Spark Protocol and MakerDAO’s eDSR

MakerDAO has experienced strong profitability this year as they enjoy high yields on their real world asset (RWA) portfolio thanks to Mr Jerome Powell and the Federal Reserve cabal.

These profits were being used to buyback MKR from the open market but given recent governance developments, DAI holders now stand to benefit from the large profits being generated by the DAO’s RWA portfolio.

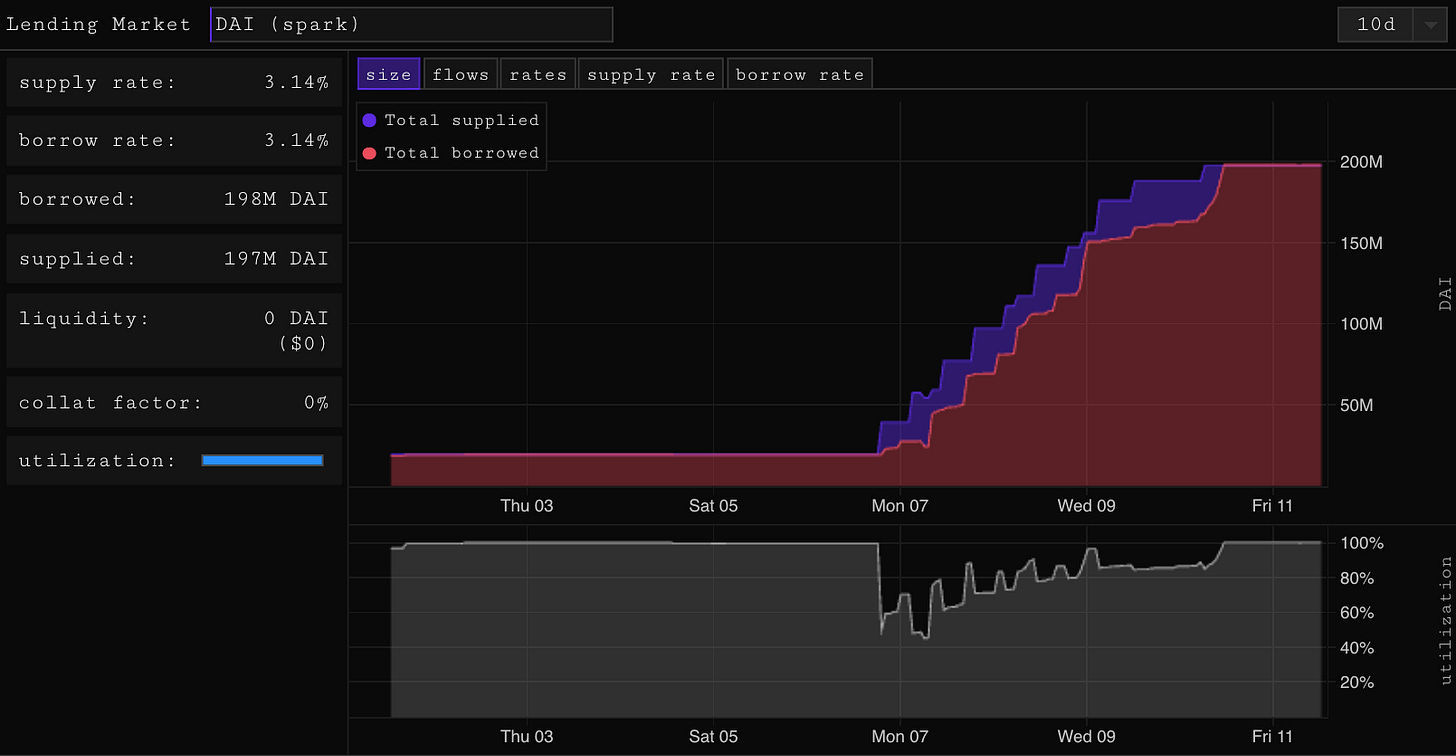

The enhanced DAI savings rate or eDSR is a subsidised interest rate of 8% paid to those who stake DAI into the sDAI contract via Spark Protocol (one of Maker’s subDAO’s). The idea behind the eDSR was to increase utilisation of the DSR and bootstrap adoption ahead of Maker’s Endgame plans taking place later this year. Unsurprisingly, in a world where on chain rates have been below those in traditional money markets, the introduction of a low risk 8% rate has led to significant inflows:

Alongside increased DSR utilisation, DAI supply itself has increased by 830m in the same period. Spark Protocol has been the primary beneficiary of these inflows as users access the eDSR by staking DAI into sDAI on Spark. Perhaps more importantly, Spark allows users to borrow DAI at 3.19% creating a positive carry trade whereby participants can borrow DAI at 3.19%, stake this DAI into sDAI for 8% and enjoy the positive delta. The choice trade here has been to use wstETH as collateral:

These deposits have tapered somewhat over the past 24 hours as the DAI pool has reached 100% utilisation:

Given the rapid uptake and concentration of usage being skewed towards large wallets looping to lever up the rate, there is a new proposal to cap eDSR rates at 5%. This still allows for a positive carry so we would expect sDAI growth to continue while Maker leaks less value.

A recent governance post teasing a retroactive $SPARK airdrop will likely also contribute to sustained inflows. Equally, a recent proposal from Aave to list sDAI as collateral on Aave v3 could act as an additional tailwind for DSR adoption and ultimately DAI supply growth as the looping games ensue.

For the first time in a long time we are seeing relatively low risk, sustainable positive carry on stables - could this be the silver bullet needed to quell stablecoin outflows?

Long your friends

This morning a new social-fi app called friend.tech dropped on Base chain, made by beloved shitposters @0xRacerAlt and @Pancakesbrah. It’s a social layer on top of twitter and Base that lets a user connect their twitter account, deposit ETH and start buying shares of their friends and favourite accounts. If you own a share of someone you can talk to them in a semi-private chatroom. It’s kind of like a one way mirror, you can only see messages from the the person you bought a share of, but they can see everyones messages.

It’s absolutely blown up and taken over the timeline. To be honest I had something else in mind to write about, I kind of faded it all day until I realised it would be a way more interesting and on topic thing to cover. As soon as I started using it I was hooked, far more addicting than I had assumed.

There are currently no docs, all of this has been worked out from collective chain sleuthing and discussions on twitter so take it with a grain of salt. The shares are on a bonding curve, each time someone purchases one it’s created, the supply increases along with the price and vice versa when shares are sold. There’s a 10% fee on both buys and sells, 5% goes to the person who’s share is being traded and 5% is friend.tech revenue, in under 24h the protocol has made $350k!

It’s an interesting concept that allows users to speculate on price appreciation while potentially getting something in return, I could see this going the way of influencers/content creators using them like paid groups. We could see a potential flywheel happen here, the revenue share incentivises accounts with large audiences to onboard their followers.

A similar thing called BitClout was attempted a few years ago. The big difference was that everybody already had an account on there so people would buy up the obvious ones like Elon Musk before they were even onboarded. The other difference is that BitClout was VC funded and friend.tech is created by crypto natives that are well respected in the community, this has massively contributed to its success amongst big crypto twitter accounts. Many have joined the platform already and instantly risen to the top in terms of value as speculators rush to capitalise. Currently the highest value shares are Cobie at 1.93e, Hsaka at 1.62e and then the founder, Racer at 1.31e

Due to the extreme traffic so far (9k signups), the app has been performing badly, but it’s gained so much interest that people have begun to create their own third party tools to allow a smoother trading experience while the app is struggling. This is all a lot of fun but the main question here is longevity, the big accounts shares have already risen to pretty obscene day one valuations and at the moment the use case is enjoyment and a chatroom with your shareholders. Will users keep using the app if prices go down?

In a vote of confidence for social-fi, it seems as though friend.tech’s launch has pushed Debank to release news of their own social chain, also built on the OP stack. Could crypto social apps usher in a new meta, Is this time different?

If you’re interested in keeping up friend.tech, feel free to use these dashboards:

https://app.parsec.finance/layout/kez/uUamZ4tn

https://app.parsec.finance/layout/wilburforce/OVIYYWz8

https://app.parsec.finance/layout/willprice/0zG76zRn

Lfg

good