The Blast Ecosystem

In the recent weeks at parsec we have been diving into the Blast ecosystem as we build out Voyager on testnet (the official Parsec Blast Explorer)...

Today I want to discuss a little about what we are seeing on the ecosystem side and the primitives we are most excited about.

Our expectation was that the Blast ecosystem would be overwhelmingly focussed on NFTs and while there are some prominent teams building NFT protocols on Blast (think Metastreet, nftperp etc.), the ecosystem is shaping up to be far more broad.

We are seeing a broad swathe of DeFi protocols across AMMs, borrow/lending, launchpads and a high concentration of protocols building Decentralised Perpetuals or leverage trading products. In fact, dex perps/leverage protocols looks to be the most competitive sector on Blast... there is clearly an expectation that Blast will attract many a degen! Beyond DeFi and NFTs, there are a number of SocialFi, Metaverse, GambleFi and Gaming projects all building towards a launch on Blast. While the ecosystem looks to be diverse, there is certainly a focus on products which appeal to a more degen profile of participant.

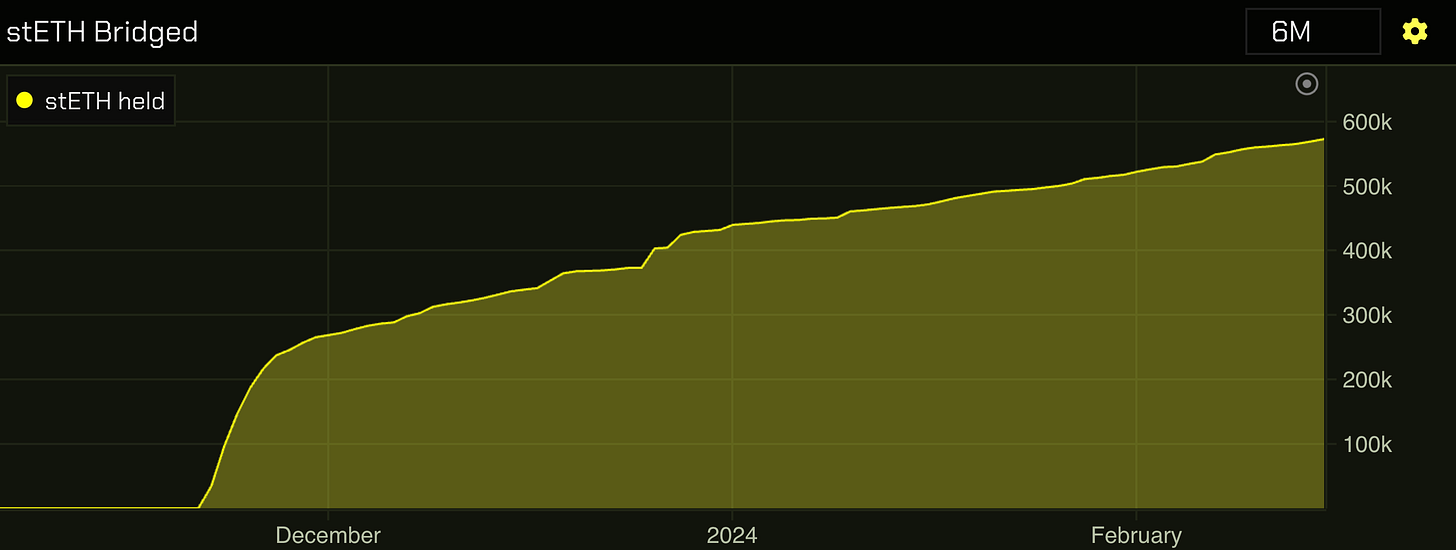

The great majority of teams who have announced that they are building on Blast are still in the building phase with very few live on testnet for now. At parsec, we are extremely excited to test out protocols across the gamut and integrate them into Voyager as they go live. With Blast mainnet looming on the near horizon and close to $2bn of capital waiting in the wings, we are well and truly approaching Blast Season!

NFTfi

-kez

To follow on from Charlie I just want to talk a little bit about NFT finance and a project that he’s mentioned above which caught my eye yesterday, MetaStreet.

MetaStreet is a permissionless and composable NFT lending platform with a focus on LCT’s (liquid credit tokens). Off the bat this means that anyone can create a pool and offer up an NFT as collateral paired against any ERC, whilst receiving a tradeable debt token as receipt.

MetaStreet have devised their own innovative pooled capital mechanism called ATM (automatic tranche maker), which benefits lenders through economies of scale and lets them choose their own risk profile. Lenders pool funds and earn different levels of returns based on these risk profiles. The lender that takes on the most risk earns the highest return, but also take the brunt of the loss should the borrower not pay back their loan.

MetaStreet are currently on mainnet but they have just begun their Ascend program. Ascend lets users deposit wstETH to mint mstETH, essentially restaking their already yield bearing wstETH into an NFT yield bearing token for a combined current total of 17% APR. By doing so you are essentially doing exactly what I described above in a streamlined, perpetual loan to punks holders.

On top of this you get MetaStreet XP (yes it’s another form of points), and you can even go one step further and pair your mstETH with some more wstETH and deposit them into the curve pool for extra yield and XP.

Why this caught my interest, is that stage two of the Ascend program is ‘Bridge to [redacted] and loop ultra-yields, trade credit, short/long the debt’ all using your LCT’s (redacted is blast if you didn’t make the connection). So the way I’m thinking about it is, not only do you get an easy, relatively low risk 17% on your ETH + points that will translate into their governance token - but you also get the potential to use your LCT’s to directly farm Blast and protocols like Thruster. Triple points farm.

To give you some context why MetaStreet are so passionate about NFT lending, see the below diagram

Some circles that I’m in have been yelling at me about the potential of NFTfi since early 2022, but the picture is beginning to become more clear.

Despite NFT lending activity on Blend having steady grwoth, there is still a multi billion dollar gap in the market to be filled, and permissionless LCT’s could be a part of the answer.

As always we appreciate your readership, if you enjoyed this article please leave a like and share it around. Have a good weekend and we’ll see you next week!

good

I think so