Parsec Weekly #81

Majors round up and the path to sustainable economics for AAVE

The path to sustainable economics for AAVE

Loyal readers of the Parsec Weekly and more broadly, DeFi enthusiasts will recall MakerDAO’s introduction of the Smart Burn Engine during the Summer of 2023.

At the time, it was one of the most exciting things happening in DeFi as the oldest bank in DeFi sought to introduce a sustainable buyback mechanism for MKR, using protocol profits to buy back MKR from the open market. The initial proposal coincided with a bottom in the MKR/ETH ratio, which proceeded to triple in the following 3 months and has shown strength ever since:

Based on a “Temp Check” post yesterday in Aave governance forums, it is possible that something similar could be due for our old friend Aave.

In a bid to create long term protocol sustainability, the proposal lays out a path to sustainable value accrual for the Aave token. Currently stkAAVE is incentivised using AAVE emissions from the ecosystem rewards contract. The proposal correctly notes that this contract does not have infinite AAVE and lays out a path towards replacing these AAVE emissions with AAVE which would be bought back from secondary markets and in turn, distributed to stkAAVE.

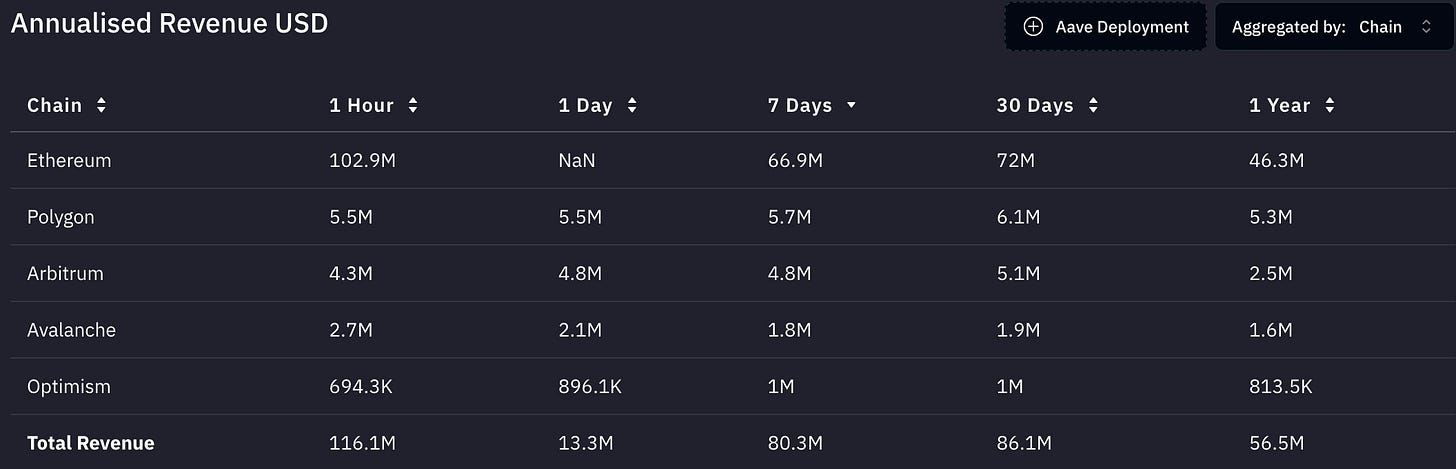

These buybacks would be funded using excess protocol revenues or in traditional business speak: profits. Aave currently generate close to $90m in revenues on an annual basis (based on an annualised 30d lookback):

It is not entirely clear how much the protocol generates on the bottom line from these top line numbers but the margins are significantly higher than for MakerDAO, where much of the protocol revenue is redistributed to sDAI.

One of the key determinants for this “Buy & Distribute” program to go live is Aave’s stablecoin GHO. Notably, the proposal states that they would look for 175m in GHO supply and sufficient secondary liquidity to allow for a 10M swap with 1% price impact before the fee switch could go live:

GHO currently sits at around 100m in supply with 60% being staked as stkGHO for a juicy ~20% in incentivised yield:

