NFT market overview

gm parsec enjoyers, it’s been a quiet few weeks in NFT’s as meme coins continue to hold mind share, but it’s been a hot minute since we’ve published anything so I thought I’d give a brief update.

Last week we saw an uptick in overall NFT volume, users and some floor prices. Nothing to write home about but a nice spot of reprieve in a quiet jpeg market. The general trend is still downwards, BTC and ETH are in a precarious place and shit coin volume seems to finally be winding down.

Pudgy’s

have been steadily climbing from a local bottom of 3.6e for the last 30 days. Lately, there’s been an increase in pudgy presence on the timeline off the back of their $9m seed round and toy line announcements. The penguins have managed to reclaim a previously long held range, between 5 and 6e.

Jack Butcher’s Opepen's

have had a monster run these last couple of weeks, currently sitting almost 400% up off the bottom at 0.75e

Opepen’s are kind of like the Art Blocks of pfp’s. Most are still ‘unrevealed’ as the supply is 16k and they work to reveal in sets of 80. Each set might be designed by Jack himself, or another artist - The most recent announcement was the beloved Pepe maestro himself, Batzdu.

Jack has had a fast rise to notoriety in the crypto space. He is well respected and because of that, other notable people want to work with him. Just recently he auctioned off 3 pieces at Christies which all sold for over 15e each.

Milady’s

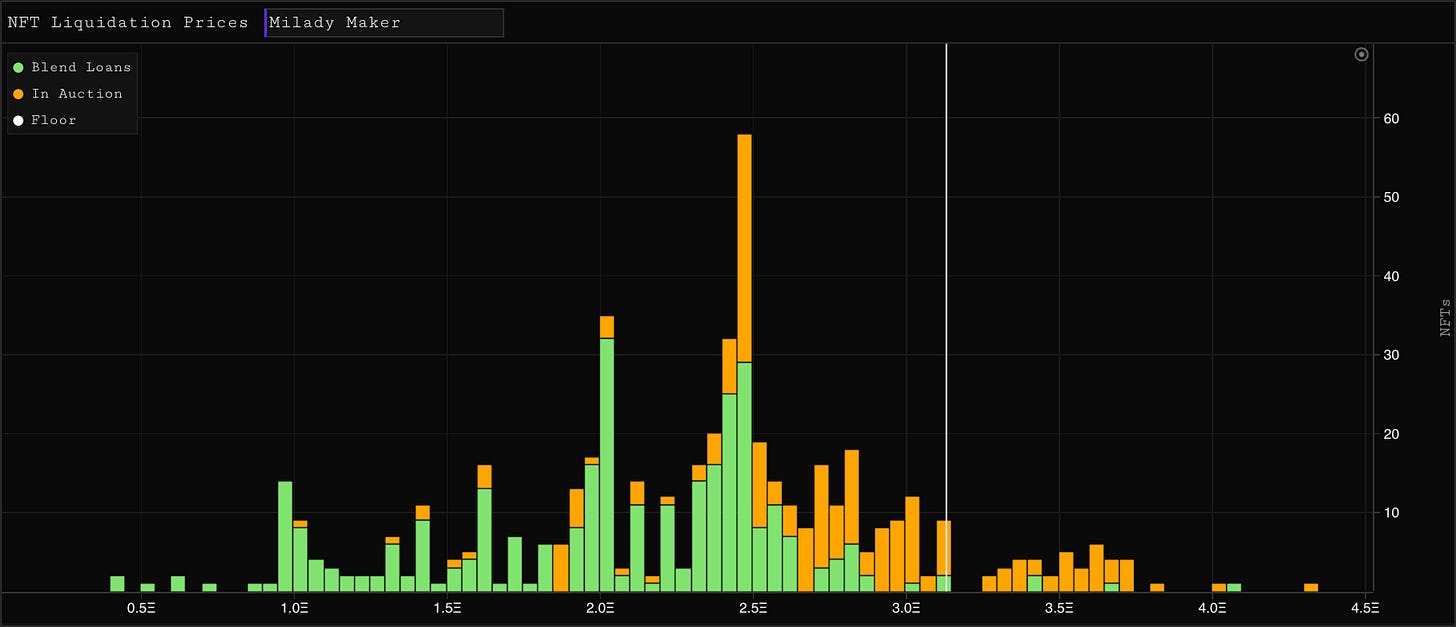

are experiencing a sizeable retrace for the first time since their run up from under 1e. They are down 40% in the last week, and 56% since the Musk tweet. It seems to be a combination of the galactic Musk tweet top, and too much leverage since in the inception of BNPL on Blur.

There are currently 511 Miladys in the Blend escrow wallet, though the loans chart is looking a lot thinner compared to yesterday. Some sizeable buying pressure came in at 3e and so far that level hasn’t been tapped again.

Blur

has continuously added new collections to their Blend platform since launch at the beginning of May, and the volume of new activity reflects this. Volume of Blend events has been basically up only since inception and they are currently sitting around 2k events per day. Though I do think their growth aligns with their growth in available collections, it’s still an impressive feat in this market.

In just under a month they have facilitated over 150,000 ETH in loan activity with $31m worth of those loans still active.

good

nice