The DeFi Gravy Train

DeFi is seeing quite the flow of good news as of late with the Circle IPO exceeding expectations, positive words of affirmation from the SEC and encouraging project specific developments across the board.

Circle IPO exceeding expectations

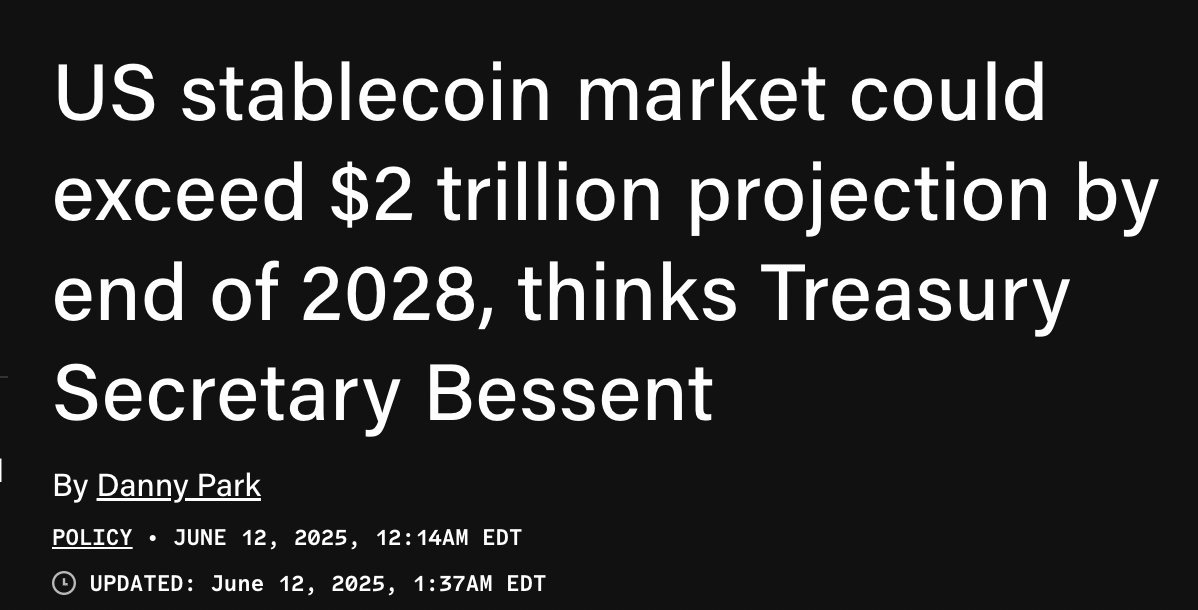

Following our coverage a couple of weeks back, the CRCL IPO has significantly exceeded expectations. With an initial IPO price of $31, CRCL has traded as high as $138.57 indicating insatiable tradfi demand for the regulatory compliant pure play on stablecoin adoption. Based on my read on the interest of crypto native participants in this IPO, PA seems mostly non native driven. After all, it’s hard to find another market where the US government's base case is for 800% growth in the next three years (cc @Matt_Hougan).

Positive words of affirmation from the SEC

This week also saw a surprising thread from the official SEC X account. The thread summarised key points from the SEC Chairman Paul Atkins at “DeFi and the American Spirit” - the SEC’s Crypto Task Force Roundtable on Decentralized Finance.

Amongst other comments, one which particularly stood out to me was the recognition that the values of DeFi closely align with those of America; notably economic liberty, private property rights, and innovation. (Full thread)

Granted, this was just a roundtable and not indicative of immediate regulatory action but it’s hard to imagine a future where this kind of sentiment doesn’t lead to positive regulatory change.

We’ve also seen a slew of positive project specific developments both on the centralised and decentralised side of things.

Stripe acquires Privy

Stripe, combined with Privy and Bridge, has created the first complete fiat-to-app stack that bypasses centralized exchanges entirely - eliminating the need for CEXes as onramps by enabling seamless, low-friction, embedded wallet onboarding directly within apps.

Spark announces the SPK TGE and Airdrop

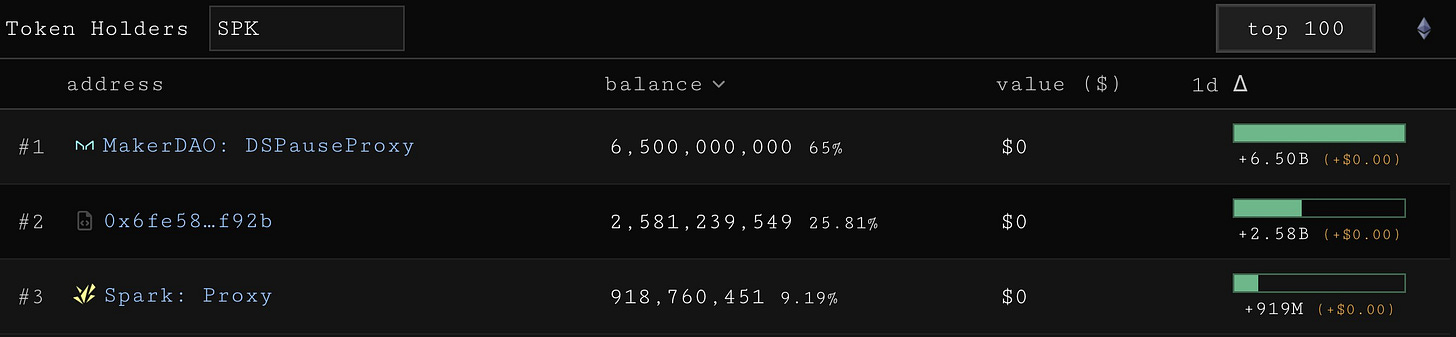

The current on chain distribution indicates 65% to Sky, 25.8% to Phoenix Labs and 9.2% to Spark:

Note that this should be a positive tailwind for MKR/SKY given Spark’s plans to implement SPK farming for USDS/SKY deposits. By introducing extrinsic incentives, this should lead to USDS flowing out of Sky Rewards and Sky Savings - reducing emissions and increasing profitability for Sky.

It’s hard not to be excited about the future of DeFi at this juncture and I am looking forward to seeing what the rest of 2025 has to bring.