Parsec Weekly #84

Arena, Canto, Hyperliquid, and DEX Screener revenue

Good morning crypto market participants, a fairly dull week with a little bit of drama here and there, a few new developments, the slow death of the trenches and a pinch of crime.

Arena

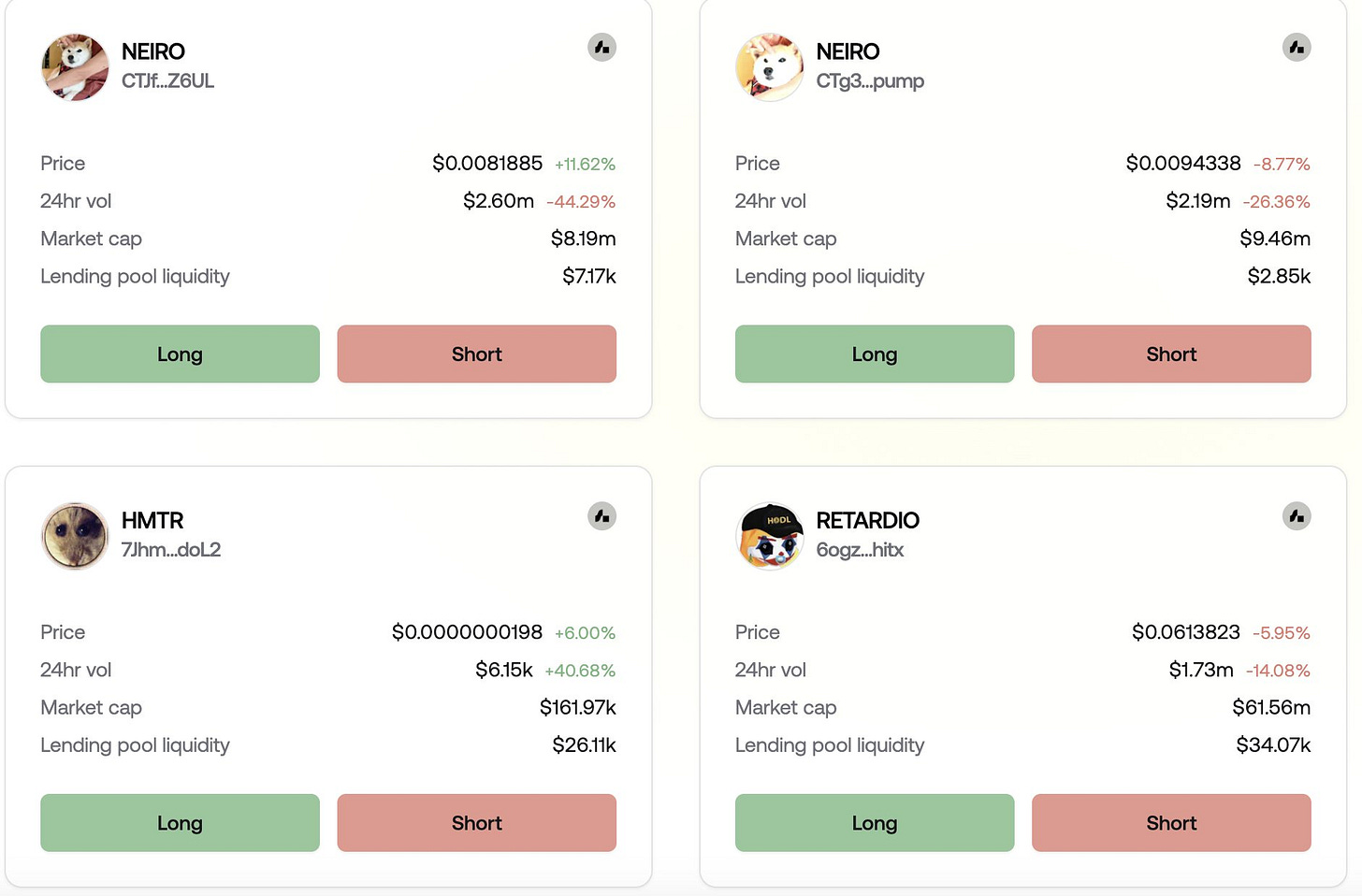

This week Marginfi launched Arena, introducing the concept of permissionless banks allowing users to trade memecoins with leverage. Currently there are 15 coins available to trade, these banks were created by the team but the end goal is permissionless deployment, at the moment users can request listings. The fact that these banks are isolated is important, each one acts independently and the movements within one bank does not affect the others.

Arena uses flashloans to facilitate leverage, so to long a coin you need to already own some of that coin. Say you hold $100 worth of BILLY and you want more exposure, Arena uses that BILLY as collateral in a flashloan to borrow USDC in order to buy more BILLY. When you want to exit the trade and you are in profit, the BILLY is sold, a portion of that USDC repays the loan and the user keeps the rest.

Conversely when you want to short, Arena takes your USDC, borrows the memecoin in question and sells it for more USDC. When the price falls and you want to close the trade, Arena buys that same coin back for less, repays the loan and the user keeps the profit.

At the moment there is very little volume flowing through the app and not much in terms of deposits. Regardless I like the innovation, up until now traders have only had the option to bet that a coin goes up. As far as I can recall this is the first app attempting to let users permissionlessly short anything.

Canto

Honorable mention for Canto this week as they have been rapidly gaining mindshare after a planned node upgrade went wrong and bricked the chain.

Canto hasn’t produced a block since Monday, but inverse correlation has provided some quality entertainment from the intern. They’ve been on a tear this week, taking self deprecation to a whole new level and shitposting themselves back into relevance.

Hyperliquid

Hyperliquid has reached a new all time high in TVL, now sitting at #10 across all chains. There is currently $527m in USDC sitting on the bridge contract on Arbitrum. This accounts for over a third of all USDC on Arbitrum.

Most of this has been going into the HLP vault for an attractive 27% on stables. I suspect word got around about how well HL held up during last Monday’s drawdown, and how much the HLP vault benefits from those types of situations and subsequent liquidations. There is about $30m more in there now than there was a week ago, and the vaults cumulative profits since inception sit at over $30m.

DEX Screener

It turns out that pump.fun and the trading bots are not the only ones who have found PMF in the Solana memecoin infrastructure sector. Yesterday DefiLlama added Dexscreener revenue, they’ve been making $100-250k per day mainly by charging new tokens to add images and social links to their token pages.

As always we appreciate your readership, if you enjoyed this article please leave a like and share it around. Have a good weekend and we’ll see you next week.

Great writeup, kez!

Nice curation! :)