Parsec Weekly #41

Exciting parsec news, the potential resurgence of our old friend Canto and Blur season 2 comes to a close

Parsec’s $4m Strategic Round

-parsec team

Before we get into the meat of this parsec weekly we wanted to share some good news! We’re excited to announce our $4m Strategic Round led by Galaxy w/ participation from Robot Ventures, Uniswap, and CMT Digital! We’re also stoked to bring on power users Will Price, Rice Maximalist, Freddie Farmer, and others as angels!

We’re looking forward to the future as we build towards an exciting product release (soon™) and solidify our market position as a leader in on-chain analytics.

Check out this longer form blog post from our founder Will for more details: https://parsec.finance/blog/galaxy-raise

i Canto believe it

Canto was all the hype earlier this year following excitement about their novel economic incentive mechanisms and the announcement of an open market investment from Variant which led to an emissions/farming fuelled reflexive cycle to the upside.

One of Canto’s unique value propositions was Contract Secured Revenue which allows a certain % of gas paid to the network when users interact with smart contracts to be directed towards the developers of said smart contracts, this acts as an incentivisation mechanism for app developers to build on the chain. Equally, they introduced public goods built into the chain, notably a DEX, lending market and native stablecoin (NOTE). These products were implemented without a fee switch hence the term “public goods” with liquidity and usage being incentivised using CANTO emissions to attract LPs, lenders and NOTE minters.

While the 80% genesis token supply allocation towards liquidity mining and no allocation to presale/venture buyers was well received by the community, following an initial hype cycle the high emissions have weighed heavily on token price:

As with any reflexive system, poor price performance led to lower yields which led to capital flight and so on. The ecosystem has been stagnating with a lack of developer and user interest but recent on-chain activity and intriguing announcements from the team signal this could be changing...

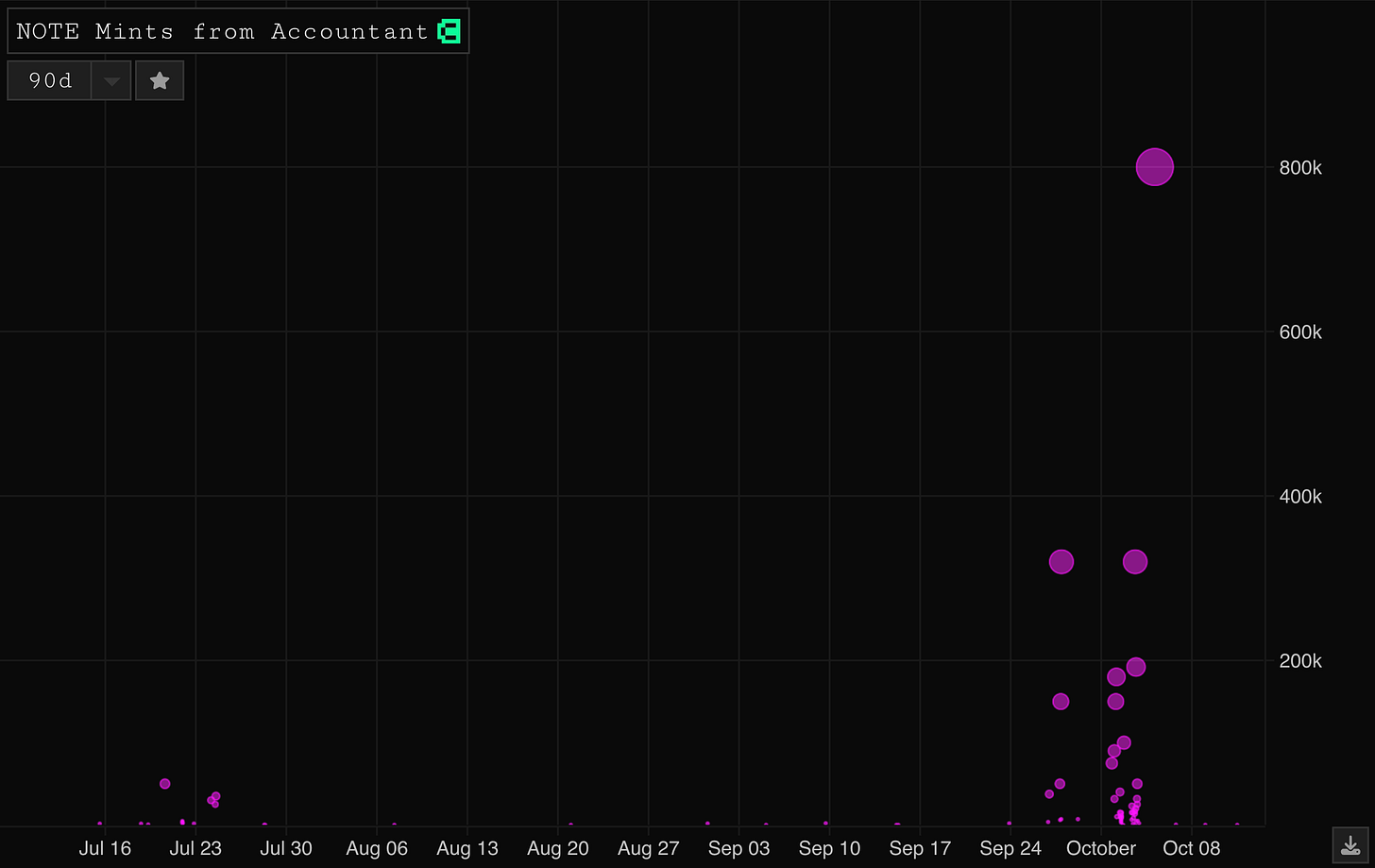

Alongside an announcement that Canto will migrate to a ZK L2 on Ethereum using the Polygon Chain Development Kit, Canto have partnered with Hashnote and FortunaFi to onboard RWA collateral. KYC’d participants will be able to buy T-Bills and borrow NOTE at a high LTV on Canto enabling cNOTE lenders to earn a yield close to that being paid on the underlying collateral as the KYC’d participants perform the following loop: post tokenised T-Bills as collateral, borrow NOTE against, swap to USDC, buy tokenised T-Bills and repeat. This mechanism means there’s quite a high chance NOTE will depeg if we see an influx of capital following the onboarding of RWA collateral.

