Parsec Weekly #94

$HYPE and the HyperEVM

-kezfourtwez

Good morning bulls, what a mfin week. We’ve had a lot of bullish and bearish factors influence price over the last eight months and it got pretty touch and go there at times. The early August BTC low was -33% off the March high, CT was in a sorry state and a lot of people thought it was over.

Fast forward to four months later and we have a crypto friendly President for the first time in history, an economically favourable environment for risk, enough time post halving to feel the economic effects, and as a result we made a clean break through the $70k sellers and secured a new Bitcoin all time high.

I’ve been trying to stay composed but it’s been difficult, somehow I was more euphoric when Cobie changed back to his OG pfp than on election/ATH day. It truly feels like the stars have aligned and I think the following tweet sums up how a lot of us are feeling right now.

In my totally uninformed and solely intuitive opinion, it feels like the BTC ETF prematurely pulled us towards the 2021 high, resulting in a particularly painful eight month range with five failed breakout attempts. And now those that stuck around get to reap the rewards, congratulations.

It does feel a little strange having everyone so bulled up on the timeline. Generally when an opinion on CT is consensus, the universe ends up saying fuck you it’s the opposite. I can’t remember feeling like this since 2021 so in this case I’m choosing to believe that’s just lingering bear market PTSD. There are enough fundamentals and positive catalysts coming into a Trump presidency to outweigh the consensus, and an ATH break really gets the retail fomo going. Remember that CT is a tiny echo chamber of people mentally ill enough to stick it out through bear markets, if you’re scared right now go and ask 10 random people on the street about crypto.

Hyperliquid

Hyperliquid’s Jeff has a very ambitious goal which is to “Create the platform on which all of finance happens”. While this goal has not yet become a reality, they have captured not only the lions share of onchain perpetuals volume, an impressive portion of centralised exchange volume, and the hearts, minds and devotion of their early users.

We are now likely just weeks away (if that) from TGE and mainnet and the excitement from the community is palpable, so let’s explore what Hyperliquid currently is and what it aims to be.

Hyperliquid is first and foremost a decentralised perpetuals exchange, at least that’s what they’re most well known for. A common misconception is that it’s ‘just another Arbitrum perp dex’ because that’s currently the only official way to bridge. Yet every user action on HL is an onchain transaction processed by their own highly performant L1.

On the other side you have the EVM (HyperEVM) which is akin to a side chain as not to affect the performance of the perpetuals trading on the L1. The EVM is currently on testnet but will transition to mainnet around the same time as TGE, as it’s been confirmed that $HYPE will be the native gas token. You can think of their go to market strategy as a product first approach. Build a great product > attract users > transition to a wider permissionless blockchain ecosystem.

I’m not an expert on the tech so I’m not going to do you the injustice of trying to explain that side any further. I’ll just say that Jeff and the whole team are giga brain chads that built their own custom consensus mechanism, have a grand vision, have executed extremely well so far, and they were able to self fund because of their background in market making.

That second sentence is one of the major bull cases for Hyperliquid. Jeff knows and has publicly stated multiple times that high FDV/low float tokens that are mainly VC owned don’t work, and that he prefers a wider initial distribution like Bitcoin. So instead of taking VC funding they’ve been entirely self funded since inception. The tokenomics aren’t out yet but this likely means that a large portion of the supply goes to users that have earned points over the last two years, ie. the incentive aligned early adopters.

Let’s look at the stats, as I write this Hyperliquid have just tweeted out that they’ve reached a new all time high in open interest at $1.5b. $417m of that is in BTC, to put that into perspective, that would place Hyperliquid at #12 across all centralised exchanges in between Bitmex and Kraken, or 4% of Binance’s open interest. A remarkable accomplishment for a fully onchain perpetuals protocol in its infancy.

