Parsec Weekly #27

HAI and decentralized stables

Ameen, a RAI cofounder announced a spinoff project called HAI, HAI is a RAI fork with 3 major changes. 1) Multi-collateral, RAI is ETH only and has suffered similar scale effects that SAI had. 2) Pro governance, this is more in line with the maker vision of highly active governance, even leading to Rune praising HAI. 3) On optimism. Parts 1 & 2 excite me a lot, I am a huge proponent of experimentation around stable assets and pushing out on the risk curve. The more collateral assets the better, abracadabra remains one of the fastest scaling stables ever before degenbox lit the protocol on fire. The optimism choice does limit their options though. In terms of collateral, they can really only start with {st, r}ETH and OP (maybe some velo pools?). In general, with crvUSD and GHO coming up the more the merrier in this vertical, the importance of properly decentralized stable(ish) assets is top priority for the industry

Kwenta

For over a year, the DEX perps market has been dominated by GMX and dYdX. The first major challenger here appears to be Kwenta. Kwenta is the product of years of iteration on the Sythetix staking model. SNX stakers issue sUSD against SNX and take the other side of sythetic holders. In Kwenta’s case, a high fidelity funding rate has allowed for the system to scale to a ~$50m in open interest, and notably a long tail of markets, a feat GMX has not been able to replicate with their current system. The recent success is intrinsically tied to a windfall of rewards from OP, but a challenger nonetheless. With Kwenta, the question becomes one of scalability - could markets like these actually handle “the move” the way nance and bybit can. The 0 slippage model likely bears higher stress under market leading activity. That being said, the march towards DEX perps eating CEX market share continues and synthetix remains the cockroach of DeFi

Meme Coin Apocalypse

Meme coins thrashing the chain this week, led by PEPE, a host of new coins popped up and moved hard on low liquidity. The Uniswap routers flashing and leading gas usage by a longshot is often a ominous signal - and for good reason. Explicit vaporware moving can imply that the market can’t hold up narratives for “actual” projects.

NFT Market Overview

-kezfourtwez

Blood on the streets, the NFT market continues its downward momentum as the top collections fall fast and sharp, few projects have shown strength over this time but we’ll get to that.

In the last couple of weeks we’ve seen some big capitulations which are generally a good indication that we are somewhere close to at least a local bottom. Volume is back to pre Blur levels, active wallet count has nosedived, massive amounts of large holder selling, floor prices collapsing, cascading liquidations triggered (most are being paid back before actual liquidation), and we had two of the most prolific Blur farmers and ape traders call the quits and cease their farming & trading - Franklin even deleted his twitter account.

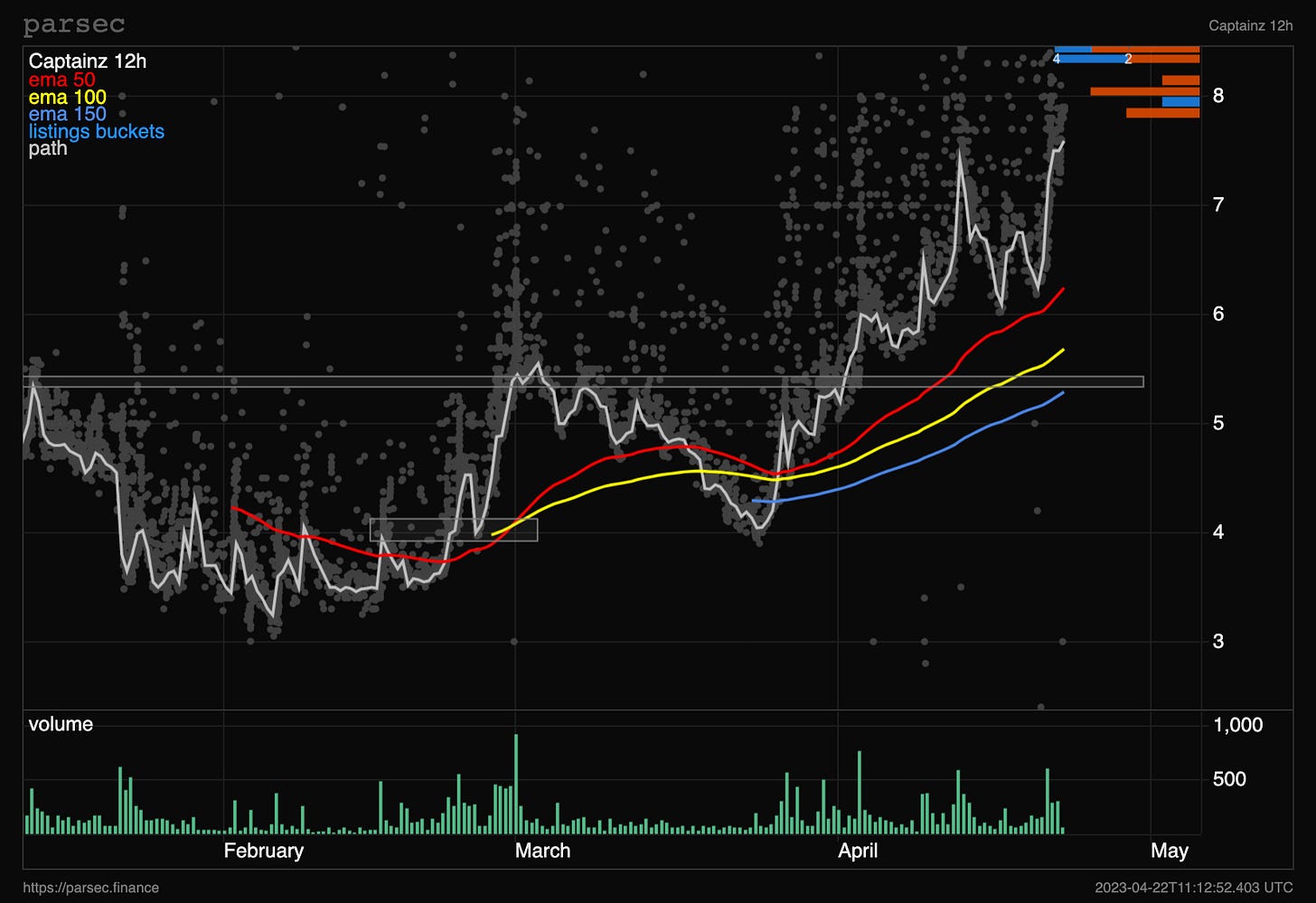

Some charts for reference.

Interestingly all of this is happening whilst NFT lending TVL is hitting all time highs. This indicates that at least a chunk of what’s left of volume can be attributed to NFT leverage. On one hand it’s good that most loans are getting paid back before actual liquidation, this says that the people using leverage at least have the means to pay back their loans whether liquid or by forced selling. In the last week alone on BendDAO, 7000e worth of loans went to liquidation, but only 500e worth were actually liquidated. On the other hand it’s not great that TVL hasn’t really taken a hit yet.

Currently almost 11% of all bored apes are deposited between ParaSpace and BendDAO. Will be interesting to watch how this unfolds, whether or not we see a massive hit to NFT lending TVL at some point remains to be seen.

As far as strength goes over the last few weeks, the clear winners are the Milady & Memeland ecosystems. Whilst everything else has pretty much been down only, these collections have been climbing. The Remilio/USD vs ETH chart below is truly wild. It’s not often NFT’s even manage to hold their ETH price as ETH itself climbs. Yet Remilios are up another 150% in the last 7 days while ETH is down 13.5%

Captains are holding steady between 7 and 8e in anticipation of the MEME token and art reveal. Memeland’s grail collection ‘You the real MVP’ is selling for a whopping 60e up from a low of 5e back in June.

Thanks for reading and bye for now, stay on top of the markets with Parsec and we’ll see you next week

nice

excellent