Parsec Weekly #77

A reshuffling of the cards in LRT land

A reshuffling of the cards in LRT land

Following the emergence of Liquid Restaking Protocols around the beginning of the year, their story has been characterised by growth. With each LRT protocol offering a form of points program or incentives on top of the underlying EigenLayer rewards, it is no surprise that we have seen an increasing amount of ETH find its way into these protocols over time.

While LRT flows are much cooler now in comparison with earlier this year, total LRT supply is still sitting pretty at around $13 billion (or 3.7M ETH):

However, the past few days have seen somewhat of a reshuffling of the cards. Over $1.5bn of weETH and ezETH has been freed from Pendle and Zircuit pools as their respective Pendle bonds came to expiry.

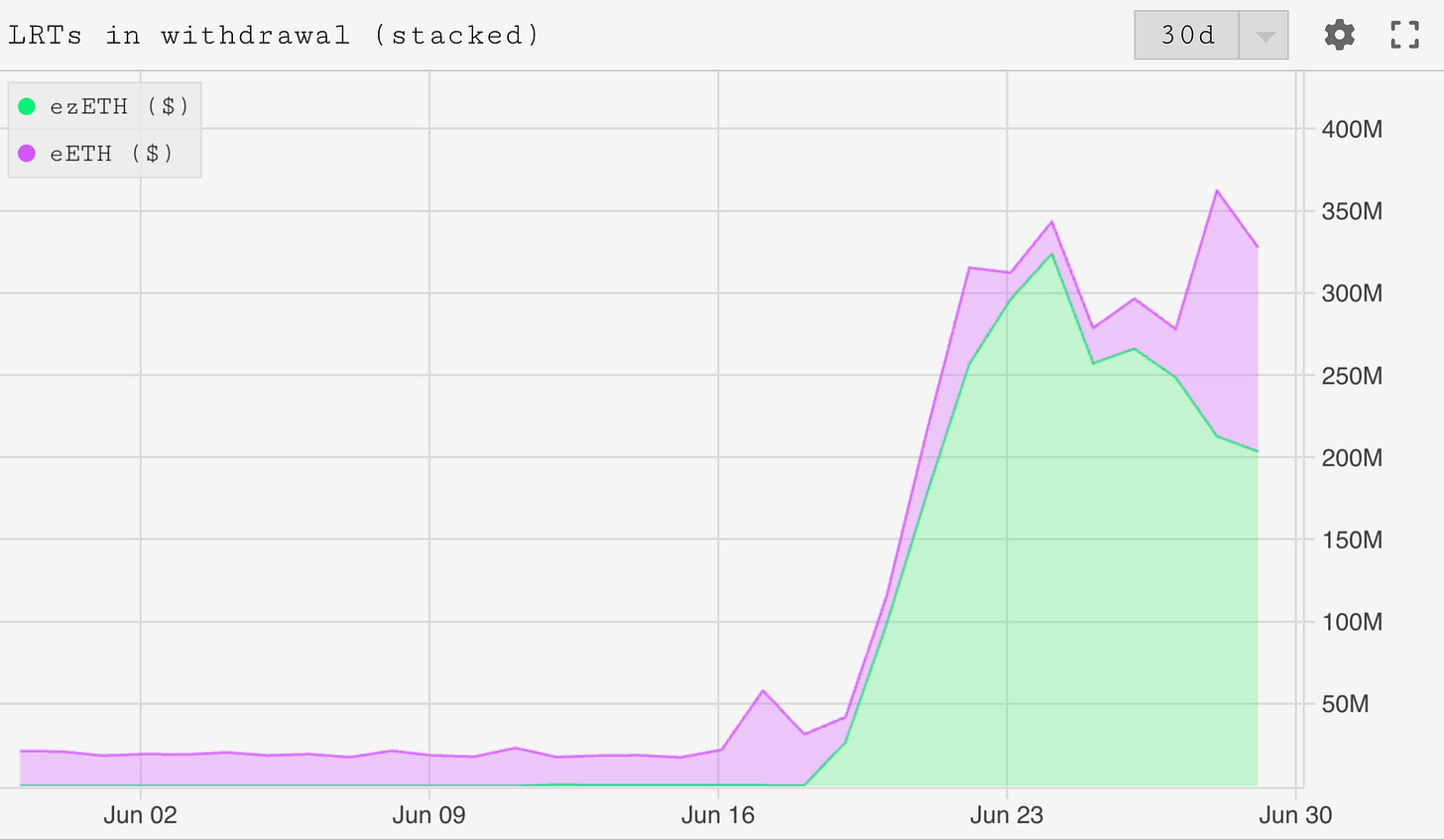

Some of this capital ran straight for the exit with around $330m currently moving through the eETH and ezETH withdrawal queues. This represents roughly 1.5% of EtherFi and 6% of Renzo’s TVL being withdrawn. With the Renzo airdrop being in the rear window while EtherFi’s Season 2 Airdrop program is still ongoing and plenty more usecases (read: farming opportunities) for eETH, this large relative difference is no surprise:

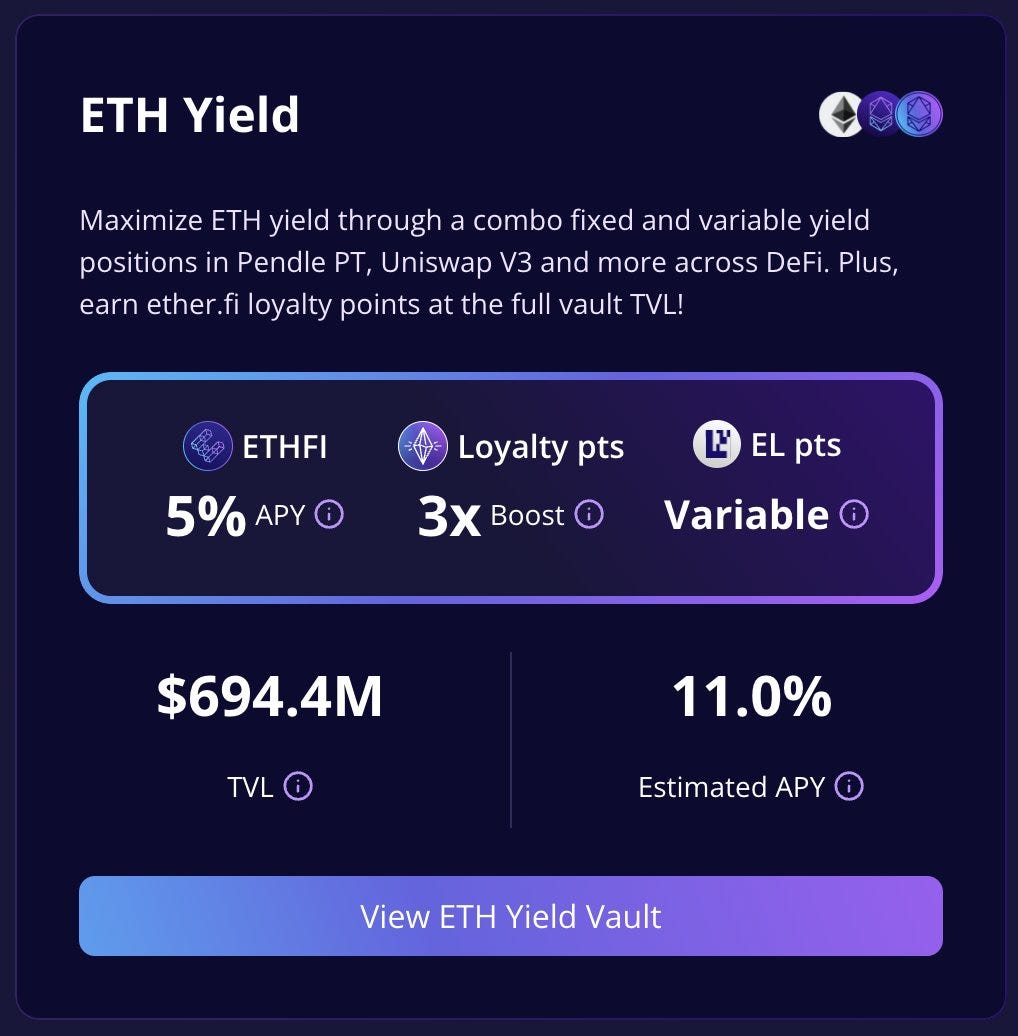

Despite some flowing into withdrawals, the majority of the Pendle outflow has flowed back into EOAs/multi-sigs, Aave and EtherFi’s liquid vault:

For the uninitiated, EtherFi’s Liquid ETH Vault is like a managed fund for weETH, a one stop shop for a whole variety of yield strategies under the hood. It is currently home to ~$700m of ETH and holds a monstrously large Aave V3 position:

EtherFi is clearly emerging as the category winner in the LRT space (for now). Their choice to go with a multi-season airdrop made sense in order to increase the stickiness of capital within the protocol. Equally, rolling out products like their Liquid ETH Vault so that capital doesn’t need to leave eETH is equally as smart and represents yet another key decision which has contributed to EtherFi being No.1 in terms of TVL in this category by quite some margin.

Follow along yourself on parsec.fi:

As always we appreciate your readership, if you enjoyed this article please leave a like and share it around. Have a good weekend and we’ll see you next week!