Parsec Weekly #87

The State of Crypto (an honest take)

The State of Crypto (an honest take)

During times of market uncertainty we so often see a “flight to quality” not just in terms of relative strength in certain coins but also in what the collective mindshare seems to value as being important.

It’s quite amusing to observe commentators flip flop between praising the existence of memecoins and the validity of the gambling sector in boom times, to preaching the benefits of stablecoin finance, onchain cashflows and tokenisation during times of depression.

The truth is that speculation comes and goes and while it might make money for some participants (or even many participants) during certain reflexive periods, it’s hard to justify the existence of an entire industry based on ephemeral bursts of speculation. Ephemeral bursts of speculation which seem to come and go without much predictability.

I believe this is why we see mindshare return time and time again to stablecoins, cash-flow generating projects in DeFi and tokenisation (RWA, if you will). It’s because, taking Bitcoin out of the equation, these are the verticals which have achieved the strongest product market fit thus far and not just speculator market fit!

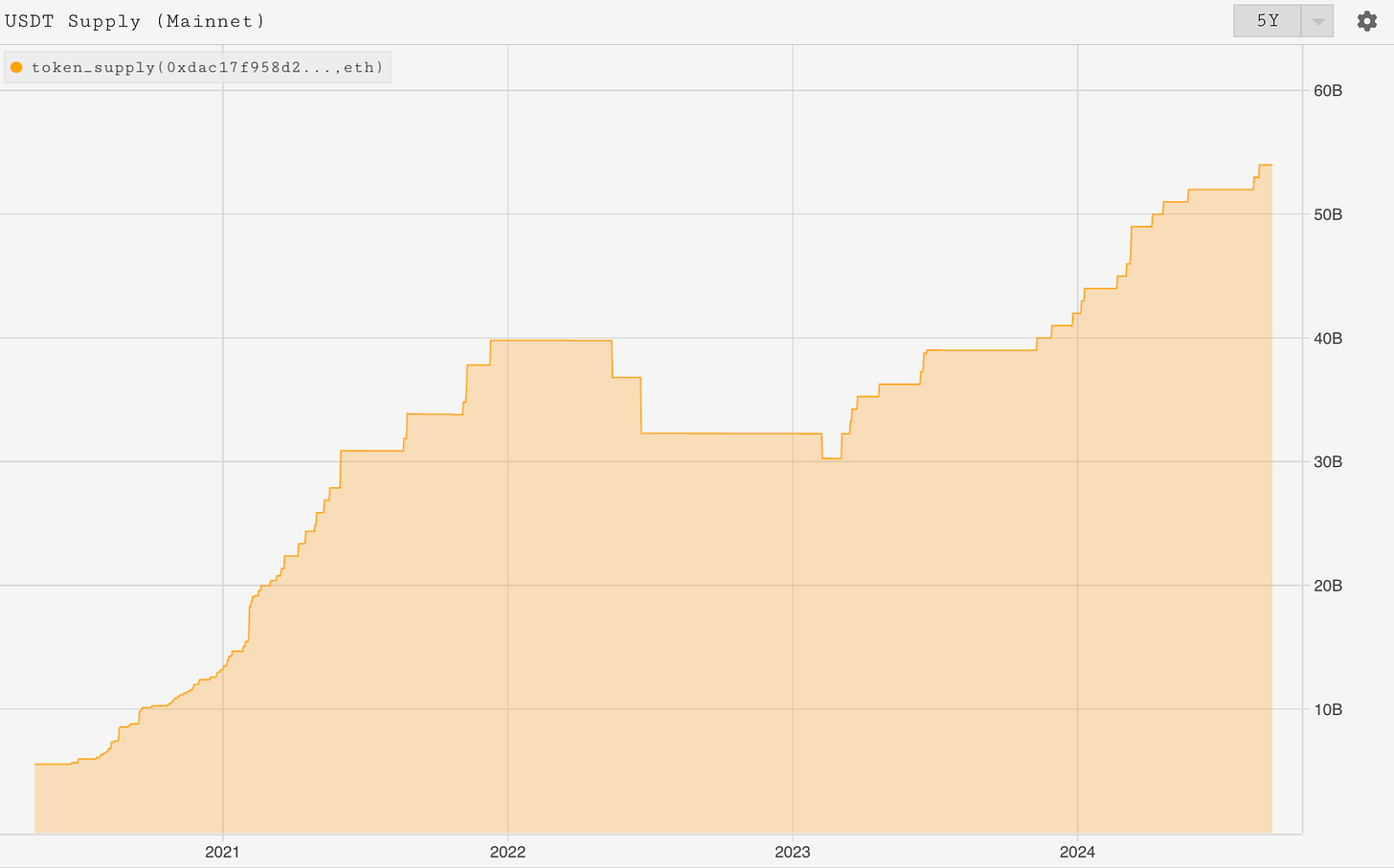

Aggregate stablecoin market cap has definitively bottomed and is close to exceeding highs set back in 2022 (we are about $8bn away from those highs, adding $35bn in aggregate stablecoin market cap from the bottom). While USDC supply is still around 38% below the highs set in 2022, USDT continues to notch new all time highs in terms of supply on a weekly basis:

