Aerodrome

Having achieved success on Optimism mainnet with Velodrome, the same team took to launching Aerodrome on Base earlier this week. For the uninitiated, Velodrome and Aerodrome use the Solidly DEX model which essentially directs LP fees to a veToken while compensating LPs with a generous and drawn out emission schedule. Historically a bribe economy has emerged surrounding the veToken as holders benefit from governance rights to direct emissions to given pairs. It is reminiscent of a Curve-style model with some tweaks - using a combination of token emissions and liquidity bribery to create an incentivisation flywheel:

A very large portion of supply (40% or 200m tokens) was set aside as an airdrop for veVELO lockers, unsurprisingly the entire allocation was claimed in an extremely short window of under 1.5 hours:

It’s worth noting that the veAERO airdropped to veVELO lockers is max locked for 4 years so will not be unlocking until 2027.

By all accounts Aerodrome got off to an incredible start; garnering more than $200m in TVL in a matter of days, sucking liquidity out of many incumbent native DEXs and becoming the No.1 DEX on Base by TVL. Following a prolonged period of low and unsustainable yields on chain, farmers rejoiced as initial APRs looked extremely attractive across pairs. As for token price performance, we are seeing a levelling off following initially strong price action:

In terms of volume, UniV3 on Base is still dominant but if we exclude majors, the picture looks quite different:

Granted, much of the volume on Aerodrome is $AERO trading but we would expect to see a diversification in volume over time as more protocols launch on Base and buy into the flywheel through the bribe economy which has proven so strong for Velodrome. We are looking forward to tracking this one over time and perhaps dipping our toes in an LP or two!

On chain shenanigans

For a moment we were so back, but I regret to inform you that it is once again so over. After months of grinding down, the Grayscale ruling on Tuesday resulted in an instant 8% candle for BTC and ETH, only to be absolutely barted just a couple short days later. We are truly entering rektember, historically the worst month of the year for BTC returns.

In that 48hr period we saw a brief pulse in the shitcoin market. The on chain index, specifically RLB and $BITCOIN performed extremely well with a 12% and and 40% move respectively. But more importantly we saw signs of life lower down the food chain in the micro caps, a good temperature gauge for risk appetite in shitcoins. Coins like these are where people begin to park their funds when nothing else is going on but conditions are stable enough that they feel comfortable dabbling.

I can’t remember if I’ve talked about it before, but I’m pretty bullish on a base season at some point. First we had BALD, which was a disaster but publicity nonetheless, $50m was bridged over before the chain even officially went live. Then we had Friend Tech which pulled over 120k users in their first two weeks. Now we have Aerodrome reaching 200m in TVL in the first couple of days.

It’s not easy to figure out how much has actually been bridged over, but the official Base portal address on mainnet is holding $211m in ETH and there’s another $20m cbETH in another address. That barely covers what’s sitting in Aerodrome, so I’d wager that there’s at least another 9 figs on chain that came through other bridges like Synapse.

Eventually, at some point when the market conditions are just right, some of that capital will begin to flow further down the risk curve. All it’s going to take is one or two successful meme coins, one enticing NFT ecosystem, or one degenerate farming ponzi, and we could see Base season in full bloom.

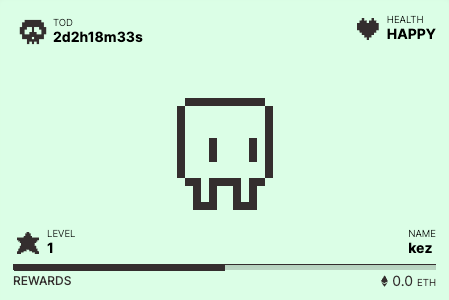

Fren Pet

Yesterday @surfcoderepeat deployed @frenpet on base, a tamagotchi style on chain game.

Buy $frenpet tokens

Mint an ERC721 pet

Buy items using the token to feed your pet, level up and gain points

‘Fight’ others on the leaderboard by ‘bonking’ them to try and steal their points

Redeem your points for your proportionate share of ETH in the contract and start your pet over at level 0

It’s a neat and novel concept packaged up nicely in the same ‘app’ style as Friend Tech, using the same infra called Privy to facilitate wallet creation and transactions natively, it feels very similar. It’s pretty cool, I spent a couple of hours dabbling yesterday having some fun and I came out of it with more ETH than I put in so that’s a bonus. I’m not sure how sustainable it is past a certain token market cap as the items get quite expensive, but a fun experiment either way.

Though the main point I wanted to make, is purely more people building cool things on Base, using certain infrastructure that may become a trend and produce many more cool and fun apps, leading to more users, yada yada. The defining factor for me here would be if Privy integrates fiat payments, allowing incredibly easy onboarding for non crypto native users:

navigate to and install [cool fun] app > sign in with apple ID or email > click create wallet > buy crypto with credit card

And voila! You’ve just onboarded a complete normie straight into transacting on the blockchain without them even having to know they are doing so.

I created some charts around pet attacks, pets killed, items consumed and rewards claimed.

Find it here https://app.parsec.finance/layout/kez/J6PTOlQ_

The project is implemented professionally and has a clear development plan. Made by a very professional and experienced team. Without doubt, this is on e of the best project

ok