Momentum

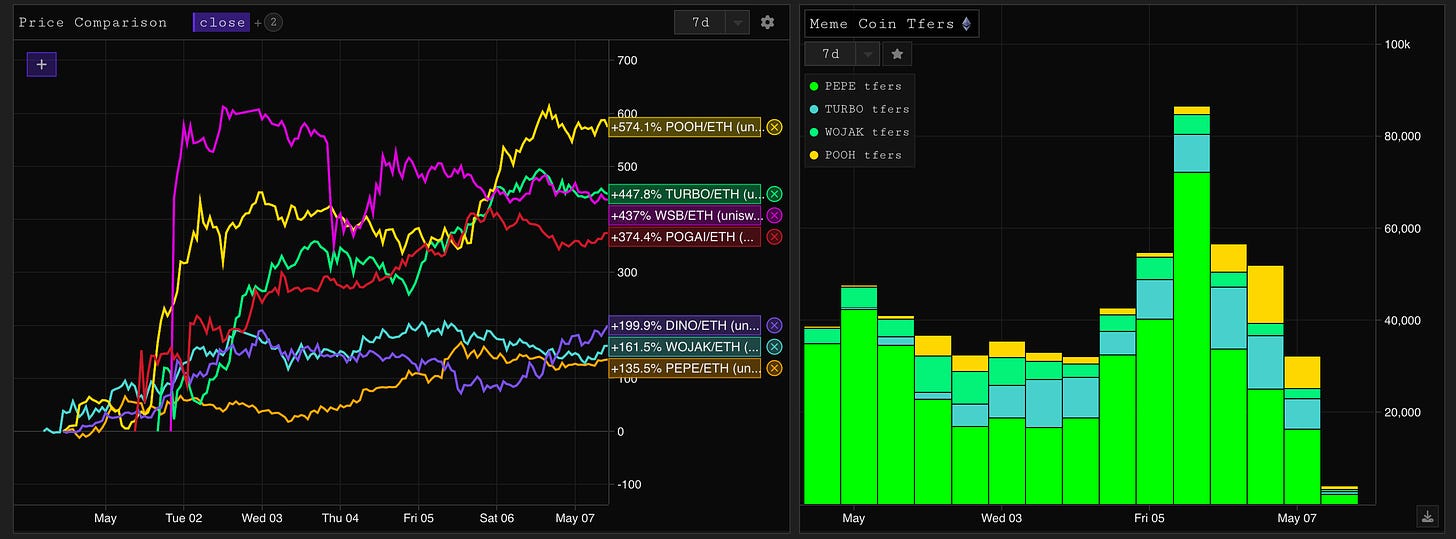

meme coin season hit a crescendo this week, with PEPE leading the way over $1bn market cap and the notoriously shrewd ETH foundation moved some ETH, leading to many traders calling top here. A lot of attention has been paid to the effects on ETH the asset, with massive fees deflating supply. Mainnet remains the schelling point for new meme coins - the reasoning here is fairly simple, most users (with an adjustment for highest willingness to ape), most prospective trader flows. In some sense meme coin successes are the purest form of chain rank signaling. A meme coin is pure momentum, and therefore must appeal the widest base of capital it can to initialize that momentum. Mainnet is clearly substantive leader here still in 2023, but another option has notably emerged - Arbitrum. The challenge with the L2 model for momentum driven coins is that fees might just not be enough of a differentiator to unseat the network effects, we’ve seen that retail will come in and spend $50 on fees to buy $10 of a coin. That being said Arbitrum continues to differentiate itself from other L2s, with some of the only size-able meme coins outside of mainnet dropping there.

Overall PEPE sucked all the (already limited) air out of the room. Some idiosyncratic new DeFi launches like Chronos and Blend in the mix, which will likely get more attention once the fervor dies down.

