-kezfourtwez

Good morning onchain enthusiasts, it seems the price action of the last 24h has once again rendered us all poor, lucky we’re all here for the tech innit.

Before we dig in I wanted to let you know that we’ve partnered with our long time friends at Page One. We’ll be jumping on stream weekly to chat about the most interesting things happening onchain, join us on Wednesdays at 6:30 pm EST on twitter, youtube or twitch

dYdX v4

Having announced their plans for the dYdX Chain (also known as dYdX v4) in June 2022, the upgrade has finally arrived as the v4 exchange opened its doors for business earlier this week.

Having been the pioneer project to deploy on StarkEx (Starkware’s L2 scalability engine), the transition to dYdX v4 represents a transition to a standalone blockchain based on the Cosmos SDK and Tendermint Proof-of-stake consensus protocol - hence the name “dYdX chain”. The decision to move to a sovereign chain was to allow full customisability over how the blockchain works, the jobs validators perform and to achieve further decentralisation. dYdX v4 achieves significantly higher throughput for the orderbook while remaining decentralised which would not have been possible on the prior technical stack (read more about the technical details of dYdX chain here).

Along with changes to the technical stack and therefore trading experience, v4 has also brought significant changes to the DYDX token. Historically, the token has simply been used for governance while trading fees from the exchange were directed towards dYdX Trading Inc. With the transition of this for-profit trading entity to a Public Benefit Corporation, in v4 DYDX will be the L1 token used for validation with stakers receiving trading fees from the exchange. The implications of this are profound as DYDX will achieve value accrual via a real cash flow yield (paid in USDC).

With staking to be activated in due course, the flow of dYdX from Ethereum to the v4 chain is fully underway. Over $1.3bn of value or 350m+ DYDX tokens have been bridged to the new chain thus far:

Following a quiet summer, with the v4 launch and a recent increase in volumes (+ fees), it is no surprise that the DYDX token has been picking up steam as of late:

It is worth noting that despite the extremely positive momentum surrounding dYdX (both for the project and the token), in early December there is a very large cliff unlock with Team and Investor tokens becoming liquid for the first time. While recent supply side worries have been unfounded (see SOL or DOT), we could certainly see significant volatility in early December as the market positions for a large increase in supply.

As for parsec, keep your eyes peeled for a v4 integration on our side in due course 👀!

The onchain shift

For the longest time the only people still here were the crypto native and unhinged, those that decide to stick around and continue to trade 10k liq/100k mcap shitters (hello). The successful coins in this environment are suited to and a reflection of the participants:

The personification and amalgamation of a wizard, an American president and a hedgehog

A cute anime girl version of the S&P500

A fictional blue smurf cat

These people are a drop in the ocean of crypto’s TAM, and these coins are not the coins that the normie retail crowd slowly trickling back onchain like.

There has been a significant shift in the last couple of weeks that seems highly correlated to the wider market’s price appreciation, and I suspect, the participants that come with it.

When prices started going up in early October, it was a signal for those who stuck around that conditions were becoming more risk on and as a reaction to that, the favourites at the time caught a bid and all went on to have a massive run to the 30-40m range. It was amazing how pegged to each other these coins were, they all took turns leading the pack but always within 20% of each other’s market cap, and all topped out in the same range. In retrospect that should have been a sign that this bid was a closed loop.

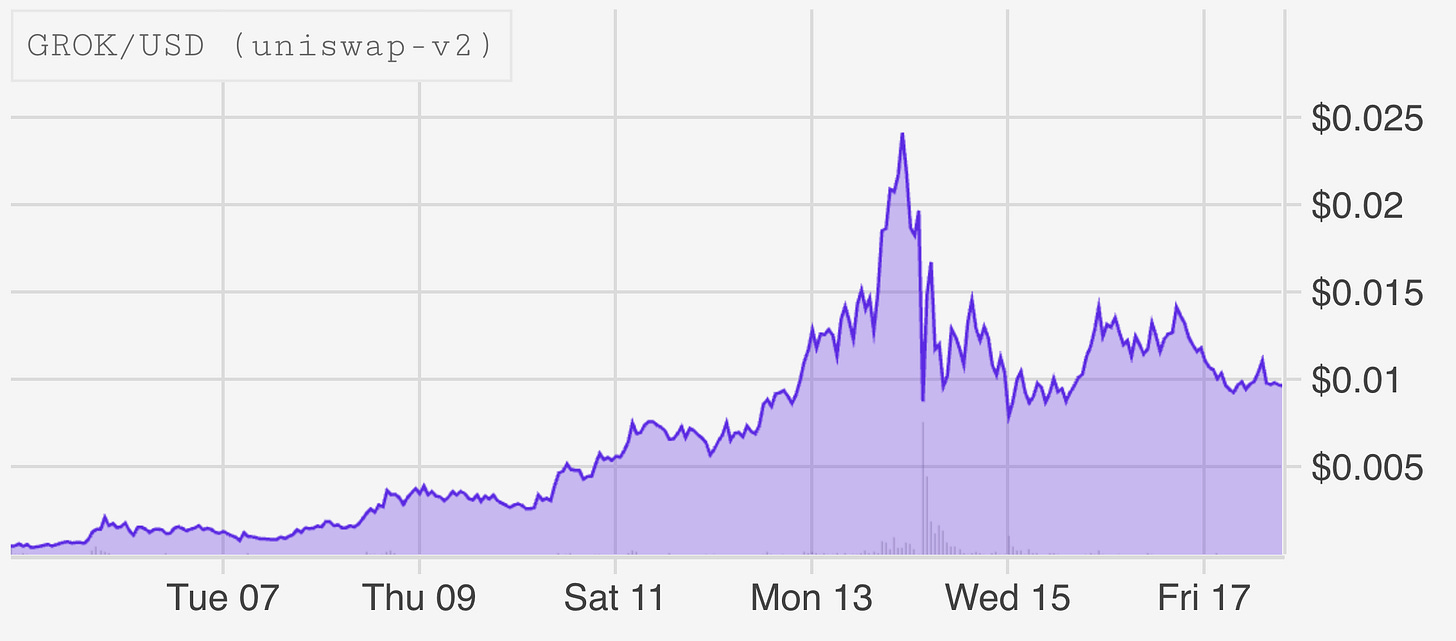

In came the elon meta and GROK (the name of elon’s new AI), as well as a whole army of derivatives named after trademarks he’s registered, or his childhood dog. GROK was a spectacle to be seen, rivalling PEPE’s first leg up - from zero to $160m in 10 days. The holder count grew rapidly to over 10k in that time. Easily surpassing all of the current memes it started to make me wonder who was really fuelling this coin? Probably not the same witty ENS’s you’ve been pvping in the shitcoin books for the last 12 months.

It got me thinking about what themes/memes have potential for exponential growth when the net is widened past the core of crypto twitter, and do our current memes fit that category? To be honest, most of them probably not. Heartereum posted some great thoughts on this on his substack the other day. I won’t go into too much detail but the gist of it is that memes need to have mainstream appeal, and to have mainstream appeal they need to be easy to understand and relatively harmless.

I think a rising tide lifts all boats and I doubt coins like HPOS die. But I do think two things:

That despite conditions improving, the pool of potential meme coins is expanding faster than the pool of available liquidity, ie. we are currently spread thin

The audience for these coins is changing/growing

As always we appreciate your readership, if you enjoyed this article please leave a like and share it around. Have a good weekend and we’ll see you next week!

Good

hafea