Unichain

Yesterday saw the announcement of Unichain which as the name suggests will be an L2 built by the Uniswap Labs team. Unichain will be a DeFi focused L2 with the following functionality:

Cheap transaction costs (up to 95% cheaper than L1)

Decentralised validation with UNI staking

One-second block times with 250ms “sub-blocks” coming soon after launch

Block builder tech built in collaboration with Flashbots

Native interoperability (single-block, cross-chain message passing) among Superchain L2s with the help of OP Labs

With Unichain, Uniswap Labs certainly seem to be going down the route of building out an entirely new generalised L2 rather than just an appchain and they are partnering with heavyweights in each vertical to make that happen (Flashbots, OP Labs, Across Protocol).

Like many L2s, Unichain does face the liquidity cold start problem but they are likely in a much better position to face the problem than your average L2. Many large Uniswap investors (a16z, Paradigm etc.) will surely migrate on chain liquidity over to the new L2 and with as much experience as any DeFi team, Uniswap Labs and Foundation are surely cooking some incentive mechanisms to attract more mercenary mainnet liquidity to migrate too.

With the Uniswap router contracts regularly being the most “fee generative” contracts on Ethereum mainnet, a significant migration of Uniswap-related activity to Unichain would certainly be a hit to Ethereum economics (assuming the reduction in transaction fees on Unichain doesn’t drive a proportionally large increase in activity/transactions and thus settlement fees to L2, which empirically has not been the case with any L2 thus far). Equally, it is well understood that DEX activity is tightly correlated with MEV, so again, a significant migration of Uniswap activity to Unichain would significantly reduce the MEV-related revenues directed towards ETH validators and ultimately stakers.

Of course, this significant migration of liquidity and activity is by no means guaranteed and all we have seen thus far is an announcement of a chain which is not yet on mainnet. Despite this, the UNI/ETH pair has already started moving to reflect a potential shift in where the economic value generated by UNI will be directed towards in the future:

Here at parsec we couldn’t be more excited to see how the Unichain story develops and what kind of cool analytics we can build on top of it!

Good morning crypto market participants. It’s been an interesting week of price action, a lot of alts have been rallying hard whilst BTC has been relatively weak. It seems to be catching people off guard as we’ve been conditioned to sell alts into BTC weakness for most of this 7-month range. Yet on the last few BTC lows, memes and strong alts have made higher highs before BTC.