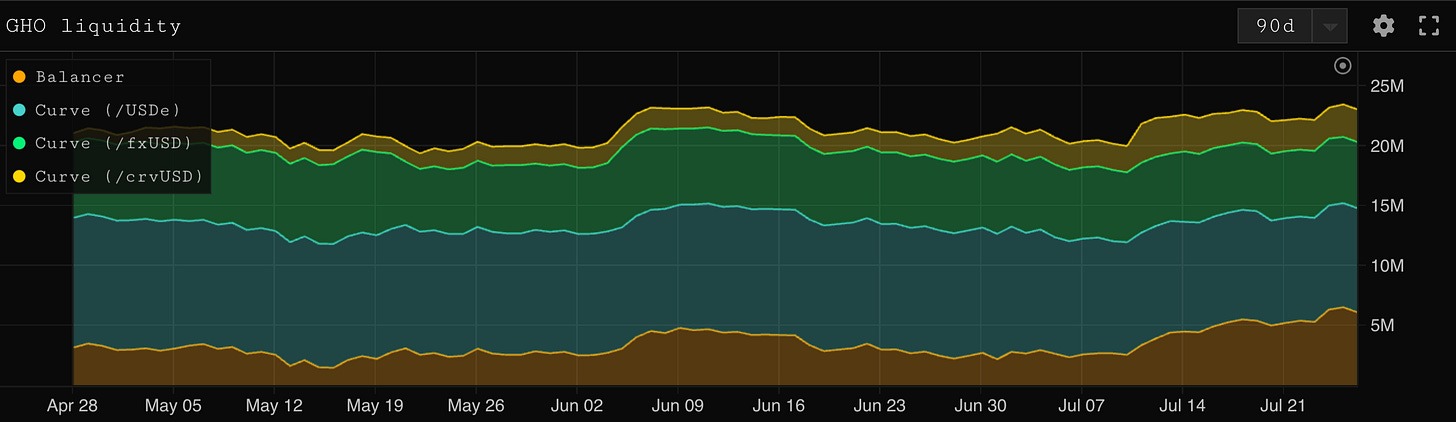

There is currently around 23m of on chain liquidity for GHO, certainly not enough for 1% slippage on a 10m sell:

These GHO metrics clearly have some way to go before the “Buy & Distribute” program becomes a reality but either way, the path towards sustainable economics for AAVE has been telegraphed and we couldn’t be more excited as our vision for these governance tokens becoming real assets with cashflows is finally becoming a reality, one DeFi kingmaker at a time!

Track the key metrics for GHO and other AAVE-related metrics on this beautiful dashboard we put together (seriously guys, bookmark this one):

https://parsec.fi/layout/geeogi/BOVXzPQj

Majors round up

-kezfourtwez

Good morning crypto market participants, I very much enjoyed skipping the small talk and getting straight to it last week so I will simply do it again, hope you are all well.

In terms of milestones it’s been an absolutely monumental week. Six months ago very few of us thought that we would be able to utter the words “Happy ETF day” at all, let alone twice in one year. The Ethereum spot ETF went live for trading on Tuesday, a huge milestone for the crypto community to say the least.

Similarly to when the Bitcoin ETF went live, the price action has not... been great, ETH has been heavy to say the least. Many were anticipating a sell the news event due to multiple factors, and so far it’s playing out. One of those factors being the heavy supply overhang from Grayscale’s ETHE Trust, as trapped holders are finally allowed to flee to a cheaper fee alternative.

In the three full trading days since the ETF went live, Grayscale’s ETHE has seen a whopping $1.15b in outflows

Tuesday -$484.9m

Wednesday -$326.2m

Thursday -$345.6m

So far the Grayscale flows are repeating the post Bitcoin ETF playbook but much faster, GBTC outflows in the days following where nowhere near this severe.

As far as the wider market goes, everything has been holding up extremely well. We had a brief nuke yesterday that took BTC down to say hello to its old friend the 100d EMA, but it resulted in a sharp bounce leaving behind a nice long daily wick.

As for the outlook, six weeks ago I was here giving you this spiel as we tapped ATH for the 4th time this cycle and I was sure we were about to break it.

>We didn’t, and instead spent the next 30d in quite a severe downtrend that resulted in BTC -25% off the highs and alts just absolutely demolished, some erasing their entire cycle’s gains. Lol whoops!

But here we are again, all of the above still stands. Crypto is increasingly becoming a political issue to the point where Trump is speaking at the Bitcoin conference in Nashville this weekend. I’m keeping my expectations low for this one but the point stands.

The BTC ETF flows have been pretty astounding lately, we are likely but a few months away from an interest rate cut or two, and we are now almost entirely rid of some supply overhangs that have been in the works for 10+ years.

We have chewed through these overhangs in an impressive manner these past few weeks whilst BTC looks like this:

GBTC outflows have come to a halt, Germany has finished selling and on Tuesday the 23rd of July 2024 not only did the second crypto spot ETF go live for trading, but the Mt Gox trustee distributed around half of its Bitcoin to creditors through Kraken.

The market has been slowly digesting these anticipated large transfers and potential heavy selling pressure for months now, but it seems like the 10+ year hold chads are ready to proverbially lock their coins again.

We are not completely out of the woods but a significant portion of the Gox coins have now been distributed. Out of the original 140,000: