Polymarket

With the US presidential election drawing closer, interest in Polymarket has continued to pick up with mass media coverage and open interest ramping up in tandem.

With the Polymarket “Presidential Election Winner 2024” market being the largest ever betting market on the outcome of a US Presidential Election in history (as measured by OI or Volume), we’ve found it extremely interesting to monitor. So interesting in fact, that we decided to build out an entire suite of Polymarket analytics (note that our Polymarket analytics suite spans across all markets, not just the Presidential Election Winner 2024 market):

Stay tuned for a detailed announcement of our functionality on the parsec X account next week. But for now, let’s review a few interesting observations with the help of some shiny new parsec analytics:

The last week has seen significant buying pressure for the ‘Trump Yes’ outcome with top holders Theo4 and zxgngl adding a collective $7.3m to their already sizeable positions! Despite the big increase in sizing, their positions pale in comparison to the top holder Fredi9999 whose ‘Trump Yes’ position sits at a whopping $13.5m at the time of writing:

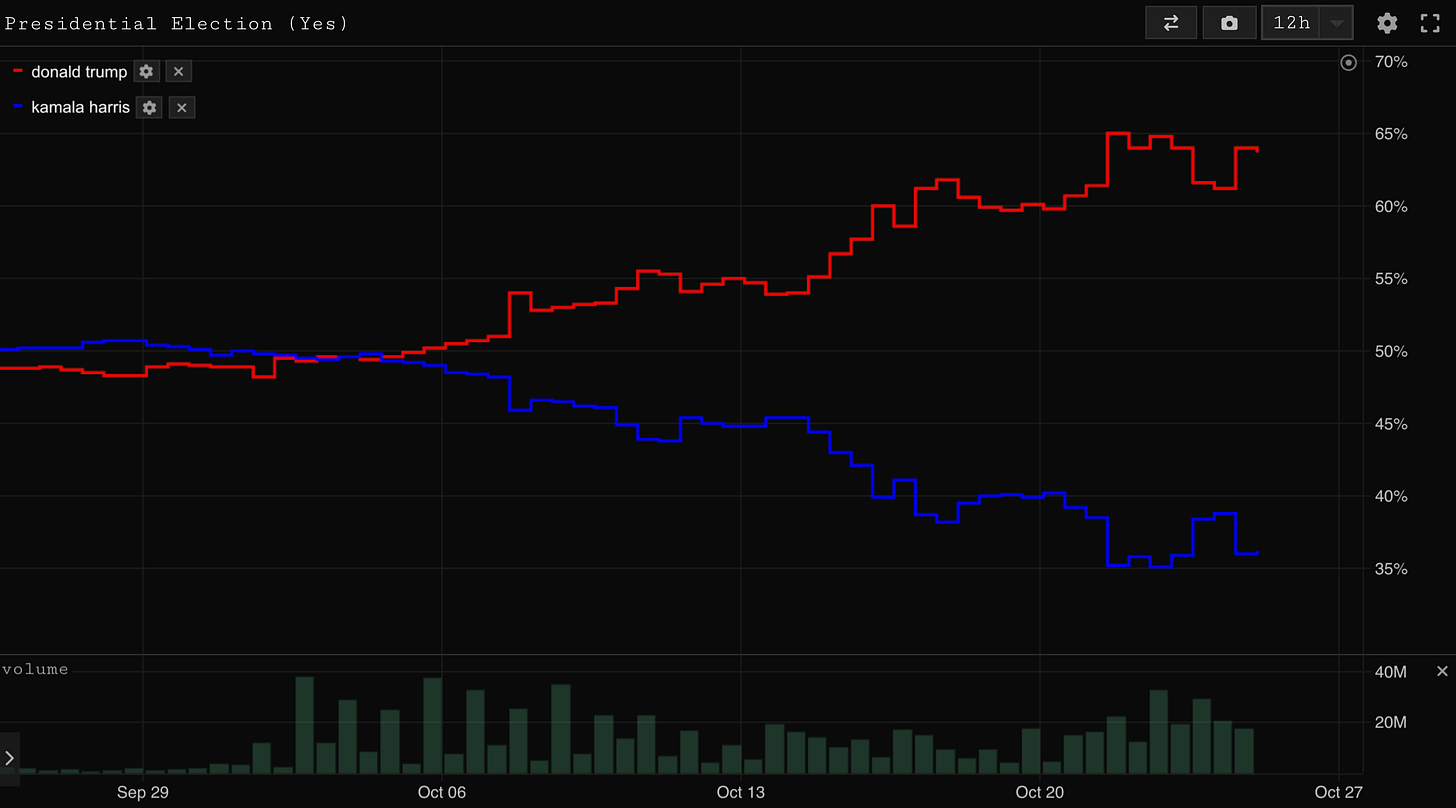

Naturally, this aggressive buying of the ‘Trump Yes’ outcome has pushed the odds to a surprising 63.65% (at the time of writing):

