Aave’s not so stable stablecoin

Consistent with the trend across DeFi 1.0 to capture more of the stack, Aave launched GHO on July 15th as its first foray into the stablecoin market. GHO is an overcollateralised stablecoin minted from assets supplied to Aave with an initial interest rate of 1.5% flowing directly to the DAO treasury.

GHO has achieved solid growth during the first weeks since launch reaching ~$24m in supply with the below market interest rate likely being a key driver.

Despite the promising growth, the stablecoin has been trading below peg for almost the entirety of its existence:

The below market interest rate combined with a lack of integrations and no liquidity incentives has been the likely cause of this depegging. Recognising that peg deviation can limit growth and trust, there are plans to implement a GHO PSM (Peg Stability Module) alongside various additional peg-supportive proposals:

proposal to increase GHO borrow rates by 100bps to 2.5%

proposal to implement wGHO as collateral to allow for arbitrage and leveraged positions when GHO is under peg

Aave will likely also need to incentivise liquidity as has been the historical playbook for maintaining a strong peg. Perhaps the recent OTC CRV purchases by the Aave DAO will come in handy...

These developments are particularly important ahead of the onboarding of sDAI as collateral given that the rates differential between sDAI and GHO might lead to further GHO peg pressure as participants seek to collect the positive carry.

It is worth noting however that the realised yield generated by carry-chasing loopers will be deteriorated significantly if GHO repegs post their entry as their debt reprices higher eating into the expected return. Given this risk, the sDAI-GHO carry trade might be best implemented following a successful repegging - something which Aave look to be laser focused on.

On chain shenanigans

It’s been a pretty quiet week lower down the risk curve, BTC and ETH’s lack of volatility over the last few months led to the perfect conditions for a flourishing on chain playground. The on chain index were making new high after new high, the vibes were good and we were all prerich. Then friend tech came along and stole the show and the majors got knocked off their shelf, that was all it took for traders to feel less comfortable aping the newest shitcoin. I’ve still been making my daily visit to the trenches and it does feel like the hard mode switch has been flicked, pumps in the micro caps are visibly less sustained and you can feel most traders rushing for the exit faster. A few weeks ago buying a 50-60% retrace into the golden pocket on a new coin with enough momentum was almost a sure thing to new highs, now most are straight to zero after 1 measly parabola. It’s the time to be patient and wait for a new meta to rear its head along with some real strength.

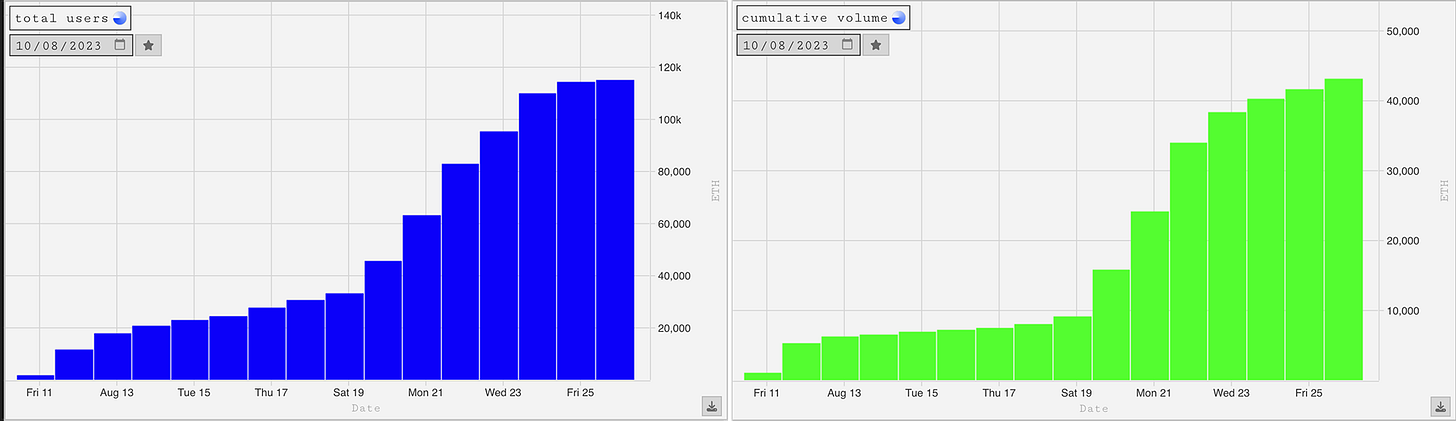

In just over two weeks Friend Tech has managed to onboard an impressive 115,000 users who have driven 43,000e in volume through the contract. That’s $71m total, $3.5m revenue each for the team and users through through the trading fees. The user with the top volume traded is Cobie at 1742e and 87.2e gained in fees.

Egirls have set up camp on Friend Tech, it seems as though they share some qualities with the CT crowd and the CT crowd have more than obliged their arrival. Earlier today a highly anticipated feature was released, image sharing. Many have been speculating since launch on egirl shares in the hopes of this functionality, in the last 12h the egirls in the top 100 have seen 312e in volume, and a cumulative volume or 1200e in the last 7 days.

The on chain index on the other hand is having a tough time, with $RLB showing strength as the outlier after finally being cleared of a whale that sold off $22m worth of the token over the last week.

This morning the $PEPE multisig was downgraded from needing 5/8 signatures to just 2/8. Shortly after, pepecexwallet.eth (a team wallet) transferred 16T tokens ($14m at current price) to a fresh wallet which then sent to Binance and OKX to be presumably sold off. Understandably word spread fast and $PEPE experienced a sell off, it’s currently down 17% on the day and seems to have found a local bottom, but the originating wallet still has 10.7T tokens left.

ok

Great