Parsec Weekly #55

Pendle's growing role in the LRT Sector

Pendle’s growing role in the LRT Sector

It’s been a long time since we last discussed Pendle in this forum. Last July we discussed vePENDLE and the emergence of vePENDLE locker protocols like Equilibria and Penpie. At that point in time the Liquid Staking Derivative market was most prominent on Pendle as yield traders both speculated on and collected ETH yields via the Yield Token and Principal Token respectively.

Since then, with the introductions of new primitives like Yield Bearing Dollars and most recently, Liquid Restaking Tokens (LRTs), Pendle has seen it’s use cases expand alongside these primitives. The LRT narrative and it’s close relation to EigenLayer have been particularly strong drivers of $PENDLE price in recent months:

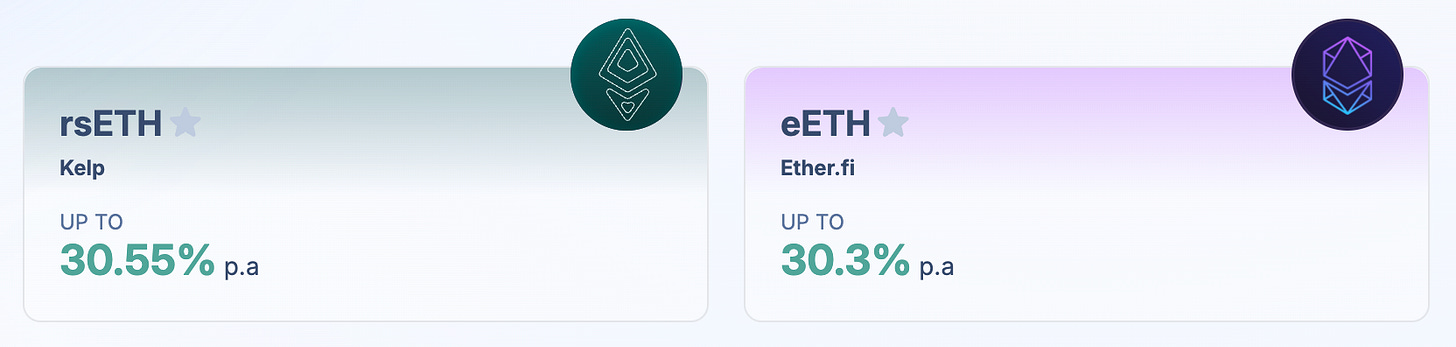

By introducing PT/YT markets for LRTs, Pendle essentially introduces a market for trading the future EigenLayer and Restaking Protocol airdrops. LRTs from both Kelp and Ether.fi are currently supported. The Principal token essentially allows the holder to pre-sell and lock in the underlying staked ETH yield, the EigenLayer airdrop and a potential airdrop from the Restaking Protocol:

On the other side, the Yield Token (YT) in this case has been designed by Pendle to allow “leveraged point farming”. As we can see you can swap 1 eETH for 9.53 YT eETH which accrues points as though you were holding 9.53 eETH.

Given that the YT is an instrument designed to bet on the yield, its value will eventually converge to 0 as the time to expiry decreases. So in this case, unless a YT trader thinks the PT yield is mispriced and they are playing a rerating higher, they are ultimately making a leveraged bet on the value of the EigenLayer and Liquid Restaking Protocol airdrop. The value of these airdrops combined must be greater than the ETH spent to purchase the YT given we know that the YT itself takes a path to 0 as it approaches maturity.

In a certain sense, Pendle are allowing for the pre-market trading of airdrops. This is a very interesting use case and ultimately demonstrates how easily the concept of yield trading can extend to alternative primitives...

The Parsec Explorer now supports Pendle Markets, check out the eETH layout here.

As always we appreciate your readership, if you enjoyed this article please leave a like and share it around. Have a good weekend and we’ll see you next week!

good

Welcome