NFT Market update

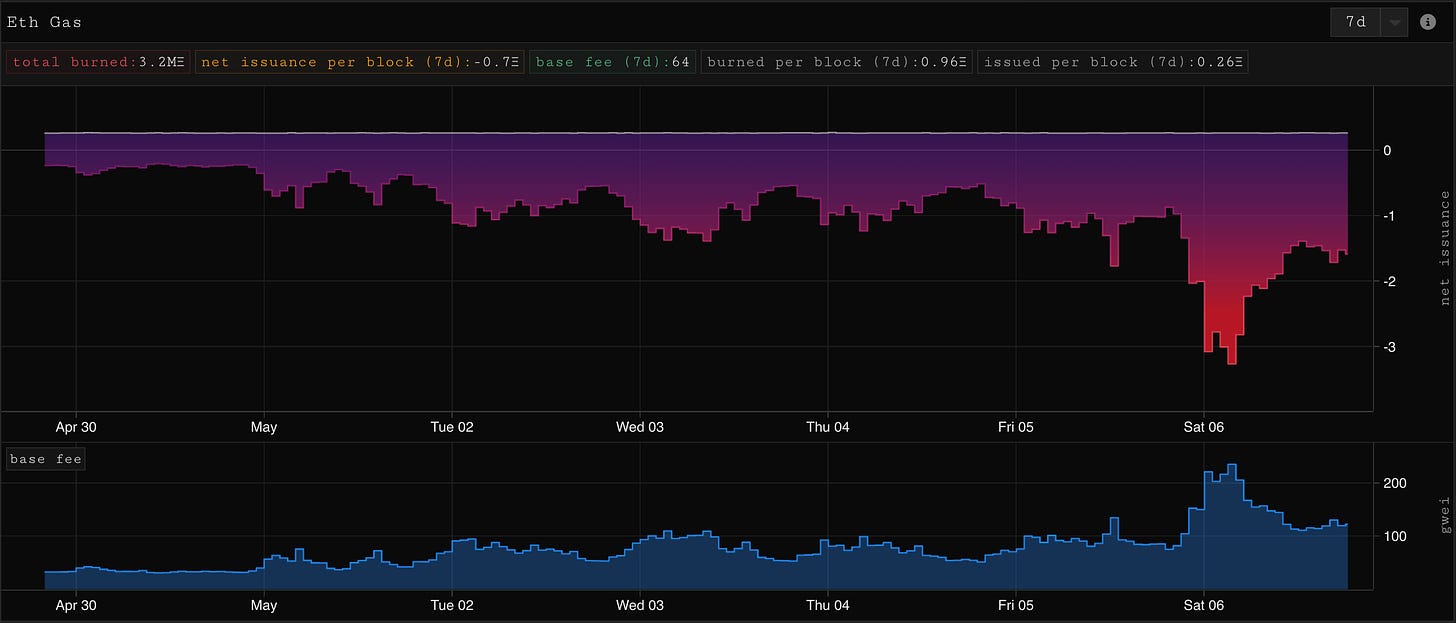

gm jpeg enjoyers, I feel like a broken record saying this but it’s been a very uneventful couple of weeks in NFT’s again, especially volume and performance wise. Most collections are still grinding down along with volume and active traders, with the odd exception. It’s pretty hard to sell your average market participant on trading jpegs when the majority are down only and average gwei looks like this.

Over 3m ETH were burned in the last 7 days mostly due to shitcoin szn, net issuance went as low as -3.2e per block amongst the $PEPE Binance listing madness yesterday.

Would you rather buy 10t $WASSIE coin that’s already up 300% on the hour and climbing for $50 in gas total, or would you rather buy 5 turbonerdickbutts at $50 gas per pop? Doesn’t really make sense does it, paying gas per token on NFT’s while interest & volume are at all time lows, the R/R just isn’t there. The trend is your friend and it’s often -EV to fight it.

