Round up

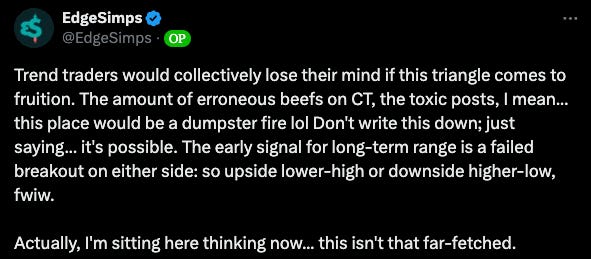

Good morning crypto market participants, onchain enthusiasts and KOL’s alike. Another week of chop, hopium, overium, it’s so over, we’re so back n’ all that. I saw a tweet this morning that both excited and terrified me:

On one hand the timeline would deteriorate into a dysfunctional cesspool of daily fluenza on fluenza violence, on the other I’m firmly in the camp that the quality of memes and price are inversely correlated - you either get incessant bullposting (cool) or funny self-depraving memes (also cool).

On a serious note, it would be bullish for the eventual next leg, the tension and yearning towards the end would be palpable and it would likely give BTC a better shot at a higher end of cycle price than if we broke out imminently. Not sure I could do another six months of pvp though. Ecosystems lacking in sticky liquidity would suffer considerably and I think many alt/btc pairs would continue to grind down, following the many that have already erased their YTD gains.

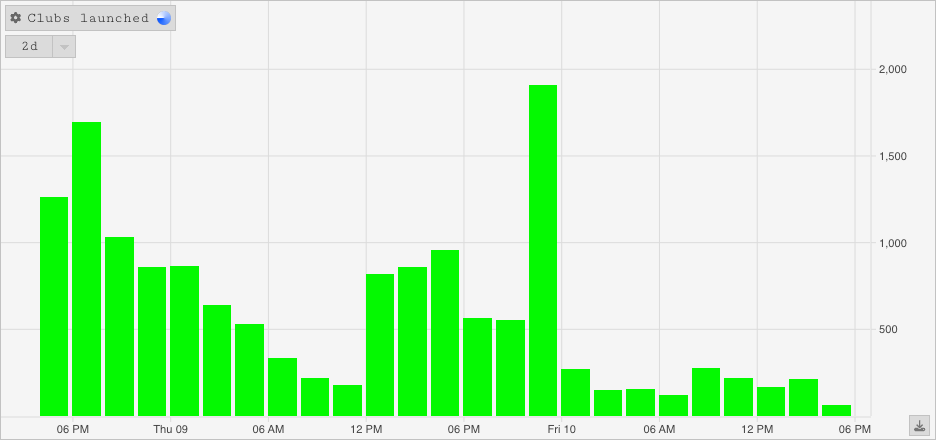

This weeks mind share winners were ...Nope! Solana meme coins again!

*Meme for dramatic effect - they were not the only mindshare winners this week but it’s still funny*

