Parsec Weekly #83

Market round up

Good morning crypto market participants, what a bloody week. On Monday it felt like the industry was over and spiralling towards certain doom, BTC suffered a 30% drawdown from range high to black Monday bottom, and now the weekly is green after a 30% bounce bottom to top.

I tend to be pretty desensitised to large moves these days but I certainly experienced a prang of panic or two on Monday. I was watching Margin Call for a bit of extra masochism when I briefly looked back at the chart and saw we were below $50k, whew boy.

On Monday the markets saw some of the largest liquidation, volume, drawdown data and absolute madness in recent black swan history, some even eclipsing the Covid crash and FTX. This was the result of a few different factors and large sellers, but mainly attributed to the JPY carry trade.

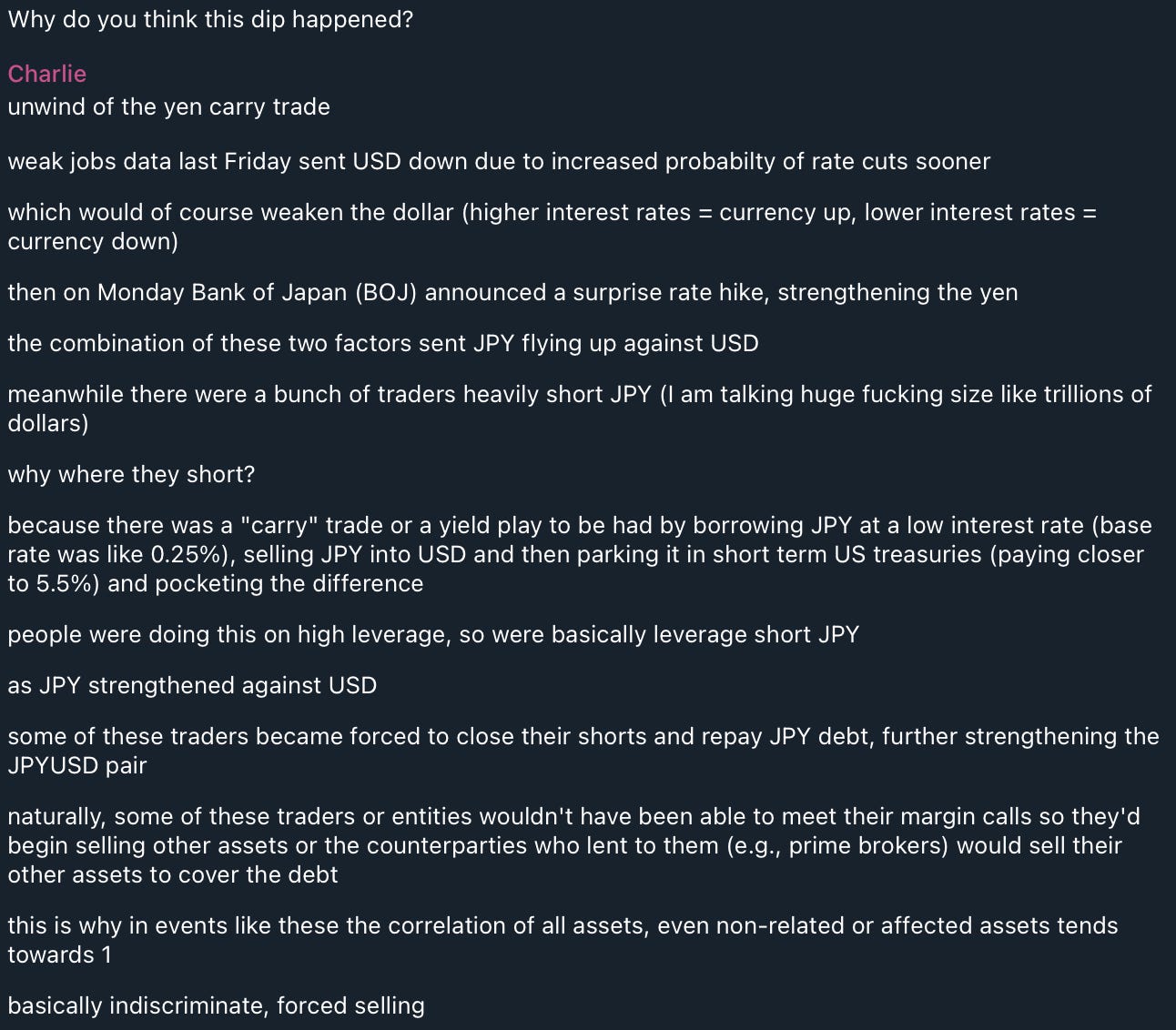

An explanation of what took place under the hood from our resident macro enthusiast Charlie:

A large portion of Monday’s price action across all markets can be attributed to this unwind. The Nikkei fell 20% in four days leading up to Monday.

On the bright side many thought that this trade could take months to unwind but the severity of Monday’s sloshing global liquidity seems to have massively sped this process up. JP Morgan put out a statement two days later approximating that 75% of global carry trades had been unwound.