good morning WW3 survivors, an eventful few days in the charts but pretty quiet on the new development and release front. So today I’m just going to give you a little temp check on the markets in my neck of the woods and then a write up about the going’s on of Hyperliquid’s L1.

Since word first broke of the Israeli<>Iranian conflict BTC is down 15% and some alts as much as -60%, some erasing their entire 2024 gains. Alt OI is down more than 50% and we’ve seen an obscene amount of liquidations both onchain and off - close to $200m onchain in the last week and on the first big nuke the CEX perp market saw $600m in long liquidations.

Needless to say it’s been a rocky ride these past few days, the whole timeline turned mega bearish and the vibes were enough to test even the perma-est of bulls - Many lev traders evidently got carried out but the spot soldiers carry on (painstakingly obvious lesson in that).

Despite the microcosm of CT spending a few days in the depths of despair, there are signs that we may be bottoming:

DXY looking toppy at resistance

Stonks looking bottomy after nicking the the 100d MA

Geopolitical tweets having less of a negative effect on the coins

Alt OI down 50%

Spot premium

And of course, the Bitcoin halving is less than 12 hours away at the time of writing

And maybe most of all, BTC is up 9% off the bottom since I started writing (lol)

I heard a good quote today;

“If you were to tell me that the world produces 100m barrels of oil per day, and that next week that figure was going to be cut in half to 50m barrels per day, I would be trying to buy every oil futures contract I could off anyone that would sell it to me.” - Jonah, 1000x podcast

The above demonstrates why the halving is so bullish for Bitcoin. One of the main sources of BTC sell pressure is miners, It’s a business and businesses need to sell their product to cover operational costs. In less than 12 hours these miners are going to have half of the amount of BTC to sell than they do right now. The thing to keep in mind is that these effects are a brewing tailwind, they are not the only source of sell pressure, but in time they will be felt.

Hyperliquid and $PURR

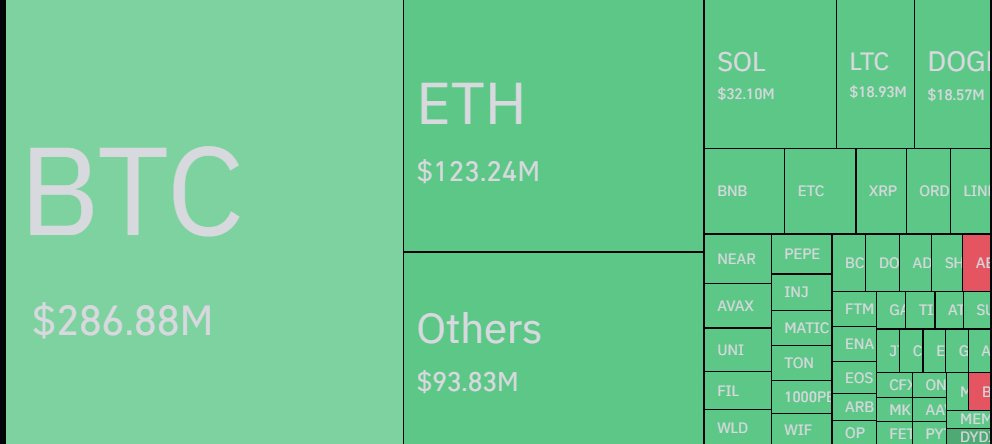

Hyperliquid is perhaps one of the most successful recent additions to the perp-dex eco. They are their own L1 that supports 20k orders per second and is easy to bridge to from Arbitrum, it doesn’t even feel like you’re bridging, you are just ‘depositing’. They have a good CEX-like UX, lots of pairs, agile at adding new pairs, a social trading element with their vaults, premarket’s, and a points program. They’ve pulled in 117k users and currently facilitate more volume than dYdX V4 at approximately $2b per day, with $154b in cumulative volume. They are also the 16th largest chain by TVL at $400m, sitting in front of Aptos, Thorchain, Mantle and Cardano.

