-kezfourtwez

Good morning onchain enjoyers, and happy ETF day! I can’t believe I get to say that twice in one year in our nascent industry, but the flood gates have opened post BTC ETF, and the politicians are doing a 180 as crypto gets pulled into the political arena and used as campaign fuel - more on that from Charlie below.

Before we go any further, a shout out to Kabosu the mother of memes. The dog that started it all passed away just a few hours ago at the ripe old age of 18. RIP Kabosu.

Sanko

Today I am proud to give you a little write up on the newest addition to the Parsec family, SankoTools.

SankoTools is a feature complete block explorer and comprehensive analytics terminal for the Sanko L3.

The explorer contains everything you need to help you traverse and explore the Sanko ecosystem, whether you are a degen or a dev. The pages you visit and data you see are all contract-type dependent, the addresses are aptly labelled and auto tagged. Try it out for yourself here.

The homepage consists of:

Trending contracts, trending assets and a TPS chart

An ecosystem page with info and links to projects on Sanko

$DMT price chart and supply metrics

Sanko NFT’s

Bridge flows

If you require deeper analysis, sign up for a free account to create custom Sanko dashboards.

It’s been an absolute pleasure working with the chads at Sanko, we at Parsec look forward to continuing this relationship and to continue upgrading and optimising Sanko Tools as the ecosystem grows. A huge congrats to the team on the successful launch!

My journey with Sanko started on the day of the DMT presale about a year ago, I’d heard about it a few days prior and had planned to participate but didn’t know much about it. I was instantly hooked by the esoteric and nostalgic nature. I stuck around and they started shipping immediately and never stopped, I believe it was a small raise of $3m for the presale and it was just smoovie and company phone at the time.

In a few days they had an attractive staking mechanism and after just a few weeks they already had two games out. Sanko has always been about games and interactive experiences and in just over a year they’ve shipped:

Four games of various complexities

A fully functional and very fun poker room

A streaming app

Their own L3 that uses their native token for gas

And now, just a few days after Sanko’s one year anniversary they have released SankoPets

SankoPets is a well put together and thoroughly thought out farming game with some novel contracts. The game is centred around Buns. They start off as eggs, you hatch them, their stats are dynamic and they even own their own gold and items. All of this happens and yet the Buns live on one contract, onchain magic.

Obtain a Bun

Stake DMT for rewards in GOLD and DMT - gain the ability to farm

Plant seeds on your patch to grow and harvest fruit (and maybe gold?)

Use gold to buy more seeds and funky items, or sell it for $DMT

Use those items to fit out your island

Some sort of PVP tournaments for GOLD?

???

The theme here seems to be GOLD, and then today smoovie tweeted this:

It’s been a fun week, I look forward to continuing to nurture my buns as well as whatever comes next in the Sanko ecosystem.

Crypto goes bipartisan

In the realm of institutional Crypto adoption, nothing could be more relevant than the ETH spot ETF madness this week. An unexpected tweet from Bloomberg analyst Eric Balchunas on Monday reported that they had TRIPLED their odds of approval after having heard that the SEC could be feeling political pressure:

With the approval date just 3 days out from this tweet, naturally the market experienced a knee jerk reaction with a monster move in the price of ETH, ETH/BTC and ETH/SOL:

By the end of the trading day on the 20th, ETH had closed up $590 representing its largest ever one-day gain and adding $70bn to its market cap... truly a monster move! Unlike BTC markets which had months to price in a potential approval following the infamous Cointelegraph intern tweet, ETH markets had just a matter of days which is likely what contributed to such a huge move, catching many market participants off sides.

Lo and behold, yesterday in the final hour, we saw the news roll through that the SEC had indeed approved the ETH spot ETFs:

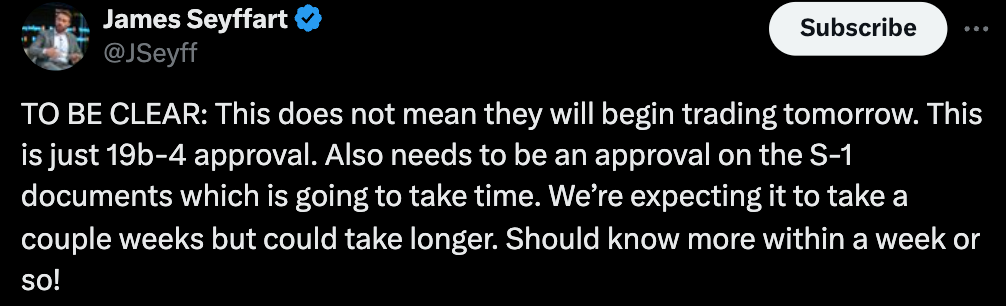

It is worth noting that this approval is slightly different from the BTC spot ETF approvals in that they only approved 19b-4s filings not S-1s. This means that an SEC commissioner can challenge in the next 10 days and also has the effect of hiding the vote which may be what the SEC wanted (because this decision has become increasingly political). The Bloomberg analysts expect approvals on the S-1 documents within the next few weeks which would actually allow these things to start trading and accepting inflows:

With this in mind, we might be waiting just that little longer before the institutions buy our ETH bags. Perhaps this is an anti-climax for some but it shouldn’t outweigh the overwhelmingly positive news we have seen from US regulators this week. Not only did the SEC take the first step in approving spot ETFs for the 2nd largest asset in Crypto they did so due to political pressure which implies that the Democrats might be softening their stance on what has historically been a hostile one towards Crypto.

Additional newsflow we saw this week would support this view with the Biden Administration stating that they are eager to work with Congress to create a "balanced regulatory framework for digital assets". Meanwhile the Trump administration announced that they are to accept Crypto Donations. Senator Cynthia Lummis concluded that “there is a bipartisan majority in both chambers of Congress in favor of crypto”, this looks to be increasingly true.

Crypto seems to be making the transition from the naughty kid in the corner to a supermodel which both presidential campaigns are beginning to court. If we zoom out a little, longstanding US regulatory headwinds turning into tailwinds could be much bigger than spot ETH ETF approvals.

As always we appreciate your readership, if you enjoyed this article please leave a like and share it around. Have a good weekend and we’ll see you next week!