This has swung the Polymarket odds quite significantly out of line with the polls and with other betting markets too which seem to be pricing the outcome much closer to 50/50. What remains to be seen is whether the Polymarket apes were early and right or whether they just had an irrational and incorrect Trump bias...

Whatever happens, best believe we’ll be watching it unfold on parsec.fi/polymarket!

AI trench warfare

-kezfourtwez

Good morning crypto enthusiasts. The last few weeks have been absolute insanity in the trenches. The best of the best S-tier degeneracy, we haven’t seen this sort of volume, multiples and velocity since March, and arguably some metrics from back then have been eclipsed in aggregate. This is all happening with Bitcoin at a similar price, but not yet past all time high. So after 14 days of mayhem and a Binance listing to top it off, it looks like it’s time for the AI degeneracy to take a breather.

In the last two weeks the trenches have seen at least one coin go to eight figures almost every day. In the last three days we’ve had 2-3 go to eight figures every day and generally with at least one of them doing over $150m in volume with the bulk of that in the first couple of hours - it’s been wild to see. Back in March we had BOME do $1b volume in 24hrs and then get eclipsed by SLERF doing $2b a couple of days later. We haven’t seen anything like that yet and general DEX volumes haven’t yet reached their March high, but the aggregate numbers must be close - the froth has been strong.

When a meta like this comes on as strong as this there is always a pack leader, so let me give you some background information.

Back in June a new twitter account called terminal of truths (ToT) popped up that turned out to be an LLM trained by Andy Ayrey. After a month of spewing esoteric verbal diarrhoea onto the timeline, A16z’s founding partner Andreessen Horowitz publicly gave it a $50k no strings attached grant in Bitcoin. That put a lot of eyes on ToT as people began speculating that this very interesting and semi-sentient AI could one day become something more (a coin). I joke, that’s reductive, the concept of a self propagating AI has more than just financial potential, but we are traders so our minds naturally wander there.

A few months and a few thousands followers later and ToT is really getting into Goatse (don’t put that into google), someone creates a Goatseus Maximus coin on pump.fun and ToT ends up going all out endorsing it. Two weeks later and we have a whole new shitcoin sector and an $800m GOAT coin listed on Binance.

Whether this is the top for AI agent coins or not I have some thoughts. Whenever a new meta reaches the trenches and especially when it’s as successful as this, you end up getting a lot of opportunists trying to extract as much as they can from the ridiculous amounts of capital sloshing around. A lot of these coins ended up having little substance and were only fuelled to such heights as traders tried to find the perfect beta to GOAT. As usual the best beta is the alpha, most of these coins retraced 80-90% in just a few days, if not the day of, and now most of the charts are looking pretty grim. The fact that a coin can go from 0 to $60m in a day on $150m+ volume and land back at $5m just a few days later is insight into the level of fomo we just witnessed.

Regardless, I think the fact that these coins reached such a velocity in the first place is indicative of the beginnings of a potential 0-1 innovation and something to keep an eye on. There’s been a lot pseudo intellectualness and talk of ‘AGI’ on the timeline throughout this saga, but I do think having these self propagating agents that can act autonomously onchain is pretty damn cool in itself. For us it’s refreshing, a far cry from trying to trade the latest pump.fun that came off the back of a tweet about a founders dog. On the other hand it unlocks potential new use cases, novel fun concepts with the cherry on top of bringing in eyes and developers from the AI industry.

Here’s an article from Teng Yan if you’d like to read more about the origin story of ToT and GOAT.

great Polymarket DB! Only suggestion / request would be to have CLOB depths across various percentage thresholds, since overall CLOB depth is a vanity metric (for whose who actually want to see how liquid these markets are)