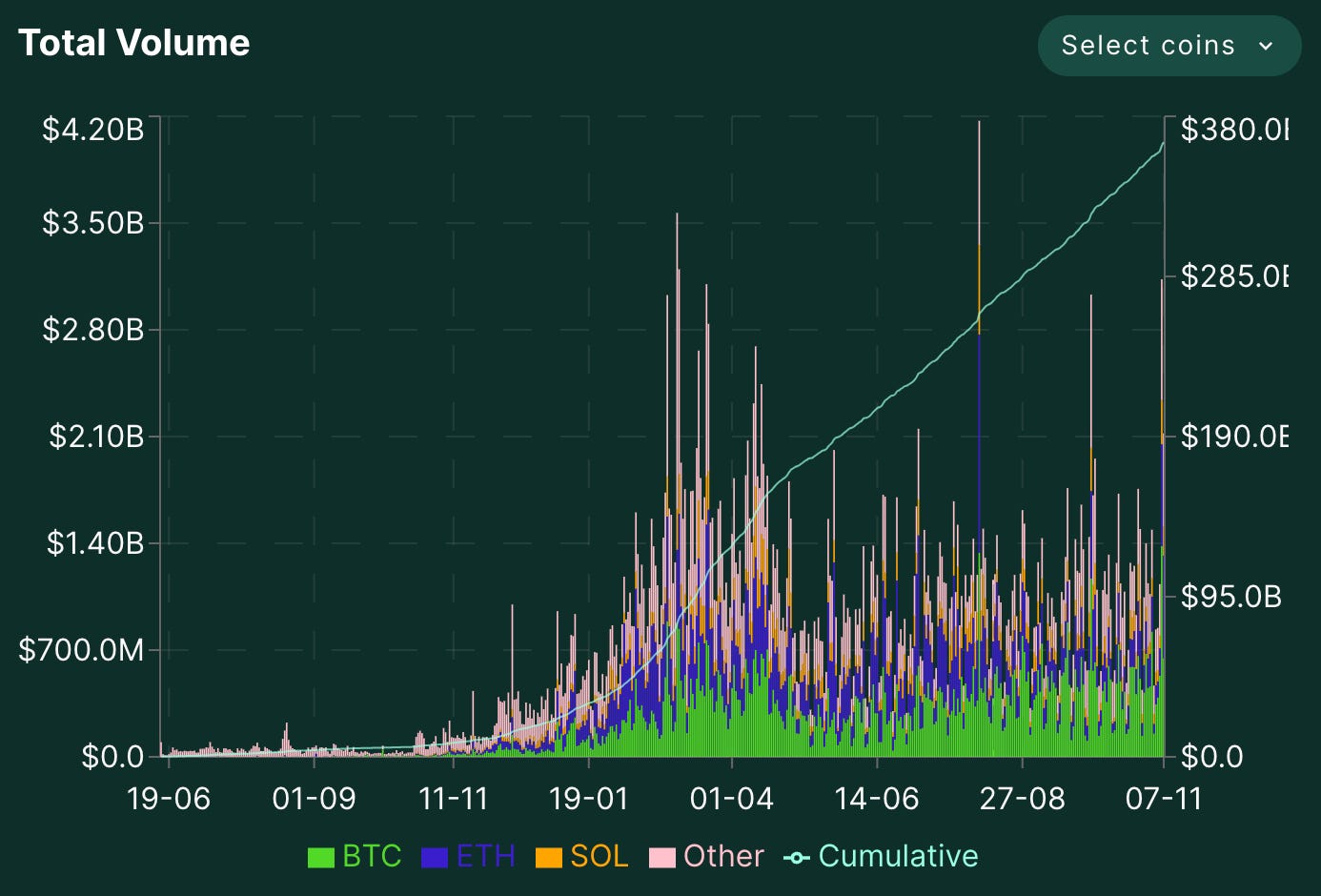

As you can see from the chart below, volume really started to pick up at the beginning of this year. They now average around $1b in volume per day, with the highest day being $4.17b on the August 5th low when BTC touched $48k. On that same day they also processed $345m worth of liquidations. It’s worth noting that they’ve never experienced any downtime during these periods of intense volatility.

One of the big bear arguments against Hyperliquid is that its users are primarily mercenary farmers that would leave and take their TVL with them as soon as the incentives stopped. This has been proven wrong on multiple occasions. During May there were no known incentives, at the end of April they announced season one would be finishing with no further details about a season two. Volume dropped a little but stayed steady mostly bouncing around between $600m-1.2b per day. There was a second season from June until the end of October, once again volume remained steady after the season ended. More impressively, TVL has been up only since the second season ended five weeks ago, and the USDC in the Hyperliquid bridge contract now accounts for over 50% of all USDC on Arbitrum.

In the last four days the TVL has jumped by $70m, eager traders likely getting ready for the $HYPE launch.

