Parsec Weekly #32

Your weekly dose of DeFi and NFT's, brought to you by Parsec

Curve chaos

-chulie

The past week has been eventful to say the least - let’s dive into exactly what happened, as always with assistance of some beautiful parsec visuals.

The market has known for some time that Curve founder, Michael Egorov (or Mich), has sizeable debt positions across multiple venues with CRV as collateral. Other than one targeted attack in late 2022 (looking at you Mr Eisenberg), Mich’s positions have mostly been safe as he has continued to increase the health of these positions by adding CRV as collateral as it vests.

Over the weekend, the health of these positions came into question as a reentrancy vulnerability in an old version of Vyper led to multiple Curve pools being drained with initial losses totalling ~$65m including the CRV-ETH pool, the most liquid on chain LP for the CRV token.

As LPs fled Curve pools en masse, a reflexive loop ensued whereby initial selling due to the exploit led to fear surrounding Mich’s leverage which led to further selling, shorts piling in and so on, all of which was exacerbated by a degradation in on chain liquidity. The market naturally began to discount mass CRV liquidations and potential bad debt for money markets. Interestingly though, the first point of stress for Mich was not his largest loan on Aave v2 but a smaller loan on Fraxlend.

Due to their interest rate and utilization parameterization, on Fraxlend interest rates grow very quickly when a lending pool is fully utilized. As fear surrounding potential bad debt on Fraxlend ignited, lenders began withdrawing which led to spiking utilization and increasingly higher rates for Mich. The implication of this was that his position could be liquidated within days despite no further CRV price decline.

Initially as Mich frantically paid back FRAX debt, lenders simply withdrew newfound liquidity as they feared the bad debt scenario. As another solution was needed, Mich spun up a CRV incentivised fFRAX(CRV-FRAX fraxlend pool deposit)/crvUSD pool in the hopes that high APRs would incentivise lenders to stay in the pool or indeed enter. This helped some but was not the silver bullet needed; enter the OTC markets...

