Social-Fi: The good the bad and the ugly

Good morningggg crypto market participants, welcome to the 69th edition of the Parsec Weekly. The last few weeks have been trying times, a perpetual motion machine made of sideways-nuke-sideways-nuke, where each hourly candle feels like a painstaking 24 hours.

But following fud after fud, war mongering, sizeable ETF outflows, regulatory scrutiny and general despair on the timeline, BTC finally started not giving a fuck, and even started going up??

We finally got some relief over the last few days and our precious magic internet money looks like it may not be heading straight to zero anymore as some filthy bera’s have been proclaiming. I am not a magic 8-ball but from the copious amount of information that I read, hear, ingest and digest about our markets, my gut says that we may not break and reclaim 62k right meow, but that at the very least downside is limited from here on out.

Feels like we’ve been starved of onchain activities for a couple of months now since everything quietened down post brief ATH break. Which is why I was very excited for two upcoming social-fi apps. I got my start trading coins but the first thing that really hooked me into crypto was NFT’s, it’s fun making money but it’s very fun when the market your trading has a slight element of gamification and tangible competition.

So along come Fantasy.Top and FriendTech V2. I was very excited for both, especially after the enjoyment I got out of FriendTech V1 in the initial few weeks. But after the shenanigans and shitfire that was today’s launch, that I’m sure many of you have experienced as well, I am far less excited for one of these apps. I’m going to be honest, I felt disappointment today which doesn’t happen very often in my personal or crypto life, I’m a pretty happy go lucky person. But after months of working on V2 with $50m in fees from the first iteration we were presented with:

A completely bricked app

0.01e of liquidity seeded into the LP

95%+ of users not being able to claim for hours because of various problems (ongoing)

The new bonding curves aren’t really customisable, you just get to choose normal or steep

And the big change is clubs which are just rooms where everyone can talk

Anyway I won’t rant about it for too long, but I don’t have high hopes for the future of the app unless racer has some tricks up his sleeve.