Expectations for $HYPE valuation are all over the place with the most pessimistic being anchored around $1bn and the most optimistic at $10bn+! The reality will likely settle somewhere in the middle. Either way, the $HYPE airdrop is set to be a significant one, probably the largest we will have seen this year by quite some margin, especially when we consider the likely high allocation there will be towards community.

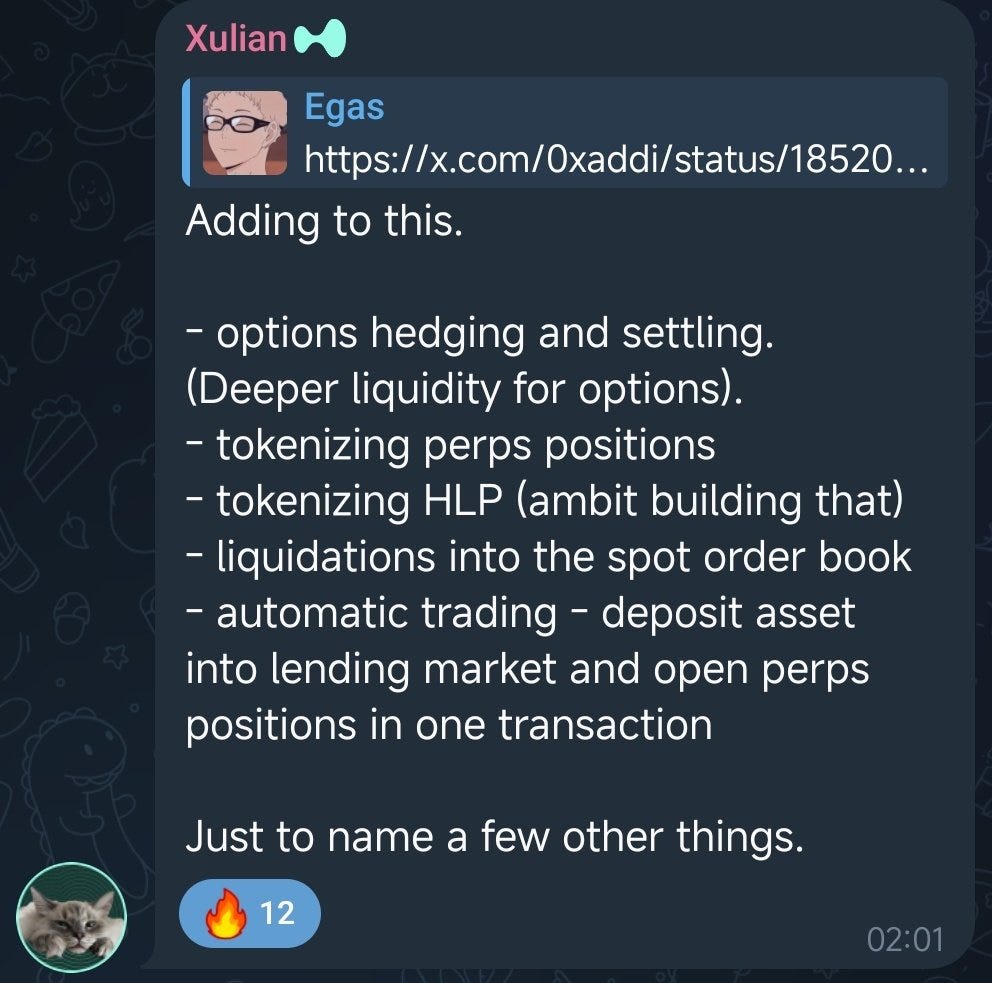

As mentioned, the $HYPE launch and HyperEVM are set to launch in tandem and teams are tripping over themselves to build on the permissionless side chain. Quite to the contrary of the majority of new chain launches which can suffer from a cold start liquidity problem, the HyperEVM will be able to tap into CLOB liquidity on the existing L1. The design space is scarcely explored but here’s a few ideas we could see emerge which leverage this interoperability:

The idea of a new EVM environment which is able to tap directly into the most successful perp dex of all time really got our juices going at parsec... it’s safe to say we’ll be throwing our hat in the ring with a HyperEVM native block explorer, stay tuned™

Great project to the 🌙🌛🌙 moon