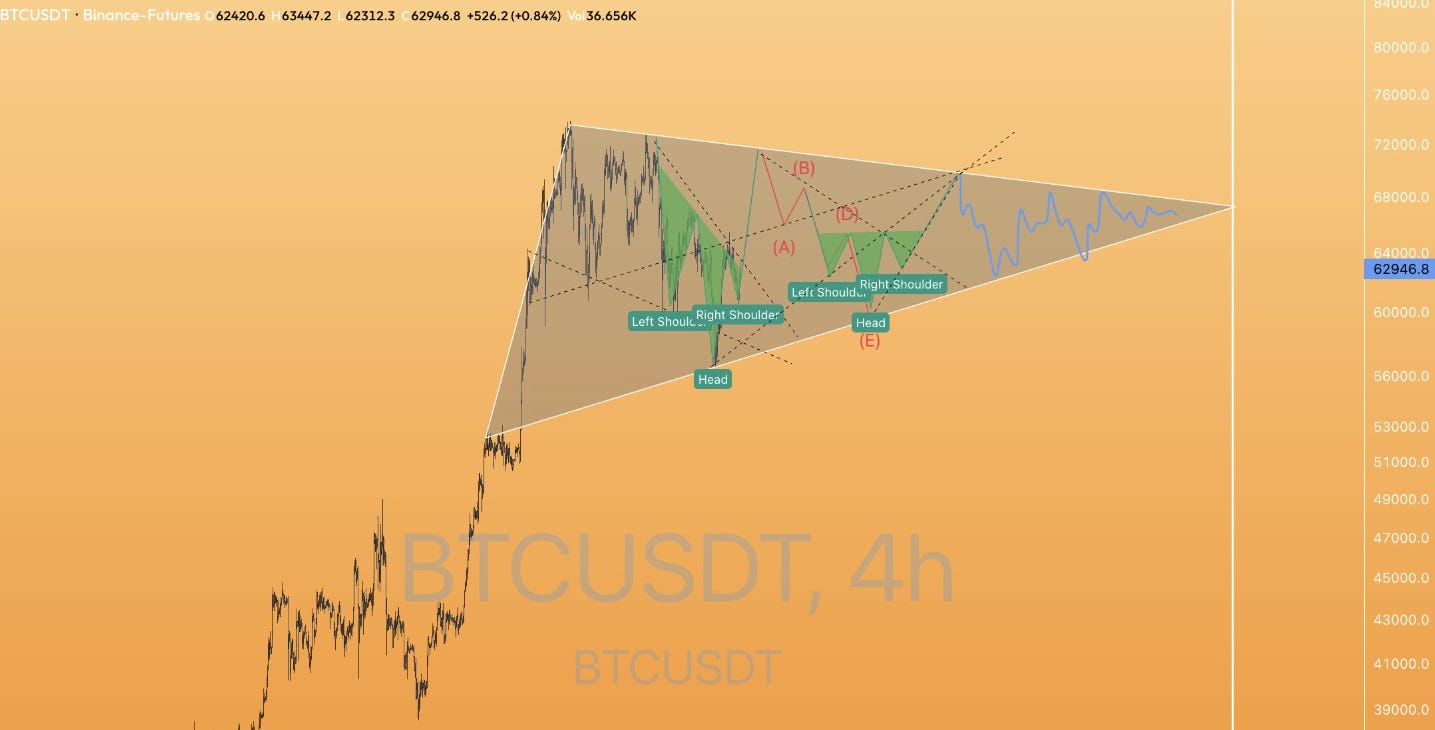

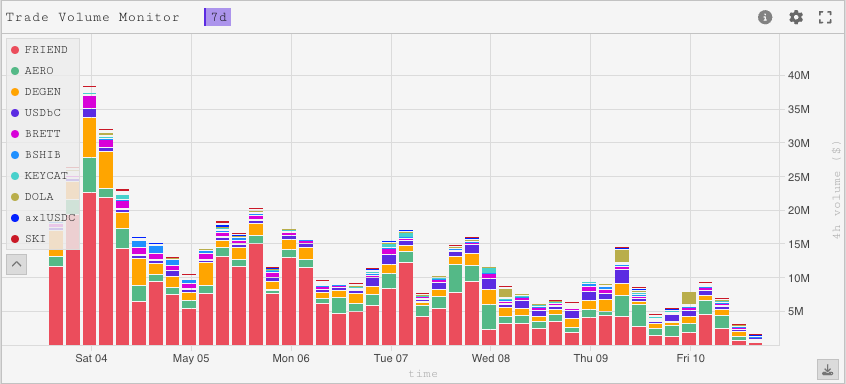

Base saw another week of declining volume on coins after a brief uptick post FRIEND launch. Personally still love the ethos of Base and am optimistic that we see a resurgence at some point this cycle. But the aforementioned chop would not bode well for the eco in my opinion, with no near term catalysts in sight, pockets of outperformance would be the exception.

FriendTech V2’s FRIEND is now almost 93% circulating, token price has stabilised but liquidity is thick and like almost everything else at the moment, it feels very BTC sensitive and general app activity is dwindling. Personally just not having as much fun as I did first go around.

I fail to see the bull thesis here other than ‘100% community owned’, regardless I’m still holding for some reason lol.

Blast has been the other benefactor of mindshare this week and as we approach the token launch, which I believe is tentatively slated for May 23rd.

Fantasy activity is still going strong and sentiment on twitter feels positive. Today they received another allocation of Blast gold to distribute to users which brings their current total to 2,163,982.

Check out our tweet from yesterday for some more fantasy.top stats and find my dashboard here.

