Announcing our Polymarket Analytics

-Parsec team

We couldn’t be more excited to formally announce the arrival of Polymarket Analytics on Parsec. Getting started is as easy as searching for your favourite market on our homepage or clicking through to parsec.fi/polymarket and exploring.

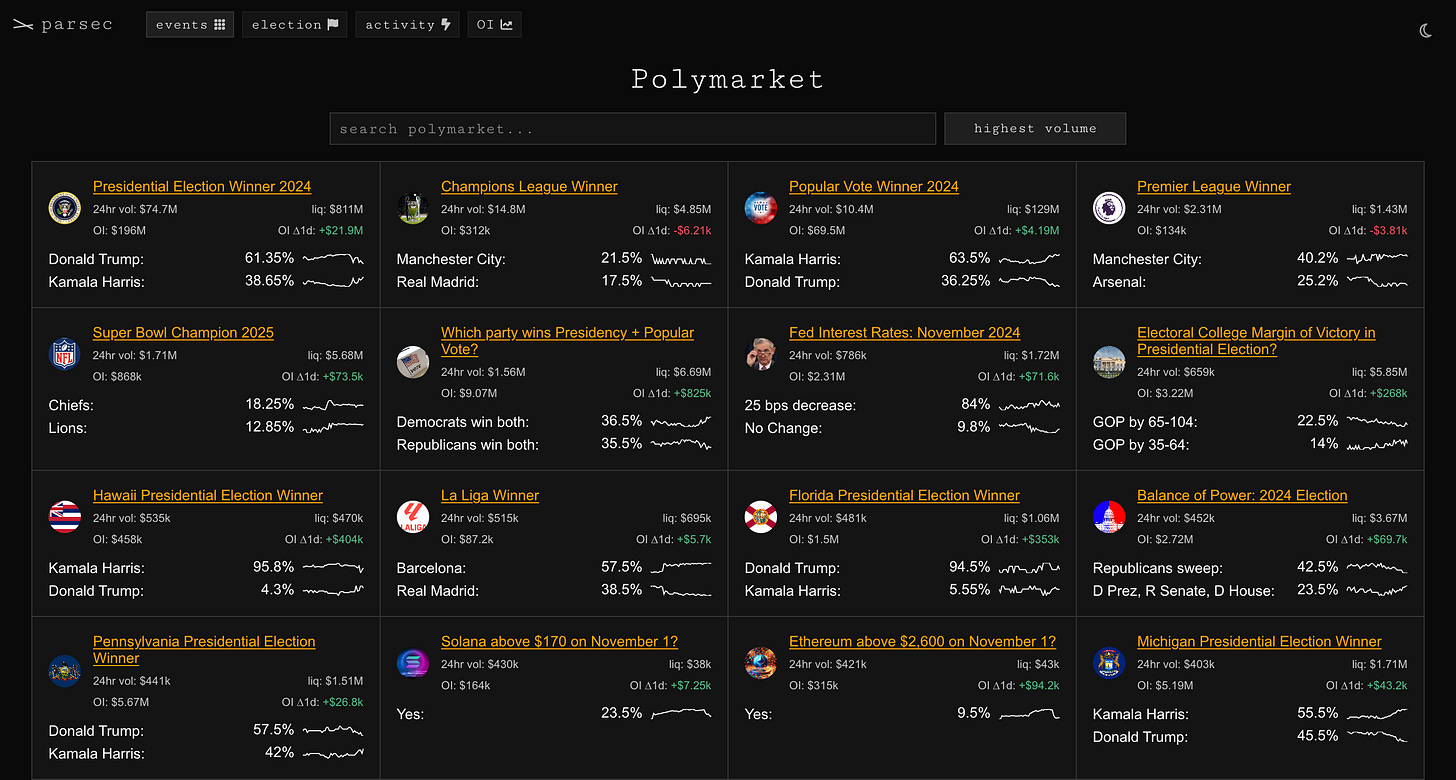

The Polymarket homepage features all events/markets on Polymarket and is filterable by volume, listing age, OI, CLOB liquidity, most comments, 1d/1hr OI delta and 1h volume delta, making it easy to drill in and find the markets you’re interested in.