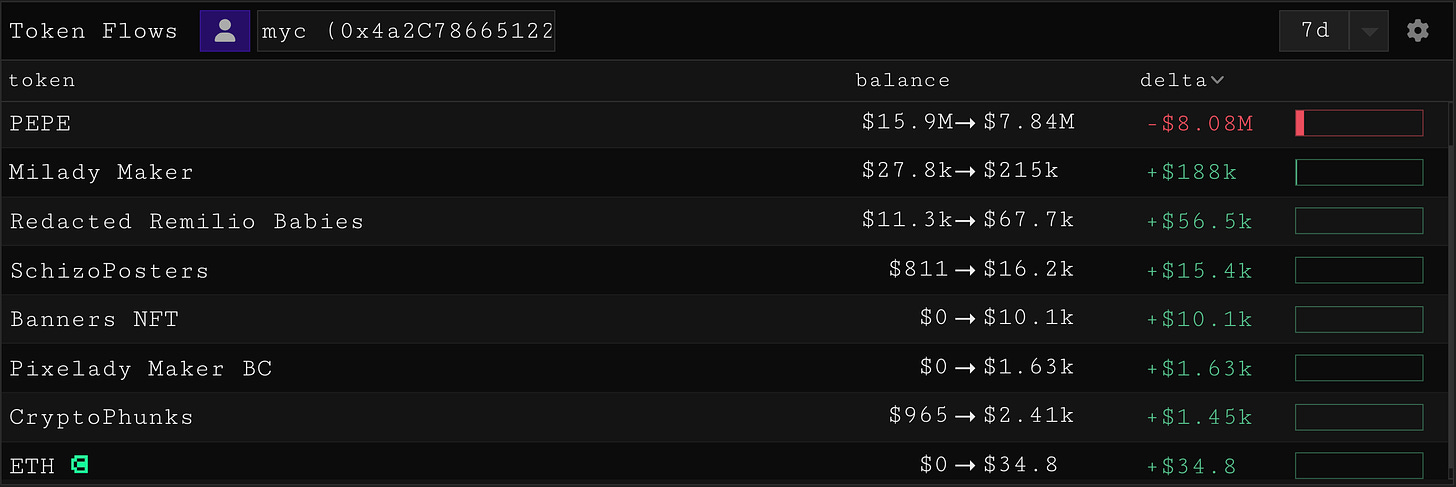

It does beg the question though, what will happen to all this new found wealth once shitcoin season winds down? I can’t say I’m optimistic that NFT’s will be the successor, but I do expect some flows to return to the jpegs for at least a period if not prolonged. Here’s an address that bought $PEPE extremely early throwing some of the gains into the milady eco.

Here’s some great analysis from @thiccythot_ on twitter about realised profits on $PEPE so far.