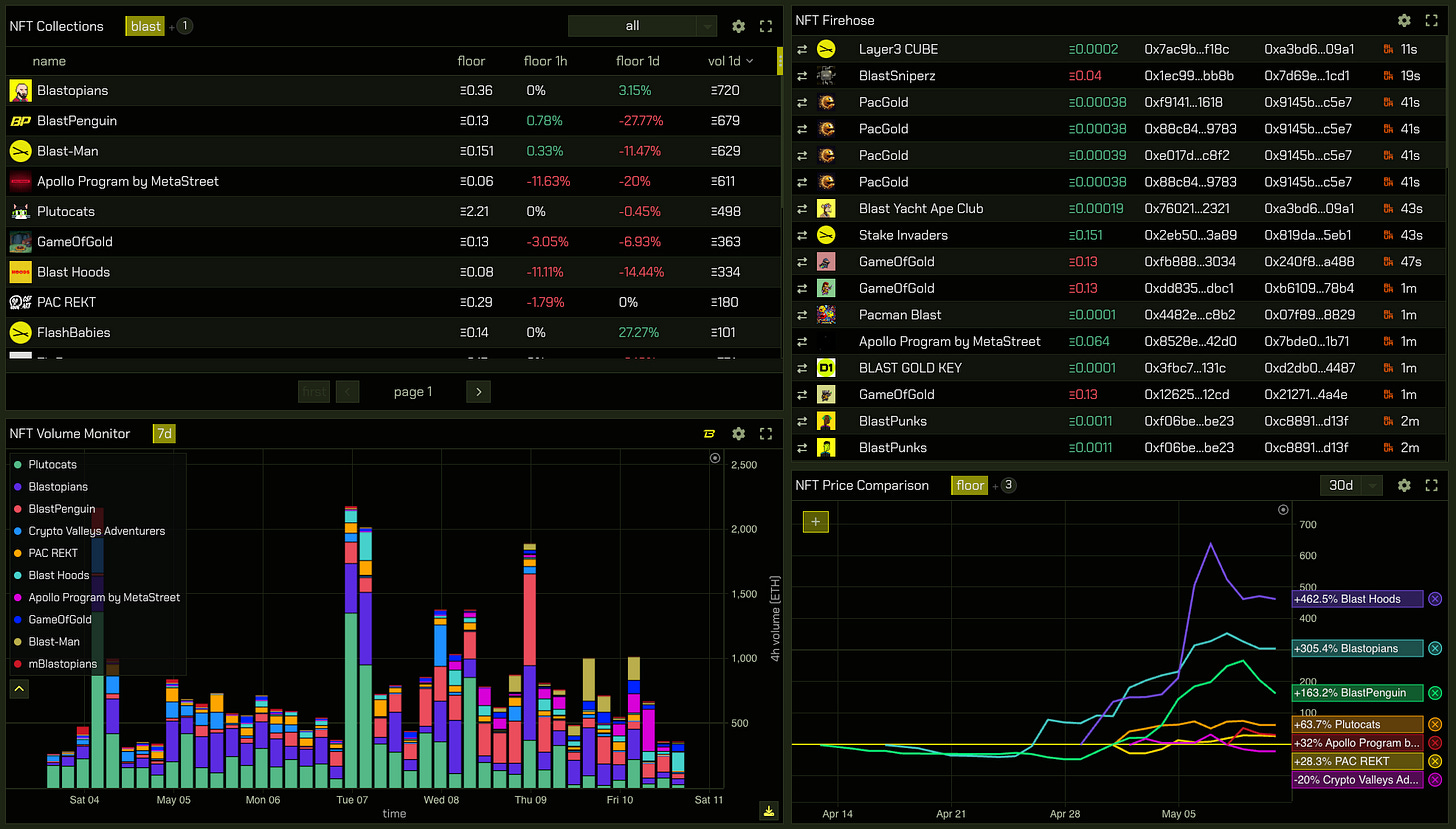

Blast NFT’s had a good week as farming for Blur’s 2,000,000 gold allocation ramps up. The quality of projects is still not great and I’m very surprised that we are not seeing dozens of daily launches, but at some point something good will come up and it will liven up the ecosystem in general.

I think I’ve written something along these lines here and on twitter many times in the last couple of months, but I’ll reiterate because it always seems pertinent. The dispersion this cycle is much greater than last. Ten’s of new L2’s, hundreds of new meme coins per day, consumer apps, native yield and gold farming etc. Basically a thousand places for traders to park funds which in turn creates more aggressive rotations and less sticky liquidity. This applies to pretty much everything but Solana meme coins at the moment, they are the only ecosystem that has consistently popped out of the slush first and without the need of catalysts.

Solana is simply the first place the collective brain of crypto decides to go back to when the market is either bored or looking good again.

Hyperliquid and $PURR

I’ve already written about HL a few weeks ago so I won’t go into too much depth, just some dot points on why I’m particularly bullish on them.

Please take off your masks and put down your hopium inhalers because this is all you’re going to need.

Bear with me…

The absolute tippy toppy, pico schmico bullcase for Hyperliquid is that this is the cycle that onchain takes significant marketshare away from centralised exchanges, and that PURR/HYPE are this cycles FTT/SOL.

Now I’m not saying that’s going to happen. Remember, it’s the tippy toppy, pico schmico bullcase. But I’m not ruling it out considering the lacklustre performance of CEX/last cycles coins compared to onchain and memes this cycle.

Hyperliquid points are finished and they are still doing > $2b in volume per day

Throughput is already stupidly good and about to get a massive upgrade

Because of this the UX is already objectively good for onchain, orders are filled instantly > everything on the UI streams in

HIP1 goes live soon, which means that anyone will be able to deploy a token on Hyperliquid - they also need to have skin in the game via forever ‘committing’ the initial liquidity, so it should be far less of a wasteland than pump.fun

They just got a DexScreener integration, great for mindshare which hopefully helps it bubble into an active ecosystem

Now dem’s the more concrete points, the thing that I think would really get the wheels turning is if they open up general smart contract deployment to the public. I don’t see why they wouldn’t at some point, feels like a net positive for both them and users, but I also haven’t seen anything concrete about that.

Basically all of this can be summed up into one line:

It's not just another perp dex, it's a high performant L1 CEX emulator.

As always we appreciate your readership, if you enjoyed this article please leave a like and share it around. Have a good weekend and we’ll see you next week!