If you want to keep up with Canto and potential NOTE trading opportunities, you can do so using this layout: https://parsec.fi/layout/chulie/eNkiDVxc

Blur Season 2

-kezfourtwez

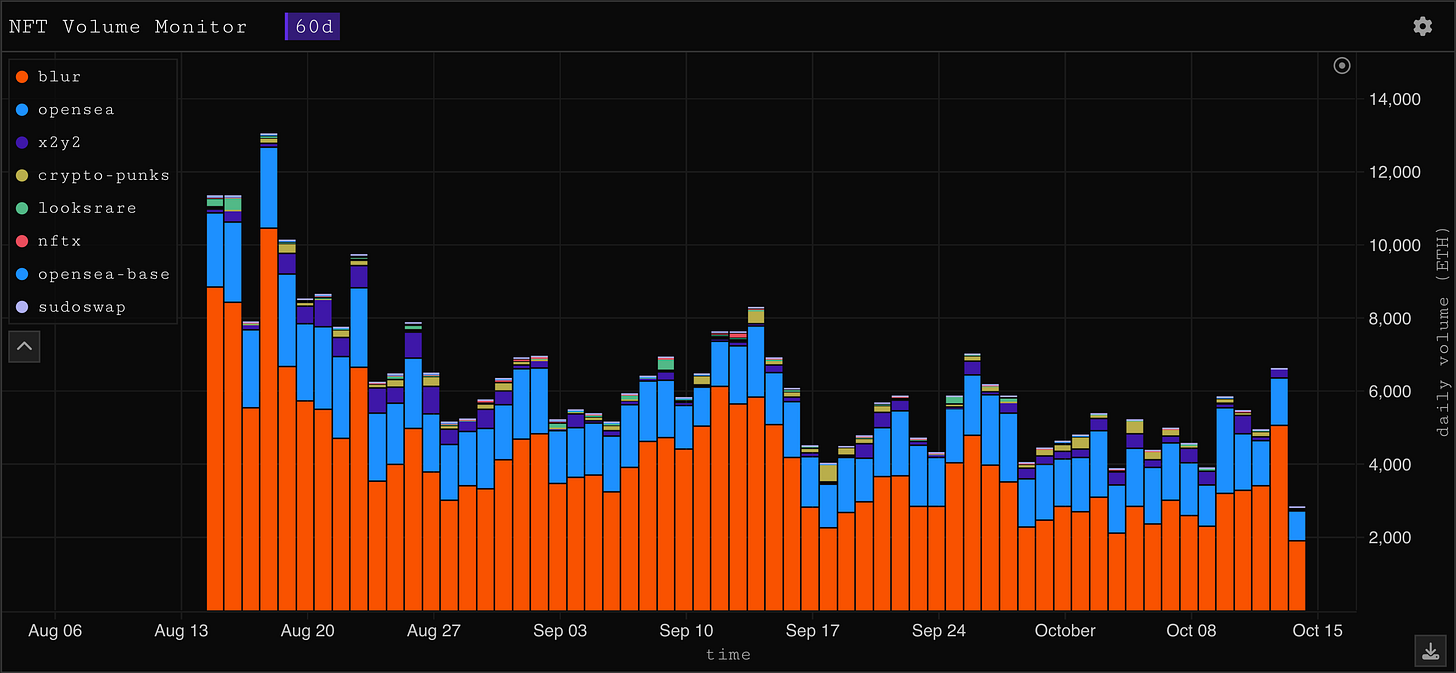

The people have finally been gifted an end date for Blur season two. Blur’s NFT marketplace and lending have been a topic that has had CT split straight down the middle since season one ended and heavy farming began. Half in the camp that Blur has been the cause for NFT’s major drawdown in 2023, and the other half of the opinion that the added bid side liquidity it has brought is the only reason the whole market isn’t already at zero. It’s been a classic chicken or the egg debate.

Season two will officially end on November 20th, no further information has been given yet but the assumption is that tokens will be allocated based on user accrued points shortly after. Many hope that this will mark the end of token incentives, giving way to a freer NFT market without the burden of farming on the ecosystem.

Even without constant emissions, Blur’s token performance has been poor and is down 90% off the high. In the beginning many speculated ways in which Blur would create token sinks and holding incentives based on a mysterious ‘ideas map’ that was released along with the token. Nothing has eventuated thus far, but eight months post token launch and a proposal has finally been made to turn on the fee switch in order to facilitate $blur buy backs.

The proposal suggests that a 1% marketplace fee be added and that the proceeds be used to buy back the token. Even with the general NFT decline over the last six months you are still hard pressed to find a day that they see less tan 2000e in volume. This would translate to a conservative estimate of 20e per day of buying pressure on the token.

As always we appreciate your readership, if you enjoyed this article please leave a like and share it around. Have a good weekend and we’ll see you next week!

i like

Good