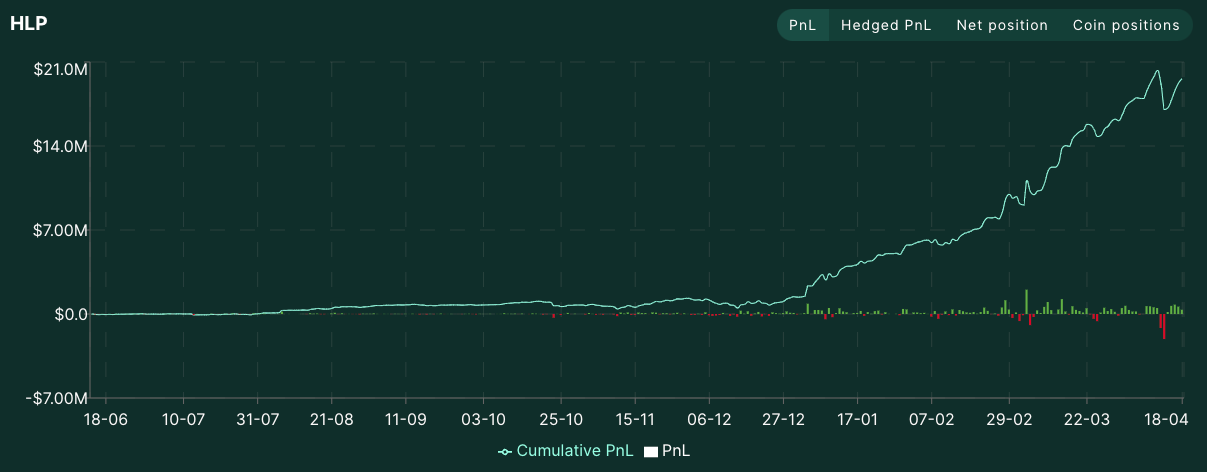

But most of all, Hyperliquid as a business is very profitable. They use a similar mechanism to GMX’s GLP, called HLP. Users can deposit into the HLP vault to contribute liquidity to what is essentially the main liquidity provider, market maker and liquidator for the whole protocol, and share in the profits. The HLP vault is up only and to date has made $19.6m in profit.

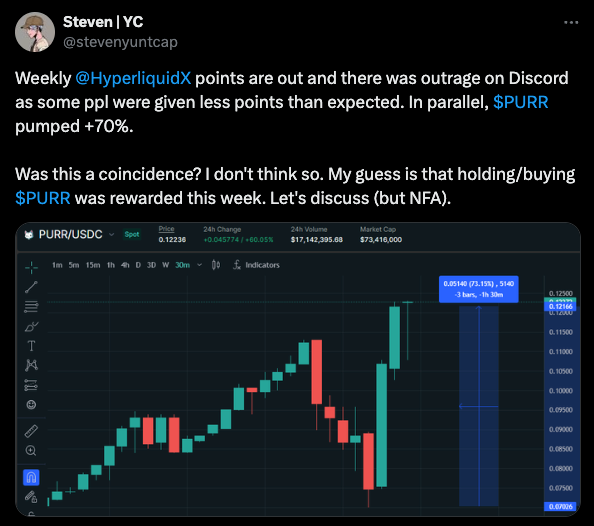

Up until three days ago HL was purely perps, but they debuted their spot trading with the launch of their own meme coin of sorts, $PURR. It’s a similar thing to what Jupiter Exchange did when they tested out their launchpad with WEN. The launch went smoothly and the coin opened at a reasonable valuation ($40m) and has been slowly climbing. At the moment it serves as a proxy trade for their main token as the only way to get direct exposure to a HL coin until their main token comes out.

Many have been actively farming HL’s points program since the beginning. This morning was this weeks points distribution, it was heavily weighted towards spot buyers sparking some outrage from longterm farmers and as a side effect $PURR caught a bid as people figured out it was the new best way to farm HL.

Hyperliquid points currently sit at around $6 on whales.market with $2.7m in total volume, not a huge amount but some of these premarket venues like whales, Aevo and Hyperliquid themselves have been quite accurate come launch despite the low volume.

As always we appreciate your readership, if you enjoyed this article please leave a like and share it around. Have a good weekend and we’ll see you next week!