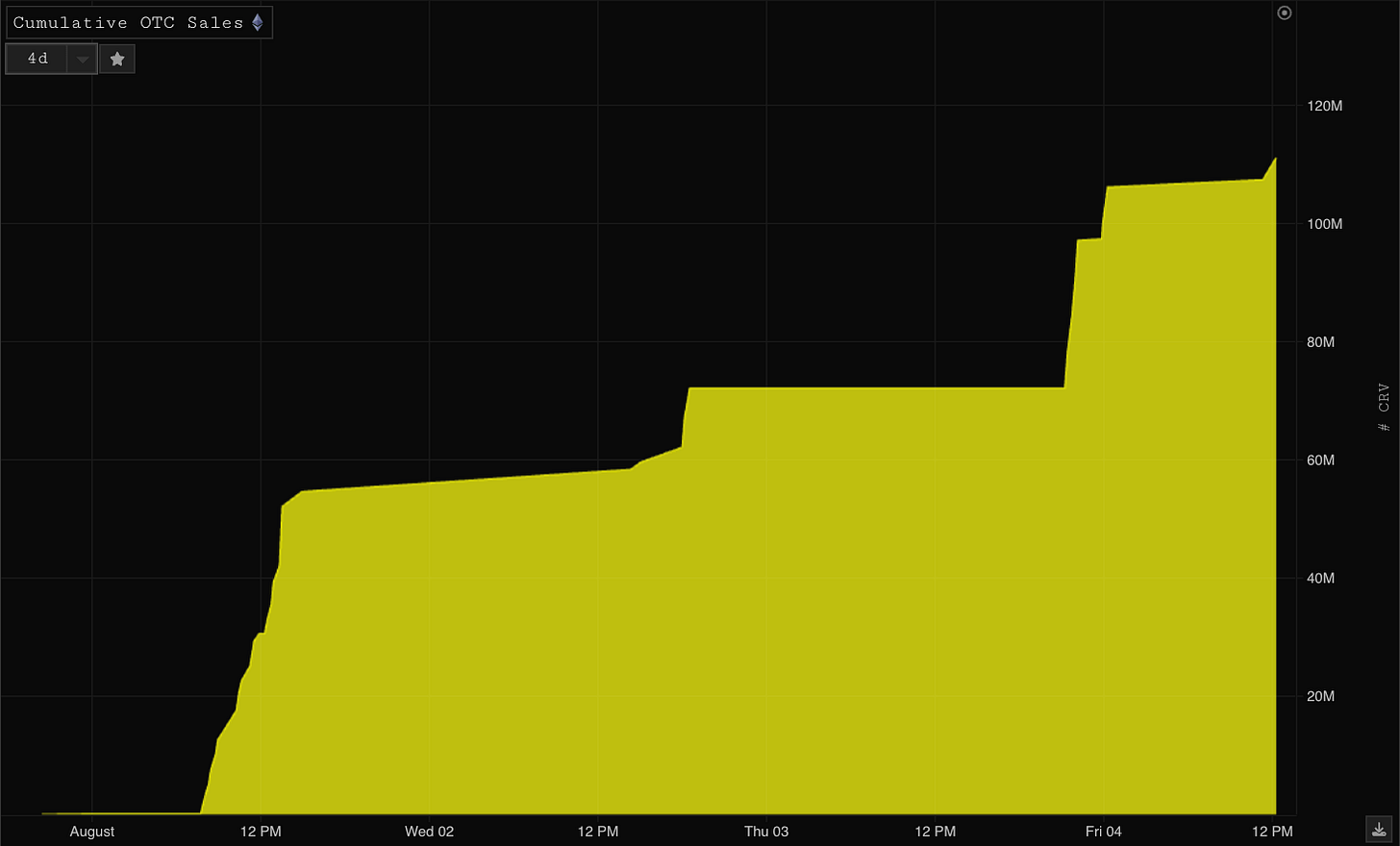

Mich began selling CRV OTC to various counterparties with a 6 month lock, using the proceeds to pay down debt and decrease utilization, finally the silver bullet he needed. Since Aug 1st Mich has sold 111m CRV OTC to individuals, funds and protocols alike, raising $44m to pay down debt and assuage the market’s fears as the Fraxlend position no longer looks to be at risk. There have still been moments of heightened concern, such as a failed Abracadabra proposal to effectively force close Mich via exortbitantly high interest rates, but the situation is generally calming as OTC sales effectively brought forward the liquidation in a controlled manner.

The ultimate fate of Mich’s outsized lending positions is unclear but for now they live to see another day...

To continue monitoring the situation as it evolves, check out our Fraxlend CRV<>FRAX dash here: https://app.parsec.finance/layout/wilburforce/eFQBEbje

Shitcoin shenanigans

-kezfourtwez

I couldn’t bare to give another boring NFT update, but I can vaguely summarise it in one sentence: ‘NFT’s spent their gorillionth day in a downtrend with zero buyers, zero innovation and only blur farmers propping up floor prices on the steady grind down’. So I’ve decided instead to write about the fun stuff happening on chain, shitcoins.