The OI and volume delta filters are particularly helpful for quickly identifying where the action is currently happening. For example, all sorts of election related markets are currently taking up nearly all of the mindshare, yet as I write this the market with the second highest hourly volume is the Champions League winner.

Before we dive deeper into each specific piece of functionality, here’s an overview of our feature set:

Step charts and candles

Multi outcome top holders table

Track flows and accumulation

Live trades stream displaying outcome

Price and taker address

Historical OI charts

Custom layouts for Polymarket trader addresses

Diving into the functionality

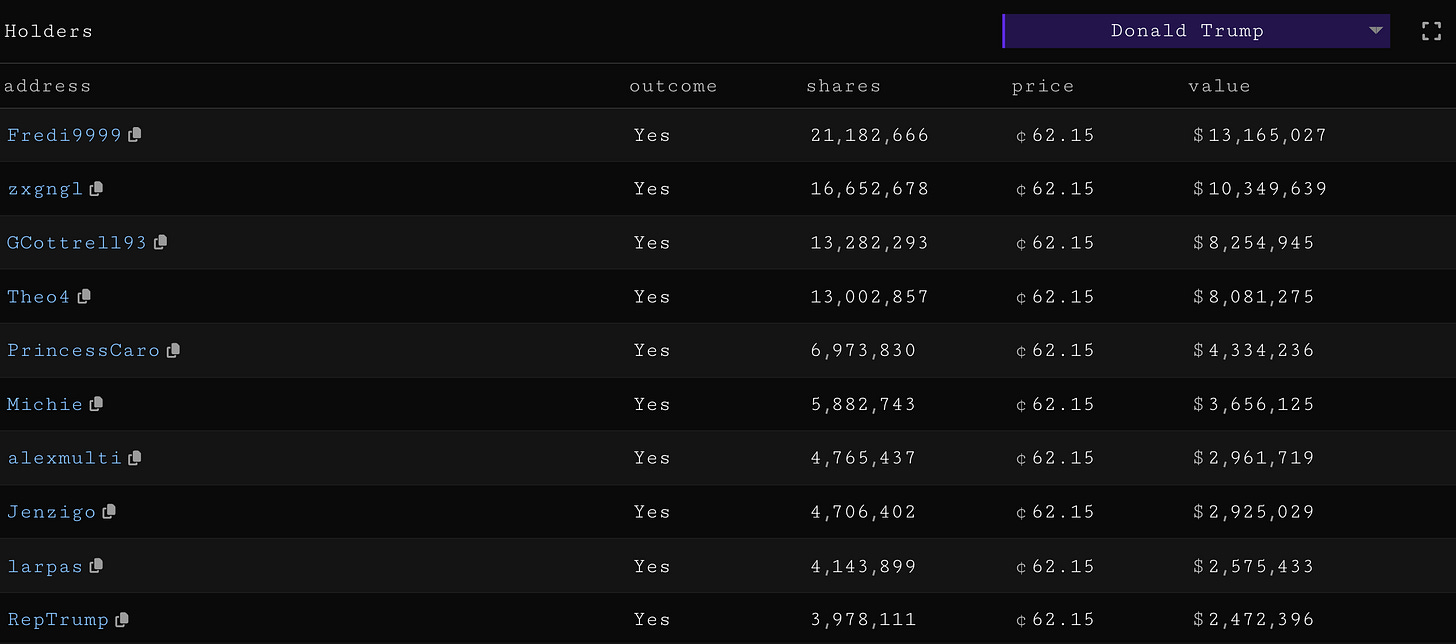

Our holders functionality includes any and all outcomes (i.e. YES and NO) for a given market, ordered by size in USD.

Interestingly, for the election market we’ve seen a significant divergence between top Trump and Kamala holders - the top Trump YES holder has $13m while the top Kamala YES holder owns just $2m.

The accumulation flows which drive the holders data are visualised too. Find the flows component by clicking through to the market of interest from the event header.