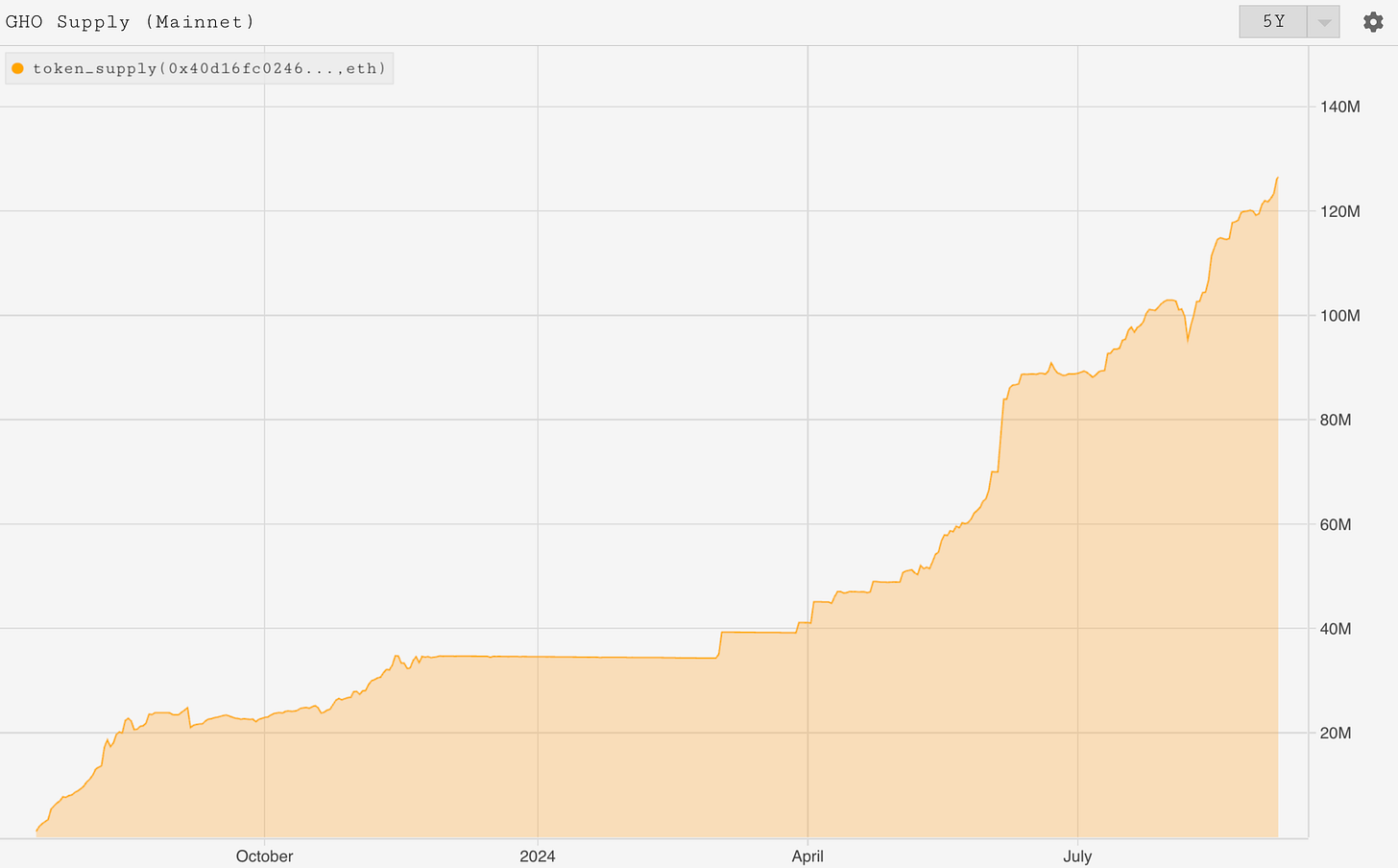

With new upstart stablecoins like GHO (issued by AAVE) experiencing growth too:

We are seeing equally impressive growth in the tokenisation of certain “Real World Assets” with Figure adding over $500m of HELOCs (Home Equity Line of Credit) per month on Provenance Chain. Similar to how USDT payments on Tron offer a cheaper and quicker payments solution for the Global South. Using public blockchain architecture in the case of Provenance allows for cheaper and quicker HELOC originations; Figure are able to fund customers in 5 days versus the conventional 30-40 days while cutting multiple counterparties out of the process and around 100bps in cost per origination.

These impressive data points so often go overlooked because they are inherently boring; while they represent important problems being solved, the growth of these verticals does not hold the promise of huge gains for liquid participants.

That’s not to say there aren’t attractive investments to be made here. A direct beneficiary of stablecoin growth and transfers, TRX, is deflating at -3% yearly (equivalent to a buyback which reduces the float by 3% per year). It’s just that the economic realities of the true fundamentals don’t seem to excite most market participants. This shouldn’t be a surprise following the 2017 and 2021 bubbles. The average Crypto market participant is like a child who has played a little too much Grand Theft Auto and now finds Scrabble boring - it’s still a great game, they just no longer appreciate it having experienced something far more dopaminergic.

I have heard the analogy banded around that we might be in a post 2000 type of era for Crypto today. Following the burst of the tech bubble, many speculators continued punting on things which would do well if the bubble returned, meanwhile they missed the multi decade compounders which emerged during that period. Following the 2017 and 2021 bubbles, so many participants seem to have a blind faith in such conditions re-emerging every 3-4 years. While I am certainly open to such conditions returning, it seems unwise to build and invest towards a future where these conditions are guaranteed. Should we not strive towards creating products, services and solutions which succeed irregardless of market conditions by solving real problems and creating real economic value in doing so?

Some readers might interpret my sentiment here as bearish, I would rather frame it as a sober take. I feel positively about the future of public blockchains, I just expect the next 5 years to look distinctly different to the last 5 years with respect to the kind of behaviour which is rewarded both for builders and investors.