gm and welcome to the 75th edition of the Parsec Weekly. Going to keep it brief today as aside from macro data, global markets and majors price action there’s not been much happening this week, just another week of deteriorating vibes on the timeline that would make you think Bitcoin is at 20k.

This week we had three significant pieces of macro data come out, and one Roaring Kitty stream go horribly wrong and somehow manage to take the wider market with it? Not on my bingo card but it happened.

Roaring Kitty hopped on his first livestream since 2021 as he was approaching billionaire status. It was a classic sell the news event, the price started moving in the wrong direction > sentiment causing sentiment down more > price down further.

Then we had CPI and FOMC on Wednesday. CPI came in under expectations and the market reacted positively, then a few hours later at FOMC minutes the Fed maintained their hawkish stance despite the CPI print and BTC jack knifed.

The next day we had PPI which also came in well under expectations, the lowest increase since July 2020. BTC tried to push up but ended up 2% further down than where it was pre print.

Some very volatile and mostly downward price action overall this week, but the lack of strength on good news is something to note. I saw a tweet today that went something along the lines of “Price reacting badly to good news is an infinitely worse setup than bad news not affecting price”.

I’m still a bulltard by nature, but this is the first time this cycle that I’m experiencing a sort of time based capitulation in regards to how I thought the cycle would play out. Based on the velocity in which price, ridiculous amounts of money sloshing around and the frequency of absolute stupidity and top signals appearing on the timeline, my ‘scary’ timer was meant to go off sometime late this year. The purpose of my ‘scary’ timer is to prompt me to have a good hard look at where we’re at, keep me in check so I don’t fall into the ‘this time is different’ camp, and let me know it’s time to start scaling out if I hadn’t already.

Which brings me another interesting tweet I saw today,

This rings true for me, but should it? Set aside your long term convictions in crypto changing the future of the financial system and think about why you are sure that the crypto markets are going higher in the short term. Just some food for thought.

Anyway, back to my point. The above was always my belief and rough plan of how this cycle would play out. But not being able to break ATH after all of this:

Has started to make me think that maybe I should shift my time horizons, that maybe we need rate cuts, and that maybe late this year and early 2025 is where the silliness really begins.

Have seen some interesting takes over the last few days on why despite all signs pointing to UP! Price has yet to oblige, and instead been incredibly weak.

The main point that resonates with me is the lack of innovation and breakout apps. Last cycle we had the introduction of DeFi, NFT’s and consumer apps and games like STEPN and Axie Infinity.

This cycle we’ve had something novel (NFT’s) replaced by something objectively less sticky and fun (Memecoins), also by and large traded by the same pool of people.

> He did not keep it brief

CRV finally comes home to roost

Those who stuck around during the bear market will remember a rather interesting start to the month of August 2023, as Curve.fi founder Michael Egorov (aka Mich) conducted a series of OTC sales of CRV in a bid to keep his highly leveraged CRV positions afloat across lending markets. Particularly Fraxlend given their aggressive interest rate policy given the state of the CRV-FRAX pool at that time.

If you weren’t active in the market back then, check out the parsec weekly we wrote back then for some additional context (click here). In short, Mich has had sizeable debt positions across multiple venues with CRV as collateral for a long time. The CRV market almost traded low enough to liquidate him last summer but a raft of OTC buyers came out to buy discounted CRV which saved his positions from liquidation.

Since then his large debt positions and the August 2023 OTC shenanigans broadly faded into the background as the CRV price recovered. That all changed yesterday, when Mich’s lending positions came under threat once again.

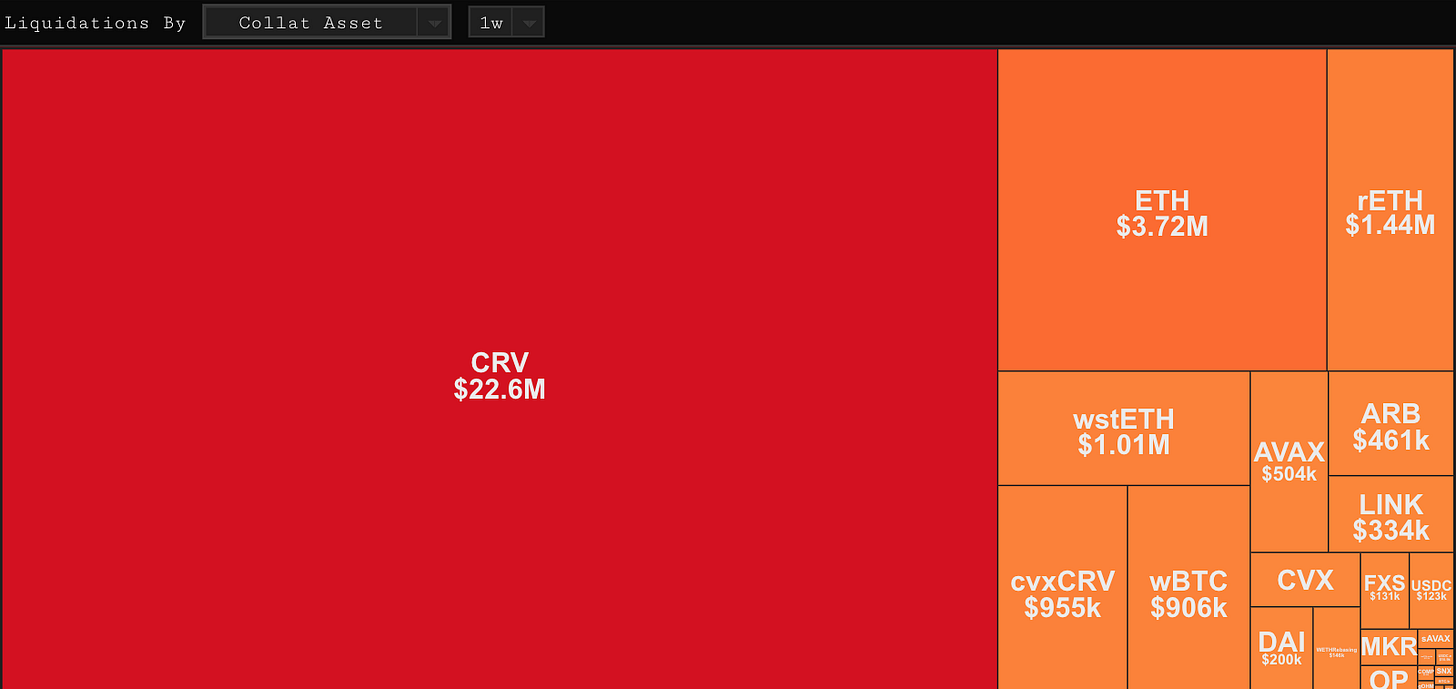

As the CRV price began to breach certain liquidation levels across venues, Mich’s positions began to get liquidated, leading to a liquidation cascade whereby liquidations led to a decrease in CRV price which led to further liquidations and so forth until CRV bottomed out around $0.25.

Roughly $11.5m of bad debt arose on Llama Lend (Curve’s own lending market) throughout the liquidation. Technically, given the nature of Llama Lend (liquidation on a curve which allows for “de-liquidation”), this bad debt could be eliminated with an increase in the price of CRV. Despite this, Mich sourced external capital to pay off this bad debt at a personal cost:

It looks as though an additional OTC sale helped this along:

Other lending markets involved in the shenanigans mostly emerged unscathed with Silo Finance, Inverse Finance and Fraxlend all incurring no bad debt.

Many people expected CRV to trade to $0 in the event that Mich’s almighty CRV position were to be liquidated, some even expected it to be the “death of DeFi”. These suppositions look extreme in hindsight. While perhaps it was not wise to have allowed so much CRV to be posted as collateral in the first instance, no systemic risk was ultimately incurred with very little bad debt created during the liquidation. Long live DeFi!

As always we appreciate your readership, if you enjoyed this article please leave a like and share it around. Have a good weekend and we’ll see you next week!

Insightful