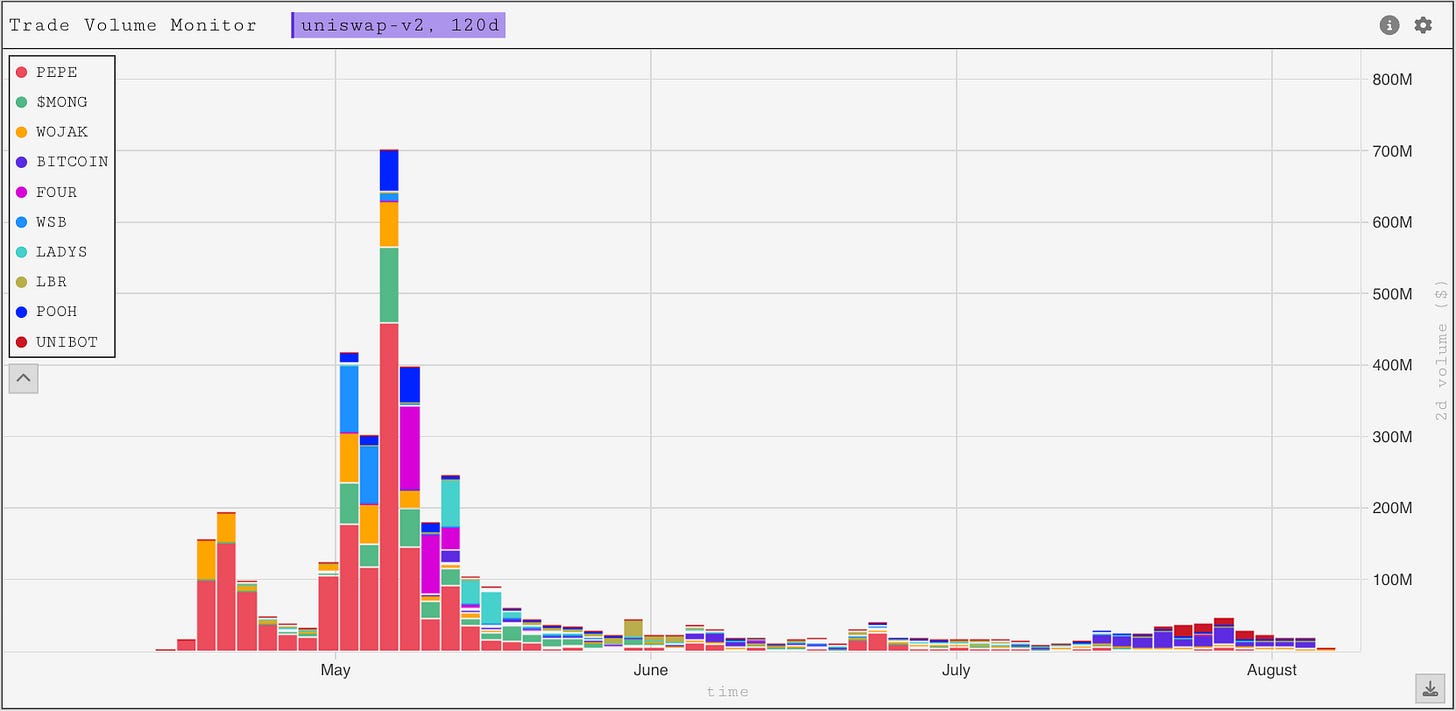

Shitcoin summer has been in full swing since $PEPE lifted off in May, rising swiftly from its sub $50k launch all the way to a $1.5b market cap in just over two weeks. This move minted new millionaires and generated massive interest and new liquidity flows into shitcoins. These new millionaires made their money on an asset that is about as risky as it gets, so naturally they would pour some of their gains back into further on chain degeneracy.

More recently the success of some tokens have seemed large in their own right, but demonstrated by the chart above nothing has compared in volume to the mania of the $PEPE run. The market has seen few tokens reach nine figure valuations or sustained activity since, which emphasises that most of this volume is but a small echo bubble.

It’s currently the absolute trenches out there, and trading micro-cap tokens looking for the next big winner has become an incredibly pvp venture. It feels like there are only a few thousand of us left battling it out. You see most of the same addresses in the top holders of new launches, we are knowingly and unknowingly dumping on the same people that we interact with everyday on twitter, discord and tg.

The two biggest successes since $pepe are undoubtedly $BITCOIN and $UNIBOT. HarryPotterObamaSonic10Inu ($BITCOIN) is a meme coin that has attracted one of the most prolific cult followings I’ve ever seen in a coin, the memes are hilariously schizo and everyone seems to just be having a good time. $unibot is a suite of shitcoin trading tools in the form of a telegram bot, it lets you analyze/buy/sell/snipe all with the click of a few buttons. This sparked a flurry of ‘utility’ tokens trying to cash in on the hype. Trading bots, analytics bots, even bots that create tokens have found themselves with high seven figure valuations.

The most recent and sizeable shitcoin shenanigan occurred on Coinbase’s new L2, Base. On Wednesday a whale wallet deployed the token $BALD, playing on the Coinbase CEO’s lack of hair and the common CT meme and began to add deep liquidity. At the time there had only been around 7k bridge tx’s to Base, which had no front end and was just a ‘send mainnet ETH to this address’ type of situation. But as the deployer added more and more liquidity, more and more wallets bridged and started max bidding.

Over the course of the next four days the deployer added a total of 6870e to the LP as well as buying 1360e worth of $bald, speculators ate this up and the market cap ran all the way to $100m mark before the deployer pulled 10,700e in liquidity. Making a total profit of 3000e, one of the larger and more bold rugs we’ve seen lately.

Nice

wow