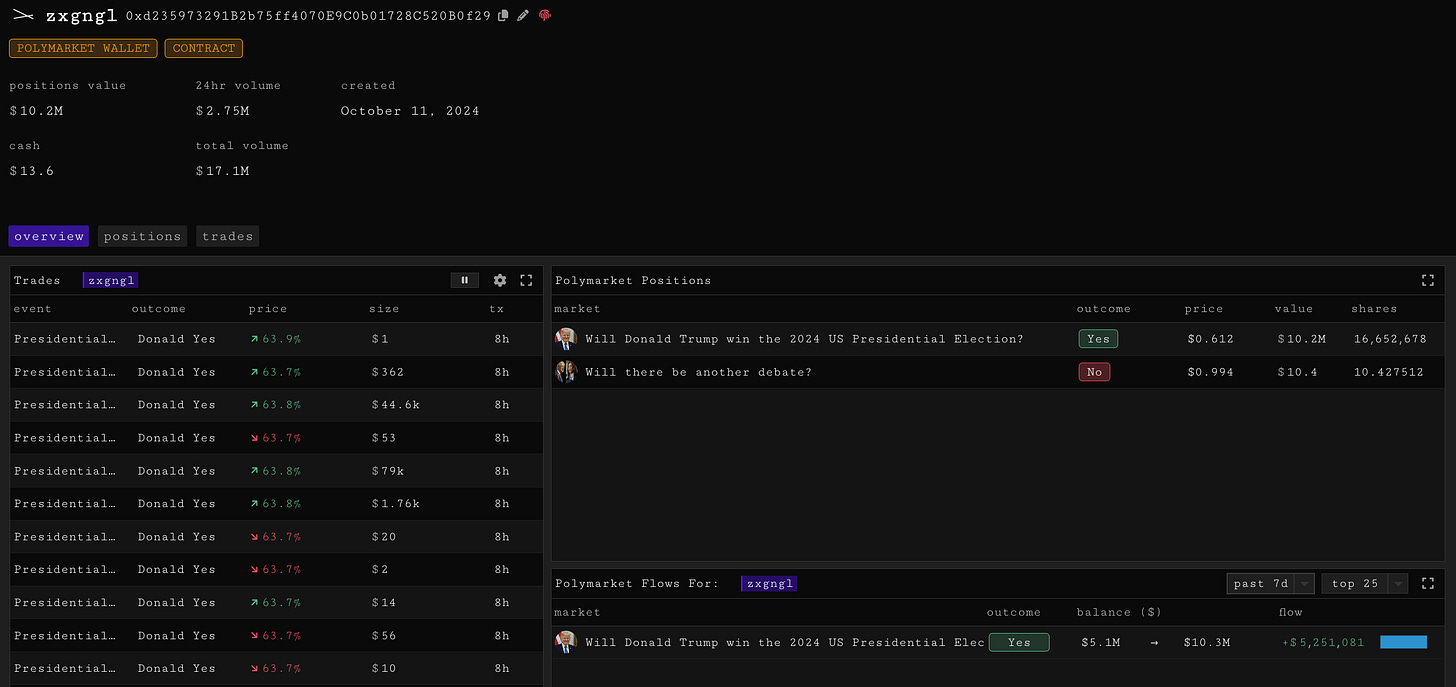

By default, it shows the top 25 flows in USD within your chosen timeframe (1h - 7d). In the last 24hrs, there have been some big accumulators of Trump YES with top holder zxgng1 doubling down and adding almost $3m, taking their holdings from $7.7m → $10.3m! As well as a fresh wallet also accumulating nearly $3m.

By clicking on a trader’s address anywhere within the analytics suite we can delve into their trades history, see their flows, current positions and cash on hand:

Our trades component shows streaming trades as they happen in real time, displaying the outcome being speculated on, the price of the trade, taker address and timestamp. It is filterable by minimum value, taker address, outcome, price and more.

Using these filters, here we see large trades from the top holder of Trump YES:

Note that these trades can be visualised differently by filtering by trader address on the charting component too:

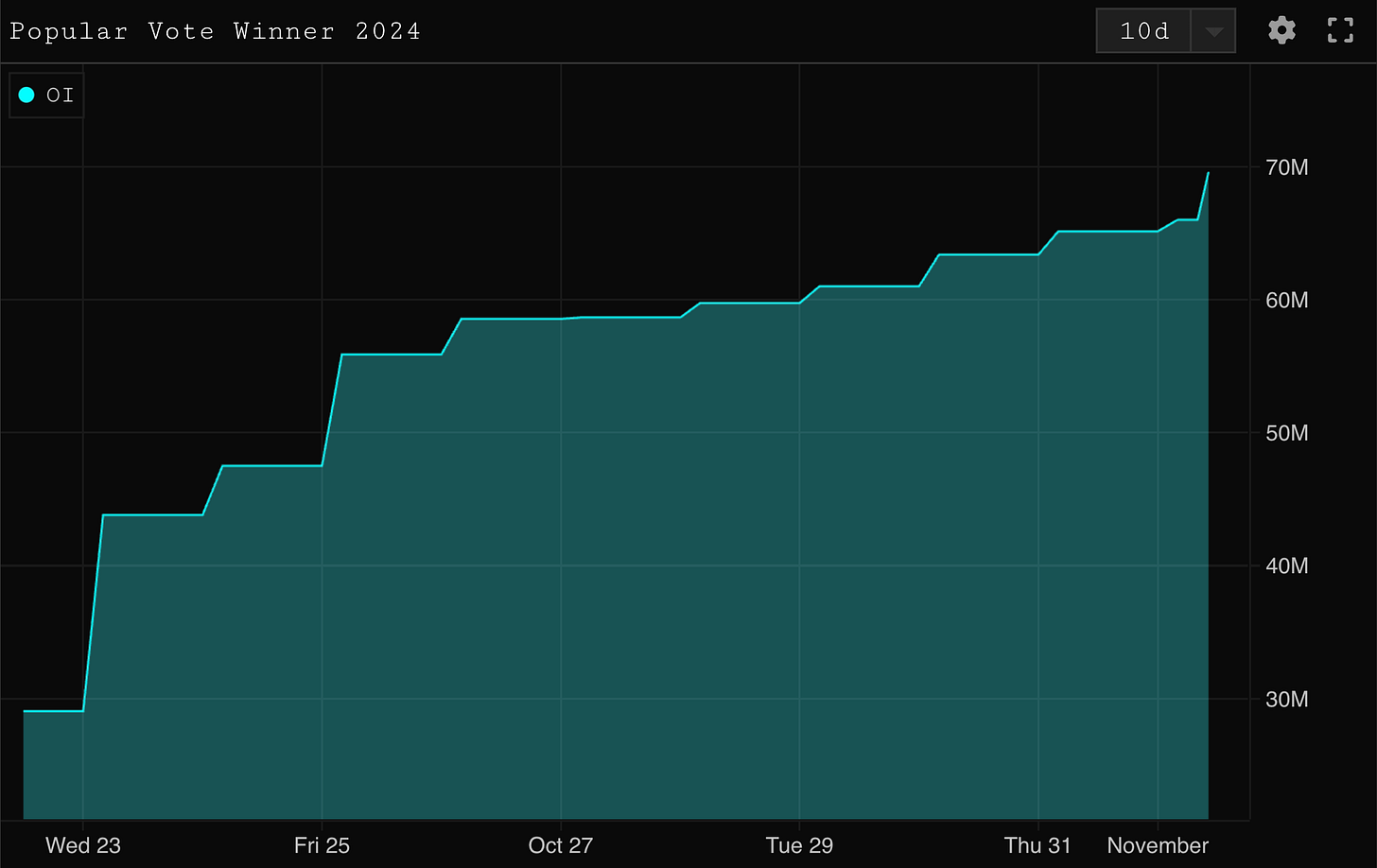

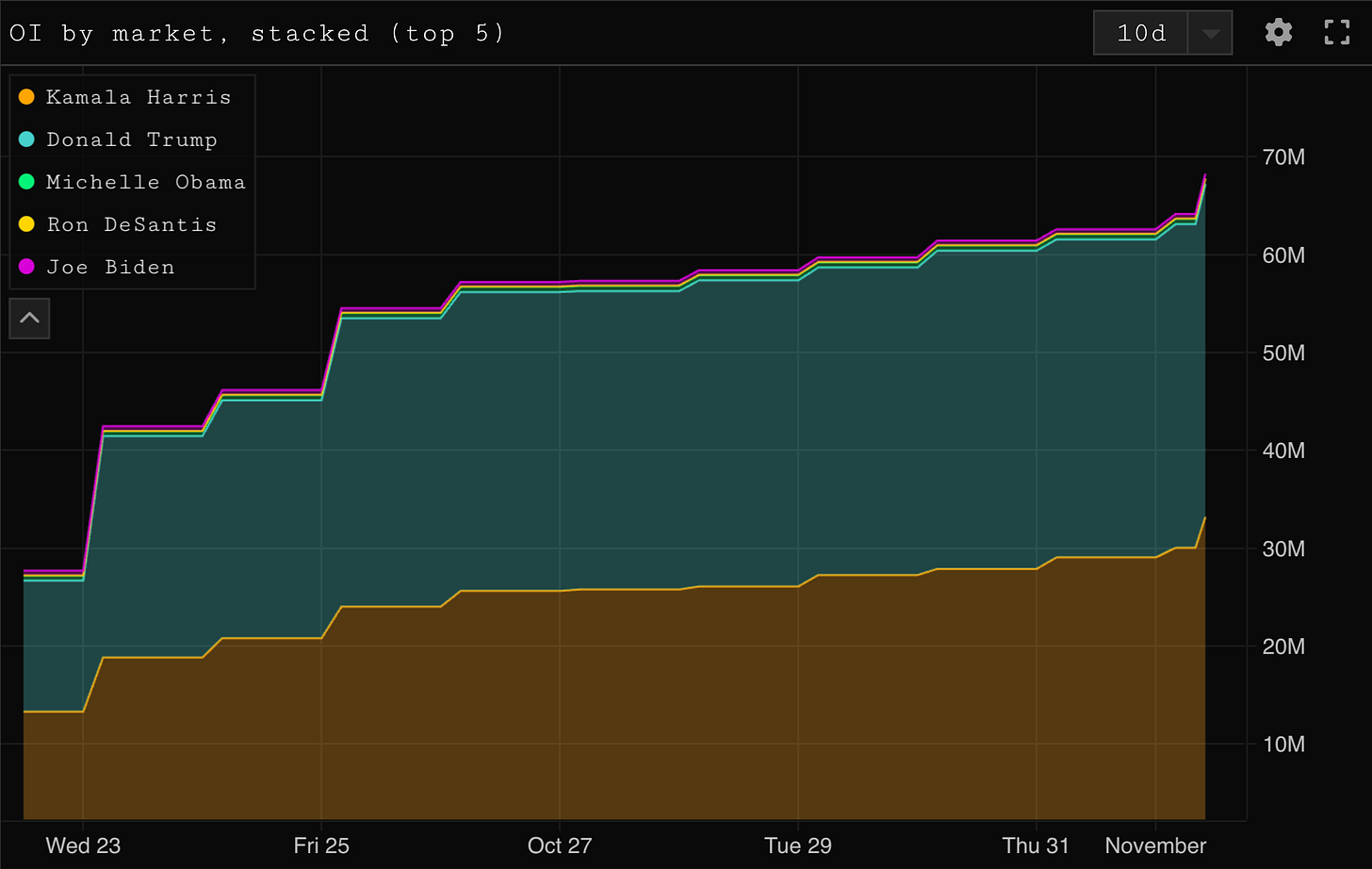

Equally, to gain insight into the overall activity of a given event or market, Parsec Polymarket analytics includes historical OI charts that show aggregate OI and stacked OI (by outcome). Both can be customised within settings for the Parsec pros!

While the main event is the Presidential election market, the open interest for the Popular vote market is rapidly growing at over twice the speed, it’s up 600% from $10m to $70m in the last two weeks:

go to parsec.fi/polymarket to get started

-kezfourtwez

gm team, just a quick little temperature check from my week in the market and a little bit more on the Polymarket stuff as we approach election day.