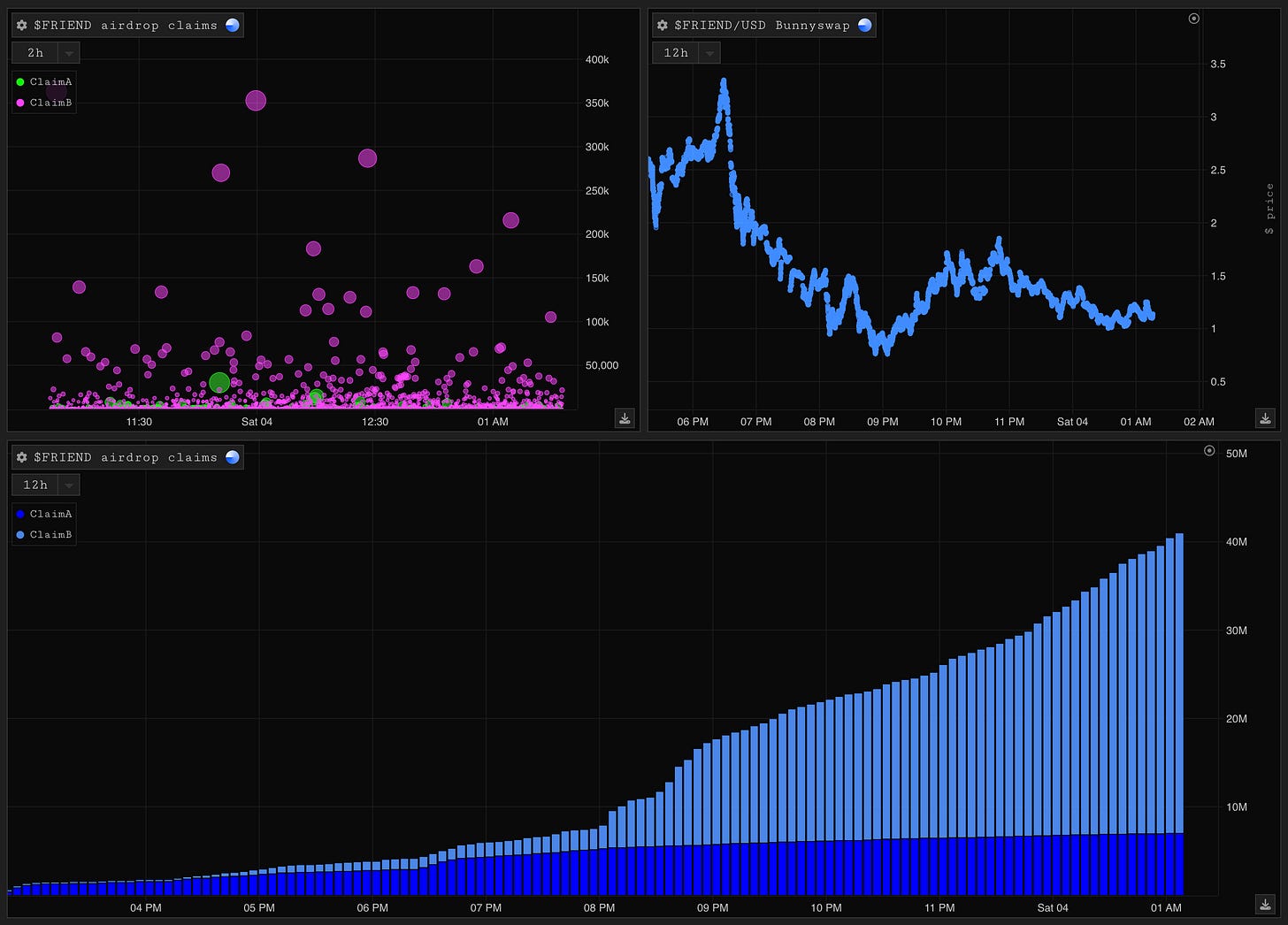

Here’s a layout that geeogi made to track all things FT V2, price has been in absolute shambles from a combination of bad sentiment, panic and a very underwhelming launch. But we are now approaching the fabled 50% claimed mark and the chart doesn’t look like too bad a candidate for the ol’ airdrop fractal.

Fantasy.Top

If you’ve been living under a rock Fantasy is a little more niche than FriendTech, I wouldn’t expect it to have any appeal outside of CT as the core mechanic of the game revolves around trading cards of popular crypto twitter accounts. But, it is a novel new mechanism.

Users have the option to opt in to having their own card, not much point if you don’t have many followers or get high engagement - but on top of the fun of it users that do, receive a portion of their cards trading fees

Everyone got a few free/discounted packs to begin with (5 cards per pack). After that pack price runs on a VRGDA mechanism (shoutout to those that remember art gobblers), and there is also a secondary market

Each card has three scoring metrics that contribute to their place on the leaderboard

- Stars represent their scoring potential based on the last week of performance

- the hero score on the bottom left is a rolling score of their 7 day performance based on various twitter related metrics

- Bottom right is their current rank based on 7 day performance

All of the above are kind of a pregame metric to help you decide who you want to put in your deck for the next competition. Once you lock in a deck for a tournament the hero score starts at 0 and rises purely based on their twitter metrics during the comp (current one goes for two days)

There is also the element of levelling up cards, if you have 5 of the same card you can burn them for the next level

common - rare - epic - legendary

These levelled up cards receive a boost on their hero score respective to the number on the top right of the card.

I’ve been having a lot of fun the last few days, strategising and trying to find cheap undervalued cards to sweep and level up. There are lots of moving parts, the twitter metrics are constantly being updated so the leaderboard can move fast. You might lock in a deck of super high ranked cards for a tournament, but they go for days so there can be lots of curveballs if the lower ranked cards start tweeting out some bangers.

Fantasy is a Blast native project and managed to get a hefty gold allocation over 700,000, which they only have a few weeks to give out before $BLAST goes live - They’ve also amassed quite the treasury from pack mints and fees since launch, sitting at $6.6m, it would not surprise me if they use some of this to juice up the prizepools.

RWA resurgence?

The last time we discussed the RWA sector directly in this forum was back in September 2023 (here), before the markets began their path upwards. Naturally, as the markets became increasingly bullish, the relatively boring RWA narrative paled in comparison to shinier coins and narratives (memecoins, AI etc.).

Despite this, a piece of news which surfaced yesterday could warrant renewed interest in the sector. Securitize announced a $47m strategic round led by Blackrock but naturally without a liquid token to speculate on, this news was largely overlooked by CT. There is no denying that this is an absolutely monster raise and signals continued interest in the RWA and tokenization theme from Blackrock, Crypto’s largest current advocate on Wall Street.

It would not be surprising to see BlackRock and Larry Fink continue to push the tokenization narrative during press appearances and via primary market investment activity like this strategic round for Securitize. This could provide sustained narrative support and perhaps a bid for liquid RWA-aligned tokens. However, the market has strongly signalled that not all RWA coins are made equal with the performance of liquid RWA tokens diverging significantly over a 90d lookback period:

This basket of RWA coins shows a tale of two cities with ONDO and GFI outperforming other RWA coins by an extremely significant margin. Some of their peers have barely outperformed vanilla ETH, let alone ETH deployed in EigenLayer while other peers are underperforming significantly against ETH. This stark divergence in performance is not isolated to the RWA sector but something we have seen more broadly across the altcoin complex - a contrast to prior cycles and perhaps an indication of increasing efficiency in Crypto markets…

As always we appreciate your readership, if you enjoyed this article please leave a like and share it around. Have a good weekend and we’ll see you next week!