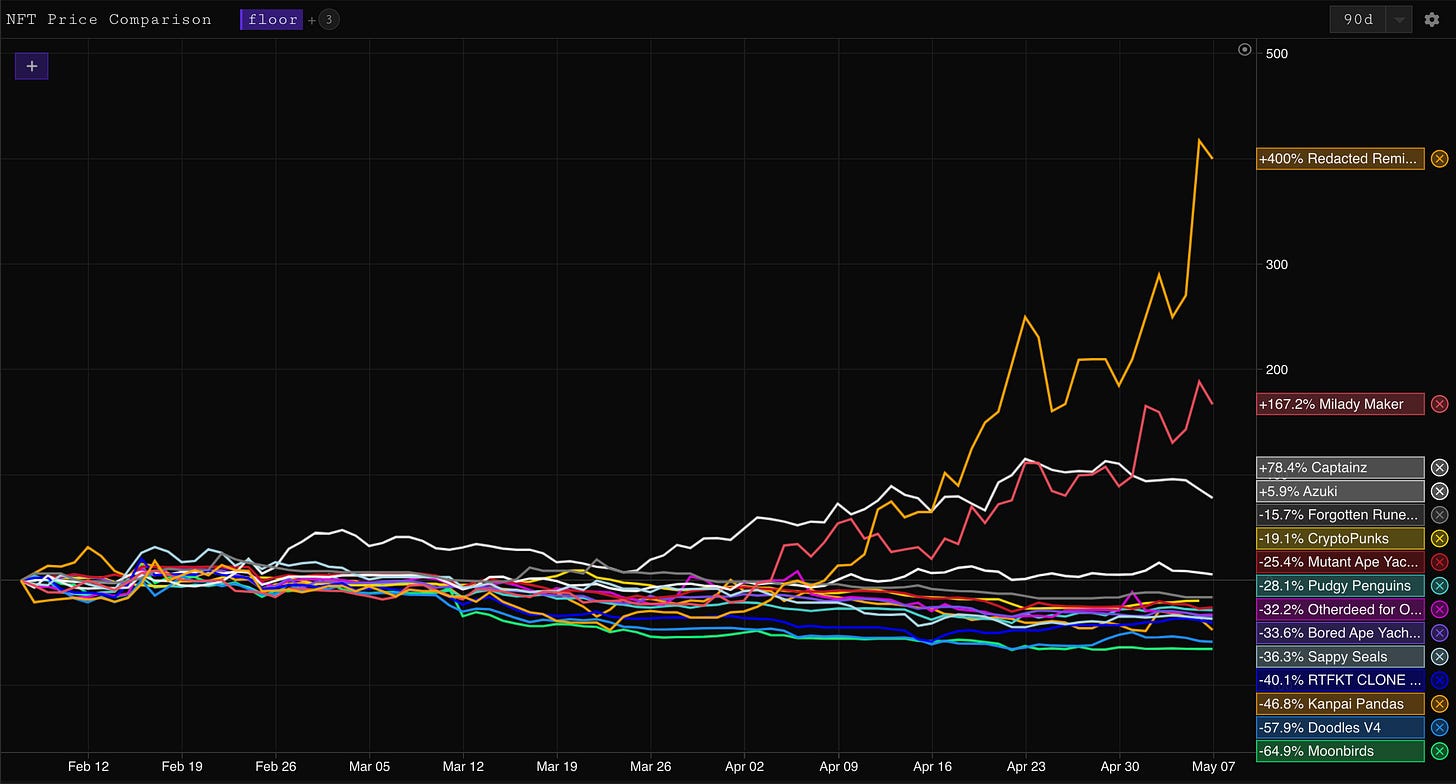

The milady eco is easily the best performing sector over the last few quiet months. Not many projects are net positive on floor price, sentiment or volume in that time, yet milady’s are up 167% and remilio’s 400% in the last 90 days, and far more off the lows.

Blend

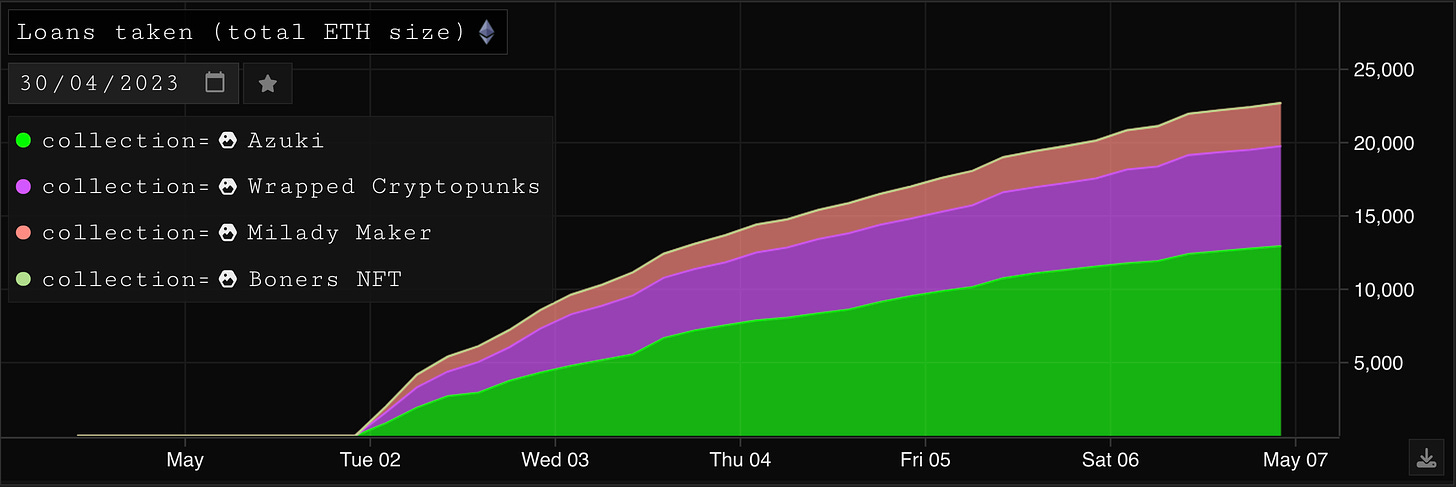

This week Blur released their p2p loan system, Blend. It has three main functions that can currently be used across 3 collections (Punks, Azuki, Milady) with another mystery collection on Monday and more to come.

Borrowers can use their NFT’s as collateral to access ETH liquidity or put down a small deposit to buy an NFT now and pay later. Lenders can offer up ETH at an interest rate of their choosing up to 1000%, though lending is incentivised by Blur points so a majority of loans are offered at 0%.