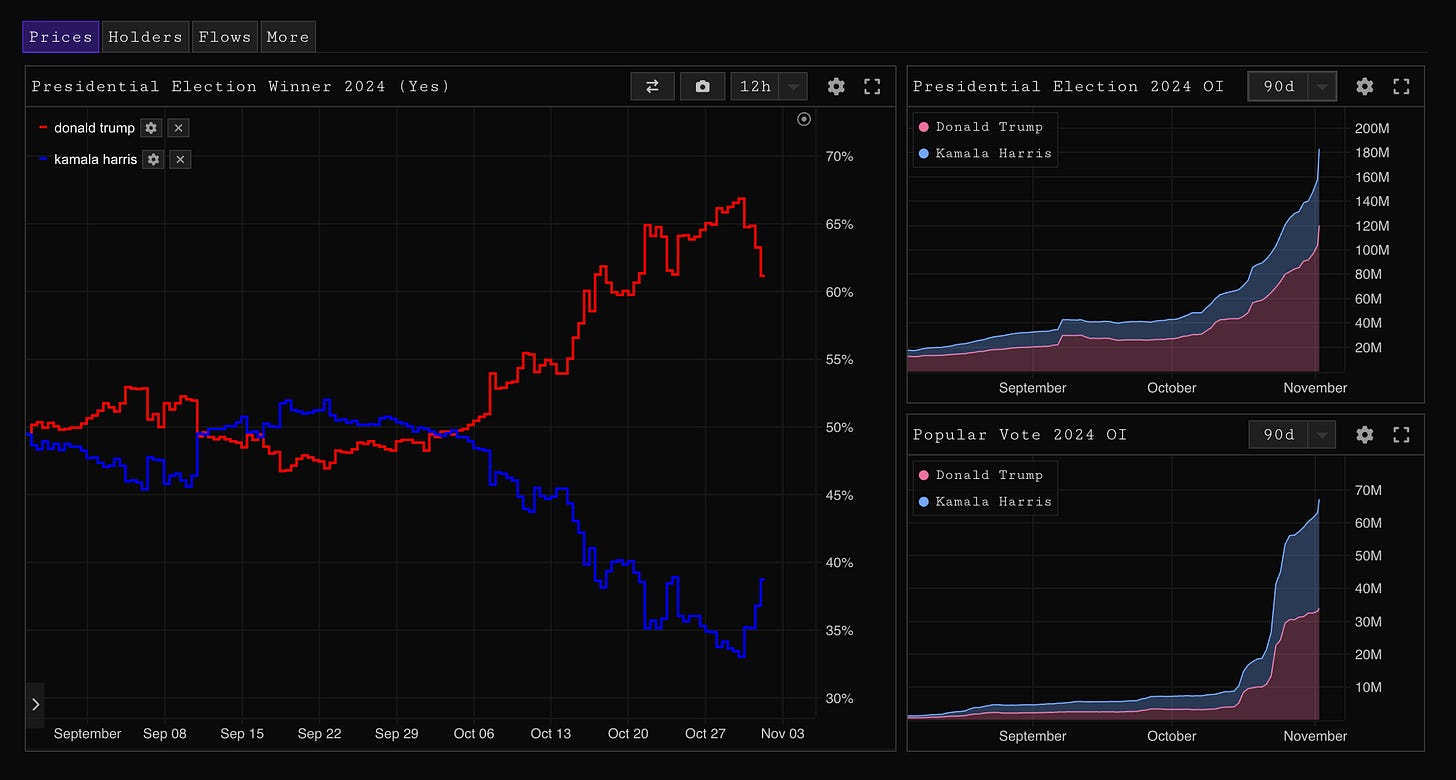

We are now just T-minus four days out from the big day and the odds are starting to converge with the polls. Crypto bros have been shovelling money into Trump YES shares since early October, open interest is up a 4x from $45m to $180m in that time. Other odds providers and the polls haven’t been following suit and it looks like we are finally seeing some rational derisking. Trump YES is down 6% in the last day or so.

On the trenches and wider markets; We’ve just had three weeks of some of the most insane shitcoin action I’ve experienced. There were winners, there were losers, and some traders got absolutely taken out back. Fomo is the drug of the trenches and as is with any big night, now comes the hangover. Low volume, lower ceilings, very few if any daily runners and group chats once again slow moving, traders are licking their wounds and picking up the pieces in anticipation for the next round. You don’t have coins going to 9 figures everyday and back again without some serious casualties.

As for majors, we were a couple hundred dollars short of a new BTC all time high. A lot of people got long close to top of the range expecting a breakout and we had a record breaking day of ETF inflows at $843m. But markets hate uncertainty, and there’s a tonne of it right now.