Parsec Weekly #45

NFT market update & an Arbitrum revival

NFT market update

-kezfourtwez

The NFT market is beginning to bubble back up in volume, floor prices and mindshare. If you’ve read this newsletter since last year you’d know that regardless of spending my time mainly in other parts of the market for the last 6-12 months, eventually I expect NFT’s to have an insane run this cycle, and it’s been nice to get a little taste of vindication.

My thesis is that 2021 was like the 2017 alt cycle for NFT’s and that volume and users will 10x last cycle’s peak. Few collections will survive, but the ones that do will see outsized gains and outperform ETH in USD. Punks, squiggles, some other gen art and a few lasting pfp’s are likely. The mysterious part of my thesis is that I have absolutely no idea what the landscape will look like and what types of collections will be the pack leaders. Maybe it’s gamefi, maybe pfp’s make a return, maybe it’s ordinals (plz no, I am not positioned for this), or maybe it’s something entirely new that doesn’t exist yet.

Just today the CEO of Roblox went on a popular Youtube channel and talked about NFT’s within the frame of Roblox. There are rumours floating around that GTA 6 will have some form of digital asset integration, and Epic Games already has multiple crypto enabled games on their creator marketplace. The seeds have been planted, those seeds have now sprouted and eventually NFT’s will play a big role in gaming.

Back to the current market: not so much in price action but in mindshare punks are leading the charge. There’s been 108 sales in the last seven days and the floor is up 17% in that time from 46e to 55e. Punks to me feel like a good barometer and leading indicator for jpeg market health. Number is starting to go up and all the people that have had certain things on their shopping list are beginning to feel more pressure to allocate. Within the flurry of punk sales was a zombie for 600e.

As you can see in the volume chart at the top, activity is picking up and it’s really starting to curl up, currently sitting a little over 2x off the bottom with an oversized amount of punk volume in that last candle. Many OG collections like toadz, cool cats and forgotten runes that were popularised in 2021 are a multiple or two off the bottom, and active traders hit their highest point since the end of June.

Across apes, mutants and dogs, Yuga did $68m in volume this week, $83m if you want to include punks. This makes up a huge chunk of ETH NFT volume, Yuga really does have a firm hold on the jpeg market whether you like it or not. But the more insane thing is that ordinals did about 65% of ETH volume this week. Like I said above, I’m really not involved in the ordinals ecosystem but it’s without a doubt something to keep a close eye on this cycle.

Whether or not the market continues up from here, the tides are changing and we love to see it.

Arbitrum’s Short Term Incentive Program

Following a period of hype surrounding the ARB airdrop in March, the ecosystem has been pretty quiet as of late. With Arbitrum’s DeFi focus and the largest protocols being derivatives protocols, the summer doldrums hit hard as many of these protocols rely on volume to generate fees. Alongside a revival in NFTs (as kez discussed above), with a recent increase in volatility and volumes across the board we are seeing somewhat of a revival in the Arbitrum ecosystem - this is being supercharged by a recent bout of token incentives.

In order to incentivise usage and growth, a proposal for a “Short Term Incentive Program” (STIP) was put forward in September and passed in October. With 50m (~$58m) ARB tokens up for grabs, protocols large and small and from across the sectoral spectrum came forth to request tokens to pursue various growth hacking (read: liquidity mining) strategies.

In true Arbitrum form, the Perpetuals sector was the largest beneficiary of grant tokens with ~43% of all tokens being directed towards the sector. It is no surprise the tokens of grant recipients reacted well to this development as usage of their products is being directly stimulated through token incentives! Equally, we are seeing ARB itself react strongly. In the prior market regime this increase in circulating supply might have been seen as a bearish catalyst but amid a wider market recovery, the STIP is seemingly being priced as a bullish growth driver:

GMX, the largest protocol on Arbitrum and largest grant beneficiary, took 12m tokens or ~24% of the entire grant pool! Following a relatively lacklustre launch of their v2 product, GMX elected to direct the entirety of their ARB grant towards incentivising v2 liquidity providers:

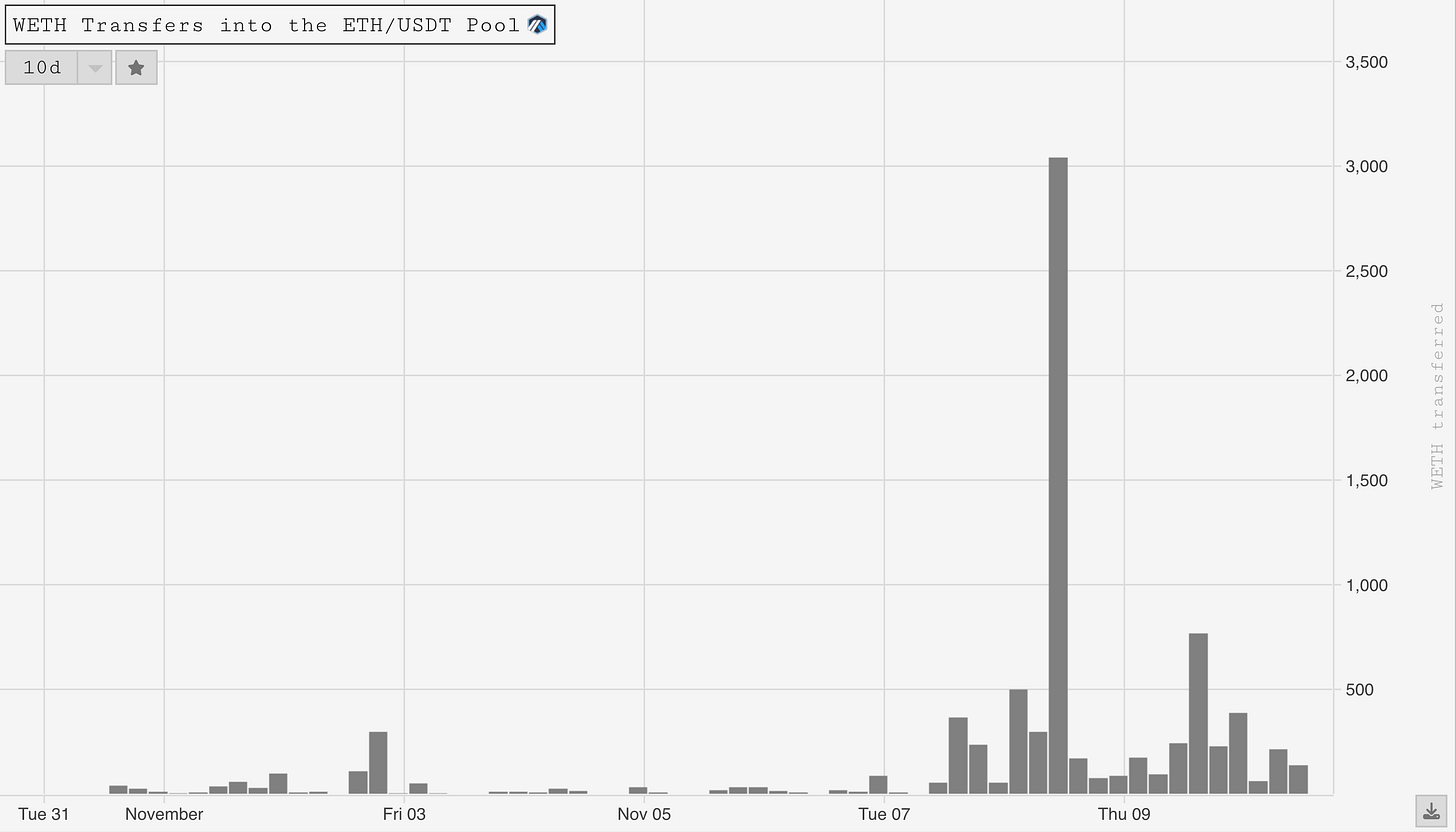

This approach has been successful so far as total liquidity in v2 has almost doubled since they began distributing ARB. For example, see below the significant increase in WETH transfers to the ETH/USD v2 pool:

Naturally, an increase in liquidity allows more trading volume to occur on the platform and therefore more fees to be collected which tends to bring in greater liquidity as returns on providing liquidity increases, a volume driven flywheel. The cynic within me would say these metrics are artificial as they are driven by short-term stimulus. However, one could equally make the case that ARB and GMX in this case, are correctly using token incentives to bring users back into their ecosystem at just the right time. Attracting more liquidity and users as the market recovers might create sticky usage throughout periods to come even as incentives wane. Only time will tell!

As always we appreciate your readership, if you enjoyed this article please leave a like and share it around. Have a good weekend and we’ll see you next week!

666666

rj7htf