The vibes are returning

-kezfourtwez

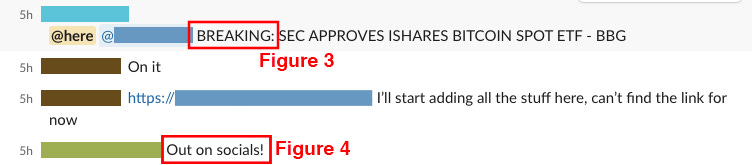

A few days ago a Coindesk employee hastily clicked send on a tweet confirming that the SEC had approved the first spot Bitcoin ETF to their 3m followers. They received the information from a user that later deleted their account in a telegram chat they use to find stories, and posted it less than 5 minutes later without verifying the source (read more about that here).

The news algo’s started firing and BTC swiftly experienced a 10% candle from $27.7k to $30.7k, word got out that the news was fake and the move was fully retraced within the hour.

This violent move came on a day that the corn was already up over 3%. The silver lining is that it didn’t take long for the market to start trending upwards again. It’s the first time since BTC nuked from $29k to $25k back in August that the move hasn’t been completely barted back down before trending lower.

I am aware that I’m currently fulfilling the ‘bullish at resistance meme’, but I’m more just excited about the periphery effects that this has had on the market, hence the title.

Onchain is beginning to see some life. All it took was the wind to change, a slight breeze of vibes wafting in and the gang decided to get back together. A number of new coins have seen sustained price action this week as new memes are forming on the ethereal planes of the blockchain and permeating the endorphin starved minds of the trenches.

There is a general air of risk-on beginning to form onchain, I’m willing to bet it’s mostly dependent on the wider market at least holding up. But personally I think the closer we get to the ETF approval deadline in Jan, the more risk flows into the system. The combination of multiple coins moving at once with sustained upwards momentum, the renewed chatter and the usual shitcoin addresses starting to ping my alerts again makes me think regardless of how long it lasts, we are about to get another little slice of onchain action.

Notable new movers this week are memecoin JOE at $6m market cap and new game-fi coin BLOX at $3m. The onchain darlings have also reared their head with HPOS leading the pack at a 70% gain in the last seven days.

Flooring protocol

The Flooring Protocol is a platform designed to enhance accessibility and liquidity within the NFT market. Through fractionalisation, it allows NFT holders to convert their assets into micro-tokens known as μTokens, democratising generally out of reach NFT collections and unlocking liquidity for existing holders.

NFT fractionalisation is not a new concept, but Flooring protocol has brought to market some innovative mechanisms. One problem with past fractionalisation methods is the total addressable market is diminished by making it unattractive to deposit anything above a floor NFT into the liquidity pool.

Flooring protocol offers two types of deposits, one into a regular pool and one into a safebox. Users can deposit an NFT into the vault, giving up the right to that specific NFT and receive the equivalent in μTokens that are fully tradable, while resting assured that arbitragers will maintain the peg between the tokens and the value of the underlying NFT. Users can also deposit their rare NFT’s into a safebox to retain the premium, conveniently facilitated by a partnership with deepNFTvalue that helps the user decide on that premium. The tokens the user gets in return are redeemable at any time for it’s NFT counterpart.

At the heart of it all is the FLC token, after a user has deposited their NFT and received their μTokens they can natively provide liquidity in certain ranges to the respective v3 pools for high APY’s paid in FLC. So basically a user can do four things:

Buy μTokens to gain fractional exposure to an NFT that might otherwise be out of reach

Deposit an NFT to gain μTokens

Deposit μTokens to farm FLC

Arbitrage between μTokens and the underlying NFT when prices are out of sync

The protocol has been live to the public for just a few days and has amassed a TVL of around $8m worth of Apes, Penguins, elementals and y00ts. Equating to just under 1800 fractionalised NFT’s.