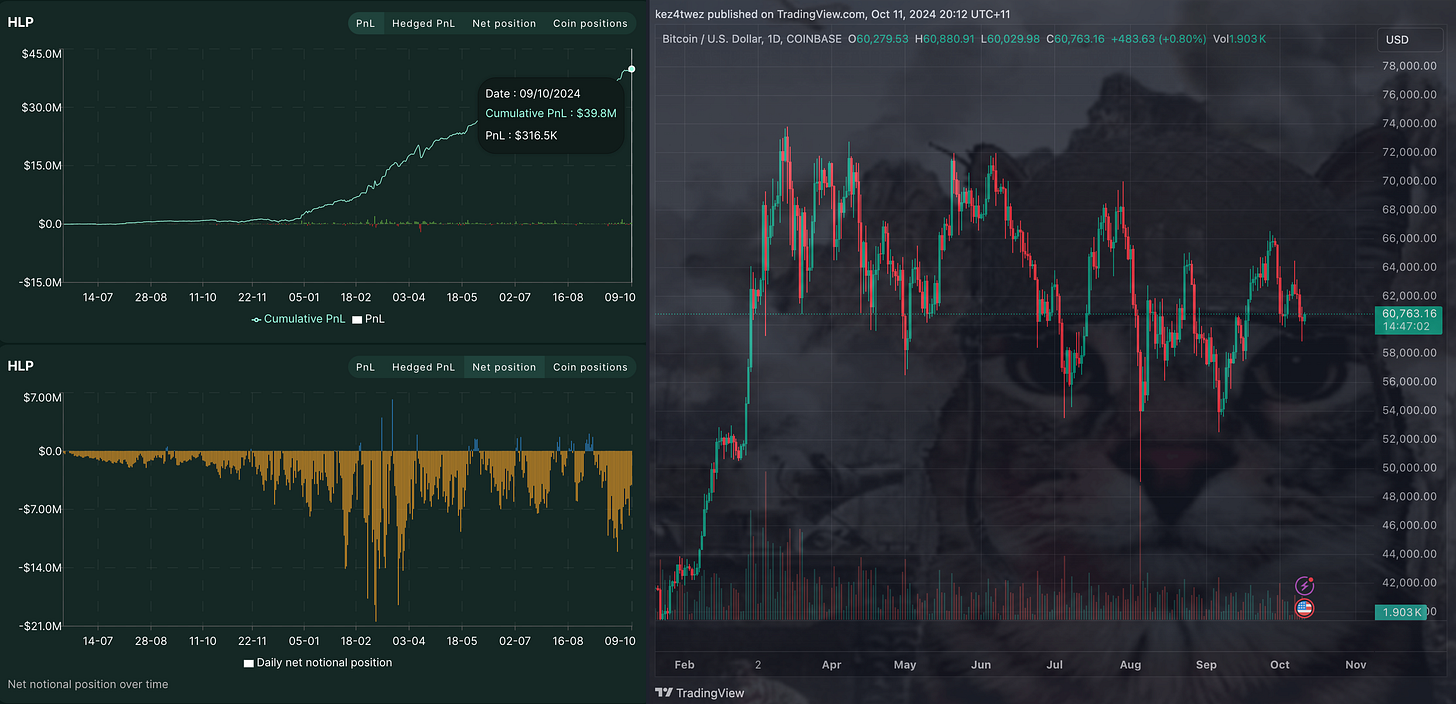

Some semi-related/interesting data I found yesterday before we get started. The Hyperliquid HLP vault is in nearly $40m profit since January but has been net short 95% of the time. I guess my point is it hasn’t been easy to be a permabull through the last 7 months of chop, or permabear for that matter.

Memes

The memecoin dynamic has done a full 180 since the March top, the ecosystem has had time to digest the cheap thrills and dispersion of the last six months and winners are beginning to emerge. We’re in this strange low cap economy where coins are going up nearly as much as they did in March but on far lower volumes and over longer time horizons. Let me remind of you the ludicrous multiples and volumes that coins were pulling onchain back then:

I think this is a function of two things; the coins that are currently winning have had a year+ of sideways to bottom out the charts and rinse the non believers, and a year+ to let organic communities form and the cream to naturally rise to the top.

Regardless of Murad I think coins like SPX6900 and $BITCOIN would have broken out eventually because of reasons stated above, but he his strategy so far is a sight to be seen. He spent six months finding the most loyal cults, accumulating supply, building his reputation, and slowly releasing his list whilst spreading the gospel. Though that’s only half the battle, his exit will be the interesting part. He has definitely had a massive part to play, but in my opinion he just frontran the narrative.

I don’t know what happens to these coins in the short term, and I don’t give much weight to his insane targets but I do think certain coins go much higher before the cycle top is in. I know it still feels crazy but unlike back in March, the pace that the repricing is happening is bullish. Instead of $2b in volume and a 1000x in 24hrs, you have SPX6900 doing a 50x over a whole month on steady but modest volume by comparison.

Trying the new thing

One quick word on trying the new thing before I let you go. This is something my friend Happy (Among countless others) has always stood by and it’s served him, and me incredibly well so far.

Try the new thing

It generally costs you nothing and the pay off can be massive, in multiple ways. From airdrops to finding things early enough that there is still decent edge just by being there. The two examples from me this week are ShapeL2 and Tribedotrun.

Shape is a new L2 focused on art and creators, and they managed to get some pretty high profile 2021 era artists to do drops during launch week. Yet not many people outside the art community we’re talking about it let alone bridging. I initially bridged because I wanted a shot at the XCOPY drop, then I ended up buying an esoteric shitcoin and made some easy money. No charts, no tooling, not even a decent block explorer. Just a black circle on a screen that grows with the marketcap, and a buy/sell button.

Tribe.run is a new social platform on Solana founded by billzh and incubated by AllianceDAO. Apart from ‘trying the new thing’, one of the reasons this one interests me is because billzh messaged me some questions a couple of months ago asking for feedback on the good and bad parts about friendtech, a sign he’s taking it seriously. I’ve only just started using Tribe today so I’ll report back next week.