breakdown of why capital efficiency matters so much here. The observation about fixed-rate protocols forcing an impossible negotiation between lenders and borrowers gets at something I've seen play out in my own testing with various protocols. Instead of trying to move entire principal amounts, Supernova's derivatives approach feels like it could finaly bridge that gap with way less friction.