Competition intensifies in the yield-bearing dollar market

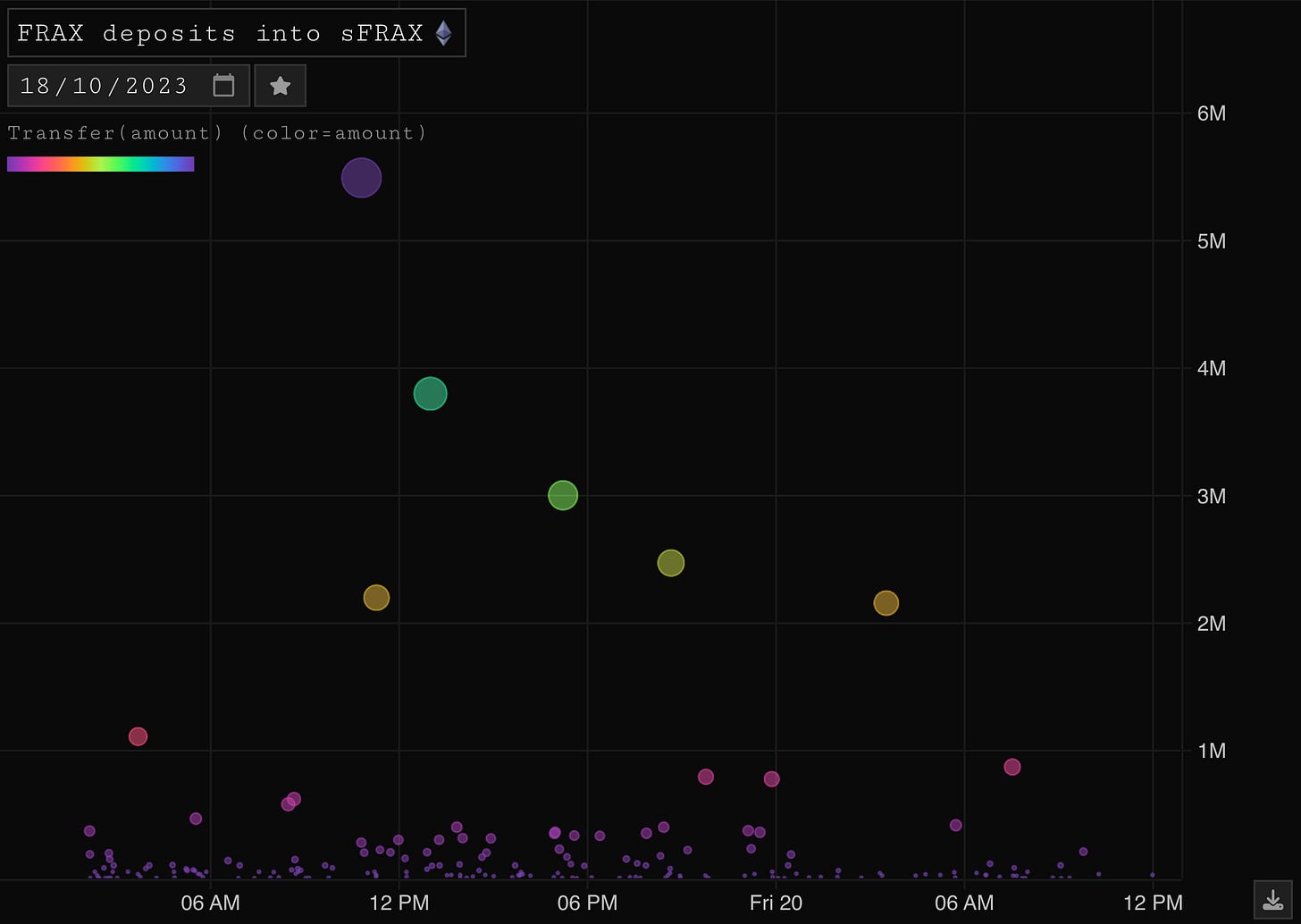

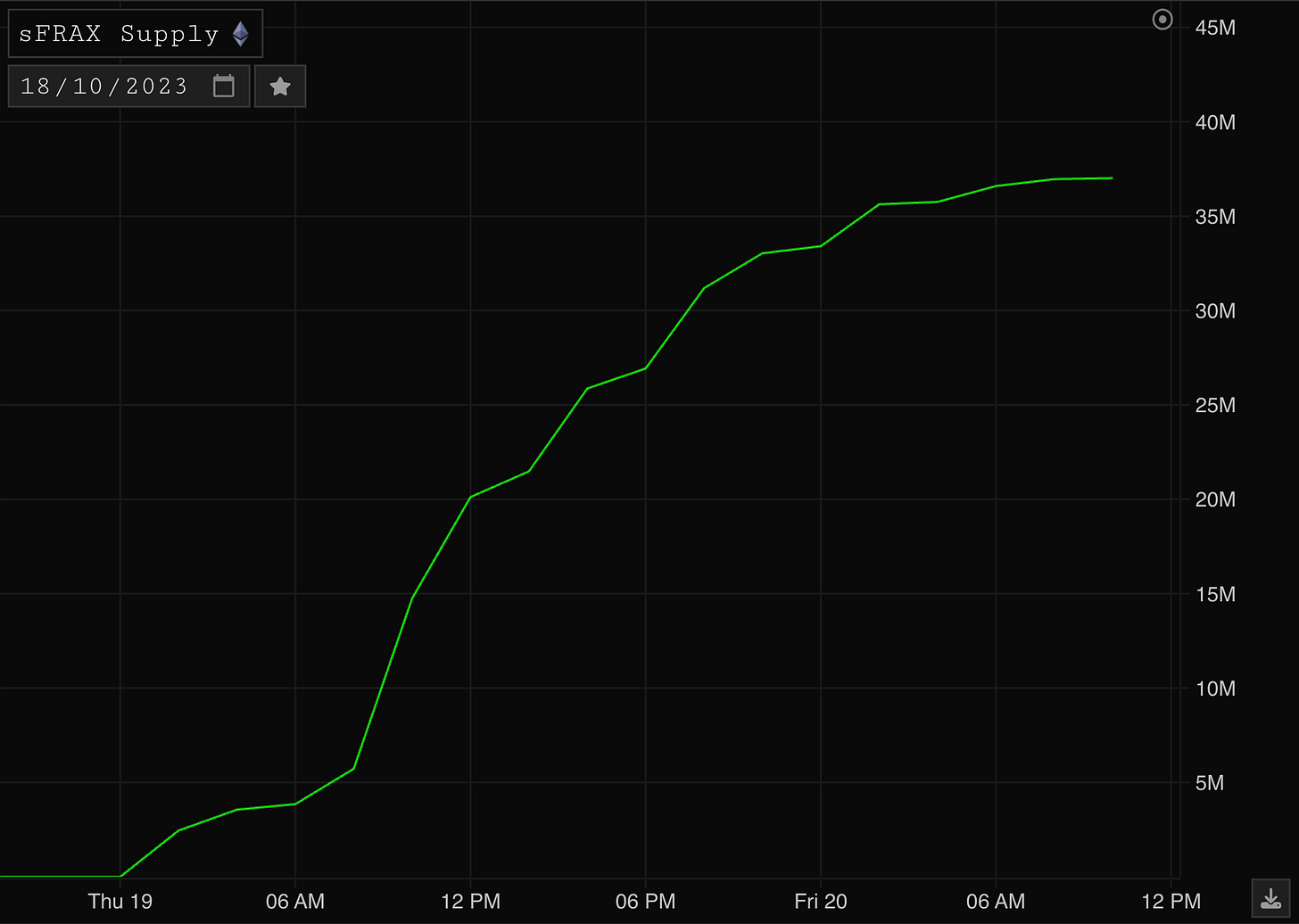

I have covered MakerDAO’s sDAI at length in previous articles and while it continues to be the main player in town, we are seeing a proliferation of yield-bearing dollar product releases. Roughly a month ago, I mentioned Frax Finance’s entrance into the picture through their off chain entity FinResPBC to bring treasury yields to FRAX at the lowest possible cost. sFRAX is now a reality and yielding 7.28% at the time of writing (this should decrease as supply expands):

sFRAX allows FRAX holders to stake their FRAX and effectively participate in the short end of the US treasury market. The yield on sFRAX changes using an oracle tracking the Interest Rate on Reserve Balances (IORB - essentially the overnight repo rate). Each week depending on the amount of FRAX staked in sFRAX and the IORB, Frax will move the necessary amount in/out of US treasuries using the aforementioned FinResPBC vehicle.

Frax is also looking to introduce Frax Bonds (FXBs) which will open access to the longer end of the yield curve. FXBs will be sold and the principal invested in bonds of a matching duration through FinResPBC, their yield should track the interest rate on the underlying bonds of matching duration. With the introduction of sFRAX and FXBs (soon™), Frax are enabling an on-chain representation of the yield curve to take form.

New market entrants like Mountain Protocol are also looking for a piece of yield-bearing dollar market share with their USDM product. Mountain Protocol are pursuing a regulatory-compliant-first approach, while this might win out in the long term - heavily permissioned minting/burning and limited on chain liquidity has been a hindrance thus far with just $4.8m in USDM supply. For now, Crypto native providers remain dominant:

Check out the following layout to track sFRAX over time: https://parsec.fi/layout/chulie/_q9o6Lzy

As always we appreciate your readership, if you enjoyed this article please leave a like and share it around. Have a good weekend and we’ll see you next week!

Keep vibe up

LFG