Unlike other p2p lending platforms like NFTfi, loans have no end date and interest accrues until either the borrower pays off the loan or the lender triggers a refinancing, which they can do at any time. If this happens, the borrower has 24hrs to repay the loan in full or a dutch auction with an ascending interest rate starting at 0% is triggered. An unlikely scenario, but if the interest rates reaches 1000% without someone willing to take over the loan, and the borrower has still not paid, they will be liquidated and the lender gets possession of the collateral.

You can read more about how Blend works in the white paper.

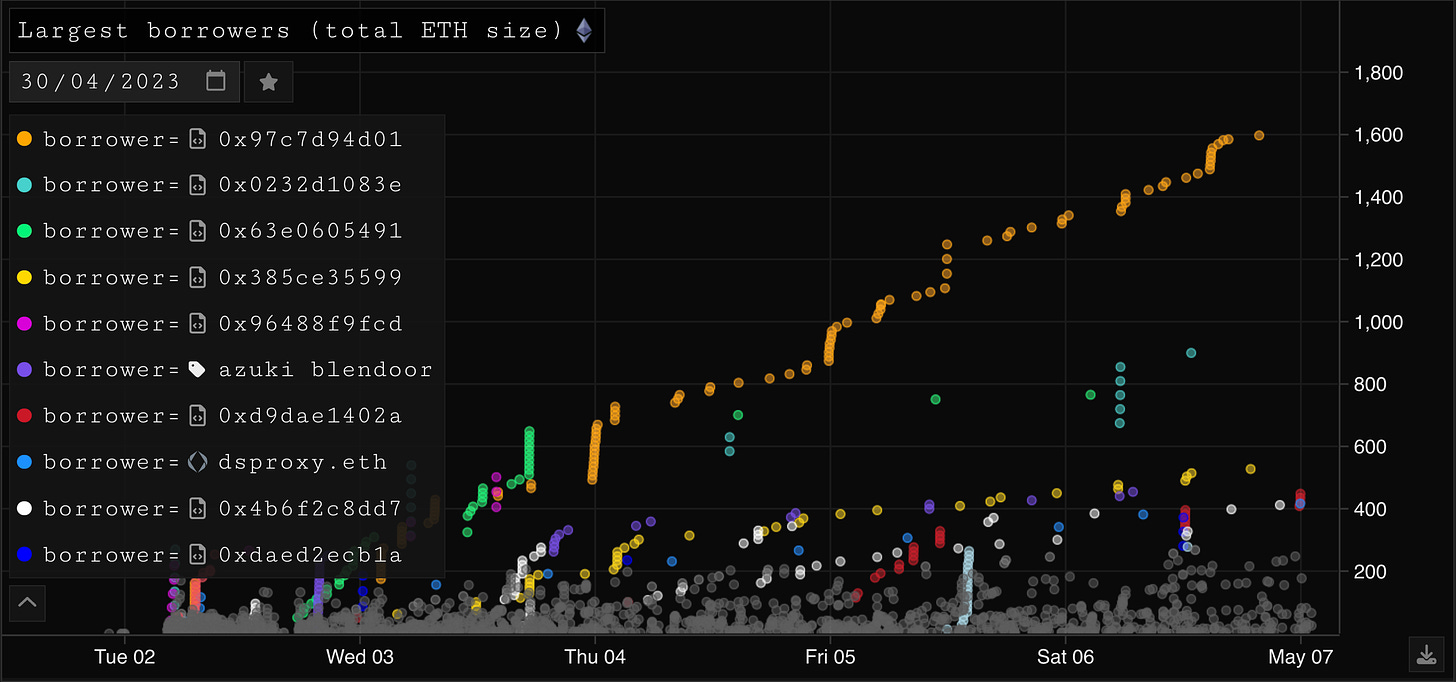

Blend launched 5 days ago and has already facilitated over $40m worth of loans with the largest borrower accounting for 7% of all borrows.

We have some great components to track Blend activity, find them under the protocols>blur tab in the elements dropdown, or search ‘Blur’.

Here’s two great layouts to get you started

https://app.parsec.finance/layout/wilburforce/b91feAkm

https://app.parsec.finance/layout/geeogi/uGURJSIe

Thanks for reading and bye for now, stay on top of the markets with Parsec and we’ll see you next week

good

amazing